Land Tax Joint Ownership Nsw

Generally your principal place of residence PPOR or your home or land used for primary production a farm is exempt from land tax. We also assess each joint owner individually for land tax.

![]() Revenue Nsw Landholder Duty Part 1 2018 On Vimeo

Revenue Nsw Landholder Duty Part 1 2018 On Vimeo

Any land you own outside of NSW is not subject to land tax in NSW but may be subject to land tax in the relevant state or territory.

Land tax joint ownership nsw. So the Joint owners are assessed as Primary tax payers. Revenue NSW assesses joint owners together on all their jointly owned land as though they were an individual. Land tax surcharge If you are a foreign person who owns residential land in NSW you must pay a surcharge of 075 for the 2017 land tax year and 2 from the 2018 land tax year onwards.

If we put one property at my name and one at my wife name then that we would both be assessable for NSW land tax with a land value of 400K. You pay land tax on the difference between the land value and the threshold which equals 51200000. In dealing with third parties joint tenants must act as a single owner.

Land Tax is tax levied on the owners of the land on the relevant date. Joint owners are assessed as if they are a single owner. So we pay 2 times the land tax at 400k which is 656 x2 1312.

An owner includes a sole owner joint owners a company a trustee of a trust a beneficiary of a trust a shareholder in a home unit company and or any person deemed to be an owner by the land tax legislation including a person who leases land from the Crown or from a Local Council. The PPR exemption is no longer available for land owned by a company or a special trust where a life interest has been granted to a natural person unless. From the 2014 tax year if land is deemed to be owned by more than one owner all of the owners of the land are taken to be joint owners of the land for the purposes of clause 11.

Revenue NSW uses land value supplied by the Valuer General who values your land as at 1 July. Then if they own other property on their own their share of the joint property is taken into account so that they are not double taxed. What if I own property in NSW with some one else.

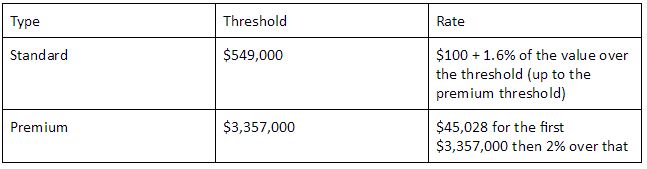

You own an investment property that has a land value of 500000000 in 2020. The ACT levy it on ownership at midnight on the first day of the quarter. Land owners are generally liable for land tax when the unimproved value of taxable land exceeds certain thresholds.

A joint assessment applies to the first property. A foreign person can be. We assess each unique joint ownership for land tax when the total taxable value of the taxable land it owns is equal to or exceeds the 250000 threshold.

Land tax is a tax imposed on the owners of land in NSW as at midnight on 31 December of each year by the Office of State Revenue OSR. Every combination of landowners is assessed separately for land tax. Chris is the joint owner of a property with a land value of 900000 and the sole owner of a second property with a land value of 400000.

600000 100000 - 560000 X 0016 100 2340. If we were put buy both properties as joint owners then we would be assessable for land tax as joint owners with a land value of 700k. You may be liable for land tax if you.

Amount 1200000-560000X0016 100 10340 Each joint owner is then assessed as a secondary tax payer who is then entitled to a deduction. The land tax payable is 51200000 x 2 6016400 7040400. 1A In respect of the taxable value of all the land owned at midnight on 31 December 1983 by a company classified under section 29 of the Principal Act as a non-concessional company land tax for the period of 12 months commencing on 1 January in the next succeeding year shall except as provided by section 27 2A of the Principal Act be charged levied collected and paid as referred to in subsection 1 at the.

Joint owners are considered one owner for land tax purposes in NSW so they dont get one threshild each but a combined one. Using the 2020 calendar figures you have a threshold of 448800000. Land tax is a tax levied on the owners of land in NSW as at midnight on 31 December of each year.

In general your principal place of residence your home or land used for primary production a farm is exempt from land tax. The land tax payable by Ms Lee before the joint ownership deduction is 675 being 275 450000 - 250000 x 02. Generally each joint tenant can only act at.

We will explain how land tax is calculated for joint ownership and secondary deduction liability. So just for owner A. All joint tenants are entitled to physical possession of the whole property.

Joint tenants must acquire the property at the same time from the same person. In this case only A and B pay land tax. You may be a foreign person if you are not an Australian citizen.

The general land tax rate for land holdings valued between 250000 and less than 600000 is 275 02 of the amount greater than 250000. Revenue NSW Joint ownership and secondary deductions for land tax on Vimeo Why Vimeo. Then each person within that combination will also receive an individual assessment which includes all their interests in land whether owned jointly individually or as a beneficiary of certain types of trust.

Each unique combination of owners is considered a unique joint ownership. Tasmania levy it on ownership on 1st July. - As individual assessment.

It is all very confusing. As a joint owner it is important to understand that. Jointly owned land tax calculation.

Land Tax Policies In Nsw Legal Point Lawyers

Land Tax Policies In Nsw Legal Point Lawyers

The Waterfront Shell Cove Contract Lot 9033 By Frasers Property Australia Issuu

The Waterfront Shell Cove Contract Lot 9033 By Frasers Property Australia Issuu

The Waterfront Shell Cove Contract Lot 9033 By Frasers Property Australia Issuu

The Waterfront Shell Cove Contract Lot 9033 By Frasers Property Australia Issuu

Https S3 Us West 2 Amazonaws Com Cdn Eaglesoftware Com Au Realpropertymanager Vgreview 2019 1 Pdf

Top Questions About Land Tax Mortgage House

Top Questions About Land Tax Mortgage House

Revenue Nsw Joint Ownership And Secondary Deductions For Land Tax On Vimeo

Revenue Nsw Joint Ownership And Secondary Deductions For Land Tax On Vimeo

![]() Revenue Nsw Joint Ownership And Secondary Deductions For Land Tax 2018 On Vimeo

Revenue Nsw Joint Ownership And Secondary Deductions For Land Tax 2018 On Vimeo

Land Tax Rules And Regulations In Nsw You Should Know About Clever Finance Solutions

Land Tax Rules And Regulations In Nsw You Should Know About Clever Finance Solutions

Revenue Nsw Land Tax Registration For Companies On Vimeo

Revenue Nsw Land Tax Registration For Companies On Vimeo

![]() Revenue Nsw Land Tax Registration For Companies On Vimeo

Revenue Nsw Land Tax Registration For Companies On Vimeo

What Is The Difference Between Tenants In Common And Joint Tenants Propertychat

What Is The Difference Between Tenants In Common And Joint Tenants Propertychat

What Is Land Tax Clinch Long Woodbridge Lawyers

What Is Land Tax Clinch Long Woodbridge Lawyers

What S The Difference Between Joint Tenants And Tenants In Common Rm Legal And Conveyancing

What S The Difference Between Joint Tenants And Tenants In Common Rm Legal And Conveyancing

Joint Ownership Icon Page 1 Line 17qq Com

Joint Ownership Icon Page 1 Line 17qq Com

Land Tax Surcharge Non Resident Property Owners Integra Partners

Revenue Nsw Joint Ownership And Secondary Deductions For Land Tax 2018 On Vimeo

Revenue Nsw Joint Ownership And Secondary Deductions For Land Tax 2018 On Vimeo

Https Www Opengov Nsw Gov Au Download 18220

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home