Delinquent Property Tax List South Carolina

We continue to process tax payments daily. Bids and Proposal Requests.

The Ultimate Guide Marketing To The Delinquent Property Tax List United States Travel Best Honeymoon Destinations Travel Usa

The Ultimate Guide Marketing To The Delinquent Property Tax List United States Travel Best Honeymoon Destinations Travel Usa

Extra copies of the Lexington Chronicle will be sent out to Chapin Cayce Gaston Irmo Pelion Swansea and West Columbia to allow greater coverage throughout Lexington County.

Delinquent property tax list south carolina. In accordance with South Carolina law pursue collection of delinquent property taxes through notification advertisement and auction of delinquent property for collection of taxes penalties and costs. SC Code 12-37-2740 - Suspension of drivers license and vehicle registration for failure to pay personal property tax on a vehicle. Title 12 of the SC.

The current amount of tax penalty and interest due may differ from the amount listed if partial payments have been made or additional penalty and interest have accrued. For questions regarding delinquent taxes call 843-665-3095. Delinquent Tax Sale November 8 2018 To Prevent property listed below from being sold please PAY THESE TAXES BEFORE THE TAX SALE An Act to amend Section 12-51-90 as amended code of laws to South Carolina 1976 relating to the redemption of property sold for delinquent taxes.

Since the last update some of these delinquent taxpayers may have resolved their debts. The Treasurer issues a warrant of execution to the Delinquent Tax Collector. An updated list is published quarterly.

The Lancaster County Delinquent Tax Collectors Office is responsible for the collection of taxes that are delinquent for real estate mobile homes business personal property and equipment boats motors airplanes and campers. At a location to be determined. Delinquent Tax Sale begins at 1000 am.

Unpaid taxes become delinquent on March 17th every year with the exception of motor vehicles. Collectively the hundreds of listed business and individual delinquent taxpayers owe 119 million in taxes. Our office hours are Monday through Friday from 830 AM.

An additional 30 fee will be added to all real property bills and an additional 40 fee will be added to all mobile home bills if the taxes penalties and assessment fees are not paid by 500 PM on Friday April 23 2021. Report vehicle tax payments to the South Carolina Department of Motor Vehicles DMV respond to taxpayer inquiries regarding DMV tags. The Execution orders the Delinquent Tax Collector in the name of the State of South Carolina and the County of Orangeburg to levy by distress and sell the defaulting.

Tax Sale The 2019 Tax Sale will be held on March 12 2021 at 1000 am at the Colleton Civic Center 494 Hampton St. Individual tax debt on the list ranges from a low of 94373 to a high of 26 million. If you wish to access current real or personal property taxes please click here.

No tax payments will be taken in the Delinquent Tax Office on the day of the sale. The Williamsburg County Delinquent Tax Sale is held once a year on the first Monday of November beginning at 10 am. Property Listing Advertising.

Taxes are delinquent 120 days from the date of your new car purchase. The Spartanburg County - SC - Delinquent Tax Office disclaims any responsibility or liability for any direct or indirect damages resulting from the use of this data. The Delinquent Tax Collectors Office was established by state law.

Taxpayers may pay their vehicle watercraft and real property taxes on-line at the county website or by mail during the restriction. Property to be sold is advertised in The Kingstree News and The Weekly Observer. It operates under the Code of Laws of South Carolina 1976 Title 12 Chapter 51 using the Uniform Tax Collection Act of 1985.

Once a property tax bill is deemed delinquent after March 16th of each year a 15 past due penalty is added to the bill and the bill is sent to the Delinquent Tax Office. This website is ONLY for the viewing and paying of delinquent taxes. After 120 days a final notice is mailed giving additional 30 days to pay.

The North Carolina General Statutes NCGS provide taxing jurisdictions with several collection remedies to enforce collect delinquent taxes. Code of Laws starting in Section 12-51-40 in the Alternate Procedure for Collection of Property Taxes. Property to be offered for sale will be advertised in the Seneca Journal Tribune for three consecutive weeks prior to the sale in the name of the defaulting taxpayer defined by the South Carolina statutes as the owner of record on December 31st of the year preceding the taxable year.

The Delinquent Tax Collector must take possession of the delinquent property and then may sell such property in order to satisfy the outstanding delinquent liability after a series of notices as described in SC. Once a property tax bill is deemed delinquent after March 16th of each year the debt goes into execution and the County Treasurer sends the bill to the Delinquent Tax Department. Online Mapping GIS.

Delinquent Tax Sale List. The ads run for 3 consecutive weeks in October. These taxes are delinquent after March 16th each year.

The primary goal is the collection of delinquent taxes not the acquisition or dispossession of property. The lists below are published to notify taxpayers of delinquent real estate and personal property taxes that are subject to enforced collection actions. Please note that all dates are subject to adjustment due to calendar conflicts.

Contact the Delinquent Tax office for details. All Delinquent Tax payments are paid in the Delinquent Tax office. Business tax debt on the list ranges from a low of 131030 to a high of nearly 28 million.

County Lists Properties With Delinquent Taxes Columbia Sc Patch

County Lists Properties With Delinquent Taxes Columbia Sc Patch

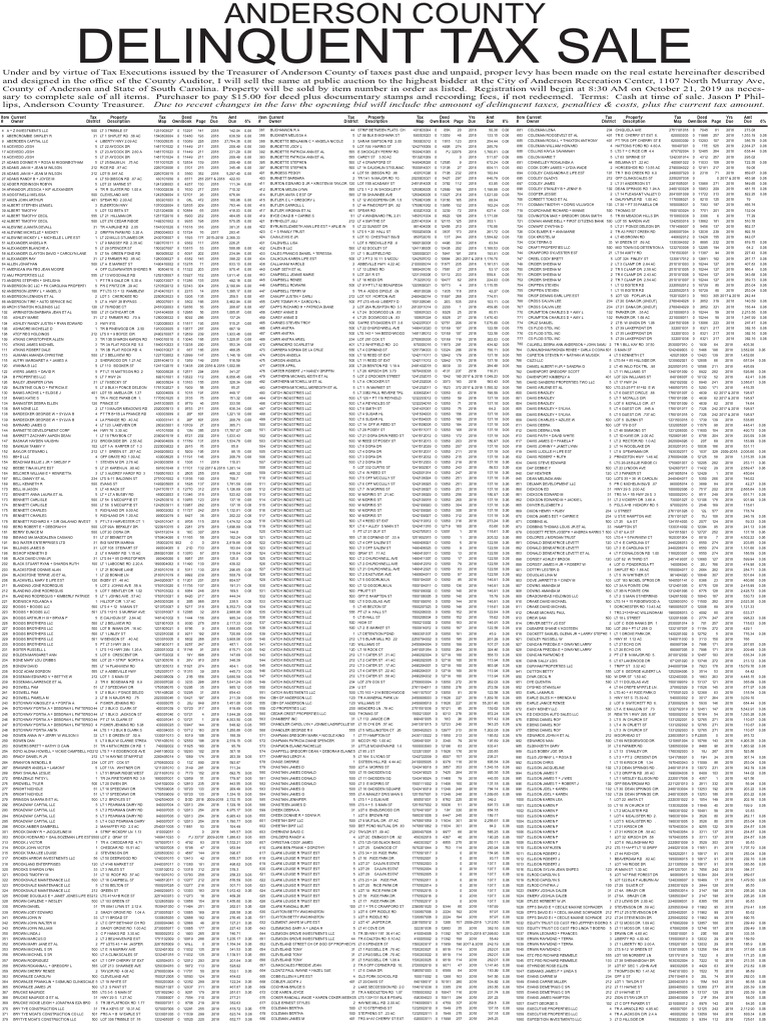

Berkeley County Delinquent Tax Sale To Take Place October 21 2019 The Berkeley Observer

Berkeley County Delinquent Tax Sale To Take Place October 21 2019 The Berkeley Observer

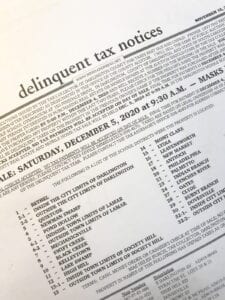

2020 Delinquent Tax Notices Online Here News And Press

2020 Delinquent Tax Notices Online Here News And Press

Http Www Clarendoncountygov Org Files Delinquenttaxlist 2019 1 Pdf

Names Of Delinquent Property Tax Owners To Be Listed In Newspaper

Names Of Delinquent Property Tax Owners To Be Listed In Newspaper

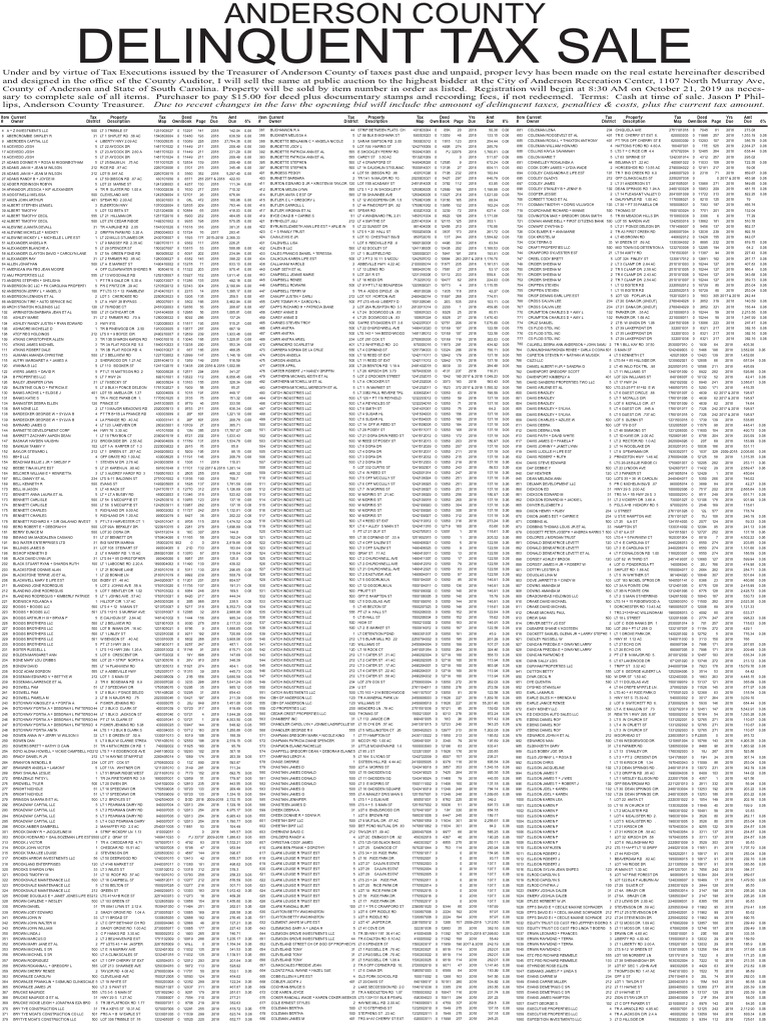

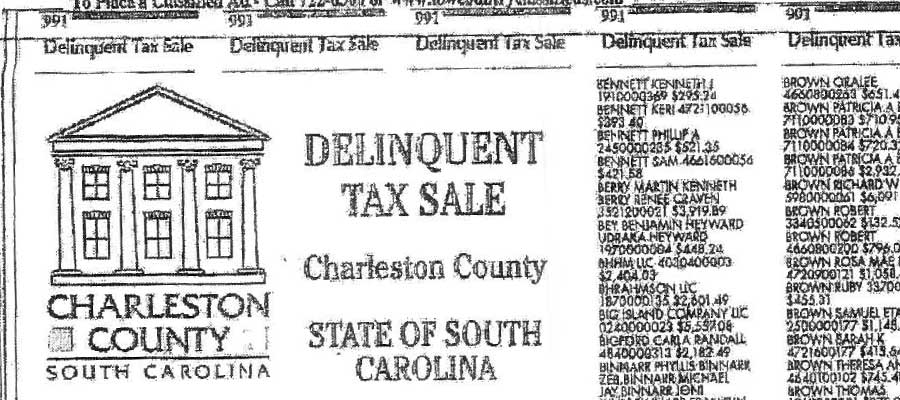

Legal Notice Of Delinquent Tax Sale State Of South Carolina Cherokee County The Gaffney Ledger

Legal Notice Of Delinquent Tax Sale State Of South Carolina Cherokee County The Gaffney Ledger

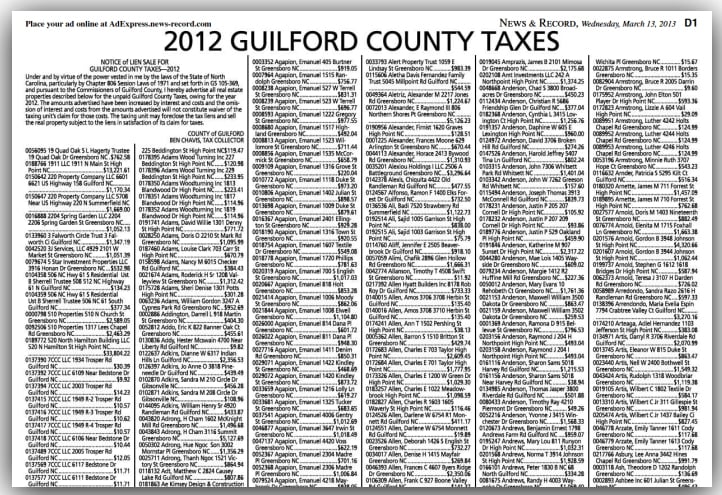

Agapion Top Tax Delinquent Again State And Regional News Greensboro Com

Agapion Top Tax Delinquent Again State And Regional News Greensboro Com

Get Your Property Off The Delinquent Tax Sale List

Get Your Property Off The Delinquent Tax Sale List

Https Www Anderson County Com Wp Content Uploads 2019 06 County Held Delinquent Tax Properties June 2019 Pdf

Pickens County Sc Delinquent Tax Auction

Legal Notice Of Delinquent Tax Sale State Of South Carolina Cherokee County The Gaffney Ledger

Legal Notice Of Delinquent Tax Sale State Of South Carolina Cherokee County The Gaffney Ledger

Https Www Fairfieldsc Com Uploads General 2019 Tax Sale Lising Pdf

Https Www Bambergcountysc Gov Data Sites 1 Media Delinquent Tax Sale 10 01 2019 Pdf

Https Marlborocounty Sc Gov Sites Default Files Documents Delinquent 20tax 20sale 20notice 20for 202019 Pdf

Lexington County Delinquent Tax Auction

Notice Of Clarendon County Delinquent Tax Sale Manning Live

Lexington County Sc Delinquent Tax Auction

Labels: carolina, delinquent, property, south

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home