How To Get A Personal Property Tax Waiver Online

You will need to contact the assessor in the county of your residence to request the statement or non-assessment and to be added to the assessment roll for the subsequent tax year. Choose the document you need in the collection of templates.

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

Personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later than December 31 each year.

How to get a personal property tax waiver online. You will need your Account Number to proceed with payment. Louis assessor if you did not own or possess personal property as of January 1. A statement of non-assessment also called a tax waiver indicates a specific person business or corporation does not owe any personal property taxes for a specified tax year.

Select the fillable fields and put the required details. Legible photo or scan of both sides of the title signed over to you or an Application for Missouri Title in your name or out-of- state registration. Please sign up for our virtual queue through QLess.

Read the instructions to discover which info you have to give. The Assessors Personal Property service windows on the first floor are open to the public. Taxes are assessed on personal property owned on January 1 but taxes are not billed until November of the same year.

Avoid crowds and save time with real-time status updates. A tax waiver is only used to license a vehicle or obtain a business license. All personal property assessment forms are to be returned to the County Assessor no later than March 1st.

In accordance with Rule 35 we consider the following factors when reviewing a waiver. A tax waiver also known as Statement of Non-Assessment indicates a specific person business or corporation does not owe any personal property taxes for a specified tax year. A non-assessment is issued to a county resident when no personal property tax was assessed for the prior year.

A tax waiver is only used to license a vehicle motorcycle trailer or other assets. Every person or business owning or holding tangible personal property on the 1st day of January of that calendar tax year shall be liable for taxes for the year. Learn what you have to bring to the Assessment Office to remove a vehicle from your individual personal property.

You may be entitled to a waiver if you are one of the following. Information and online services regarding your taxes. Legible photo or scan of both sides of your ID.

This is the first vehicle you have ever owned or have had titled in your name. The Comptrollers Taxpayer Bill of Rights includes the right to request a waiver of penalties. The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims.

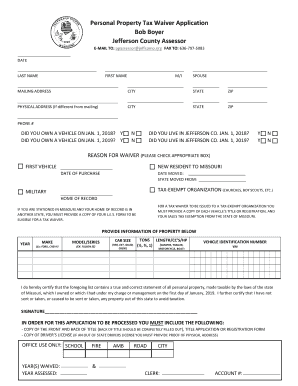

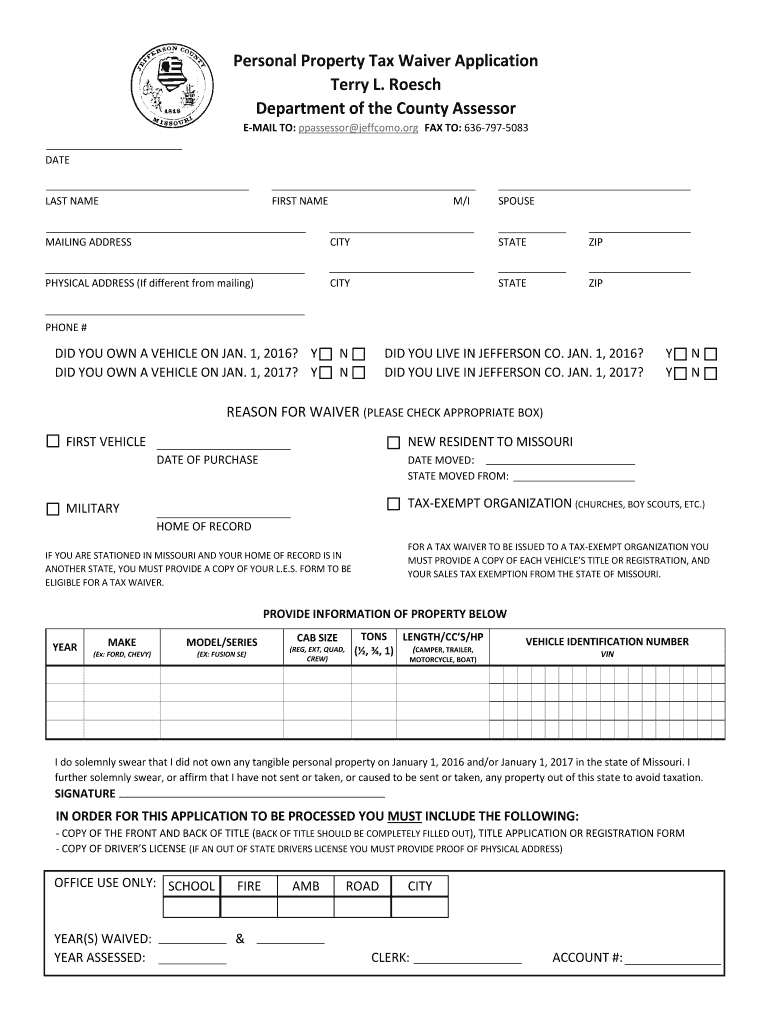

Your address on January 1 2018 2019 2020. If taxes are due you may pay online using the button below. FIRE AMB ROAD CITY PROVIDE INFORMATION OF PROPERTY.

Taxes not paid in full on or before December 31 will accrue interest penalties and fees. For further questions call our department at 636-949-7425. You can use our online form to request a waiver of penalties andor interest that was assessed because you filed or paid a tax report late.

Get in Line with QLess. Search Personal Property Tax Bills View Payment Methods. Stick to these simple instructions to get MO Personal Property Tax Waiver Application - Jefferson County prepared for sending.

Personal Property Tax Lookup And Print Receipt. You may be entitled to a tax waiver if one of the following applies. 636-797-5083 OFFICE USE ONLY.

A new resident to the state. You have several different options to request a waiver and will need to provide the required documentation listed below. See what documents need to be brought to the Assessment Office to establish an ownership change on a personal property account.

Receipt available for current or past two years. Open the template in the online editing tool. This certificate is used in lieu of a paid personal property tax receipt when registering a vehicle or renewing license plates.

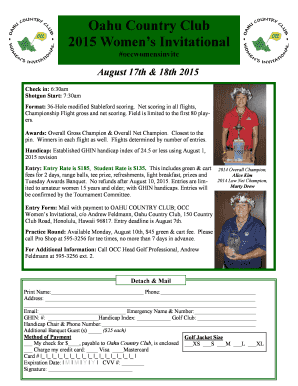

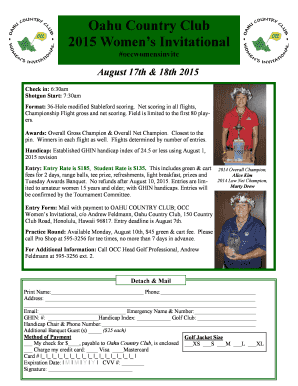

Personal Property Tax Waiver Application Bob Boyer Jefferson County Assessor E-MAIL TO. A waiver or statement of non-assessment is obtained from the county or City of St. Personal Property Tax Information.

Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. Find out how to obtain a statement of non-assessment tax waiver. No fee is charged for a certificate of non-assessment.

The postmark determines the timeliness of payment. You did not own any personal property.

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Https Dor Mo Gov Forms 426 Pdf

2018 Form Mo Personal Property Tax Waiver Application Jefferson County Fill Online Printable Fillable Blank Pdffiller

2018 Form Mo Personal Property Tax Waiver Application Jefferson County Fill Online Printable Fillable Blank Pdffiller

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Missouri Personal Property Tax Waiver Online Property Walls

Missouri Personal Property Tax Waiver Online Property Walls

Personal Property Release Form Template Lovely 26 Of Personal Liability Release Form Template Liability Waiver Job Application Template Templates

Personal Property Release Form Template Lovely 26 Of Personal Liability Release Form Template Liability Waiver Job Application Template Templates

Missouri Personal Property Tax Waiver Online Property Walls

Missouri Personal Property Tax Waiver Online Property Walls

Download Print Tax Receipt Clay County Missouri Tax

Download Print Tax Receipt Clay County Missouri Tax

Missouri Personal Property Tax Waiver Online Property Walls

Missouri Personal Property Tax Waiver Online Property Walls

How To Use The Property Tax Billing Portal Clay County Missouri Tax

How To Use The Property Tax Billing Portal Clay County Missouri Tax

2018 Form Mo Personal Property Tax Waiver Application Jefferson County Fill Online Printable Fillable Blank Pdffiller

2018 Form Mo Personal Property Tax Waiver Application Jefferson County Fill Online Printable Fillable Blank Pdffiller

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

Online No Tax Due System Information

Online No Tax Due System Information

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home