Which States Have Property Tax On Cars

Division of Motor Vehicles collects as defined by law on behalf of counties. Hawaii District of Columbia.

In Addition To The Federal Estate Tax Which Is Fourth Highest In The Oecd Many U S States Levy Their Own Estate Inheritance Tax Estate Tax Estate Planning

In Addition To The Federal Estate Tax Which Is Fourth Highest In The Oecd Many U S States Levy Their Own Estate Inheritance Tax Estate Tax Estate Planning

In addition eight cities also charged personal property taxes on vehicles.

Which states have property tax on cars. As of 2020 New York has a car tax rate of 4 percent plus local taxes whereas next-door neighbor Massachusetts has a state car tax rate of 625 percent with some local rates much higher. The island state of Hawaii has some of the lowest property and vehicle tax burdens in the nation with average real estate taxes of just 482 and no vehicle tax according to. The highest tax burden for owning a vehicle was in Providence Rhode Island where a family earning 150000 paid 3897.

325 excise tax plus 125 sales tax 45 total for new vehicles. Table 1 lists these states. State Car Tax Rate Tools.

States that assess a personal property tax on vehicles include. In other states it can be especially expensive to own and upkeep a vehicle. 51 rows Delaware Montana New Hampshire and Oregon do not levy sales tax on cars.

Eighteen states and the District of Columbia have no value-based taxes on motor vehicles either at the state or local level. The lowest tax burden for vehicles was in New Orleans Louisiana where a family earning 25000 paid 110. If you live in one of the states that base a portion of the registration fee on the vehicles value you deduct the business-related portion of the fee on Schedule C.

You asked for a list of states that have neither 1 property taxes on motor vehicles nor 2 any state tax or fee in lieu of property taxes that is based on the vehicle s value. Knowing how much sales tax to pay when purchasing a vehicle is also helpful to know when asking for financing from a lender. If you reside in New York New Jersey Florida or Texas you are not required to pay an annual vehicle property tax.

With half of US. A computer search found at least 16 states that impose statewide motor vehicle taxes or fees based on a vehicles value but only Kansas and Mississippi refers to their tax as a property tax. The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of.

AL AZ AR CA CO GA IN IO KY LA MI MN MS MO MT NE NV NH SC WA WY. Mississippi refers to its tax as an ad valorem tax the term usually associated with property taxes All the states specify the portion of a vehicles value subject to the tax ie the assessment or base value. North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred.

Deducting Personal Property Tax. 51 rows Depending on where you live property taxes can be a small inconvenience or a major burden. While there arent any states with no property tax in 2021 there are 23 states plus the District of Columbia that with no personal property tax on vehicles.

States charging a personal property tax on vehicles based on vehicle value the average annual vehicle property tax cost is 423. Vehicles are also subject to property taxes which the NC.

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

Deducting Sales Tax On Your New Car Or Boat Or Airplane Or Home Cutlass For Sale New Cars Tax

Deducting Sales Tax On Your New Car Or Boat Or Airplane Or Home Cutlass For Sale New Cars Tax

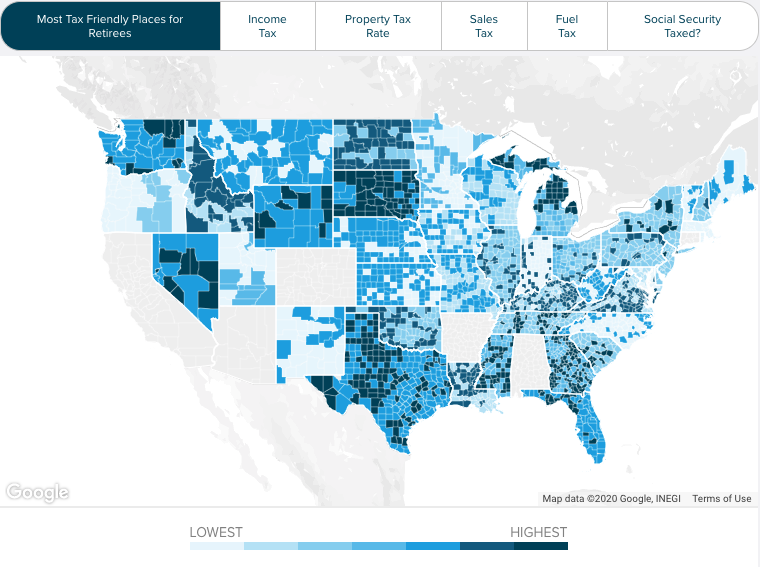

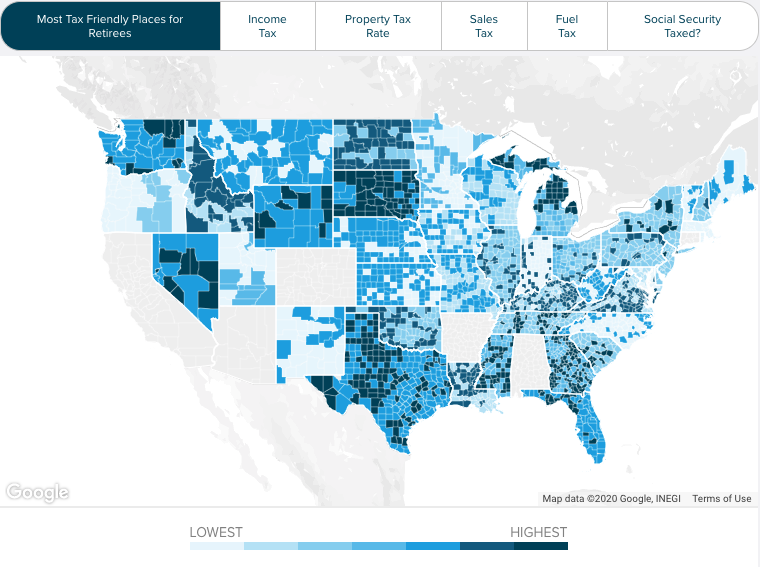

State By State Taxes Tool State Tax Tax Property Tax

State By State Taxes Tool State Tax Tax Property Tax

These States Have No Income Tax The Motley Fool Income Tax Filing Taxes Best Places To Live

These States Have No Income Tax The Motley Fool Income Tax Filing Taxes Best Places To Live

Virginia Department Of Motor Vehicles Motor Car Property Tax Personal Property

Virginia Department Of Motor Vehicles Motor Car Property Tax Personal Property

Utah Retirement Tax Friendliness Smartasset

Utah Retirement Tax Friendliness Smartasset

How To Write Off Taxes On Rental Property Tax Relief Center In 2021 Rental Property Rental Property Investment Real Estate Investing Rental Property

How To Write Off Taxes On Rental Property Tax Relief Center In 2021 Rental Property Rental Property Investment Real Estate Investing Rental Property

Bloomington Taxes 2015 Vrs 2020 Bloomington Budgeting Tax

Bloomington Taxes 2015 Vrs 2020 Bloomington Budgeting Tax

Example Of Bill Of Sale For Car Sales Tax Invoice Invoice Template Word Invoice Format In Excel Invoice Format

Example Of Bill Of Sale For Car Sales Tax Invoice Invoice Template Word Invoice Format In Excel Invoice Format

Which States Have The Lowest Property Taxes Property Tax History Lessons Historical Maps

Which States Have The Lowest Property Taxes Property Tax History Lessons Historical Maps

What Is The Washington State Vehicle Sales Tax New Cars Cars For Sale Car Dealer

What Is The Washington State Vehicle Sales Tax New Cars Cars For Sale Car Dealer

New Online Resource State By State Property Tax At A Glance Property Tax News Online Online Resources

New Online Resource State By State Property Tax At A Glance Property Tax News Online Online Resources

In The United States Many People Receive Some Sort Of Car Tax Allowance Or A Car Allowance As It Is Usually Referred To By Most People Allowance Tax The Unit

In The United States Many People Receive Some Sort Of Car Tax Allowance Or A Car Allowance As It Is Usually Referred To By Most People Allowance Tax The Unit

Own Your Home And Reduce Your Tax Burden In 2020 Tax Payment Property Tax State Tax

Own Your Home And Reduce Your Tax Burden In 2020 Tax Payment Property Tax State Tax

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

2018 Tax Laws That Affect Real Estate We Will Guide You Through The Sales Process Consult Your Cpa For Det Investment Property Estate Tax Real Estate

2018 Tax Laws That Affect Real Estate We Will Guide You Through The Sales Process Consult Your Cpa For Det Investment Property Estate Tax Real Estate

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home