Property Tax Search Atlanta Ga

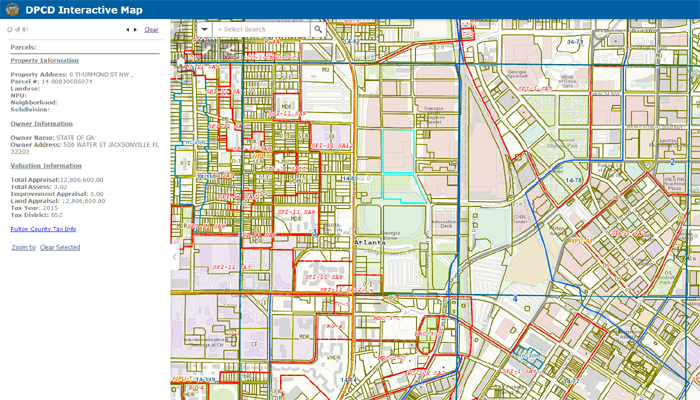

Property Information Using the new Property Information Viewer citizens can do a simple Parcel ID or Address search and obtain basic information. Search Augusta - Richmond County property tax and assessment records by address owner name parcel number or legal description including sales search and GIS maps.

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Officepersonal Injury Attorney In Atlanta Ga Gomez Golomb Law

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Officepersonal Injury Attorney In Atlanta Ga Gomez Golomb Law

Tax Summary request for multiple parcels - If you know the complete parcel IDs of the properties you are looking for this feature provides an efficient way of looking up your Tax Bills and Detailed Tax Summaries.

Property tax search atlanta ga. Unable to create map. Tax Summary request for multiple parcels - If you know the complete parcel IDs of the properties you are looking for this feature provides an efficient way of looking up your Tax Bills and Detailed Tax. To obtain a copy of a 2020 or prior tax statement please go to the Fulton County Tax.

Applications may be submitted in person by drop box or mail before the deadline. 48-5-311 e3B to review the appeal of assessments of property value or exemption denials. Augusta - Richmond County Tax Assessor.

Statements are mailed August 15th and are due by October 15th of each year. If you are having trouble with your search try reading our Search. In general property taxes in the Peach State are relatively low.

From the Tax Commissioners website property owners can find out the property taxes for their property or properties in two ways. South Service Center 5600 Stonewall Tell Road Suite 224 College Park GA 30349. Google Street View measure drawing tools and printing.

City of Atlanta homeowners living in DeKalb have until June 1 to apply for a 2021 homestead exemption. You may select from parcel ID account number or street address. Online applications are now open for the 2022 tax year.

NETR Online Georgia Public Records Search Georgia Records Georgia Property Tax Georgia Property Search Georgia Assessor. The average effective property tax rate is 087. Search for a tax bill - This feature allows you to search for a tax bill or bills using a complete or partial parcel ID account number or physical address.

Its important to keep in mind though that property taxes in Georgia vary greatly between locations. The Fulton County Board of Assessors reserves the right when circumstances warrant to take an additional 180 days pursuant to OCGA. Search For a Tax Bill - This feature allows you to search for a tax bill or bills using a complete or partial parcel ID account number or physical address.

106 rows The state of Georgia is automatically extending the 2020 individual income tax filing and. The Property Appraisal Assessment Department is responsible for the annual valuation of all taxable real and personal property in DeKalb County and producing a timely equitable and acceptable tax digest for DeKalb County that meets all state statutes and legal requirements of the Georgia. The Fulton County Tax Commissioner located in Atlanta Georgia determines the value of all taxable property in Fulton County GA.

Alpharetta Service Center 11575 Maxwell Road Alpharetta GA 30009. 530 Greene St Room 102 Augusta GA 30901. After entering your information click Search.

Monday-Friday 8am-430pm Fulton County Government Center 141 Pryor Street Suite 1018 Atlanta GA 30303-3487. In May All property owners were mailed a postcard which contains a registration ID to be used to opt-in to receive assessment notices via emailRead More. Alpharetta Service Center 11575 Maxwell Road.

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Map Search BOARD OF ASSESSORS Peachtree Center North Tower Main Office 235 Peachtree Street NE Suite 1400 Atlanta GA 30303 Hours of Operation. The median real estate tax payment in Georgia is 1771 per year which is around 800 less than the 2578 national mark.

Under Georgia law every property is assessed annually at fair market value. The City of South Fulton property taxes also known as ad valorem taxes are billed and collected through Fulton County Tax Commissioners office. To search for a tax bill select your property type personal property or real estate then select the information you want to enter.

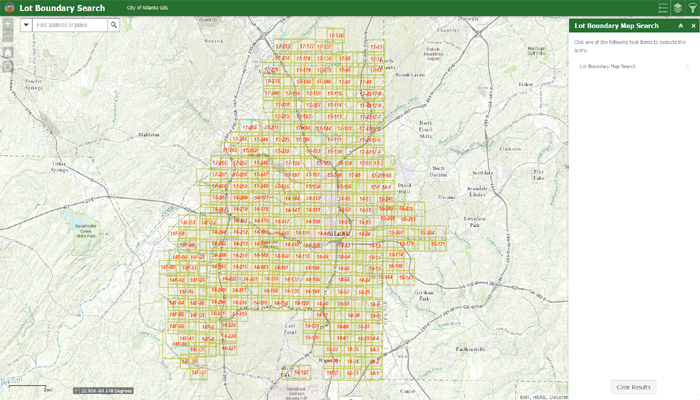

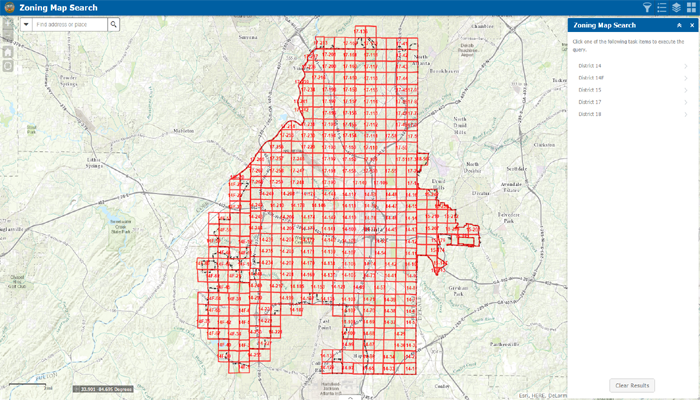

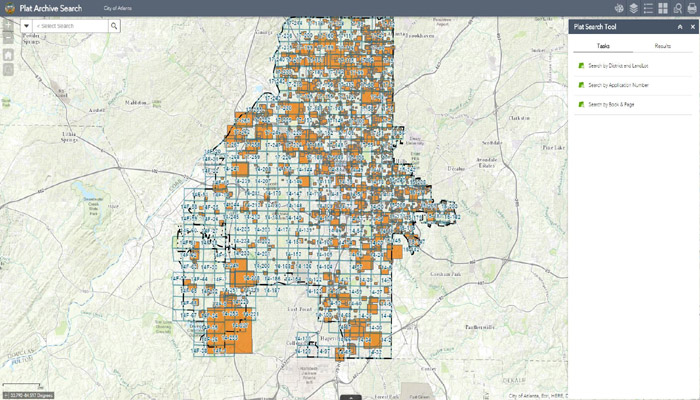

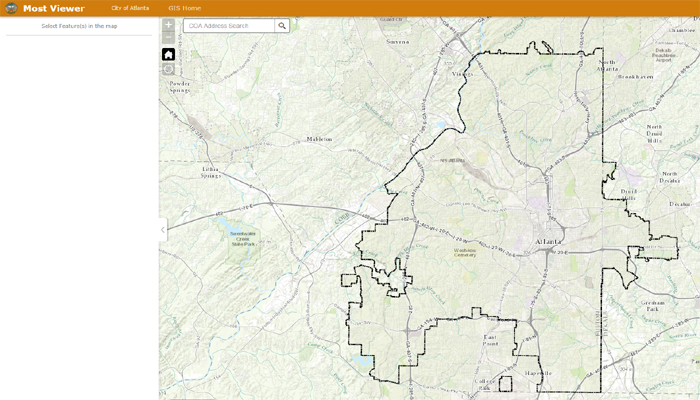

Using the Planning Viewer citizens have more tools at their disposal including. The 2020 Millage Rate is 12899 0012899. The Board of Assessors issues an annual notice of assessment for each property in Fulton County.

Approved and adopted September 2 2020. North Service Center 7741 Roswell Road NE Suite 210 Atlanta GA 30350. 159 rows The state of Georgia is automatically extending the 2020 individual income tax filing and.

Atlanta Department Of City Planning Gis Interactive Maps

Atlanta Department Of City Planning Gis Interactive Maps

Atlanta Department Of City Planning Gis Interactive Maps

Atlanta Department Of City Planning Gis Interactive Maps

Property Taxes South Fulton Ga

Cobb County Board Of Tax Assessors Official Website Of The Cobb County Ga Board Of Tax Assessors

Cobb County Board Of Tax Assessors Official Website Of The Cobb County Ga Board Of Tax Assessors

Atlanta Department Of City Planning Gis Interactive Maps

Atlanta Department Of City Planning Gis Interactive Maps

Fulton County Tax Commissioner Home Property Taxes Solid Waste Motor Vehicles Press Release Message From The Tc Recent Article From The Tc Tax Matters The Economy And Your Taxes Tax Allocation Districts In Fulton County The Supreme Court

Fulton County Tax Commissioner Home Property Taxes Solid Waste Motor Vehicles Press Release Message From The Tc Recent Article From The Tc Tax Matters The Economy And Your Taxes Tax Allocation Districts In Fulton County The Supreme Court

Online Services Fulton County Board Of Assessors

Online Services Fulton County Board Of Assessors

Equitax Georgia Property Tax Appeal Services Tax Liability Reduction

Equitax Georgia Property Tax Appeal Services Tax Liability Reduction

![]() Woodstock Georgia Property Tax Calculator Cherokee County Millage Rate Homestead Exemptions

Woodstock Georgia Property Tax Calculator Cherokee County Millage Rate Homestead Exemptions

Your Guide On Property Taxes In Atlanta Georgia Atlanta Dream Living

Your Guide On Property Taxes In Atlanta Georgia Atlanta Dream Living

Fulton County Board Of Assessors

Fulton County Board Of Assessors

Dekalb County Ga Property Tax Calculator Smartasset

Dekalb County Ga Property Tax Calculator Smartasset

Atlanta Department Of City Planning Gis Interactive Maps

Atlanta Department Of City Planning Gis Interactive Maps

Atlanta Department Of City Planning Gis Interactive Maps

Atlanta Department Of City Planning Gis Interactive Maps

Https Www Atlantaga Gov Home Showdocument Id 18844

Your Guide On Property Taxes In Atlanta Georgia Atlanta Dream Living

Your Guide On Property Taxes In Atlanta Georgia Atlanta Dream Living

Tsplost And Marta Referenda Atlanta Ga

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home