How To Record Property Tax In Journal Entry

Step 2 When Adjustment of Income Tax is Done. You can create a journal entry so you can record your business expenses paid with your personal funds.

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

How to record a journal entry for a tax refund 1.

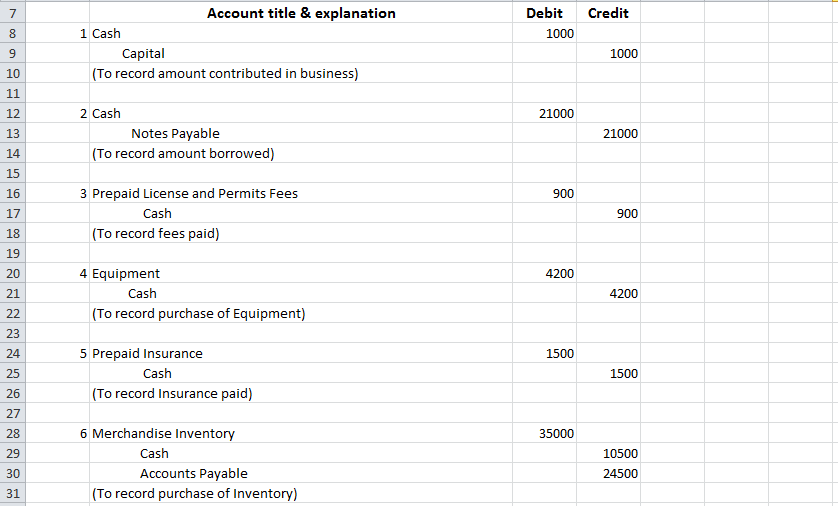

How to record property tax in journal entry. With regards your year-end adjusting journal entries AJE one of the entries should be to record a tax provision for 2011. Sales tax accounting is the process of creating journal entries to record sales tax you collect and pay. There may be an accrued wages entry that is recorded at the end of each accounting.

Once you have entered the AJEs make sure you balance your balance sheet and income statement to the S100 and S125 filed with your T2. Record the original entries for the tax payment When you pay taxes you need to record the transaction in your books. The company remits the sales taxes collected in the first week of February 2020 to appropriate taxes authority on March 05 2020.

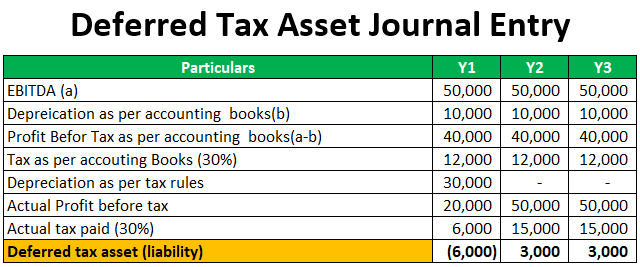

There can be the following scenario of deferred tax asset. These resources are necessary for the companies to operate and ultimately make a profit. Step 1 When Tax is Paid.

Deposit made by the buyer. This is the double-entry made in opposition to point no. Nevertheless heres how you can create your journal entry.

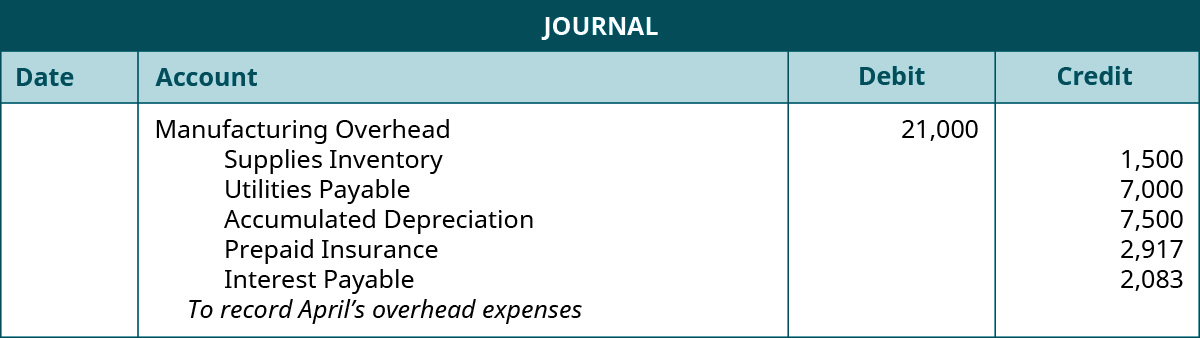

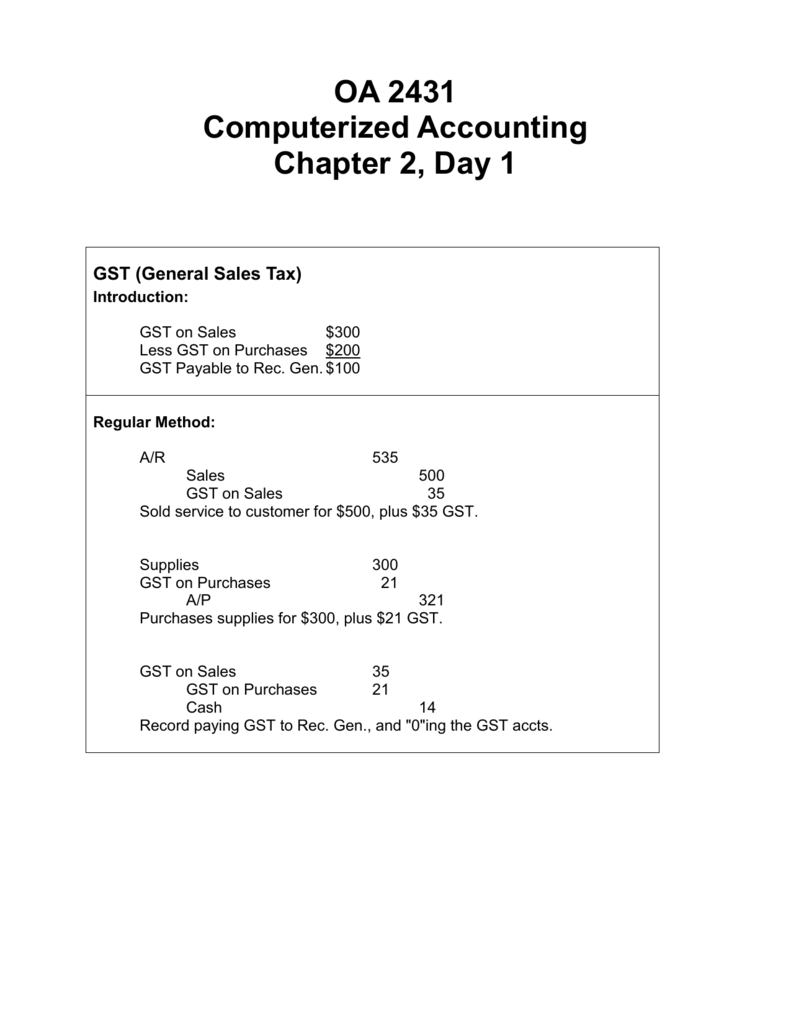

Accounting for indirect taxes. The journal entry to record the payroll in the governmental activities journal at the government-wide level is. In order to.

Property plant and equipment fixed assets or operating assets compose more than one-half of total assets in many corporations. Property Tax revenue - General. But Id still recommend contacting your accountant for further guidance in choosing the account specifications.

The journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in your accounting software application. Taxes Receivable-Current Estimated Uncoll-Current Property Tax Revenue GA. B1 ACQUISITIONS To record an acquisition using the fair market value of assets and liabilities with an entry.

Prepare the journal entry for the remittance of the sales taxes payable in March 2020. Cash Tax Anticipation N P N. Journal entry for income tax in case of a sole proprietorship contains 2 steps as follows.

The primary payroll journal entry is for the initial recordation of a payroll. Youd pay 118010 per year in San Francisco but 37560 in Garden City. Your sales tax journal entry depends on whether you are collecting sales tax from customers or paying sales tax to vendors.

ExpensesGeneral Government 178000 ExpensesPublic Safety 480000 ExpensesPublic Works 290000 Due to Federal Government 86000 Due to State Government 49000 Cash 813000. Example - Indirect taxes. At the end of the accounting period you should make an adjusting entry in your general journal to set up property taxes payable for the amount of taxes incurred but not yet paid.

If a seller charges you sales tax you must record the sales tax expense in your books. State of Connecticut Office of Policy and Management. 5 made in the list of sellers debit transactions.

Short-Term Cash Disbursement Needs. It is the efficient use of these resources that in. Provides cleaning services to.

Property tax and assessment pro-ration credits from seller to the buyer of the HUD Settlement Statement. If a company has overpaid its tax or paid advance tax for a given financial period then the excess tax paid is known as deferred tax asset and its journal entry is created when there is a difference between taxable income and accounting income. Make an accounting entry for tax refund money.

Your accountant may also have other entries for you to record. Adjusting income tax as drawings. Click on the More button in the upper right corner and choose Add journal transaction In the journal transaction enter the amount of deferred payroll taxes as a debit to Payroll Employer Taxes and a credit to Payroll Liabilities.

Entries for Cash and Lump-Sum Purchases of Property Plant and Equipment. B Journal Entries There are a few instances where journal entries should be reversed in the following accounting period. Paying tax via the bank Income Tax Account.

Thats a big difference so make sure your property tax accounting entry is accurate for where your business is located. The journal entry for recording the remittance in March 2020 is as follows. The amount owed by the seller to the buying party is a credit entry and must be recorded.

Example Estimated property taxes of 5200 were assessed on July. Journal Entries for Deferred Tax Assets. When this is necessary a warning note is attached to the bottom of the relevant journal entries.

In case of indirect taxes on revenue for example a tax on goods and services a business is required to collect an amount from its customers on each unit it sells to them and deposit it with the government. Navigate to Accounting Transactions. This entry records the gross wages earned by employees as well as all withholdings from their pay and any additional taxes owed to the government by the company.

Select Make General Journal Entries.

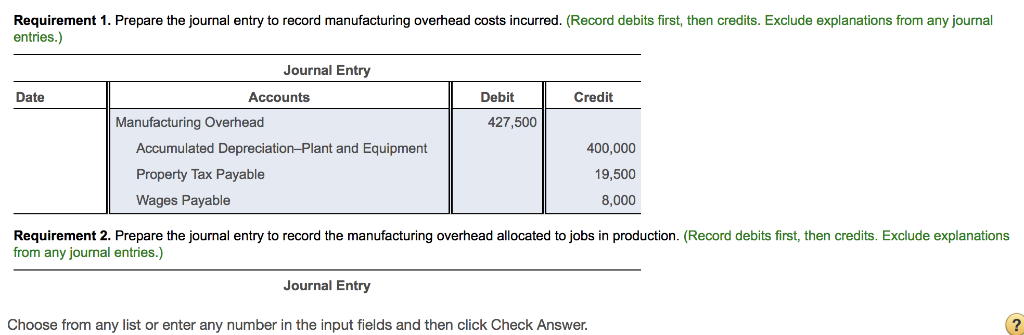

Solved Requirement 1 Prepare The Journal Entry To Record Chegg Com

Solved Requirement 1 Prepare The Journal Entry To Record Chegg Com

Lo3 Journalizing And Recording Wages And Taxes Acct 032 Payroll Accounting

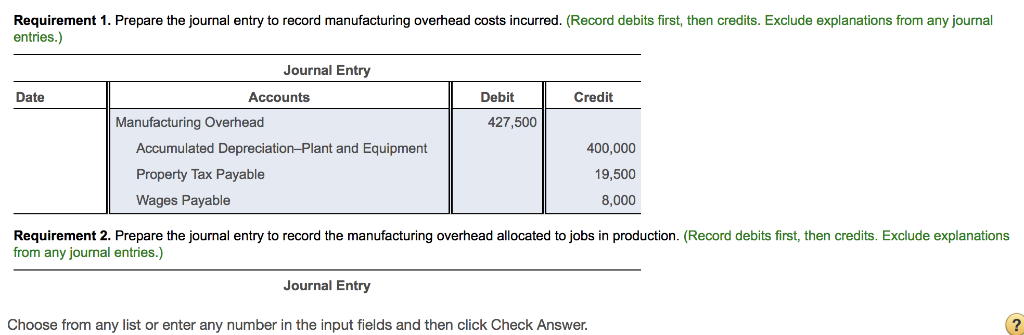

Solved 1 Prepare Journal Entry To Record Income Tax Expe Chegg Com

Solved 1 Prepare Journal Entry To Record Income Tax Expe Chegg Com

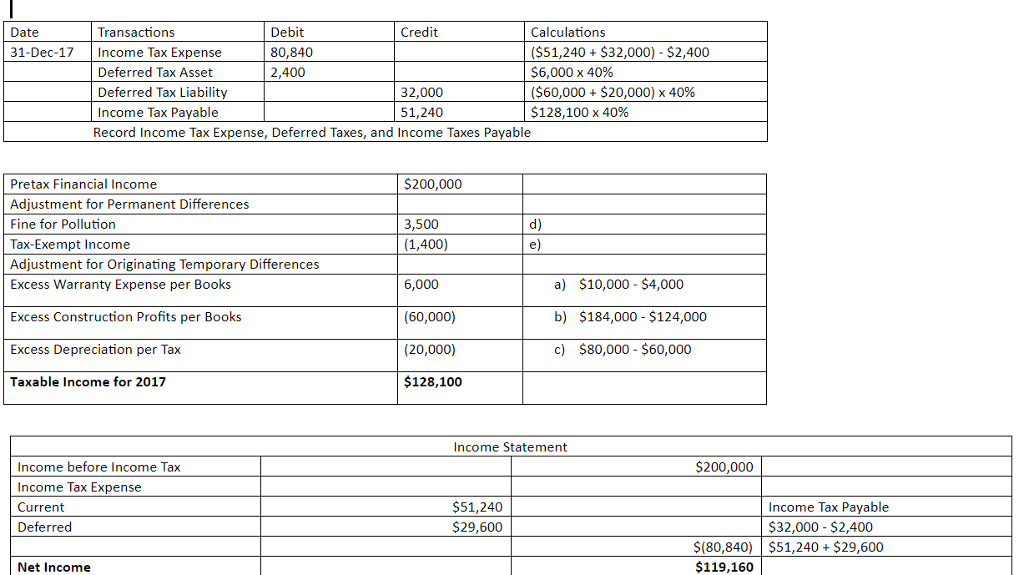

Solved Need Help With Journal Entry E Cant Figure Out Th Chegg Com

Solved Need Help With Journal Entry E Cant Figure Out Th Chegg Com

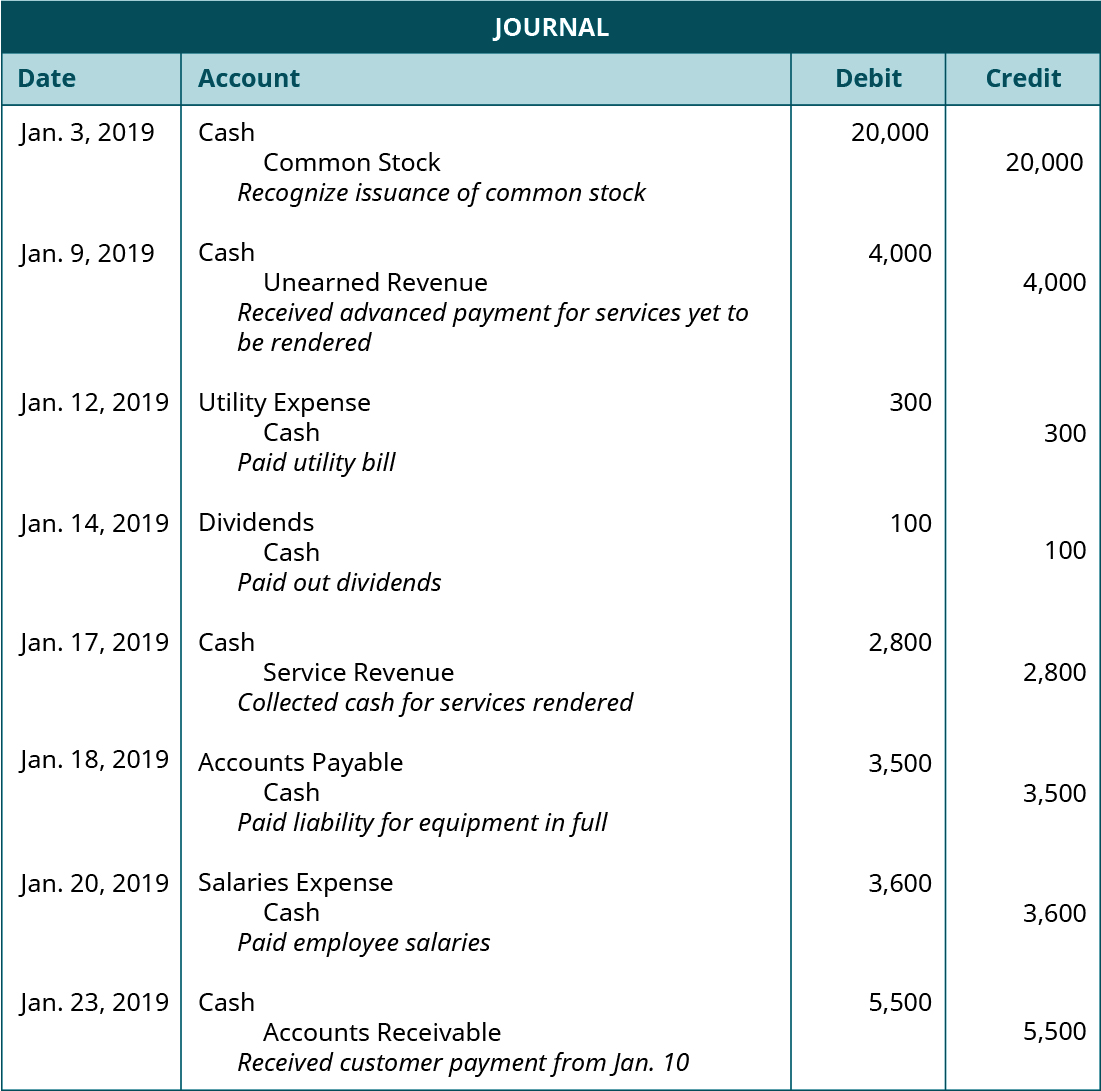

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

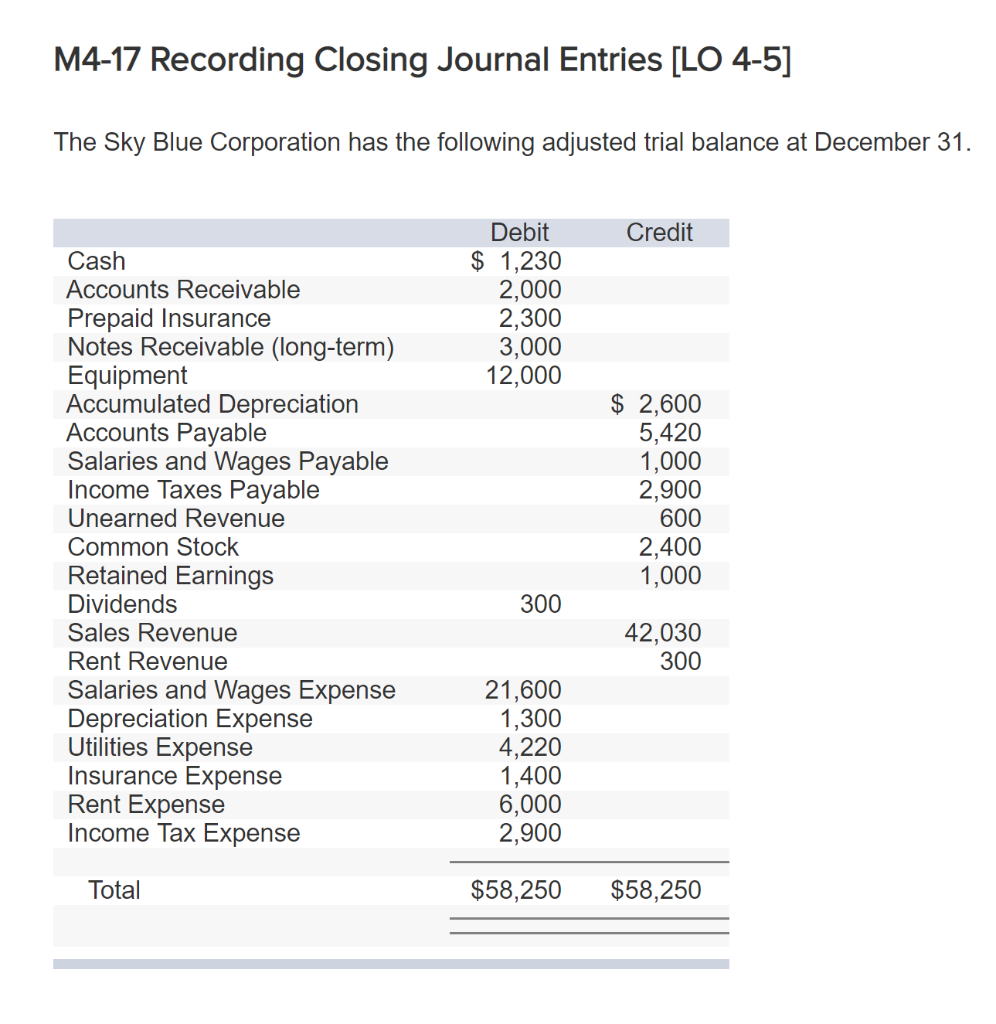

Solved M4 17 Recording Closing Journal Entries Tlo 4 5 T Chegg Com

Solved M4 17 Recording Closing Journal Entries Tlo 4 5 T Chegg Com

Barter Transaction Accounting Double Entry Bookkeeping

Barter Transaction Accounting Double Entry Bookkeeping

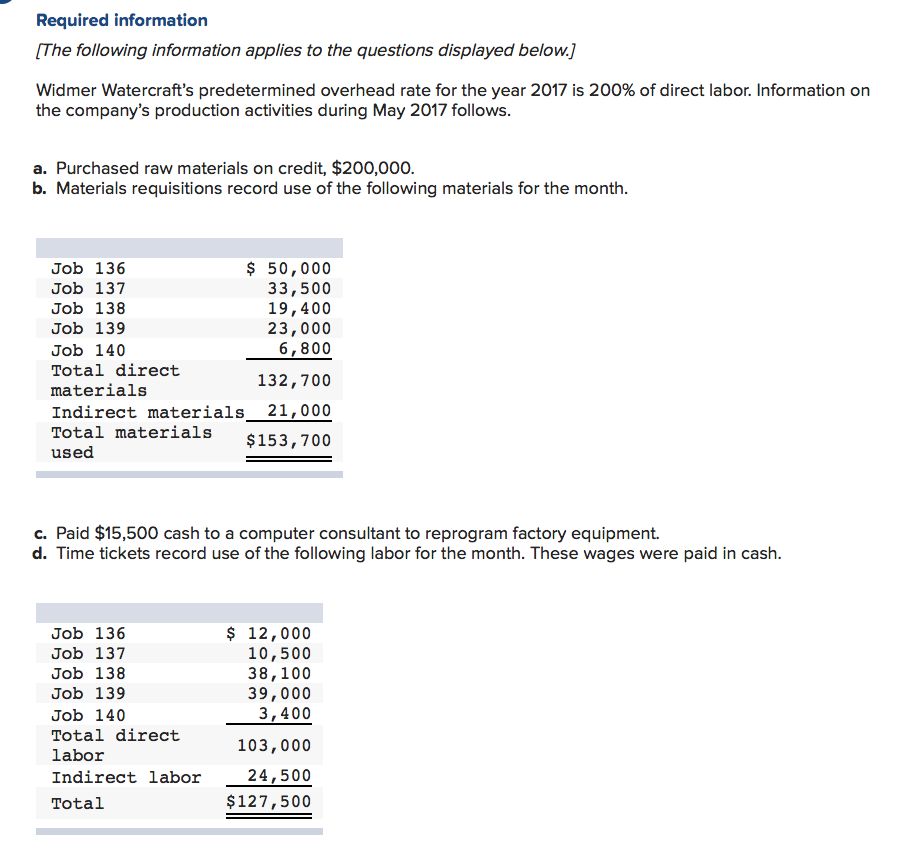

Solved Journal Entry Worksheet 1 Record Raw Material Purc Chegg Com

Solved Journal Entry Worksheet 1 Record Raw Material Purc Chegg Com

Solved Required Record Journal Entries For The Pp E Even Chegg Com

Solved Required Record Journal Entries For The Pp E Even Chegg Com

Solved Required Record Journal Entries For The Pp E Even Chegg Com

Solved Required Record Journal Entries For The Pp E Even Chegg Com

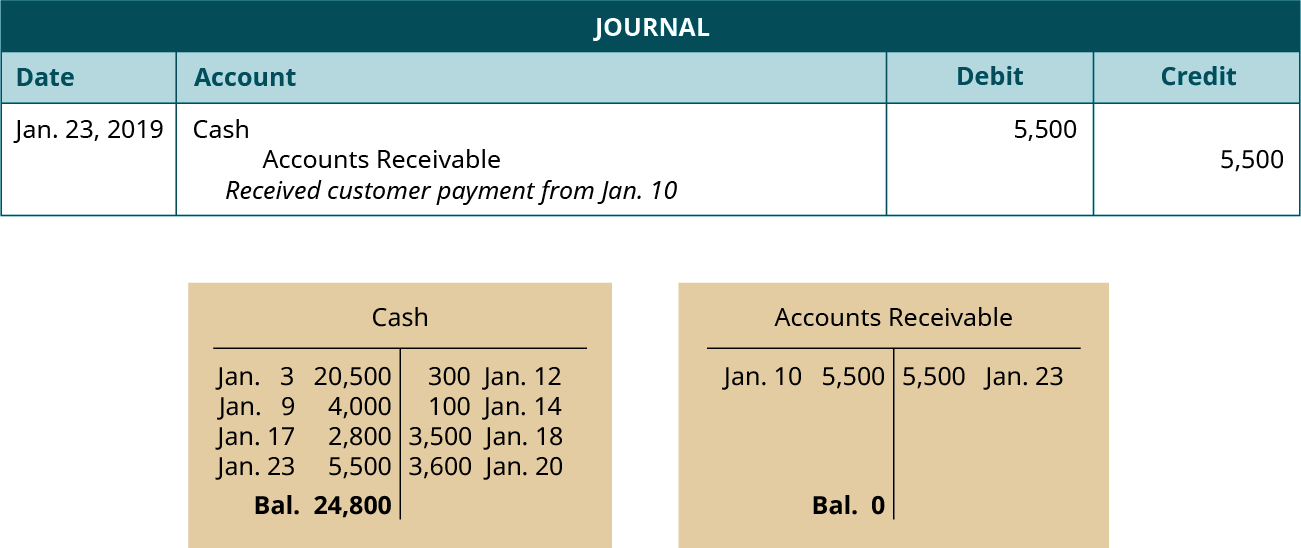

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Revenue Received In Advance Journal Entry Double Entry Bookkeeping

Revenue Received In Advance Journal Entry Double Entry Bookkeeping

Lo3 Journalizing And Recording Wages And Taxes Acct 032 Payroll Accounting

Reversing Entries Principlesofaccounting Com

Reversing Entries Principlesofaccounting Com

Deferred Tax Asset Journal Entry How To Recognize

Deferred Tax Asset Journal Entry How To Recognize

Solved 1 Set Up T Accounts And Post Your Journal Entries Chegg Com

Solved 1 Set Up T Accounts And Post Your Journal Entries Chegg Com

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

Prepare Journal Entries For A Job Order Cost System Principles Of Accounting Volume 2 Managerial Accounting

Prepare Journal Entries For A Job Order Cost System Principles Of Accounting Volume 2 Managerial Accounting

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home