Property Tax Exemption Below 500 Sq Ft

The waiver will be applicable from January 1 this year. The Maharashtra Cabinet on March 8 to approved a proposal that was moved by the BMC earlier.

Mumbai Property Tax Exemption Bjp Clarifies That All Components Will Be Waived Housing News

Mumbai Property Tax Exemption Bjp Clarifies That All Components Will Be Waived Housing News

If you are living in a unit in that falls under the jurisdiction of the Birhanmumbai Municipal Corporation BMC and measures up to 500 square foot sqft you are exempted from paying property tax.

Property tax exemption below 500 sq ft. In a major pre-election concession the Maharashtra government has decided to exempt residential properties up to 500 square feet from property tax giving relief to. In a pre-election bonanza the Maharashtra government on Friday decided to completely waive property tax on residential units up to 500 sq ft located within the. Soon homes in the city of up to 500 square feet will be exempt from property tax and those sized between 501 sq ft and 700 sq ft will get 60 discount on the tax.

BMC has a total of over 420 lakh property taxpayers in the city including 136 lakh homes measuring less than 500 sq ft. The biggest decision however is that the Government has confirmed 100 property tax waiver on housing units sized below 500 sq. C If an owner receives an exemption for property under Section 1113 under the circumstances described by Subsection a and sells the property before the owner completes construction of a replacement qualified residential structure on the property an additional tax is imposed on the property equal to the difference between the taxes imposed.

To steer clear of controversies the BMC hasnt issued property tax bills to around 25 lakh buildings which have homes that fit the criterion. The BJP-led state government has passed a proposal to waive property tax on houses up to 500 square feet. In the US property taxes predate even income taxes.

Properties belong to the Diplomatic or Consular Mission of a foreign state as specified by the government. Feet or less shall not exceed the amount of property tax levied and payable as on 31st March 2015. The state legislative council on Monday cleared the bill which gives residential properties with carpet area up to 500square feet a property tax waiver.

Property tax in Delhi. Shiv Sena has fulfilled its electoral promise by clearing the proposal at the BMCs general body meeting on Thursday. The Maharashtra Government on Tuesday made amendment in the Municipal Corporation Act exempting the property tax to property sizes 500 sq ft or less and the bill was passed in the State Legislative Council.

This will naturally spark massive demand for affordable housing and even mid-range units all throughout Mumbai. Property particularly used for public worshipcharitable purposes. Units below 500 sqft.

To not pay cess The Maharashtra Legislative Council on Monday unanimously passed a Bill to amend the Municipal Corporation Act. What Are Property Taxes. If you are owning a 500-sq ft 4645 sq m or less apartment in Mumbai then henceforth you do not need to pay the property tax to the Brihanmumbai Municipal Corporation BMC.

Four years after the Shiv Sena promised exemption of property tax for residential properties measuring up to 500 sq ft in Mumbai BMC will starting this week start issuing tax bills to such properties exempting only the general tax component of the tax. In fact the earliest known record of property taxes dates back to the 6th century BC. A concession of 60 for housesflats measuring between 500 to 700 sqft.

Capital value of property x Current property tax rate x Weight for user category The Maharashtra cabinet on March 8 2019 approved a proposal to exempt residential properties up to 500 sq ft within the Mumbai municipal area limits from property tax. The fifth proviso to section 140A of the Mumbai Municipal Corporation Act provides that for the period of five years commencing on the 1st April 2015 the amount of property tax leviable in respect of residential building or residential tenement having carpet area of 4645 sq. Three months after the state government made a promise of bringing in an ordinance to give full property tax waiver to homes below 500 sq ft there is still no clarity on the issue.

Here is good news for those living in Mumbai. The Shiv Sena had promised the move in the run-up to the 2017 BMC elections while city BJP chief Ashish Shelar had asked for waiver for houses up to 700 sq ft. Flatshouses measuring less than 500 sqft are exempt from payment of property tax.

The Maharashtra ordinance number 11 of 2019 is a farce as it waives only 0110 per cent of the property tax. No property tax on flats below 500 sqft 60 concession for ones between 501-700 sqft The state cabinet on Friday approved the proposal to exempt residential properties of up to 500 sqft in Mumbai from property tax in a likely bid to woo urban middle-class voters ahead of the Lok Sabha polls. Therefore all Mumbai residents who live in houses not bigger than 500 sq ft should NOT pay their property tax for the year 2017-18 Deora tweeted.

Simply put property taxes are taxes levied on real estate by governments typically on the state county and local levels. Property taxes are one of the oldest forms of taxation.

No Property Tax For Up To 500 Sqft Mumbai Homes

No Property Tax For Up To 500 Sqft Mumbai Homes

No Property Tax For Mumbai Homes With 500sqft Carpet Area 60 Discount Up To 700sqft Hindustan Times

No Property Tax For Mumbai Homes With 500sqft Carpet Area 60 Discount Up To 700sqft Hindustan Times

Mumbai Property Tax Exemption Bjp Clarifies That All Components Will Be Waived Housing News

Mumbai Property Tax Exemption Bjp Clarifies That All Components Will Be Waived Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Understanding California S Property Taxes

Understanding California S Property Taxes

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Pay Property Tax In Mumbai Bmc And Mcgm Step Wise Procedure

Pay Property Tax In Mumbai Bmc And Mcgm Step Wise Procedure

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Tax Reforms Key For India S Post Covid Urban Transformation Orf

Property Tax Reforms Key For India S Post Covid Urban Transformation Orf

Pay Property Tax In Mumbai Bmc And Mcgm Step Wise Procedure

Pay Property Tax In Mumbai Bmc And Mcgm Step Wise Procedure

Https Dor Sc Gov Resources Site Lawandpolicy Documents Sctied Chapter 204 Pdf

Katy Property Taxes Information By Local Area Expert

Katy Property Taxes Information By Local Area Expert

Understanding California S Property Taxes

Understanding California S Property Taxes

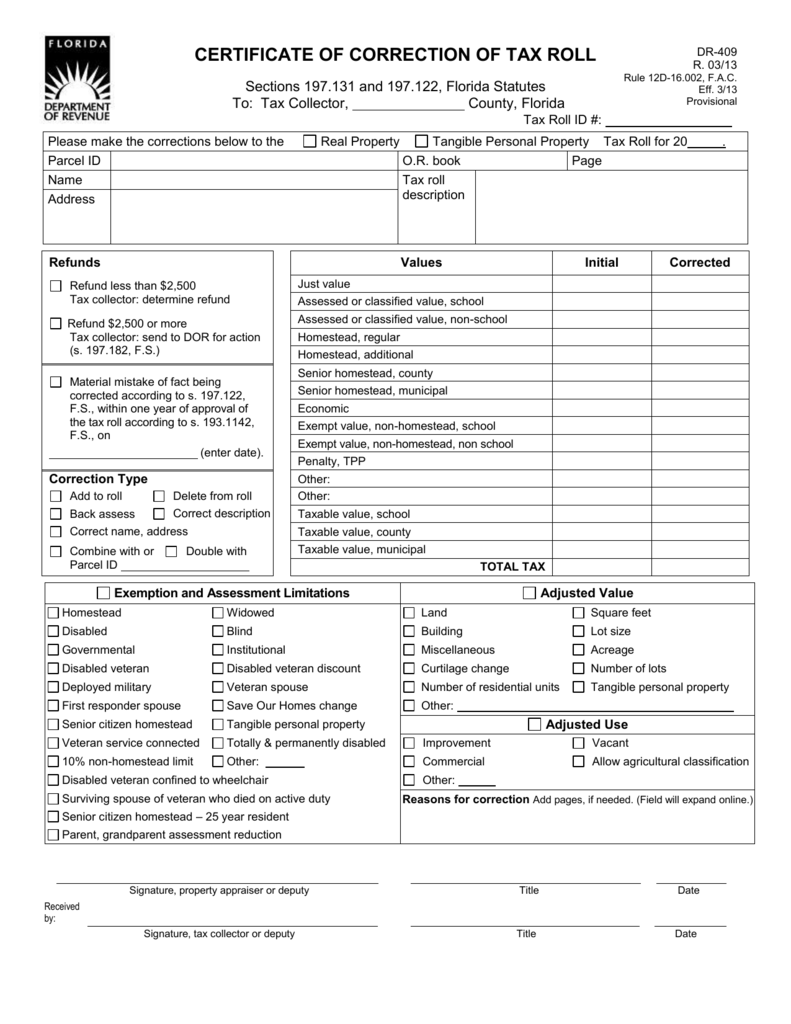

Certificate Of Correction Of Tax Roll

Certificate Of Correction Of Tax Roll

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home