How To Reduce My Property Taxes In California

Look for local and state exemptions and if all else fails file a tax appeal to lower your property tax bill. The caveat here is the market value of the new house generally must be lower or equal to the home being sold.

Understanding California S Property Taxes

Understanding California S Property Taxes

Steps to Appeal Your California Property Tax.

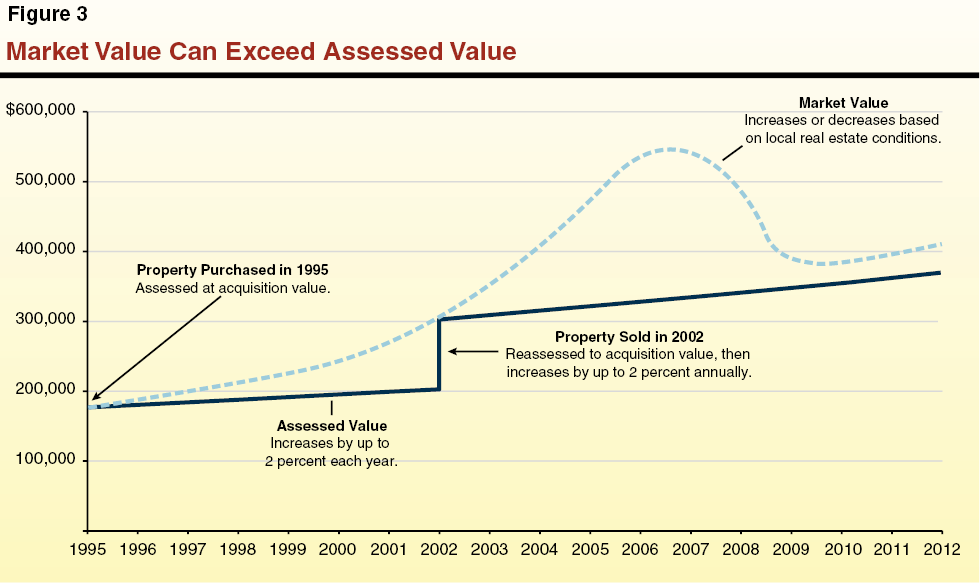

How to reduce my property taxes in california. Under California law property values cannot be assessed at more than 2 of what the value was the prior year which helps control property tax rates for homeowners. Appealing your assessed value is a time-consuming process but if you are successful you can significantly reduce your property tax burden and set a precedent for years to come. Begin your appeal process by filing an Assessment Appeal Application Form BOE-305-AH which you can obtain from your county clerk or online.

Whichever route you choose DoNotPay is your go-to resource for property tax reductions in California. The property tax postponement program gives qualified seniors the option of having the state pay all or part of their property taxes until the individual moves sells the property or dies. This video covers how property tax is calculated and how you can pay a lower overall property tax.

California has three senior citizen property tax relief programs. By the time you are already paying a certain amount its. Failure To File Appeal Of Supplemental Or Escape Assessment Within 60 Days Of Mailing.

For married couples only one spouse must be 55 or older. When your property taxes are assessed youll receive full records of how your taxes were assessed based on the value of your property. One of the primary ways that you can reduce your overall tax burden therefore is by reducing the assessed value of your homein other words filing an appeal arguing that its assessed value is actually less than what the assessor assigned it.

For Supplemental Adjusted Supplemental or Adjusted Property Tax Bills a formal appeal may be filed within 60 days of either 1 the. The California Board of Equalization offers a helpful guide to the appeals process. There are however a few ways homeowners can reduce their California property taxes.

If you disagree with the assessed value of your property you should contact the Assessors Office to request a review of the valueTo protect your right to appeal the value of your property you may file a formal appeal with the Assessment Appeals Board. Familiarize yourself with the appeal procedures and your rights and. Lower My Property Taxes.

Can I lower my Property Taxes. DoNotPay Can Help Reduce Your Property Tax in California. Decline In Value Prop 8 Calamity Property Destroyed.

Failure To File Proposition 8 Appeal By September 15 Of Each Tax Year. Option 1 Appeal The Taxable Value In California the State Board of Equalization BOE oversees the local county assessors offices which determine the property taxes in their area. The property tax assistance program provides qualified low-income seniors with cash reimbursements for part of their property taxes.

10 Commonly Overlooked Ways To Reduce California Real Property Taxes. February 18 2015 at 722 pm. Failure To Seek Correction of Erroneous Change of Ownership.

California Prop 60 and Tax Assessment Value Under Prop 60 homeowners are allowed to take the locked in tax assessment value of their original primary residence and apply it to another home in the same county that is of equal or lesser value. California homeowners 55 and older can get a one-time opportunity to sell their primary residence and transfer the property tax assessment to a new home under Proposition 60. There are a few small exceptions to.

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans

How To Cut Your Property Taxes Credit Com

How To Cut Your Property Taxes Credit Com

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

How To Lower Your Property Taxes In California Youtube

How To Lower Your Property Taxes In California Youtube

California Property Taxes Explained Big Block Realty

California Property Taxes Explained Big Block Realty

Understanding California S Property Taxes

Understanding California S Property Taxes

Pay Property Tax Bill Online County Of Los Angeles Papergov

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

California Property Tax Appeal How To Lower Property Taxes In California Property Tax Mortgage Payoff Pay Off Mortgage Early

California Property Tax Appeal How To Lower Property Taxes In California Property Tax Mortgage Payoff Pay Off Mortgage Early

What You Need To Know About Property Renovations Assessment Rpc Property Tax Advisors

What You Need To Know About Property Renovations Assessment Rpc Property Tax Advisors

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home