Property Tax Assessments Kelowna Bc

It is based on the assessed value of a property. Kelowna BC V1Y 0B5.

Residential Property Assessments Soar In Smaller North Island Communities

Residential Property Assessments Soar In Smaller North Island Communities

BC Assessment Interactive Maps.

Property tax assessments kelowna bc. For inquiries or concerns about your property tax notice please contact the City of West Kelowna by email taxeswestkelownacityca or phone 778-797-8860. Property taxes are due July 2 2021. Kelowna BC 052605 5.

NEW FOR 2021 - Effective January 1 2021 all home owner grants must now be claimed directly through the Province of BC Home owner grant program online or by phone. The typically assessed value now sits at 629000 down from 643000. Cities With Lowest Property Tax Rates Based On Cities Included In The Study 1.

If you own a property you will have to pay property tax. New for 2020. Here are the findings.

Property Tax in British Columbia. Assessments have also now been mailed out to property owners around the. Property tax and assessment search Search by tax roll number address block or PID to view property assessments and taxes.

Revenue Branch Kelowna BC V1Y 1J4 Tel 250-469-8757 option 3 Fax 250-862-3391 revenuekelownaca. If youve already set up a property account ie. Or complete the BC Assessment Authoritys Change of Address Notification Form online.

Abbotsford BC 051300 3. Log in to your property account and register your business licence account to pay your renewal fees by credit card. 300 - 1631 Dickson Ave.

Change Name or Title. Vancouver BC 024683 2. Be sure to include the roll folio number of the property the previous mailing address the new mailing address your printed name and a signature.

For inquiries or concerns regarding your assessment notice please contact the BC Assessment Authority or by phone 1-866-825-8322. 3 rows Kelowna property tax rates are the 24th lowest property tax rates in BC for municipalities. For your property tax or utility billing account use this account and log in below.

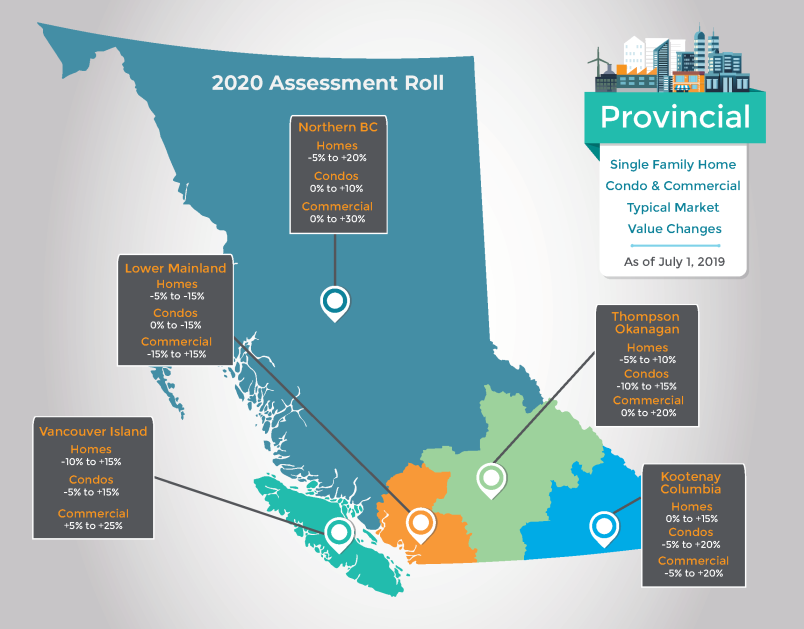

Access current assessment information. Use your mouse to zoom and find one of the top 500 valued residential properties in British Columbia. Your mouse scroll wheel to zoom and click on an assessment area outlined in grey to view the average percent change by property class between July 1 2019 and July 1 2020.

Municipalities are no longer able to accept any home owner grant applications. This assessed value can differ significantly from the market value of your propertyYour final property tax amount is calculated by multiplying the West Kelownafinal property tax rate for the year by the BC Assessment value. Property tax is a tax on land and property.

You can also add your City Water Utility account if you receive water from the City and business licence account. Combined property tax estimator with property tax and assessment tools. Who do I call if I have more questions.

BC Assessment will register an address change in the City of Kelownas property tax system weekly. Every year the BC Assessment conducts an evaluation of properties all over British Columbia. In Kelowna there was a two percent drop from last years typical assessed value of a single-family residential property.

Enter the assessed value of your properties. This data is generally updated each summer. 2021 property information was released on January 4 2021 and is based on market values as of July 1 2020.

Get data on municipal property taxes including tax rates property assessment data and tax burden on different property classes and annual taxesfees on a representative home. Property tax details including account balance assessment information claim your Home Owner Grant and view your bill online. If you have questions about the estimator or other property tax matters please contact the Revenue Branch at 250-469-8757 option 3 or email revenuekelownaca.

BC Assessment provides current actual value assessments for tax purposes on all properties in British Columbia and provides expertise in real estate. Market Movement by Property Class. Overall the Thompson Okanagans total assessments increased from about 1477 billion in 2019 to 1531 billion this year.

Look Up Property Assessment Look Up Property Assessment Access the Assessment Search and start your search for British Columbias property assessments information. The province has released its 2019 property assessment which are available to check through the BC Assessment website. It is used to pay for city services such as police the fire department and public transit as.

Property tax estimator Use your BC Assessment notice to estimate your municipal taxes. Zoocasa compared the property tax rates of 25 major cities across Canada to understand how taxes range between municipalities. Visit BC Assessment online.

If a taxpayer no longer owns a specific property the change in ownership will be picked up when BC Assessment is provided information from the Land Titles office. Victoria BC 052035 4.

2017 Bc Assessment Values Now Available Online Abbotsford News

2017 Bc Assessment Values Now Available Online Abbotsford News

2017 Bc Assessment Values Now Available Online Abbotsford News

2017 Bc Assessment Values Now Available Online Abbotsford News

Tax Decrease For Port Edward Residents Prince Rupert Northern View

Tax Decrease For Port Edward Residents Prince Rupert Northern View

Who Pays The Least Property Tax In Canada Smart Reno

Who Pays The Least Property Tax In Canada Smart Reno

Notice Of Assessment Noa Http Ontarioincometaxservices Com Notice Of Assessment Noa Noticeofassessment Income Tax Preparation Tax Preparation Assessment

Notice Of Assessment Noa Http Ontarioincometaxservices Com Notice Of Assessment Noa Noticeofassessment Income Tax Preparation Tax Preparation Assessment

1791 Shaleridge Pl West Kelowna Bc V1z 3e4 Redfin

1791 Shaleridge Pl West Kelowna Bc V1z 3e4 Redfin

You Didn T Fill Out B C S Speculation Tax Declaration Now What Globalnews Ca

You Didn T Fill Out B C S Speculation Tax Declaration Now What Globalnews Ca

718 Highpointe Dr Kelowna Bc V1v 2y1 Zillow

Bc Assessment Independent Uniform And Efficient Property Assessment

Bc Assessment Independent Uniform And Efficient Property Assessment

Bc Property Assessment Vs Market Value Of Housing Prices In Bc For 2020

Bc Property Assessment Vs Market Value Of Housing Prices In Bc For 2020

Province Wide Property Assessments

Province Wide Property Assessments

Bc Assessment Independent Uniform And Efficient Property Assessment

Bc Assessment Independent Uniform And Efficient Property Assessment

Labels: assessments, kelowna, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home