Property Tax Bill Quarterly Statement

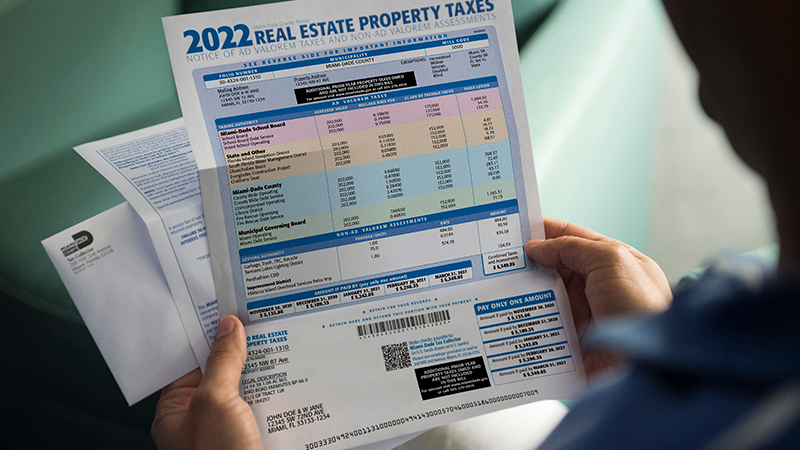

Property Tax Bills Bills are generally mailed and posted on our website about a month before your taxes are due. If you pay your property taxes yourself rather than through a mortgage lender you should receive your statement by March 1 2021.

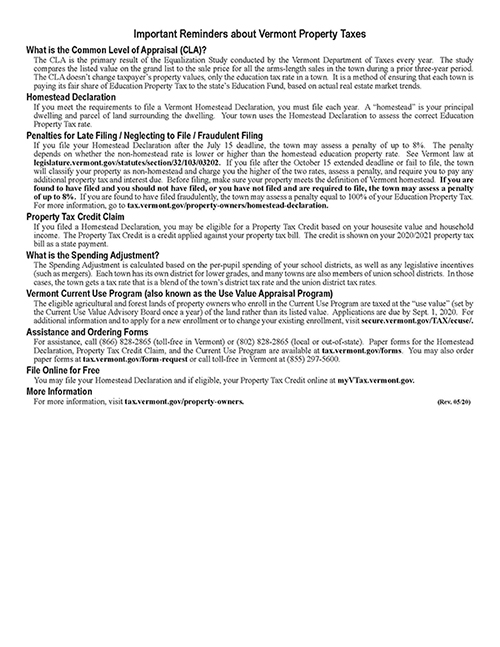

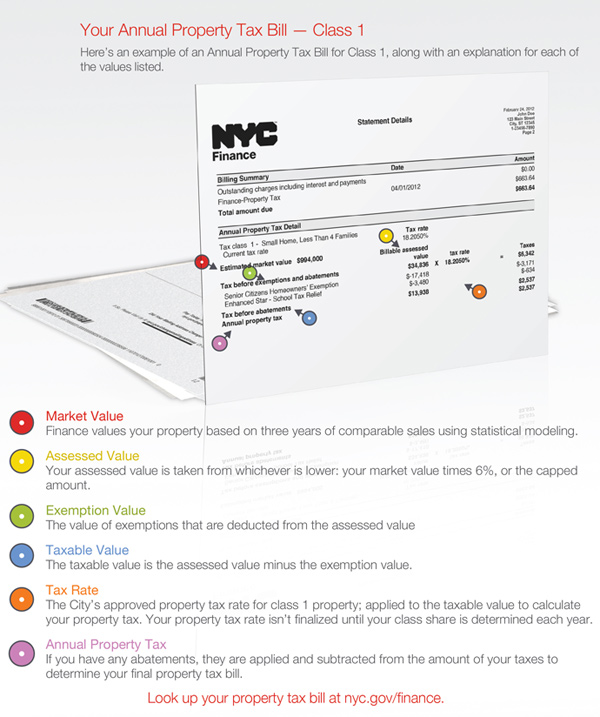

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Payment deadline for first half of property taxes is April 30 2021 and second half November 1 2021.

Property tax bill quarterly statement. 32019 Instructions Page. To review current amounts due please use the safe and secure online eCommerce System. Because I am wondering as a foreigner if my Kingdom doled some funds on Jared Kushner or on Ivanka Trump.

View your property tax bills annual notices of property value NOPV and other important statements. If you do not receive your reminder tax notice call our office at 305-270-4916 or e-mail email protected for a duplicate tax bill. Borough block lot.

FLUSHINGNY11367-1334 Owner nameBOROHOV DANI Property address. Property Tax Bill Quarterly Statement Activity throughNovember 21 2020 Mailing address. 3 Click on the tab that says Bills Fig.

1A NEW YORKNY10003-2824 Owner nameFOTINI EQUITIES LLC FOTINI EQUITIES LLC Property address. Property Tax Bill Quarterly Statement Activity throughNovember 21 2020 Mailing address. EDT Eastern Daylight Time on May 31 2021.

Press Enter or click on the magnifying glass to search. Taxpayers may use the secure drop box located in the lobby of the 77. The 2020 property taxes are.

Pay online dont stand in line. What makes this tax bill different from the secured tax bill is that the lien for taxes is against the owner of the property. Division of Income Tax home page.

The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. You can get a discount if you pre-pay taxes that are not due until later in the year. We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance.

Current and past due property tax changes. Click on the year to see the bill Fig. You can view bills statements back to 2018.

This is a question that the Americans should ask themselves. Due to the COVID-19 pandemic the Division is currently closed to the public. Tax bill process is a long and involved process which starts with.

Failure to receive a tax bill does not relieve the responsibility for timely payment nor constitute cause for cancellation of penalty andor cost charges. Is the White House for Sale. QUEENS 4065370008 Outstanding Charges 132070 New Charges 293282.

Quarterly tax bills for properties with an Assessed Value under 250000 are due on July 1 but owners have a grace period through July 15 2020 during which no interest is charged. Please complete a blue comment card and drop in the designated location when you visit our offices or use our electronic form to let us know how we are doing. City of Columbus Income Tax Division 77 N.

It is the duty of the Tax Assessor-Collector to assess and collect for the County all taxes imposed on property within the county. 2 Click on the row that shows the property you are looking up. Borough block lot.

2020 Reminder Tax Bills. The property tax bills recently sent out by DOF are due on July 1 2020. Online information - E-mail address.

BOROHOV DANI 6707147TH ST. General information about how your tax is calculated. Front Street 2nd Floor.

An unsecured property tax bill may also be for real property such as land in some cases. Your Property Tax Bill shows. Your bill will open in a new browser window or be downloaded to your computer depending on your browser.

In keeping with our Mission Statement we strive for excellence in all areas of property tax collections. The Tax Collector may have a program to assist you with deferring taxes and paying in quarterly installments. If real property is purchased during the fiscal year or if a mortgage company is no longer responsible for making tax payments call our office to request a bill at 702-455-4323 option 3.

Section IV Real Property Tax Adjustment for Volume Sold Optional The Ohio Department of Taxation has requested that the Division collect this information. Amount you can pre-pay. Property Tax Statements are mailed out in October and are due upon receipt.

The 2020 reminder tax bills will be mailed on April 20 2020. You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statements. Exemptions abatements and credits.

To avoid penalties pay your taxes by January 31 2021. Quarterly Statement of Production Form 10H Instructions continued- Quarterly Statement of Production Form10-H Rev. Apply for tax exemptions and see which exemptions you already receive.

Type in your address or property ID number. Online payment function 2020 taxes only will be available until 1159 pm. The Property Appraiser does not determine the amount of taxes.

An unsecured property tax bill is usually for property such as aircraft boats and business personal property. 614 645-7193 Customer Service Hours. Monday through Friday 900 am.

FOTINI EQUITIES LLC FOTINI EQUITIES LLC 307 E18TH STAPT. Our primary focus is on taking care of citizens. Property Tax Bill Quarterly Statement Opinion.

Other property-related chargesincluding past due amount. Understanding your Tax Bill. Pay property taxes on time.

The property tax account is being reviewed prior to billing. Simply begin by searching for a property by address or borough-block-lot BBL number. If you have any questions contact us.

Understanding California S Property Taxes

Understanding California S Property Taxes

The Official Website Of The Borough Of Roselle Nj Tax Collector

The Official Website Of The Borough Of Roselle Nj Tax Collector

Tax Collector S Office City Of Englewood Nj

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Pay Your Property Tax Bill Online

Pay Your Property Tax Bill Online

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Freehold Township Sample Tax Bill And Explanation

Freehold Township Sample Tax Bill And Explanation

Freehold Township Sample Tax Bill And Explanation

Freehold Township Sample Tax Bill And Explanation

Https Www Boston Gov Sites Default Files Imce Uploads 2019 06 2020 Insert 1qb Pdf

Understanding Your Property Tax Bill And The Services Supported

Understanding Your Property Tax Bill And The Services Supported

Tax Finance Dept Sparta Township New Jersey

Tax Finance Dept Sparta Township New Jersey

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home