Are Property Tax Liens Public Record

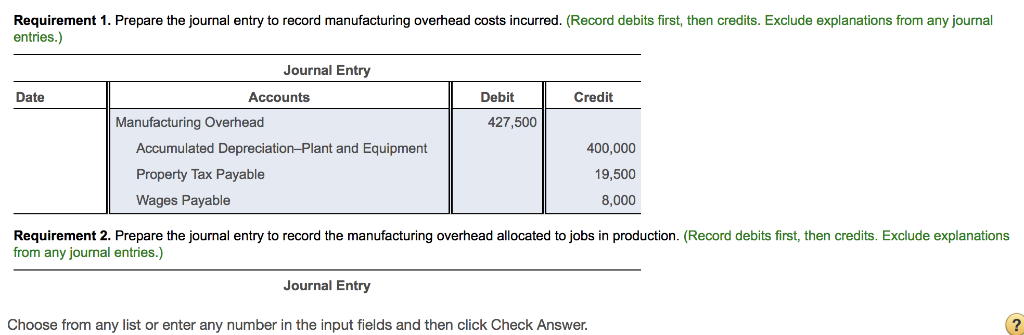

Look up property assessments online. Under judicial foreclosure the property is subject to auction by a county authority such as a sheriff or by an officer of the court.

Pin Slamming How To Avoid Unexpected Property Taxes Proplogix Real Estate Fun Property Tax Real Estate Buying

Pin Slamming How To Avoid Unexpected Property Taxes Proplogix Real Estate Fun Property Tax Real Estate Buying

To remove or block information from public record complete form 404-64.

Are property tax liens public record. How to Get Rid of a Lien. Tax liens are incurred by non payment of real estate taxes. The database from which this information was extracted doesnt represent the legal filings of notices of federal tax liens.

The Department of Finance the Department of Environmental Protection DEP and the Department of Housing Preservation and Development HPD hold outreach events in every borough to provide owners with one-on-one assistance with lien. A filed tax warrant creates a lien against your real and personal property and may. Lien Search Search for liens filed in the County Clerks Office.

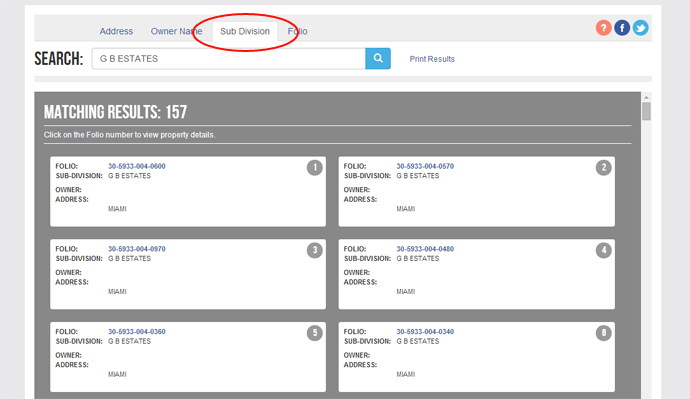

The property and owner information is the most current information as provided by the Town Assessors. Public Records Property Records Search Perform a free public property records search including property appraisals unclaimed property ownership searches. You may contact the Town Assessors office in which the property is located to obtain the Tax Map Identification Number.

Search Records This is for individuals or companies that are r egistered agents with the Broward County Records Taxes and Treasury Recording Office. This office may take different names in different states but it will likely be the same place you record a property deed. How a Lien Affects You.

All property lien records are placed on the database as a part of the online public records under the clauses like possession cessation and completion. This state office often provides an online index of lien documents. The Clerks Office provides property-related services and forms including.

Tax liens must be officially recorded in order to provide public notice of the governments claim on a taxpayers property. Must use the 19 digit number Tax Map ID No. A Mechanics Lien recorded by the person furnishing labor or materials for construction work a Government Lien recorded by a government agency for the failure of the owner to pay personal business or real property taxes and.

Allow us to seize and sell your real and personal property. The liens are recorded with a state recorders office. New York property tax records.

Find Tax Records including. Enter without punctuation ie 0501 010 00 0300 019000. Land Records Online Record Search.

Today even the forms for filing a mutual lien case are made available online. In states without judicial foreclosure statutory foreclosure allows the mortgage holder to conduct a public auction to resell the property. We file a tax warrant with the appropriate New York State county clerks office and the New York State Department of State and it becomes a public record.

For more information refer to Publication 594 The IRS Collection Process PDF. Nassau County Clerks Office. The public information contained herein is furnished as a service by Onondaga County Real Property Tax Services.

Available information includes property classification number and type of rooms year built recent sales lot size square footage and property tax valuation assessment. 2020 Tax Lien Sale Virtual Events. The data therefore may be incomplete and in some instances inaccurate.

Also known as the District Section Block and Lot numbers. Property Business Excise Tax Professionals Forms Select Tax Bills and Payments Data and Lot Information Dividing Merging Lots Assessments Tax Rates Guides. Three examples of recordable liens include.

A lien is a claim or charge by a creditor upon the real property of a debtor. Our property records tool can return a variety of information about your property that affect your property tax. Certain Tax Records are considered public record which means they are available to the public while some Tax Records are only available with a Freedom of Information Act FOIA request.

Property and tax information is available for the towns in Onondaga County. Tax Records include property tax assessments property appraisals and income tax records. Access local real estate records.

A standard listing of business liens extracted quarterly from the IRS Automated Lien System database is available in pipe-delimited text format on compact disc CD. The database can be further categorized as per the city or county. The IRS files a public document the Notice of Federal Tax Lien to alert creditors that the government has a legal right to your property.

You can search by Party Name or Address or File Date or Block and Lot numbers.

Read more »