How Does An Escrow Account Work For Property Taxes

Your lender must work directly with the county tax collector to obtain the information on your. Escrow Payments Are Divided Into Monthly Installments.

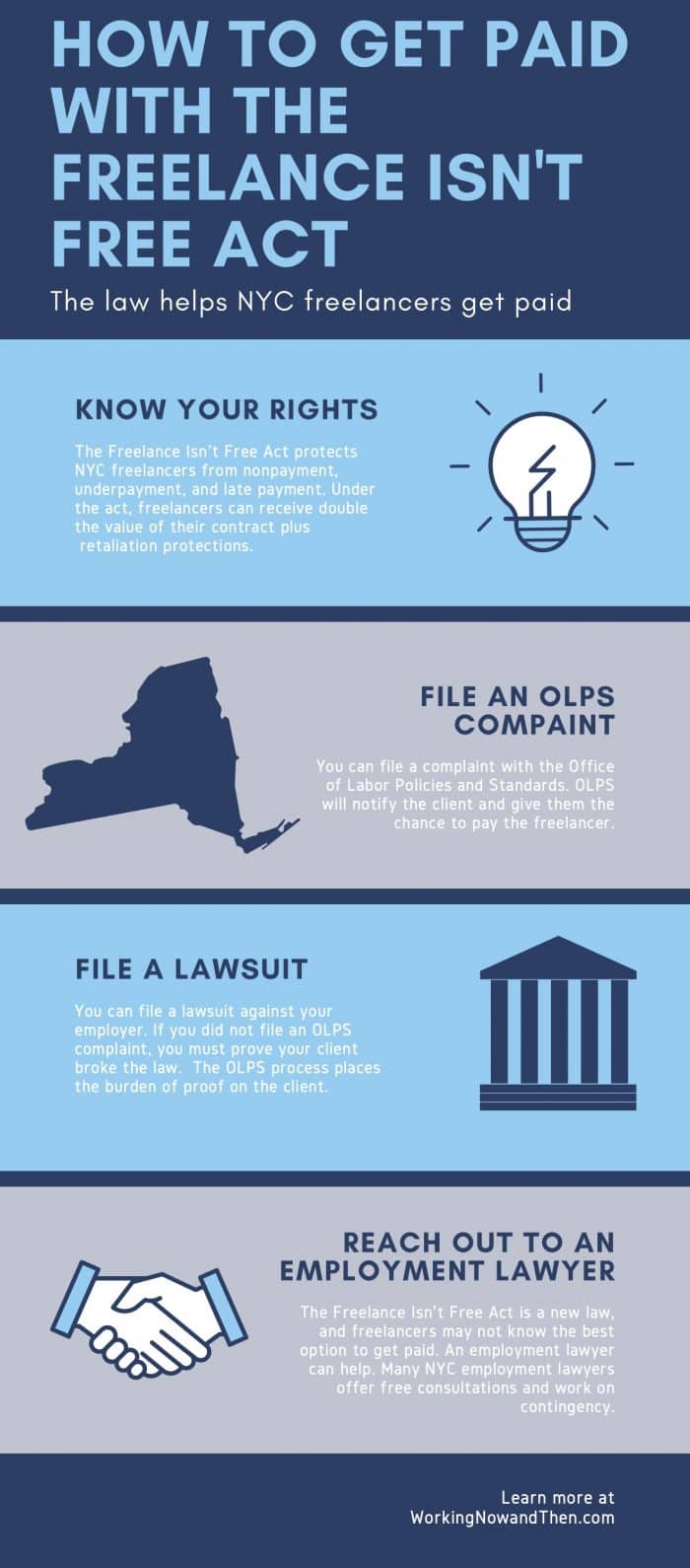

Infographic What Do Mortgage Lenders Look For When Approving A Home Loan Thinking About Buying A House While Idl Home Loans Mortgage Lenders Mortgage Loans

Infographic What Do Mortgage Lenders Look For When Approving A Home Loan Thinking About Buying A House While Idl Home Loans Mortgage Lenders Mortgage Loans

When your insurance or property tax bill comes due the lender uses the escrow funds to pay them.

How does an escrow account work for property taxes. Part goes toward your mortgage to pay your principal and interest. Rather than making lump contributions directly into that account to be put towards bills like your homeowners insurance premium and property taxes your lender breaks up the total into 12 monthly payments. Mortgagers Ask Their Borrowers To Open One At Closing.

How Does An Escrow Account Work. Your escrow account will cover regular property taxes and homeowners insurance as well as flood insurance if its required in your area. Watch our videos to learn how escrow works.

How does an escrow account work. Combined these are sometimes referred to as principal interest taxes and insuranceor PITI. After you purchase a home your lender may establish an escrow account to pay for your taxes and insurance.

That way you dont have to keep up with the payment deadlines and youre not forced to shell out hundreds or thousands of dollars all at once to cover your taxes or keep your insurance current. Escrow accounts hold money collected in advance. Establishing An Escrow Account At Closing.

By choosing to use the taxes of the estimated improved value the escrow account will be properly funded. After receiving your monthly payment which includes principal interest taxes and insurance PITI the servicer puts the amounts for taxes and insurance into a designated account called an escrow account or impound account. When you have an escrow account your monthly mortgage payment is made up of two parts.

It does not cover homeowner association dues or supplemental tax bills. Escrow accounts can only be collected using one tax value. Escrow accounts are used in conjunction with your mortgage loan.

The bank just pays it with your money on your behalf. Its one of the closing costs of buying a home. Real Estate Escrow Accounts When a bank or other financial institution underwrites a loan for a big-ticket itemlike a homethey want some assurance that the property they are lending money for is protected.

Each month the lender deposits the escrow portion of your mortgage payment into the account and pays your insurance premiums and real estate taxes when they are due. One portion is what you pay for your mortgages principal and interest. When closing the sale of a house the mortgage company will ask the homeowner to open an escrow account to maintain real property tax and insurance payments.

Although a portion of every mortgage payment goes into your escrow account for property taxes your loan servicer doesnt pay the taxes on your behalf until the bills come due. How Are Property Taxes Paid Through an Escrow Account. Understand that since escrow money is your money the bank isnt paying the property tax you are.

That usually happens two or four times a year. They want to make sure the property taxes are. That amount is then rolled into your monthly mortgage payment.

To set up your mortgage escrow account the lender will calculate your annual tax and insurance payments divide the amount by 12 and add the result to your monthly mortgage statement. Escrow funds are used to pay property taxes and insurance bills Open an escrow account with your mortgage lender which typically services the account Escrow accounts give borrowers the convenience of a bundled monthly payment Taking out a mortgage comes with many costs besides the principal and interest. The bank will use your money in the escrow account to pay your property tax bill when its due.

Your mortgage lender typically opens an escrow account on your behalf. Escrow accounts are set up to collect property tax and homeowners insurance payments each month. When those bills are due we use the funds in your escrow account to pay them.

At closing the seller will issue a credit to the buyer for. The other portion gets set aside in your escrow account for property tax and insurance payments. When property taxes or insurance premiums are due the lender pays those for you Of course the lender doesnt actually come up.

Youll find the amount that was paid out on the annual escrow analysis provided by your servicer. The other part goes into your escrow account for property taxes and insurance premiums like homeowners insurance mortgage insurance or flood insurance. The downfall occurs with the tax prorations.

An escrow account is set up to collect your payments for property taxes homeowners insurance and possibly other items in equal amounts over a 12-month period to be paid on your behalf when those bills come dueWhen lenders require escrow accounts the law limits the amount borrowers must pay. They act as a savings account to hold. It does not cover watersewer bills or one-off assessments by your local government.

A mortgage escrow account is an account used to pay a homeowners property taxes and homeowners insurance premiums and at other times to hold an earnest money deposit when the homeowner first. After closing your lender or mortgage servicer if your lender isnt servicing your loan takes a portion of your monthly mortgage payment and holds it in the escrow account until your tax and insurance payments are due.

Read more »