Farm Property Tax Exemption Oregon

Or Subdivide the property. A The property is used by the lessee or if the lessee is not in possession of the property by the entity in possession of the.

Understanding Your Property Tax Statement Clatsop County Oregon

Understanding Your Property Tax Statement Clatsop County Oregon

Transfer the land to an ownership that makes the land exempt from property tax.

Farm property tax exemption oregon. The Farm Use Manual is organized into sections that follow the statutes. If you are granted this property tax exemption any in lieu of tax amount based upon rentals must be paid to the county treasurer on or before November 15 see ORS 307490. Unfortunately there is confusion from taxpayers assessors and the department of revenue as to what farm machinery and equipment should actually be exempted.

Exemption for Property Owned by Specified Institutions 20000 Application Fee Required 95 KB Exemption for Property Leased- Taxable Owner to Exempt Organization 20000 Application Fee Required 180 KB Enterprise Zone Authorization Application 40000 Application fee 153 KB. Assessment of Farmland Not in an Exclusive Farm-Use Zone. The landowner is required to be actively growing a marketable species of trees on the property or have a.

Oregon law allows for reduced property taxes for farms forestland and some natural spaces. Change the use of the land to be incompatible with returning it to a farm use see note below. The property tax is based upon a special-assessment value that represents the price a knowledgeable purchaser would pay for land that is primarily used to grow and harvest timber which is typically much lower than the real market value.

A table of contents identifies each section. ORS 307495 For office use only Received by Date received Approved. Exemption or the right to claim exemption for any of its property under ORS 307090 307130 307136 307140 307145 307147 or 307181 3 is exempt from taxation if.

Application for Conservation Easement Special Assessment. By Oregon Family Farm Association The 2015 Oregon Legislature will consider a bill to end farm property tax exemptions in 2018. Agricultural tax exemptions provide a break at tax time for those who live on property that is used for agricultural purposes or who earn farm income as.

ORS 307394 exempts certain items of farm machinery and equipment. The Oregon Legislature reinstated the property tax exemption in 2013 for certain types of property acquired and installed by Oregon food processors ORS 307453 by the passage of House Bill 2735. Exemptions can be either full or partial depending on the program requirements and the extent to which the property is used in a qualifying manner.

These additional taxes are added to the next tax roll. The most common institutions or organizations are religious burial grounds and cemeteries fraternal certain schools and day care centers and charitable which. 8-13-20 3 Property Tax Deferral for Disabled and Senior Citizens Property Tax Deferral for Disabled and Senior Citizens As a disabled or senior citizen you can borrow from the State of Oregon to pay your property.

Erty tax specialists and an external group of county assessor property tax specialists have developed this manual. Property Taxes Farmers pay reduced property taxes on farm land at 12 of RMV while taxes on all property of all types in the state is taxed at 73 of RMViv 3537 m Farm home sites are taxed as farmland rather than as residential land 258 m Farm machinery and equipment is all tax exempt. You will be assessed an additional tax if your farm-land is disqualified and you.

Assessment of Farmland in an Exclusive Farm-Use Zone. Failure to pay this in lieu of tax will cause the property tax exemption to be denied in future years. The manual is designed so that it can be modified or updated on an ongoing basis.

Oregon has over 100 exemption programs A property tax exemption is a legislatively approved program that relieves qualified individuals or organizations from all or part of their property taxes. As a result farmers and foresters pay greatly reduced property taxesin the range of 10 or 20 percent of what theyd otherwise pay. A property tax exemption is a legislatively approved program to relieve qualified individuals or organizations from paying all or part of their property taxes.

The program allows food processors to request a property tax exemption for qualified property machinery and equipment and personal property. Currently farmland is taxed at a reduced value through a special assessment program and crops livestock and farm machinery are exempt as. Application for Real and Personal Property Tax Exemption For lease sublease or lease-purchased property owned by a taxable owner and leased to an exempt public body institution or organization other than the state of Oregon or the US.

Government ORS 307112 Application for Real and Personal Property Tax Exemption. Oregon laws provide property tax exemption for property owned being purchased or leased by specified institutions and organizations. The most common exemptions are.

That costs local tax authorities across Oregon nearly 250. There are many different exemptions andor special assessments which qualifying property owners and lessees can apply for. Oregon laws provide property tax exemption for property owned or being leased by specified institutions or organizations.

In 2018 Marion County farms identified discrepancies in the implementation of the exemption. There are over 100 exemption programs in Oregon. But you must apply.

Exemptions can be either full or partial depending on the program requirements and the extent to which the property is used in a qualifying manner.

For Sale When Oregon Farm And Ranch Land Changes Hands Agriculture Eastoregonian Com

For Sale When Oregon Farm And Ranch Land Changes Hands Agriculture Eastoregonian Com

Https Www Co Marion Or Us Ao Documents Formsandresources Faq Pdf

Hobby Farms Under Scrutiny Local News Bend The Source Weekly Bend Oregon

Hobby Farms Under Scrutiny Local News Bend The Source Weekly Bend Oregon

Https Olis Leg State Or Us Liz 2017r1 Downloads Committeemeetingdocument 100647

Https Olis Leg State Or Us Liz 2017r1 Downloads Committeemeetingdocument 102267

California Farm Tax Exemption Form Fill Online Printable Fillable Blank Pdffiller

California Farm Tax Exemption Form Fill Online Printable Fillable Blank Pdffiller

Amazon To Expand Data Centers In Northeastern Oregon Reaping More Tax Breaks Northwest Public Broadcasting

Amazon To Expand Data Centers In Northeastern Oregon Reaping More Tax Breaks Northwest Public Broadcasting

Tax Dollars Blow Away In Wind Projects Oregonlive Com

Change Proposed In Ag Land Property Taxes Dairy Capitalpress Com

Change Proposed In Ag Land Property Taxes Dairy Capitalpress Com

Solar Property Tax Exemptions Explained Energysage

Solar Property Tax Exemptions Explained Energysage

Oregon Property Tax Exemption For Machinery And Equipment

Oregon Property Tax Exemption For Machinery And Equipment

Facebook Presses Oregon Legislature For Property Tax Exemption Oregonlive Com

Facebook Presses Oregon Legislature For Property Tax Exemption Oregonlive Com

Assessment And Taxation Clackamas County

Assessment And Taxation Clackamas County

Farmers Obtain Fixes To Oregon S Corporate Activity Tax Oregon Capitalpress Com

Farmers Obtain Fixes To Oregon S Corporate Activity Tax Oregon Capitalpress Com

Http Www Taxfairnessoregon Org Wp Content Uploads 2019 01 Property Tax Reform For Commercial And Industrial Properties Pdf

Farm And Forest Deferrals Polk County Oregon Official Website

Farm And Forest Deferrals Polk County Oregon Official Website

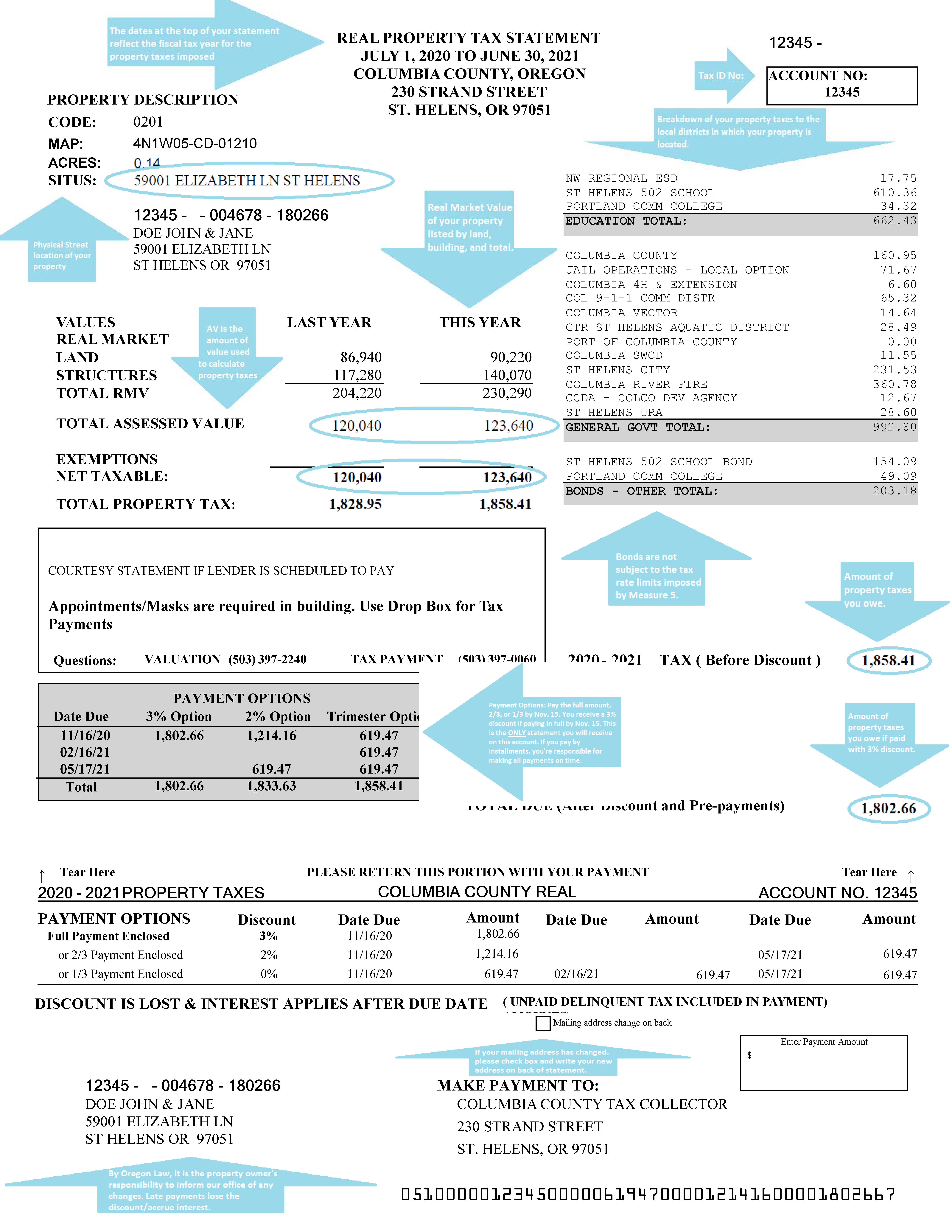

Columbia County Oregon Official Website Understanding Your Property Tax Statement

Columbia County Oregon Official Website Understanding Your Property Tax Statement

For Sale When Oregon Farm And Ranch Land Changes Hands Agriculture Eastoregonian Com

For Sale When Oregon Farm And Ranch Land Changes Hands Agriculture Eastoregonian Com

Central Oregon Town To Host Largest Facebook Server Farm Rural Life Capitalpress Com

Central Oregon Town To Host Largest Facebook Server Farm Rural Life Capitalpress Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home