Which County Has The Lowest Property Taxes In New York

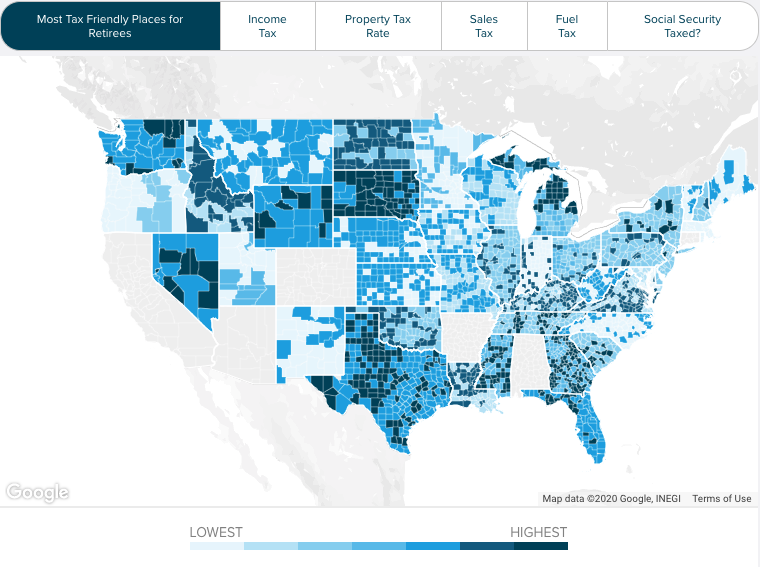

However there are a few outliers from elsewhere in the country that sneak into the bottom five. There are a multitude of factors that determine how high your yearly property tax bill is.

Map How Much 100 Is Really Worth In Every State Map States Cost Of Living

Map How Much 100 Is Really Worth In Every State Map States Cost Of Living

Head south if you want to pay less in property taxesmany southern states have lower property taxes on average.

Which county has the lowest property taxes in new york. The lowest effective tax rate in the state was 419 per 1000 levied on homes and businesses in the Sagaponack school district portion of the town of Southampton in Suffolk County. Property tax rates vary wildly depending where you live in New. Lawrence County has the lowest property tax in the state collecting an average tax of 167400 21 of median home value per year.

That low rate reflected high property values in the town where the latest Census Bureau data. The exact property tax levied depends on the county in New York the property is located in. The rate is an amount applied to every 1000 of a.

See for yourself below as we go county-by-county to find the lowest average tax bills based on data from the state Department of Community Affairs. Baffled by Hudson Valley Catskills property tax rates. School property tax rates vary wildly depending on where you live.

Capital Region Central New York Finger Lakes Long Island Suffolk County Mid-Hudson Mohawk Valley North Country Southern Tier Western New York. Only five other counties in the state are lower. The Southern Tier 3057.

Four regions paid less than the states average. The median property tax also known as real estate tax in Erie County is 312000 per year based on a median home value of 11770000 and a median effective property tax rate of 265 of property value. 60 rows Overall full-value tax rates by county all taxing purposes.

The highest and lowest rates and property taxes on a median-value home in each region can be found here. In fact of the five counties with the lowest relative property taxes three are in Alabama. At the bottom of the ranking Rochester New York boasts a whopping 34 property tax rate well above the national average of 1 and expensive homes that are not appreciating in value.

The school district with the lowest property tax rate in Western New York is Ellicottville Central School District. Allegany County has the lowest median property tax in dollars in Western New York. As well as the North Country and the Capital Region which.

Lloyd Harbor another Suffolk County village had combined annual taxes of 38341 on a median-value home. Of the sixty-two counties in New York Erie County is ranked 21st by median property taxes and 14th by median tax. Search our database of tax rates in every municipality in New York state.

Meanwhile Scarsdale has relatively low property taxes for New York state according to the Westchester County website. This week on Upstater well attempt to unravel the locations with the lowest property taxes in the region. SourceThe Tax Foundation based on a three-year average and out of 1824 counties nationwide.

Median Property Taxes Paid on Homes2380. Taxes as Percent of Home Value237. The lowest tax bill on a median-value home was 1128 in the Hamilton.

910 Shaver Hollow Road Andes. The village has a property tax rate of. Three counties tie for highest property taxes in the state.

Lowest Property Taxes by County. Compare property tax rates in every city town village county school district in New York. Westchester County collects the highest property tax in New York levying an average of 900300 162 of median home value yearly in property taxes while St.

Erie County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Read more »