Nye County Nevada Property Tax Records

Online Tax Information or payment Our online credit card company is no longer compatible with Internet Explorer. Go to Data Online.

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

A single 500 deposit plus a non-refundable 35 processing fee is required to participate in the Nye County auction.

Nye county nevada property tax records. 11 rows Physical Address. These records can include Nye County property tax assessments and assessment challenges appraisals and income taxes. County to county We can now accept most major Credit Cards Follow us on Facebook.

Median Property Taxes Mortgage 1132. Nye County Treasurer Tax Records Nevada httpasdbconyenvus1402cgi-bintcw100p Search Nye County Treasurer tax records by parcel number and owner name. Nye County Treasurer Property Inquiry.

If you have this number no further information needs to be entered. The median property tax in Nye County Nevada is 1143 per year for a home worth the median value of 161700. Per Nevada Revised Statutes 361483.

Tax Records include property tax assessments property appraisals and income tax records. See the posting at top of the page for list of parcels that will be offered this Tax Sale. Property Reports ownership information property details tax records legal descriptions.

Boards Committees and. Click on Assessor Property Inquiry. The Nye County School District.

County Commissioner Annual Appointments. State and National Officials. Select Property Inquiry from list on left side of screen.

Located in the County Seat of Tonopah Nevada the Nye County Treasurers Office is the property tax collector for several taxing entities within Nye County including. NOTICEProperties in the Nye County Treasurers name as Trustee may require additional fees to redeem. The State of Nevada.

Assessor Nye County Assessor 101 Radar Road Tonopah NV 89049 Phone 775482-8174 Fax 775482-8178. Make a secured online tax inquiry or payment. Assessor Property Inquiry A Spreadsheet of ownership and mailing address DATA for Nye County Parcels can be downloaded below the data is current as of.

Nevada Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in NV. The Nye County Recorders office will be closed to the public until Monday November 30 2020 at the earliest. Board of County Commissioners.

These records can include land deeds mortgages land grants and other important property-related documents. Enter or click on Search key. The Nye County NV Treasurer offers tax-defaulted property for auction and encourages bidders to research the property thoroughly using the following information as a starting point.

Nye County Property Tax Payments Annual Nye County Nevada. Deposits must be received by Bid4Assets no later than 400 PM ET 100. The best way to search is to enter your Parcel Number 8 digits or Account Number 2 letters 6 digits from your tax bill into the Parcel Number or Account Number field.

Nye County Property Records provided by HomeInfoMax. Nye County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Nye County Nevada. In the Parcel ID field enter a parcel number 8 digits no dashes.

Search Nye County real property assessment records by parcel number owner name or property location. Nye Assessor 775 482 - 8174. Right hand side of results click on View Plat Map.

Our staff are working and able to assist you remotely. Involuntary Liens mechanics liens HOA IRS tax liens State tax liens other liens. Nevada is ranked 1254th of the 3143 counties in the United States in order of the median amount of property taxes collected.

Nye County Assessor Property Inquiry. 4 rows Nye Treasurer 775 482 - 8147. Please contact the Nye County Treasurers office for the total amount due.

Nye County Land Records are real estate documents that contain information related to property in Nye County Nevada. Title History ownership title history deeds and mortgage records. Staff will check the drop boxes every day checking mail and processing it daily.

The plat map will be displayed in a PDF portable document format. Voluntary Liens titles deeds mortgages releases assignments foreclosure records. Nye County collects on average 071 of a propertys assessed fair market value as property tax.

DUE DATES AND GRACE PERIODS.

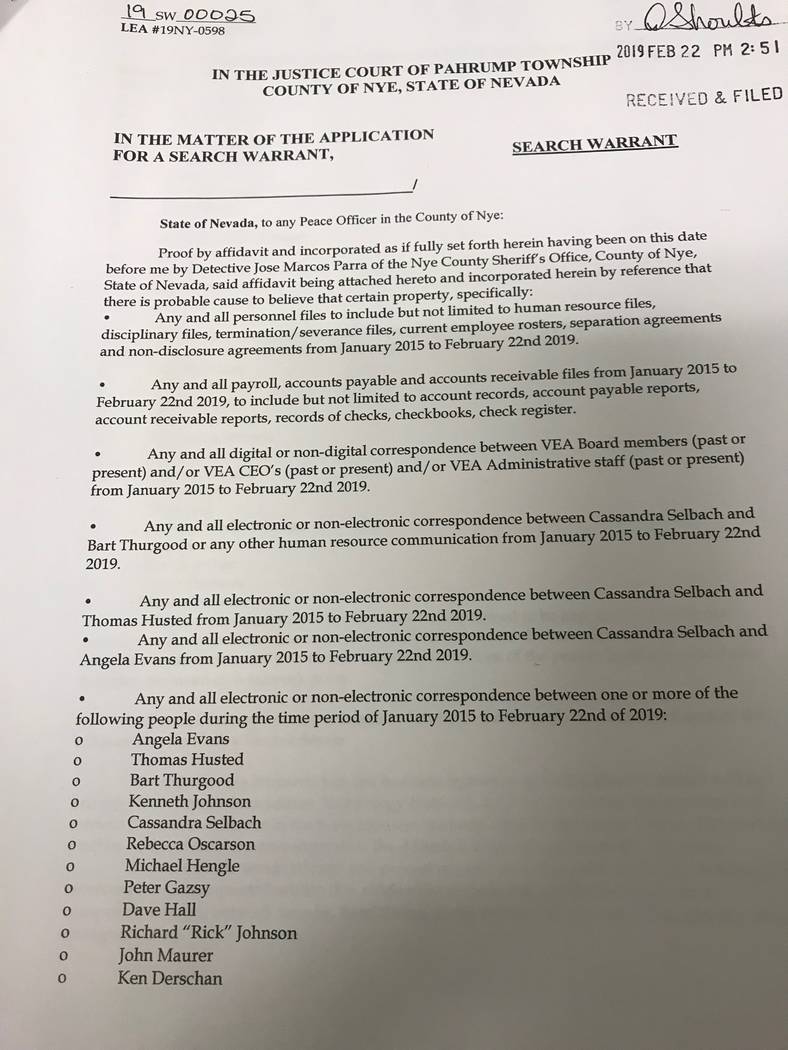

Nye Sheriff S Office Valley Ceo Arrested Pahrump Valley Times

Nye Sheriff S Office Valley Ceo Arrested Pahrump Valley Times

2491 E Deerskin Pahrump Nv 89048 Mls 2112952 Redfin

2491 E Deerskin Pahrump Nv 89048 Mls 2112952 Redfin

Solicitation For Copy Of Deed Law Firm Of Jeffrey Burr

Solicitation For Copy Of Deed Law Firm Of Jeffrey Burr

Https Www Nyecounty Net Documentcenter View 37353 Item10

Https Www Nyecounty Net Documentcenter View 34588 Item11

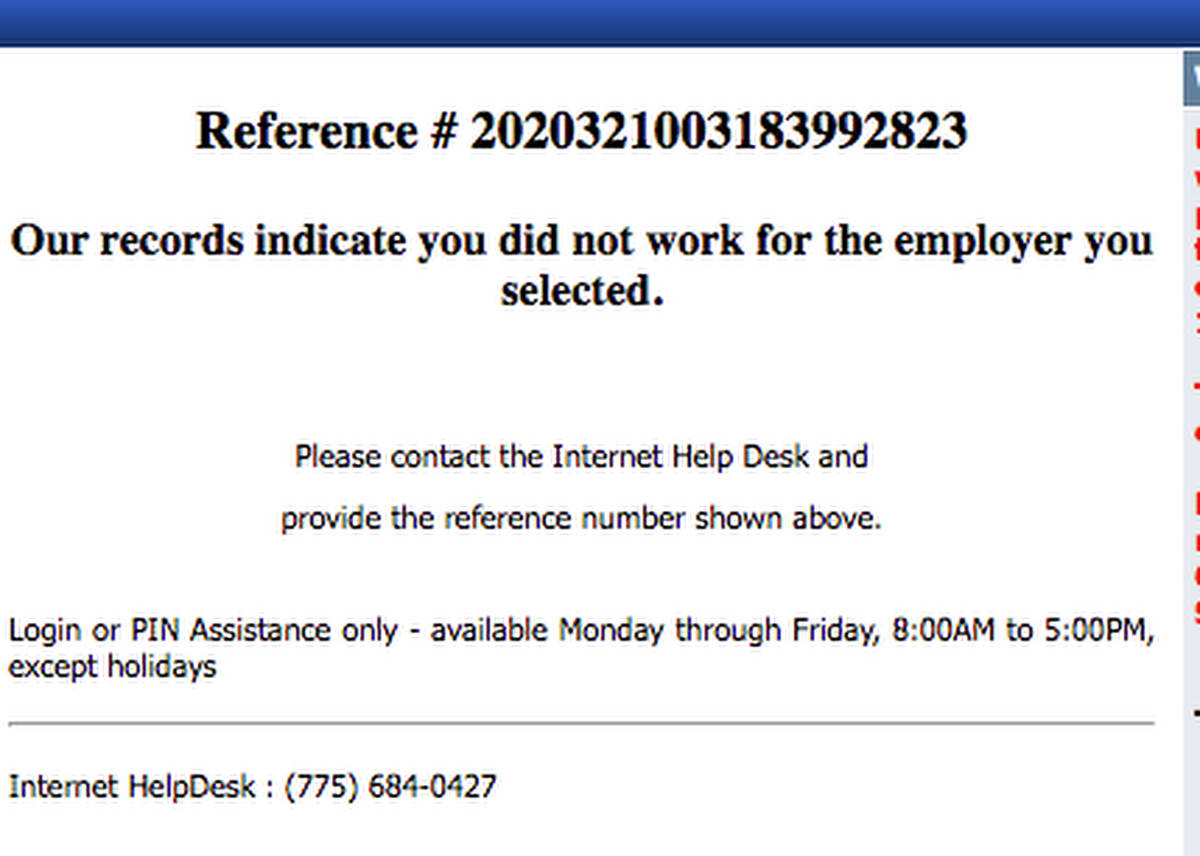

Nevada Unemployment Website Common Problems And What To Do About Them Las Vegas Review Journal

Nevada Unemployment Website Common Problems And What To Do About Them Las Vegas Review Journal

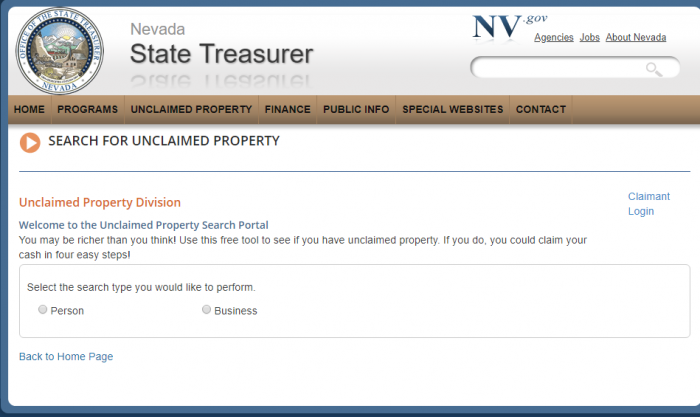

Finding Your Nevada Unclaimed Property 2021 Guide

Finding Your Nevada Unclaimed Property 2021 Guide

Tax State Nv Us Documents Sutreturn

Tax State Nv Us Documents Sutreturn

Http Www Nyecounty Net Documentview Asp Did 5350

Https Www Nyecounty Net Documentcenter View 34588 Item11

Eureka County Nevada Small Business Development Center

Eureka County Nevada Small Business Development Center

Nevada Statewide Criminal Search Accu Search Public Records Specialists

Nevada Statewide Criminal Search Accu Search Public Records Specialists

Http Www Co Eureka Nv Us Treasurer Auction 2020 81358 20 20002 038 02 Pdf

Https Www Nyecounty Net Documentcenter View 34588 Item11

Http Nv Nyecounty Civicplus Com Documentcenter View 20769

Https Www Nyecounty Net Documentcenter View 35165 Item7

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home