How To Get 2019 Property Tax Statement

Click on the link for Personal PropertyMVLT and Real Estate. Wisconsin Department of Revenue.

A real property tax lien that is sold under article 3 of this chapter may be redeemed by.

How to get 2019 property tax statement. If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill. For purposes of this section a tax bill includes both the tax bill and separate statements referenced in Tax Code Section 3101. Then select Property Tax Statement.

Steps to viewprint property tax payment information. Click on the Online Services tab at the top of the website. Make an Online Property Tax Payment Part 3.

Taxpayers concerned that their Assessed Value or Real Market Value is too high should call the Appraisal Division at 503-846-8826 to discuss the basis for their propertys appraisal. Make an Online Property Tax Payment Part 2. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property.

Assessor Auditor-Controller Treasurer and Tax Collector and Assessment Appeals Board have prepared this property tax information site to provide taxpayers with an overview and some specific detail about the property tax process in Los Angeles County. Annual Secured Property Tax Bill - The Annual Secured Property Tax Bill is mailed on or before November 1 of each year. 763-682-3900 or 800-362-3667 Phone Directory.

Appeals of value may be filed until December 31 2019. Enter Debit or Credit Card Details. Select Yes I accept.

If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your. You can also call the Property Information Center at 651-438-4576. Written authorization by the property owner is not required in order to deliver the tax bill to the mortgage company when the mortgage company acknowledges that it has authority for payment of taxes on the property.

DOR Deadline - Municipalities with population 2500 and counties e-filed Municipal Financial. The tax statement includes a section on current and prior-year values. Taxpayers can get a copy of their property tax statement from their county treasurer.

The property tax account is being reviewed prior to billing. Select the information requested from the pull down menus Tax Year - individual year or ALL. Pay or view your account online do a property search or sign up for e-Reminder Notices via text or email.

Go to the Property Information Search and enter your house number. The first notice a valuation notice is. For manufactured homes go to the Manufactured Home Tax Stubs and enter the 11-digit property identification number.

Each year property taxpayers receive three notices that provide information on the valuation of the property proposed tax amounts meetings about proposed levies and budgets and the amount of taxes due. Any person who has a legal or equitable claim in the property including a certificate of purchase of a. Special assessments are billed separately from ad valorem property taxes.

If your property is within a local improvement district a special assessment statement for the local improvements will be sent to you upon the completion of construction. Property owners have the option to defer payment over twelve 12 annual installments. Any person that wants to pay on behalf of the owner by making a charitable gift.

For contact information check your local phone book or see County Websites on Minnesotagov. View All Programs and Initiatives. NW Buffalo MN 55313 Ph.

Instructions and Supporting Material. Make an Online Property Tax Payment Part 1. The annual bill has two payment stubs.

Include the payment stub s with the payment and write the Assessors Identification Number and the YearSequence Number on the check. You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statements. The owners agent assignee or attorney.

The 2020 property taxes are due January 31 2021. Real Property Tax Real Estate 206-263-2890. Select the Tax Bill Payment option which is the 6 th option.

The county treasurer can answer any questions you may have about the statement. County Telephone Operator 817-884-1111 Tarrant County provides the information contained in this web site as a public service. Create an Online Profile.

You can request copies of property tax statements from your citytownshipvillagecounty assessors office or their web site. Mobile Homes and Personal Property Commercial Property Tax 206-263-2844.

11 Quick Ways For Apartment Owners To Make Property Taxes Filing Property Tax Filing Taxes Tax

11 Quick Ways For Apartment Owners To Make Property Taxes Filing Property Tax Filing Taxes Tax

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

What Is Boot In A 1031 Exchange Lower Debt Exchange Capital Gains Tax

What Is Boot In A 1031 Exchange Lower Debt Exchange Capital Gains Tax

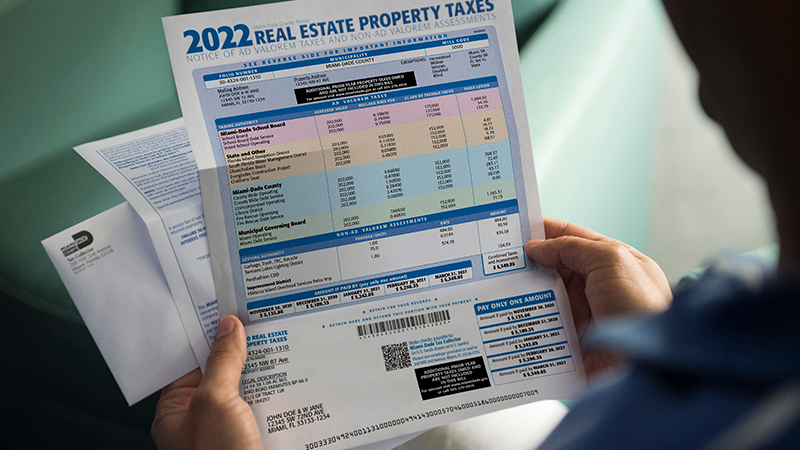

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Pay Your Property Tax Bill Online

Pay Your Property Tax Bill Online

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Treasurer Releases Estimate Of Average Property Tax Bill By Township Kane County Connects Property Tax Tax Extension Township

Treasurer Releases Estimate Of Average Property Tax Bill By Township Kane County Connects Property Tax Tax Extension Township

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

Current Payment Status Lake County Il

How To File Taxes The Easy And Organized Way Filing Taxes Tax Checklist Tax Prep Checklist

How To File Taxes The Easy And Organized Way Filing Taxes Tax Checklist Tax Prep Checklist

Rental Property Tax Preparation Worksheet In 2021 Income Tax Income Tax Preparation Tax Preparation

Rental Property Tax Preparation Worksheet In 2021 Income Tax Income Tax Preparation Tax Preparation

Tax On Purchase And Sale Of Property Property Tax Tax Consulting Tax Payment

Tax On Purchase And Sale Of Property Property Tax Tax Consulting Tax Payment

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home