Hazard Insurance Tax Deductible Rental Property

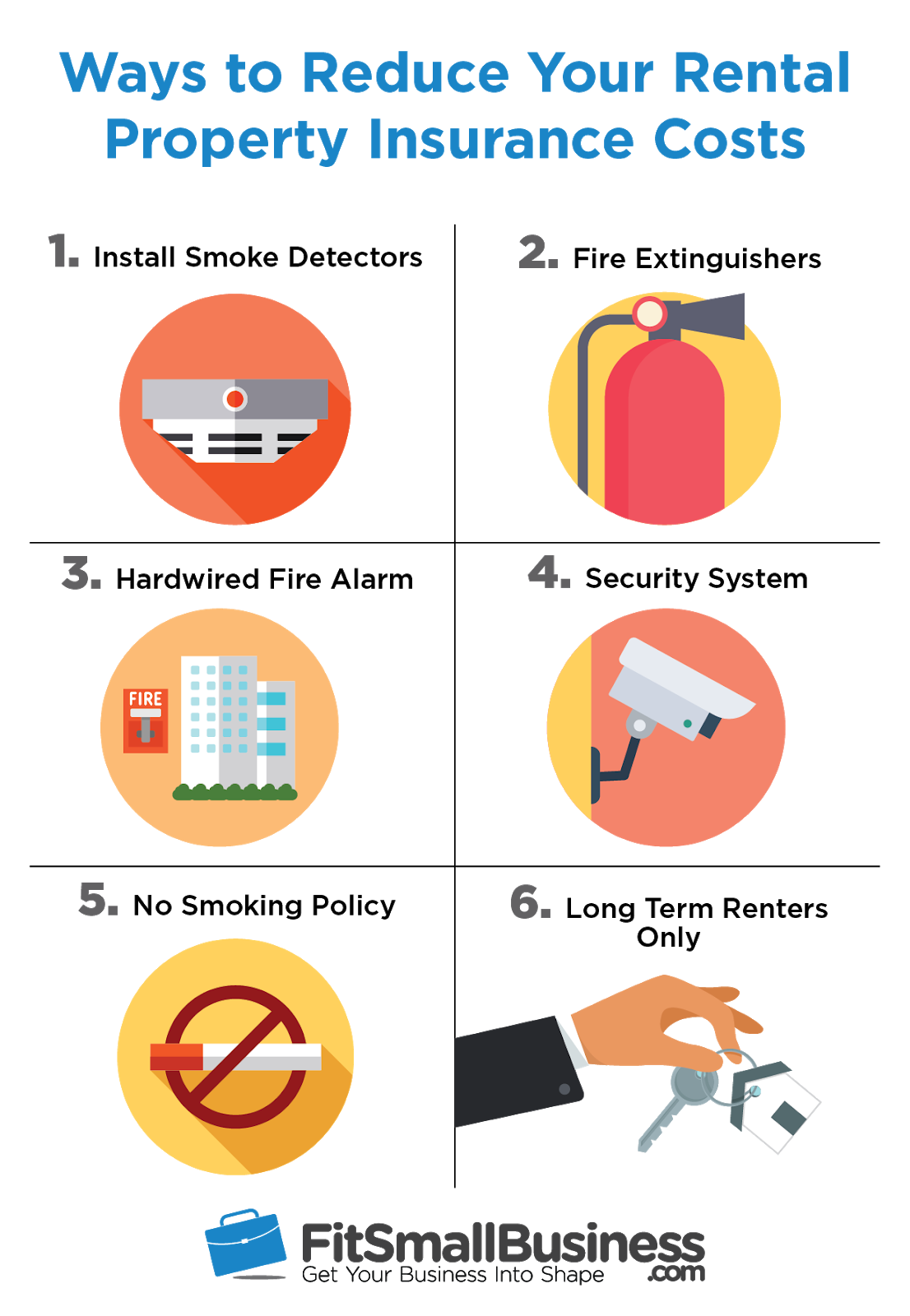

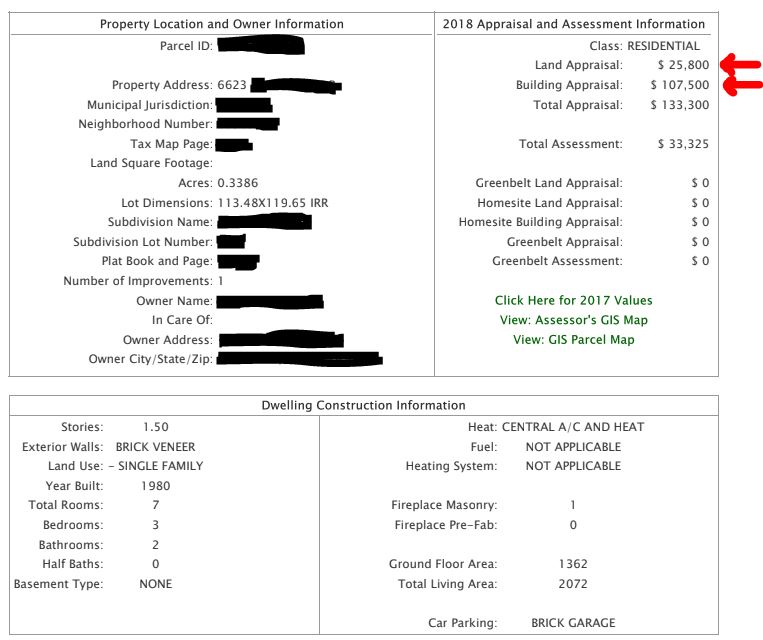

If you own a rental home or vacation property for example hazard insurance on that property is deductible along with certain other expenses of buying maintaining repairing and advertising. Your homeowners insurance on the portion of the property used as a rental becomes tax-deductible.

What Are Real Estate Taxes Real Estate Tax Basics Millionacres

What Are Real Estate Taxes Real Estate Tax Basics Millionacres

What expenses are deductible when selling a home.

Hazard insurance tax deductible rental property. For a personal home homeowners insurance including hazard insurance is a personal expense and is not deductible. Report the deduction on line 9 of Schedule E Form 1040 Supplemental Income and Loss. The following table lists the circumstances when you can get a tax deduction for your home insurance premiums and the IRS forms to file.

The deduction applies to basic homeowners insurance as well as special peril and liability insurance. Exceptions that make homeowners insurance tax deductible. However there are exceptions.

Renting a home is considered work so the income is taxable which makes expenses for that property a business expense that can be deducted. Although you might pay them both keep in mind that mortgage insurance and homeowners insurance arent the same thing. Deductions include mortgage interest property.

Mortgage insurance protects you in. Luckily any form of insurance is considered an ordinary and necessary rental property expense and is thus deductible. When you own several properties and those properties are used only for.

This is a benefit of renting a property since you cannot deduct your homeowners insurance for the property you reside in. The answer to the main question isyour homeowners insurance is tax deductible for your rental property. If you have employees you can deduct the cost of their health and workers compensation insurance too.

If you have a rental property or rent out your primary residence from time to time you may be able to deduct your insurance costs from your taxes. Insurance deductions are taken on Line 9 of Part I on Schedule E Supplemental Income and Loss. Some add-ons like hazard insurance are also included in expenses you can deduct.

In general you can deduct mortgage insurance premiums in the year paid. Never is homeowners insurance tax deductible your main home. Based on the types of selling expenses it can be deducted from the home sale profit.

You can only deduct homeowners insurance premiums paid on rental properties. Basic Deductions on Rentals As a landlord you can deduct a number of expenses you incur as the owner of a rental property on your income tax return. According to the Internal Revenue Service only private mortgage insurance can be deducted and this does not apply to a homeowners policy.

For a landlord the cost of a home warranty on a rental property is tax deductible. Therefore if you pay 1000 a year in insurance payments the IRS allows you to reduce that tax years taxable income by 150. Here are some instances to consider that could in fact make your homeowners insurance tax deductible.

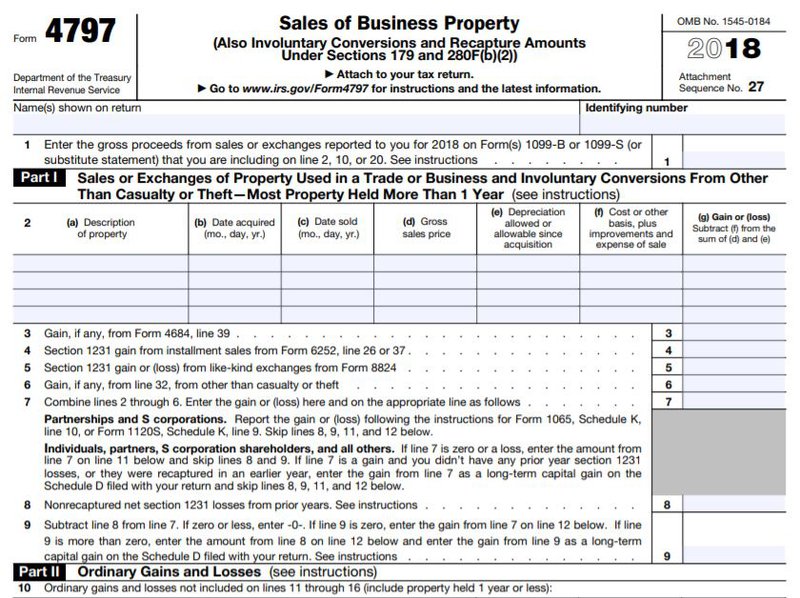

However if you prepay the premiums for more than one year in advance for each year of coverage you can deduct only the part of the premium payment that will apply to that year. View solution in original post. One more question so I can list 6000 under casualty and losses under deductions and credits on Schedule E under rental property.

Yes the 6000 is insurance deductible they subtract when they mail out the insurance claim check. Homeowners insurance protects you against loss from damage to the property. This is based on both the annual premium and other service fees based on operating expenses which can be claimed by income tax.

If you have a rental property you can deduct insurance as an expense insurance category but it would not be property taxes.

31 Tax Deductions Often Overlooked By Landlords Mynd Management

31 Tax Deductions Often Overlooked By Landlords Mynd Management

/house-model-and-key-in-home-insurance-broker-agent--hand-or-in-salesman-person--real-estate-agent-offer-house--property-insurance-and-security--affordable-housing-concepts-1076671916-586f4e8f2f994a5ca7518c675e7ae0e7.jpg) Is Homeowners Insurance Tax Deductible

Is Homeowners Insurance Tax Deductible

Https Www Stessa Com Top Rental Property Tax Deductions

:max_bytes(150000):strip_icc()/hurricane-charley-56a27caf5f9b58b7d0cb391a.jpg) Is Homeowners Insurance Tax Deductible

Is Homeowners Insurance Tax Deductible

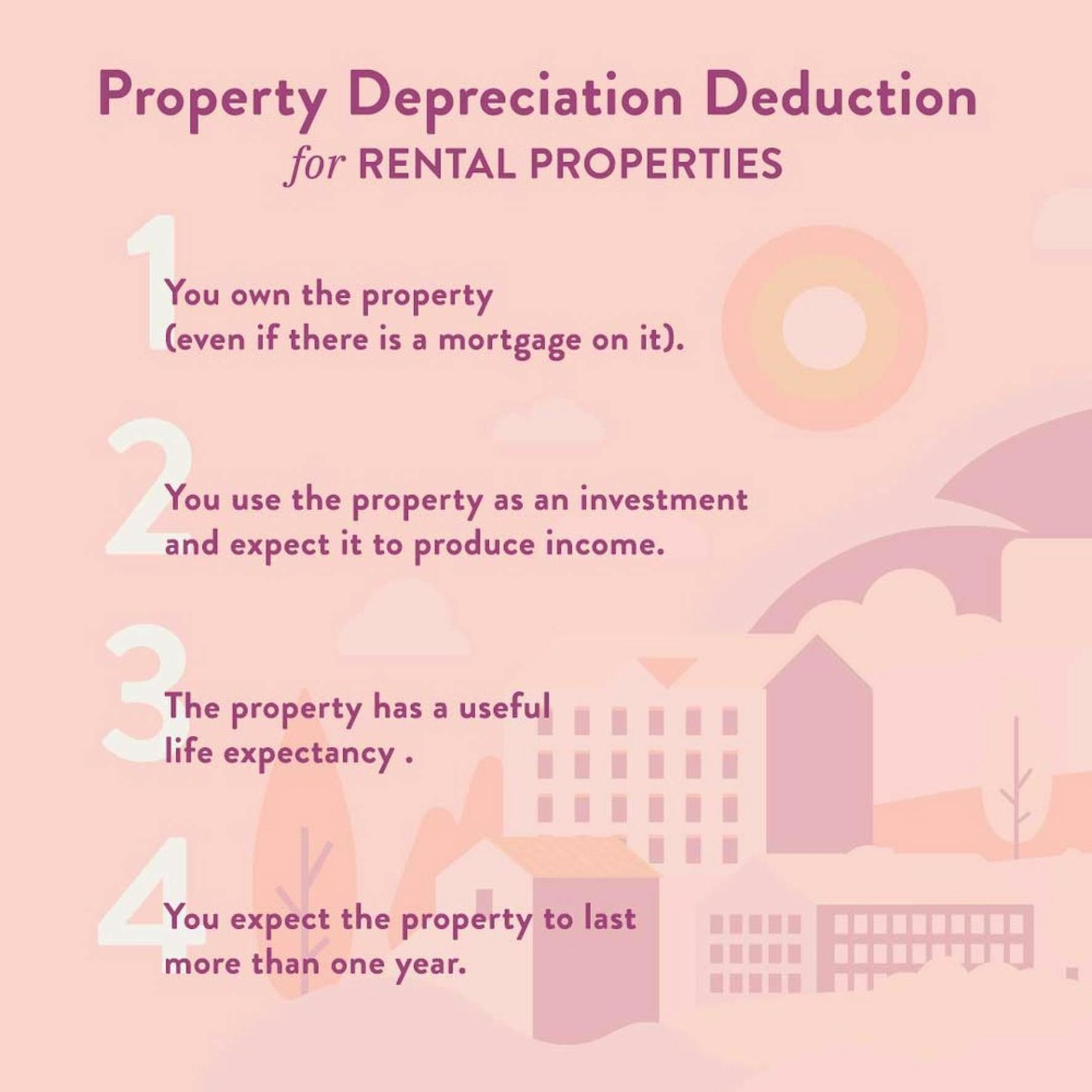

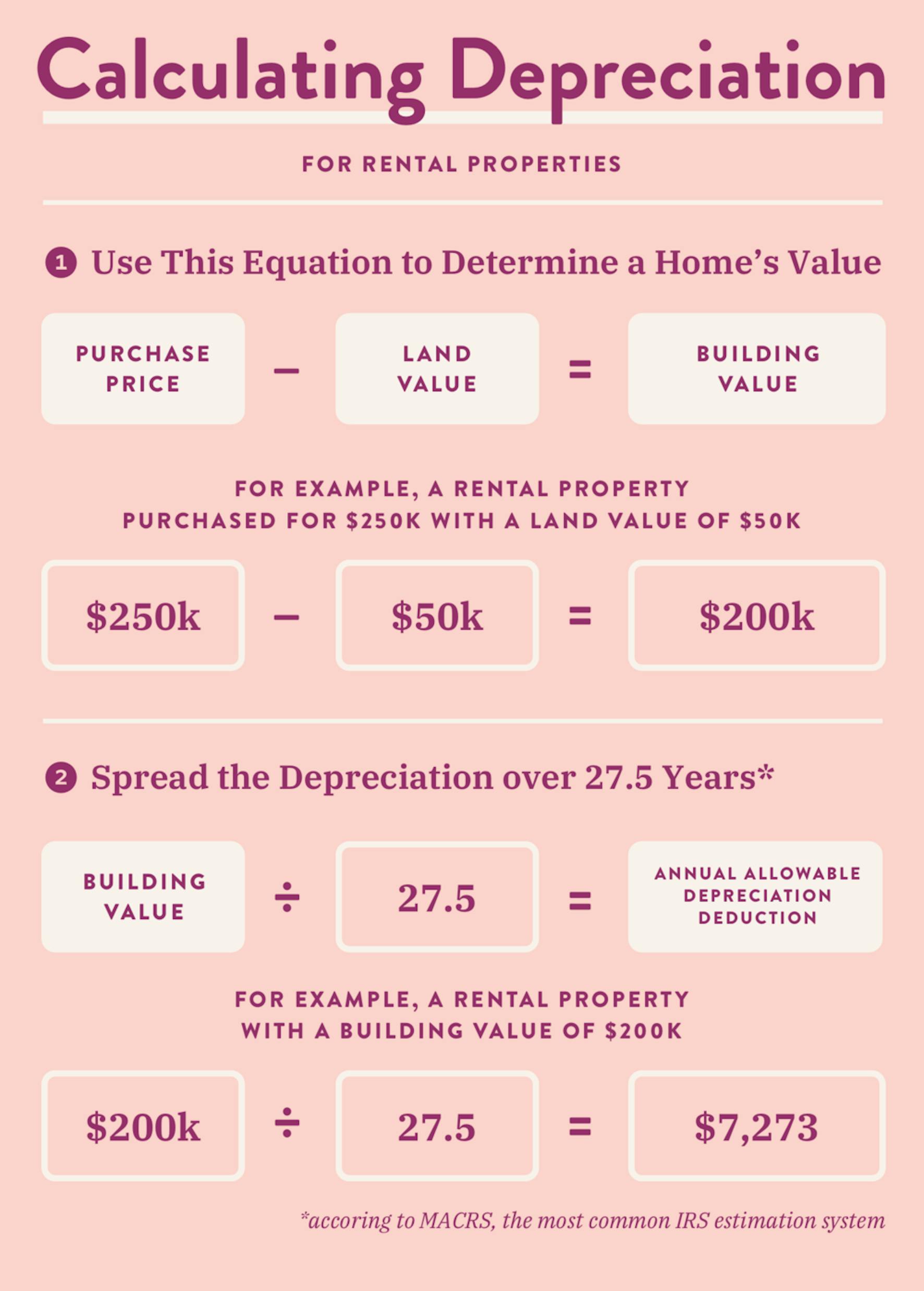

How To Deduct Rental Property Depreciation Wealthfit

How To Deduct Rental Property Depreciation Wealthfit

7 Rental Property Deductions You Re Missing Out On

7 Rental Property Deductions You Re Missing Out On

The 2020 Ultimate Guide To Irs Schedule E For Real Estate Investors

The 2020 Ultimate Guide To Irs Schedule E For Real Estate Investors

How To Deduct Rental Property Depreciation Wealthfit

How To Deduct Rental Property Depreciation Wealthfit

Real Estate Tax Deductions Guides Resources Millionacres

Real Estate Tax Deductions Guides Resources Millionacres

Mortgage Escrow What You Need To Know Forbes Advisor

Mortgage Escrow What You Need To Know Forbes Advisor

How To Deduct Rental Property Depreciation Wealthfit

How To Deduct Rental Property Depreciation Wealthfit

Is Hazard Insurance Tax Deductible What You Need To Know Clever Real Estate

Is Hazard Insurance Tax Deductible What You Need To Know Clever Real Estate

Understanding Your Home Insurance Declarations Page Policygenius

Understanding Your Home Insurance Declarations Page Policygenius

How To Deduct Rental Property Depreciation Wealthfit

How To Deduct Rental Property Depreciation Wealthfit

Rental Property Insurance Providers Costs Coverage

Rental Property Insurance Providers Costs Coverage

The 2020 Ultimate Guide To Irs Schedule E For Real Estate Investors

The 2020 Ultimate Guide To Irs Schedule E For Real Estate Investors

How To Deduct Rental Property Depreciation Wealthfit

How To Deduct Rental Property Depreciation Wealthfit

A Beginner S Guide To Investment Property Income Tax Deductions Millionacres

A Beginner S Guide To Investment Property Income Tax Deductions Millionacres

Mortgage Interest Deduction Or Standard Deduction Houselogic

Mortgage Interest Deduction Or Standard Deduction Houselogic

Labels: deductible, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home