Property Tax Rate Lawrence Ks

111 East 11th Street Lawrence KS 66044. Topeka Kansas vs Lawrence Kansas Change Places A salary of 50000 in Topeka Kansas should increase to 60181 in Lawrence Kansas assumptions include Homeowner no Child Care and Taxes are not considered.

Property Taxes City Of Lawrence Kansas

Property Taxes City Of Lawrence Kansas

Get more inforamtion graphs and analysis on the Lawrence Kansas real estate market by visiting the Lawrence Market Conditions page.

Property tax rate lawrence ks. This online service is provided by Kansasgov a third-party working under a contract awarded and administered by the Information Network of Kansas INK. Tax Rates for Lawrence KS. Judicial and Law Enforcement Center.

The 3rd and 4th quarter bills are actual bills based on the recap and the budget being passed on time and a tax rate being set. 1100 Massachusetts Street Lawrence KS 66044. Motor Vehicle office is located at 14451 Market St Suite 101.

All offices of the Revenue Commissioner are now located in the Judicial and Administrative Building 14451 Market Street Hwy 33 Moulton Al 35650. The median property tax in Kansas is 162500 per year for a home worth the median value of 12550000. 2639 per 1000 of assessed value.

The breakdown of the special sales taxes are as follows 3 cents funds streets and infrastructure projects 2 cents supports Lawrence Public Transit and the remaining 05 cents are for affordable housing. However rates can differ depending on where you live. Real estate and personal property tax bills are mailed out quarterly.

Kansas is ranked number twenty six out of the fifty states in order of the average amount of property taxes collected. The median property tax in Riley County Kansas is 1903 per year for a home worth the median value of 154800. Commercial Industrial Personal Property Tax Rate.

Property Search The Lawrence County - AL Tax Office makes every effort to produce and publish the most accurate information possible. Federal income taxes are not included Property Tax Rate. Counties in Kansas collect an average of 129 of a propertys assesed fair market value as property tax per year.

Riley County has one of the highest median property taxes in the United States and is ranked 504th of the 3143 counties in order of median property taxes. Lawrence KS Sales Tax Rate. 1227 per 1000 of assessed value.

The lawyer can review the assessors property tax records searching for errors that impact your tax bill file your appeal and be your advocate in the appeal process. Sales Tax Rate in Lawrence. Please call the Treasurers office at 785-832-5178 for the correct amount due if you are paying late.

730 The total of all sales taxes for an area including state county and local taxes Income Taxes. If you are trying to price your home for sale here in Lawrence KS I would be happy to assist you please give me a call at 785550-2585 or use my contact form. Taxes not paid by the due date accrue penalty and interest not shown on this website.

The states average effective property tax rate annual property taxes paid as a percentage of home value is 137. Property Taxes are due and must be postmarked on or before December 31st to avoid paying late fees. Riley County collects on average 123 of a propertys assessed fair market value as property tax.

Although property owners can contest their property tax without a lawyer using the services of a Lawrence property tax lawyer is beneficial. 645 The total of all income taxes for an area including state county and local taxes. Douglas County Treasurer1100 MassachusettsLawrence KS 66044Phone.

The Kansas Property Tax Payment application allows taxpayers the opportunity to make property tax payments on their desktop or mobile device. While the typical homeowner in Kansas pays just 2235 annually in real estate taxes property tax rates are fairly high. For more current information please call the Appraisers Office.

200 Common Street Lawrence MA 01840 Phone. The current total local sales tax rate in Lawrence KS is 9300The December 2020 total local sales tax rate was also 9300. However this material may be slightly dated which would have an impact on its accuracy.

Why You Should Sell Your House In Summer 2020 Selling House Sale House Real Estate Agent

Why You Should Sell Your House In Summer 2020 Selling House Sale House Real Estate Agent

6 Types Of Rental Properties Which Is Right For You Rental Property Investment Rental Property Real Estate Investing Rental Property

6 Types Of Rental Properties Which Is Right For You Rental Property Investment Rental Property Real Estate Investing Rental Property

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

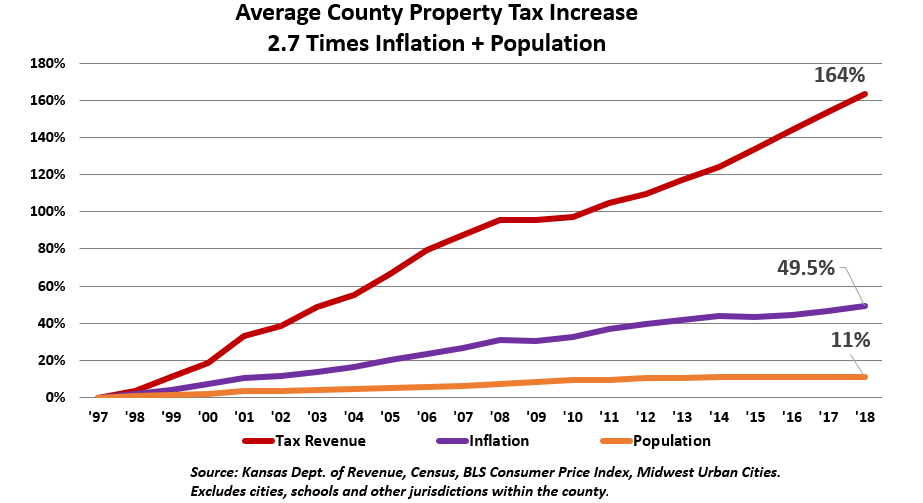

Local Government Pushes Property Tax To Record Levels Kansas Policy Institute

Local Government Pushes Property Tax To Record Levels Kansas Policy Institute

Pin By Metro City Realty On Real Estate Tips Home Ownership Real Estate Infographic Consumer Finance

Pin By Metro City Realty On Real Estate Tips Home Ownership Real Estate Infographic Consumer Finance

601 N 1600 Rd Lawrence Ks 66049 Mls 150908 Listing Information In 2020 House Styles Real Estate Country Roads

601 N 1600 Rd Lawrence Ks 66049 Mls 150908 Listing Information In 2020 House Styles Real Estate Country Roads

Local Government Pushes Property Tax To Record Levels Kansas Policy Institute

Local Government Pushes Property Tax To Record Levels Kansas Policy Institute

Local Government Pushes Property Tax To Record Levels Kansas Policy Institute

Local Government Pushes Property Tax To Record Levels Kansas Policy Institute

Buying A Fixer Upper What You Need To Know Fixer Upper Stuff To Buy Need To Know

Buying A Fixer Upper What You Need To Know Fixer Upper Stuff To Buy Need To Know

Homes Are More Affordable Right Now Than They Have Been In Years In 2020 Lowest Mortgage Rates 30 Year Mortgage Buying Your First Home

Homes Are More Affordable Right Now Than They Have Been In Years In 2020 Lowest Mortgage Rates 30 Year Mortgage Buying Your First Home

Kansas Property Tax Calculator Smartasset

Kansas Property Tax Calculator Smartasset

Where Have Property Taxes Increased The Most Valuepenguin

326 Birch Lane House Tours Home Warranty Outdoor Structures

326 Birch Lane House Tours Home Warranty Outdoor Structures

Nc Home Advantage Mortgage 101 Video Tax Credits Home Ownership Home Buying

Nc Home Advantage Mortgage 101 Video Tax Credits Home Ownership Home Buying

Which Counties Pay The Most Taxes In Kansas You Ve Probably Guessed Correctly Wichita Business Journal

Buying A Home Is A Priority Real Estate Fun Fun Fact Friday Home Buying

Buying A Home Is A Priority Real Estate Fun Fun Fact Friday Home Buying

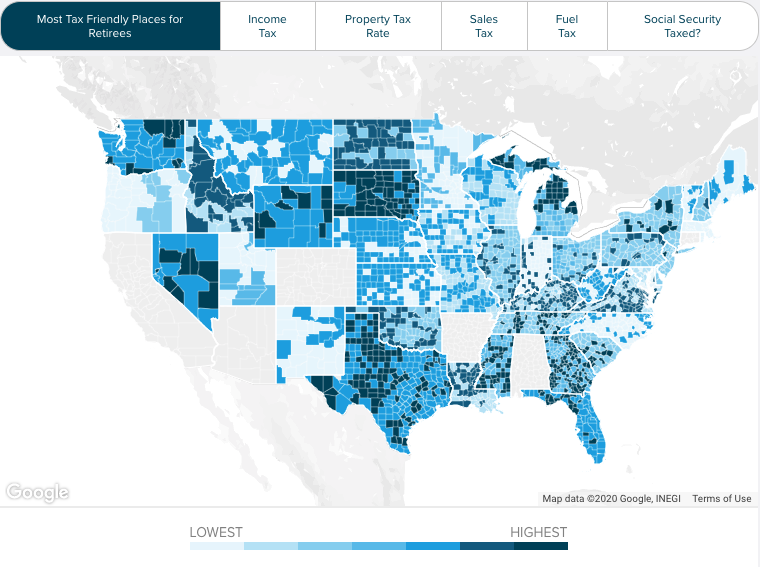

Kansas Retirement Tax Friendliness Smartasset

Kansas Retirement Tax Friendliness Smartasset

2033 Hillview Road Cozy Cottage Big Windows Reading Room

2033 Hillview Road Cozy Cottage Big Windows Reading Room

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home