Montana Property Tax Relief Form

Montana homeowners or renters age 62 or older may qualify for this program even if you do not have to file an income tax. Mobile Home Personal Property Due Dates.

Farm Tax Information Farm Link Montana

Farm Tax Information Farm Link Montana

Click here to learn about property the tax relief programs offered by the State of Montana.

Montana property tax relief form. Learn more about Montana Residency or see the NonresidentPart-Year Resident Ratio Schedule instructions in the Montana Individual income Tax Return Form 2 Instruction Booklet for more information. If filing Form 2 enter the amount from line 13 above on Schedule V line 24. When it comes to property.

General Information April 15Apply by You have to meet income and property ownershipoccupancy every year. 2 The property tax assistance is provided for the full tax year. 1 A person who qualifies for assistance under 15-6-305or 15-6-311is entitled to assistance as provided for in this section.

State tax appeal board. For agricultural and timber parcels the only eligible land is. General Information April 15Apply by You have to meet income and property ownershipoccupancy every year.

Time Period For Property Tax Assistance. A in the first year in which the applicant qualifies for assistance if the applicant resides in the qualifying property for the remainder of the tax. Delinquent real estate taxes may be subject to tax lien purchase.

Revised Individual forms for Tax Year 2020 are available now. Ownership interests in land sold for taxes. The benefit only applies to your primary residence.

Montana Disabled Veteran MDV Property Tax Relief Application for Tax Year 2017 15-6-311 MCA Part I. For more information and to see if you qualify please see Montana Disabled Veterans Assistance Program on our website. The benefit only applies to your primary residence.

Submit by email by post to 2820 W. A second attempt in the Legislature to allow Montana cities and towns. If not required to file Montana Form 2 mail Form 2EC or file it online for free at revenuemtgov.

Learn more about Montana Residency or see the NonresidentPart-Year Resident Ratio Schedule instructions in the Montana Individual income Tax Return Form 2 Instruction Booklet for more information. You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is normally based in another state. You may use this form to apply for the Montana Disabled Veteran Assistance Program.

Property Tax Relief If you are low income a 100 disabled veteran or surviving spouse or had a large increase in your property taxes due to reappraisal you may qualify for tax assistance. Collection of property taxes. MDV Montana Disabled Veteran MDV Property Tax Relief Application.

Select 2020 Income Tax Forms from the Forms drop down menu or link from the RELIEF Act Page The EITC Assistant is also available to help you determine eligibility for this important tax credit Click on the RELIEF Act tab from the landing page or from the COVID menu on mobile devices for more information BREAKING NEWS. If a delinquency exists please contact the Treasurers Office at 406-497-6310 to ensure the correct payment. Montana property tax consultants that will help you with lowering your property taxes and your property tax issues.

Property Tax Refund Homeowners or renters may qualify for a Property Tax Refund depending on income and property taxes. The bottom line on property tax relief for retirees. This is your elderly homeownerrenter credit.

You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is normally based in another state. Time period for property tax assistance. Montana disabled american veteran property tax relief application form ppb-8a Honorably discharged military members residing in Montana who are completely and permanently disabled who meet the income limitation requirements may file a form PPB-8A to seek a property tax exemption on their primary residence.

For agricultural and timber parcels the only eligible land is. Include Form 2EC with Form 2. At 406 444-6900 or Montana Relay at 711 for hearing impaired.

We offer assistance in property tax appeals property tax relief programs and Montana department of revenue issues. If you miss the deadline apply as soon as possible to ensure you are included in the programs verification process for the following tax year. Please refer to Montana State law MCA 15-16-102 for more information.

You may ask us to cancel or reduce filing or payment penalties if you have a reasonable cause or are negatively affected by the COVID-19 pandemic. Montana Disabled Veteran MDV Property Tax Relief Application for Tax Year 2018 15-6-311 MCA Part I. Montana code annotated 2019.

25 to property tax relief 5 for administration and 20 to counties. The Montana Elderly HomeownerRenter Credit program is a property tax relief program that provides a refundable income tax credit of up to 1000. Direct Deposit Your Refund Complete 1 2 3 and 4.

No one enjoys paying one penny more than required when it comes to paying taxes. Property Tax Relief Minnesota Department of Revenue COVID-19 Penalty Relief. Chapters 11 through 14 reserved.

Property Tax Help Montana Taxed Right Consulting Llc

Property Tax Help Montana Taxed Right Consulting Llc

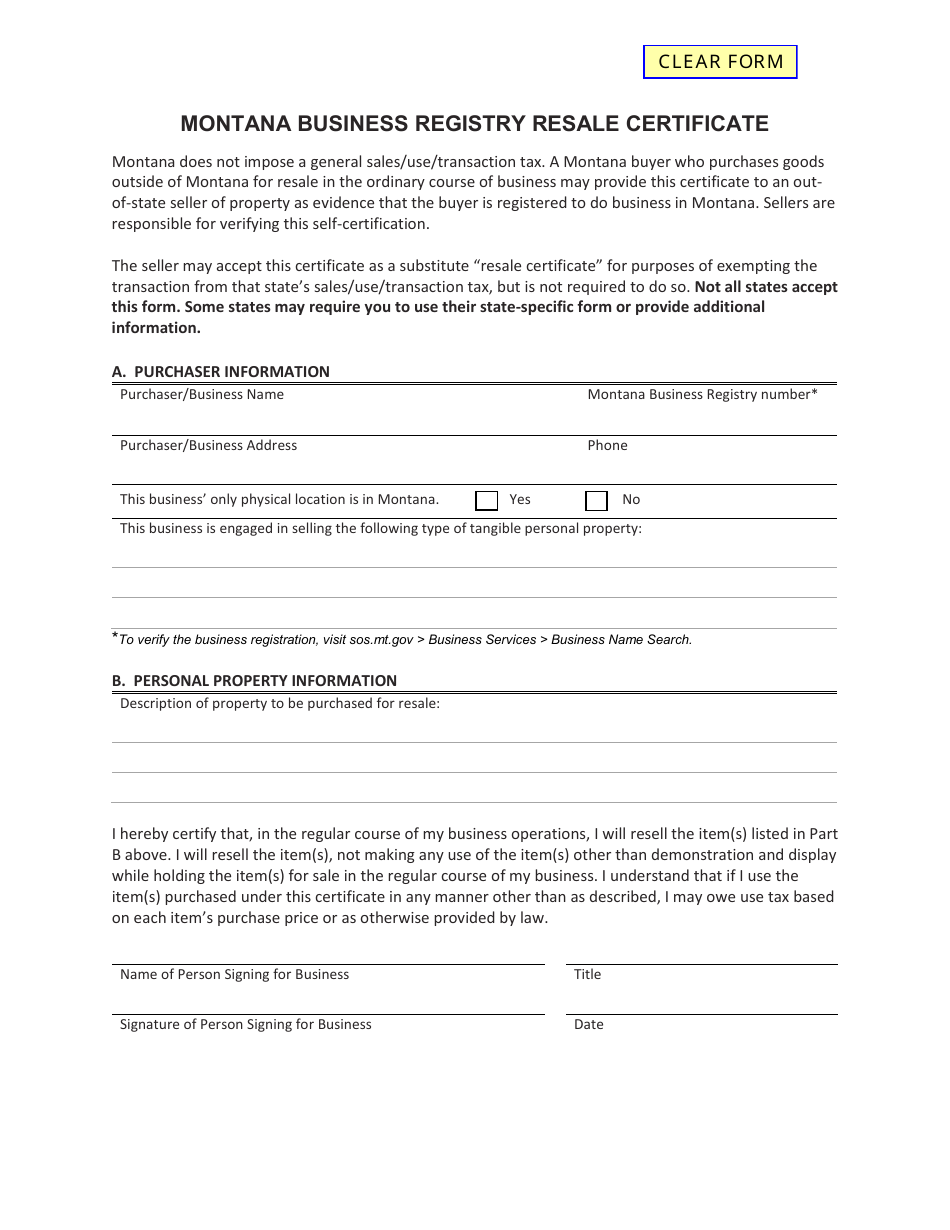

Montana Montana Business Registry Resale Certificate Form Download Fillable Pdf Templateroller

Montana Montana Business Registry Resale Certificate Form Download Fillable Pdf Templateroller

Free 10 Sample Tax Exemption Forms In Pdf

Free 10 Sample Tax Exemption Forms In Pdf

Montana Llc Steps To Form An Llc In Montana

Https Mspamt Org Wp Content Uploads 2019 12 Fid 3 2019 Watermark Pdf

Montana Real Estate Transfer Tax Montana Real Estate Transfer Certificate

Montana Real Estate Transfer Tax Montana Real Estate Transfer Certificate

Montana Income Tax Information What You Need To Know About Mt Taxes

Montana Income Tax Information What You Need To Know About Mt Taxes

Https App Mt Gov Myrevenue Endpoint Downloadpdf Yearid 301

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

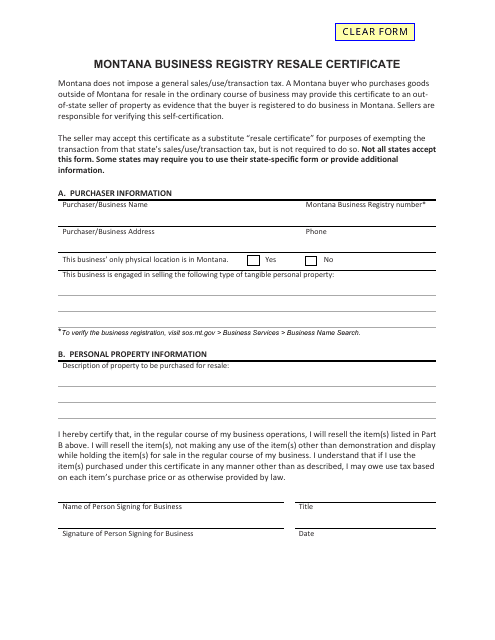

Montana Montana Business Registry Resale Certificate Form Download Fillable Pdf Templateroller

Montana Montana Business Registry Resale Certificate Form Download Fillable Pdf Templateroller

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home