How To Get Online Property Tax Receipt

Taxes become due Oct. Steps to viewprint property tax payment information.

Kdmc Property Tax Payment Receipt Online Property Walls

Kdmc Property Tax Payment Receipt Online Property Walls

Learn more about how to request a receipt for the property taxes you paid.

How to get online property tax receipt. Privilege Licenses are based according to the type of business operated andor the amount of annual gross sales. These variations can have an effect on the valuation of the property. You may obtain a duplicate of your original property tax receipt for free online.

You may click on this collectors link to access their contact information. Rent restricted properties vary widely. Select the information requested from the pull down menus Tax Year - individual year or ALL.

Examples include Room Occupancy Prepared Food and Beverage and Vehicle Rental taxes. Please raise a ticket under Grievance for chargeback queries. All request for refundcharge back of property tax payment through PayU Money and HDFC bank shall be handled by BBMP only.

Never assume taxes were paid - they may be prorated between the seller and the buyer and not paid to the Tax Office because no money was collected at closing. Click on the Online Services tab at the top of the website. To obtain your property tax receipt visit the Online Payment Program.

Issued in December upon request free of charge. Select the Tax Bill Payment option which is the 6 th option. Click on the link for Personal PropertyMVLT and Real Estate.

1 so if you buy a property in August there are no taxes due at that time and the tax bill will usually go to the previous owner on October 1. Real Property Tax Real Estate 206-263-2890. Our services are available online by phone by email or by mail.

Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. Use the information from your current paid property tax receipt such as your account numbers property legal description and county information to access the website for your county tax office. WELCOME TO TARRANT COUNTY PROPERTY TAX DIVISION.

Tarrant County has the highest number of property tax accounts in the State of Texas. Tax Receipts can be found on the current statement page or by clicking on the Property Tax Receipts button. Be sure to pay before then to avoid late penalties.

You will need your Account Number to proceed with payment. Obtaining a property tax receipt. Pay-by-Phone IVR 1-866-257-2055.

Sales receipt taxes are those taxes based on the sales receipts of a particular type of sales transaction. All Payment Options The Tax Office accepts both full. If you did not file a Personal Property Declaration with your local assessor and did not receive a Personal Property bill you will need to file.

On the home screen click the View Property History button. Contact a customer service representative or visit an Inquiry Payment Counter to make your request. Select Yes I accept.

Mobile Homes and Personal Property Commercial Property Tax 206-263-2844. No request shall be made to PayU Money or HDFC Bank as the case may be. Louis City in which the property is located and taxes paid.

Current Year Tax Receipt. Obtaining Copies of Tax Receipts To obtain a paper copy of a tax receipt please submit a written request with your name account number address and a 1 statutory fee by check or money order via one of the following methods. You can access the service through LPT online by following these steps.

Prior Year Tax Receipt. There is a 1 fee for each duplicate receipt. If taxes are due you may pay online using the button below.

111825r of the Texas Property Tax Code the Gregg County Appraisal District gives public notice of the capitalization rate to be used for tax year 2021 to value properties receiving exemptions under this section. Request must be received no later than December 31 st each year provided that taxes are paid in full. Property Tax Receipts are obtained from the county Collector or City Collector if you live in St.

CollectorAssessor Drop Box in front of the County Administration Building at 201 N. The statewide property tax deadline is October 15. Personal Property Tax Lookup And Print Receipt.

Enter your PPSN property ID and property PIN and click Login. Second Street in St. Pay or view your account online do a property search or sign up for e-Reminder Notices via text or email.

There should be an option on their web page where you can request a duplicate tax receipt. In keeping with our Mission Statement we strive for excellence in all areas of property tax collections. Receipt available for current or past two years.

You may also obtain a duplicate of your original property tax receipt from our offices. There may be a charge for this duplicate property tax receipt. Online payments are available for most counties.

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Pay Property Tax In Mumbai Bmc And Mcgm Step Wise Procedure

Pay Property Tax In Mumbai Bmc And Mcgm Step Wise Procedure

Kdmc Property Tax Payment Receipt Online Property Walls

Kdmc Property Tax Payment Receipt Online Property Walls

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

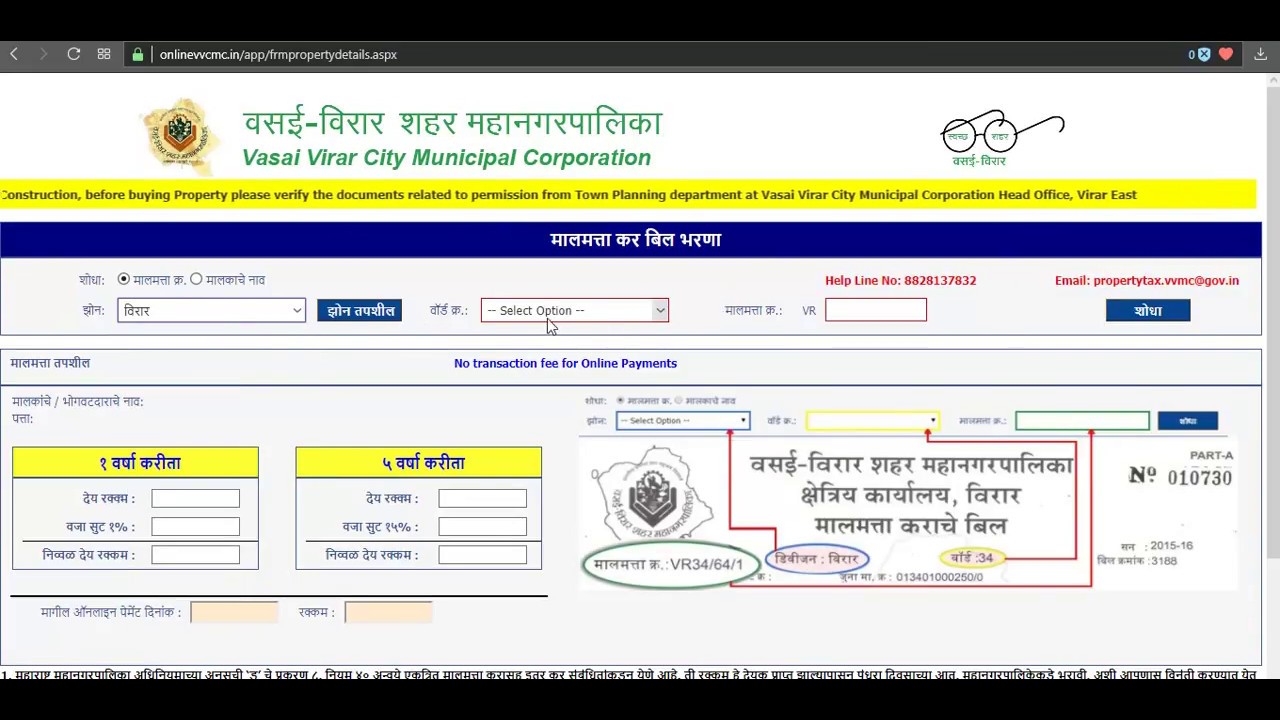

How To Pay Property Tax Online Vasai Virar Youtube

How To Pay Property Tax Online Vasai Virar Youtube

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

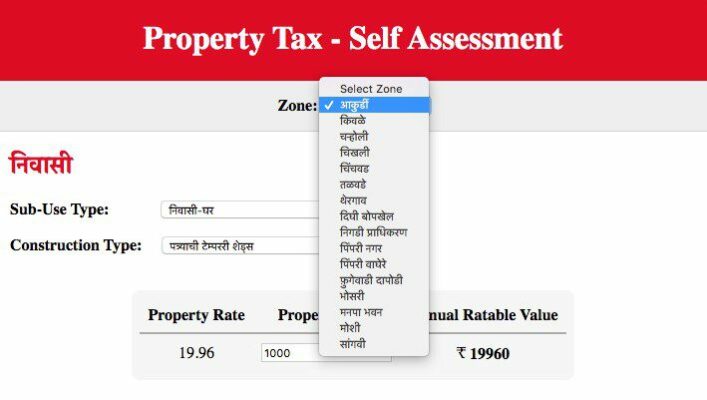

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Kdmc Property Tax Payment Receipt Online Property Walls

Kdmc Property Tax Payment Receipt Online Property Walls

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

What Is The Process For Changing Names On Property Taxes Quora

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Kdmc Property Tax Payment Receipt Online Property Walls

How To Pay Property Tax In Mumbai

How To Pay Property Tax In Mumbai

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home