Property Tax Quebec Vs Ontario

Property Taxes in Québec. Ontarios Greater Toronto and Hamilton Area Quebecs Greater Montreal British Columbias Lower Mainland and Albertas Calgary and.

The Best And Worst Cities In Canada For Property Taxes Huffpost Canada Business

The Best And Worst Cities In Canada For Property Taxes Huffpost Canada Business

Even a new tax on the rich introduced.

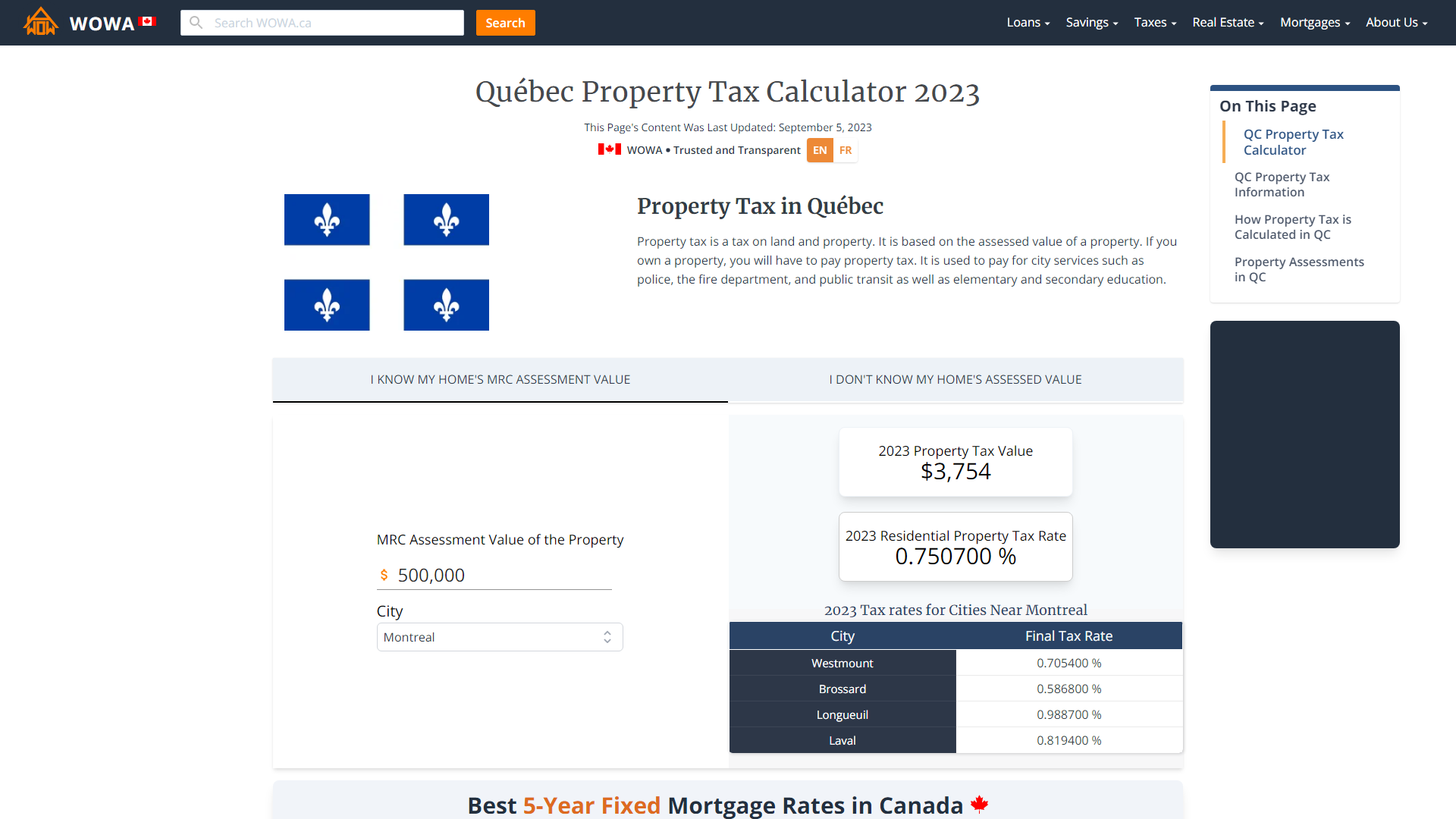

Property tax quebec vs ontario. Statistics compiled by Zoocasa offer a snapshot of how much property taxes can vary throughout Canada and show that Toronto residents paid nearly three times more in property taxes for a home of the same. 250 on the first 50000. All property tax rates were sourced from municipal websites.

Is there any possible way I can pay Ontario income taxes instead of Quebec taxes since I live in Ontario-. The Ontario Trillium Benefit gives low- and moderate-income taxpayers a break on their sales and property taxes and gives residents of the northern part of the province a break on their energy costs. There are two main parts to property taxes in Québec.

In income taxes between Ontario and Quebec. Capital gains tax is a tax you pay to the government when you make a profit by selling your investment property or something else of value for more than you originally paid for it. In my Ontario job I got to keep about 76 of my pay and in my Quebec job its about 65.

Rachael lives in Quebec but works in Ontario. 45 percent of this amount is 2250 So she may claim this as a credit on her Revenu Québec tax return TP1 and it works as a refundable tax credit. And 1500 on the extra 100000.

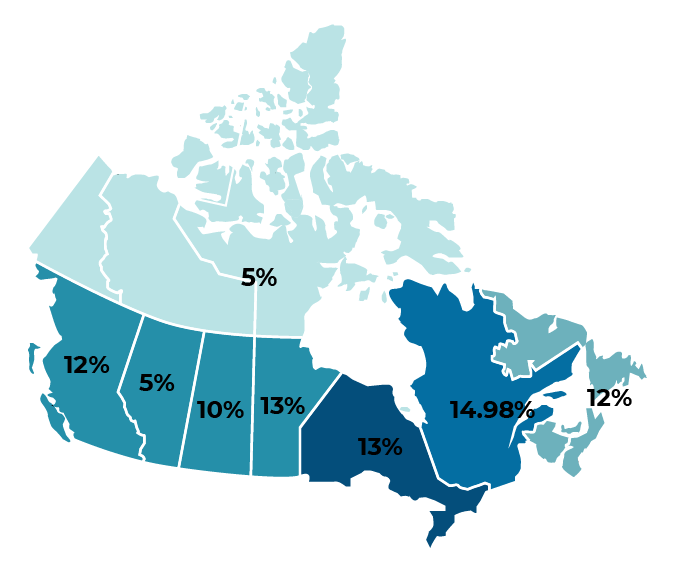

If you live in Ontario youll save 6593 on income taxes so if the house you plan to buy on the Quebec side is 54942 month less or higher than the option in Ontario then your best bet is Quebec. 15 on the first 44545 of taxable income 20 on the next 44535 24 on. In Ontario the range is 11 to 13.

Thanks to property taxes the city you live in matters too. Property taxes are charged by the municipality you live in and are used to pay for services such as garbage and recycling collection sewer protection road and draining maintenance snow removal street lighting policing fire protection and more. 2000 on the next 200000.

11 rows Other taxes Assesment value x Other taxes rate 100 Property tax Municipal tax. For example if you spent 310000 on buying a house years ago and sold it for 500000 today then your capital gains would be 190000 and youd have to. Anything above 82000 in Quebec is taxed at 24-2575.

But if its any consolation to Vancouverites the property tax on a 11 million property in their city would have been roughly 2800 and thats around 1000 less than what a Winnipegger. For instance if you earn 80000 taxable income in Ontario and you sold a capital property in BC with a total capital gain of 1000 you will pay 15740 in capital gains tax based on the capital gains tax rate of 1574 in Ontario. Choose Quebec and expect to pay 15 per cent in sales taxes on every purchase.

15 on the amount from 250000 to 500000. Then the tax is calculated as follows. Capital Gains Tax Rate British Columbia.

An education tax set by the province that is the same throughout Quebec. A municipal tax that depends on the borough of the property. 2 on the amount over 500000 So for example a property with a tax base as 350000 would be taxed.

If youre one of the many Canadian homeowners who just paid their annual property tax heres an eye-opening look at how much others are paying in different regions of the country. One of the carrying costs that come with homeownership is your property tax. 05 on the first 50000.

She receives a T4 reporting that her employer withheld 5000 in income tax. This study compares property tax ratios for major residential and non-residential property classes in five of Canadas largest metropolitan areas. Someone who owns a million-dollar property would pay 2468 in property taxes in Vancouver Zoocasa estimated compared to 6355 in Toronto and 10684 in Ottawa.

Choose Alberta and the rate drops to five per cent. The breakdown of the municipal tax rate will. Businesses offering apprenticeships may be eligible for a tax credit as are companies who employ post-secondary co-op students.

1 on the amount from 50000 to 250000. Quebec taxes the next 40000 at 20 while Ontarians pay 915. The amount of property tax included per city represents sample calculations only based on the assumption a property is assessed by its provincial tax authority to be valued at a.

Canadian Sales Tax Registration Requirements Crowe Soberman Llp

Canadian Sales Tax Registration Requirements Crowe Soberman Llp

Oh Canada Those Facts Figures On Unclaimed Funds Are So Very Hard To Find Hence The Need For Unclaimed Property Legislation Financial Asset Financial Facts

Oh Canada Those Facts Figures On Unclaimed Funds Are So Very Hard To Find Hence The Need For Unclaimed Property Legislation Financial Asset Financial Facts

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Canada Global Payroll And Tax Information Guide Payslip

Canada Global Payroll And Tax Information Guide Payslip

Delean Timing Important For Tax Purposes In Move From Ontario To Quebec Montreal Gazette

Delean Timing Important For Tax Purposes In Move From Ontario To Quebec Montreal Gazette

Canada S Least Liked Cities Canadian Facts National Debt Relief Debt Relief

Canada S Least Liked Cities Canadian Facts National Debt Relief Debt Relief

Pin By Tri Target Tax Sales Ontario On Resources For Tax Sales New Hampshire Wisconsin Michigan

Pin By Tri Target Tax Sales Ontario On Resources For Tax Sales New Hampshire Wisconsin Michigan

Unclaimed Financial Assets In Canada Financial Asset Financial Savings Bonds

Unclaimed Financial Assets In Canada Financial Asset Financial Savings Bonds

Here S How Much Canadians Are Earning By Province Workopolis Blog

Here S How Much Canadians Are Earning By Province Workopolis Blog

Infographic I Created Canadian Gst Pst Hst Canadian Facts Canadian Things Canada Economy

Infographic I Created Canadian Gst Pst Hst Canadian Facts Canadian Things Canada Economy

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Quebec Property Tax Rates Calculator Wowa Ca

Quebec Property Tax Rates Calculator Wowa Ca

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Is Quebec A North American Region State

Which Province In Canada Has The Lowest Tax Rate Transferease

Which Province In Canada Has The Lowest Tax Rate Transferease

Check Out The Top 5 Best Places To Live In Canada Best Places To Live Median Household Income Canada

Check Out The Top 5 Best Places To Live In Canada Best Places To Live Median Household Income Canada

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home