Property Tax In Quebec Vs Ontario

That means that your net pay will be 40512 per year or 3376 per month. 45 percent of this amount is 2250 So she may claim this as a credit on her Revenu Québec tax return TP1 and it works as a refundable tax credit.

Oh Canada Those Facts Figures On Unclaimed Funds Are So Very Hard To Find Hence The Need For Unclaimed Property Legislation Financial Asset Financial Facts

Oh Canada Those Facts Figures On Unclaimed Funds Are So Very Hard To Find Hence The Need For Unclaimed Property Legislation Financial Asset Financial Facts

Property Taxes in Québec.

Property tax in quebec vs ontario. For example when it comes to early education few people in Quebec business community commented that in the rest of Canada or ROC you are at disadvantage when you have kids going to daycare because in Quebec you just pay about 15-20 a day vs 40-50 in ROC. Even a new tax on the rich introduced. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488.

There are two main parts to property taxes in Québec. A municipal tax that depends on the borough of the property. The seller needs to wait two days for his proceeds.

Anything above 82000 in Quebec is taxed at 24-2575. Child Assistance payment for 2 kids starts to get reduced once you earn more than 47000 Up to 3500. All property tax rates were sourced from municipal websites.

Your average tax rate is 221 and your marginal tax rate is 349. Here you sign pay activate your insurance and then let the seller live in the house for another 2-4 days. In my Ontario job I got to keep about 76 of my pay and in my Quebec job its about 65.

15 on the first 44545 of taxable income 20 on the next 44535 24 on. Even though Quebec advantages might soon come to an end due to neighbouring Ontario. But this is only one aspect of an individuals expenses.

Conclusion de la TRILOGIE FISCALE de Michel Morin. Is there any possible way I can pay Ontario income taxes instead of Quebec taxes since I live in Ontario-. The amount of property tax included per city represents sample calculations only based on the assumption a property is assessed by its provincial tax authority to be valued at a flat amount of.

Calcul taxe TVH soit la taxe de vente harmonisée 2021 pour lensemble du canada Ontario Colombie Britannique Nouvelle-Écosse Terre-Neuve-et-Labrador. Quebec residents who earn 75000 annually will pay 4332more in taxes 20893 minus 16561 than an Ontario resident. In Ontario and other parts of Canada when you sign and pay you get the keys immediately not in Quebec.

Someone who owns a million-dollar property would pay 2468 in property taxes in Vancouver Zoocasa estimated compared to 6355 in Toronto and 10684 in Ottawa. 13 Prince Edward Island. She receives a T4 reporting that her employer withheld 5000 in income tax.

In income taxes between Ontario and Quebec. Rachael lives in Quebec but works in Ontario. An education tax set by the province that is the same throughout Quebec.

The breakdown of the municipal tax rate will differ across boroughs within municipalities. Monthly additional expense amounts to 361. This marginal tax rate means that your immediate additional income will be taxed at this rate.

14 rows Ontario. Solidarity Tax Credit called Trillium in Ontario for family earning 50000 with 2 children 800 max 1298 600 max 1500 but the higher your rent the higher the credit Tuition credits for post-secondary. GST QST 9975.

In Ontario the range is 11 to 13. Dans Maurais Live à Radio X. Les Québécois sont victimes de SURTAXES.

Quebecs income taxes and consumption taxes are higher than in Ontario but not by as much as you would imagine says Farley with his accountant hat. Quebec taxes the next 40000 at 20 while Ontarians pay 915.

Https Www150 Statcan Gc Ca N1 Pub 75 001 X 00703 6578 Eng Pdf

Statistics Canada Property Taxes

Statistics Canada Property Taxes

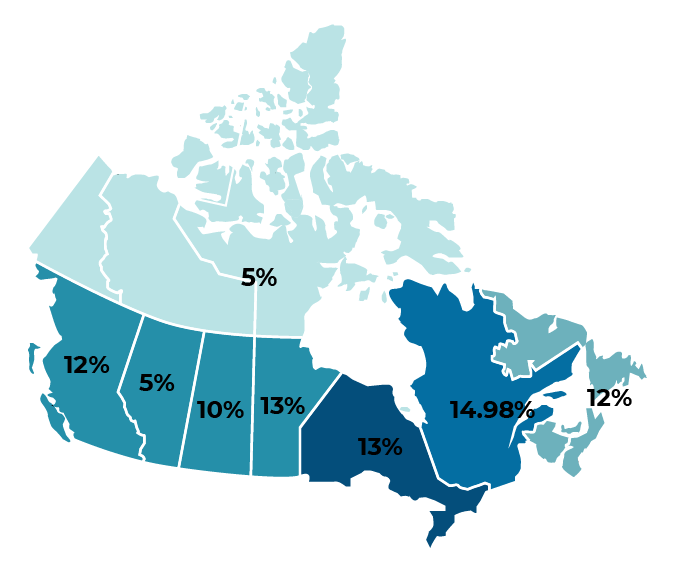

Which Province In Canada Has The Lowest Tax Rate Transferease

Which Province In Canada Has The Lowest Tax Rate Transferease

Canadian Sales Tax Registration Requirements Crowe Soberman Llp

Canadian Sales Tax Registration Requirements Crowe Soberman Llp

The Best And Worst Cities In Canada For Property Taxes Huffpost Canada Business

The Best And Worst Cities In Canada For Property Taxes Huffpost Canada Business

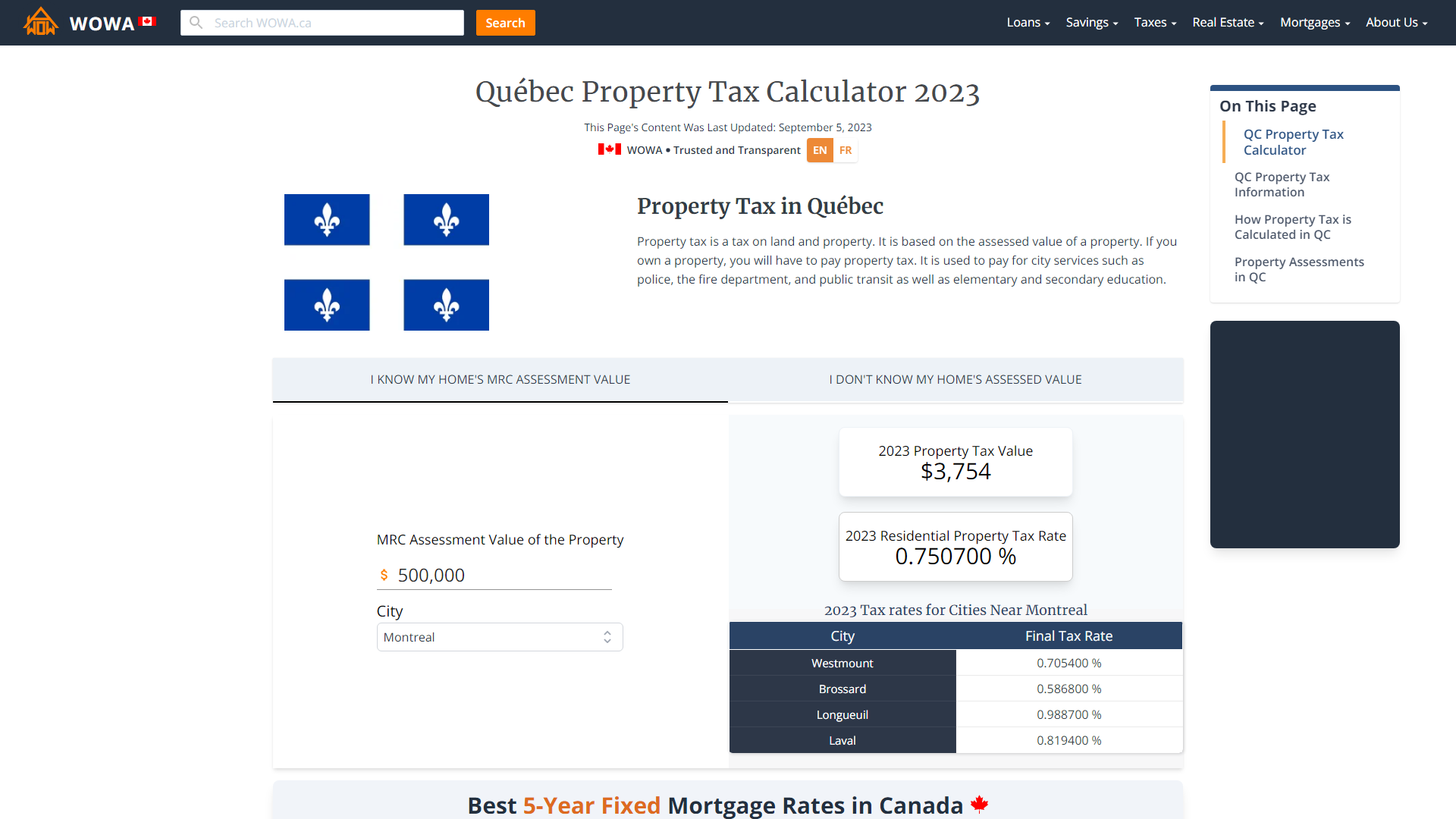

Quebec Property Tax Rates Calculator Wowa Ca

Quebec Property Tax Rates Calculator Wowa Ca

Delean Timing Important For Tax Purposes In Move From Ontario To Quebec Montreal Gazette

Delean Timing Important For Tax Purposes In Move From Ontario To Quebec Montreal Gazette

Check Out The Top 5 Best Places To Live In Canada Best Places To Live Median Household Income Canada

Check Out The Top 5 Best Places To Live In Canada Best Places To Live Median Household Income Canada

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Unclaimed Financial Assets In Canada Financial Asset Financial Savings Bonds

Unclaimed Financial Assets In Canada Financial Asset Financial Savings Bonds

Canada Global Payroll And Tax Information Guide Payslip

Canada Global Payroll And Tax Information Guide Payslip

High End Home Tax Will Force Out Toronto Talent Warns Real Estate Ceoneed A Mortgage Mortgages Victoria Toronto Luxury Homes Mansions

High End Home Tax Will Force Out Toronto Talent Warns Real Estate Ceoneed A Mortgage Mortgages Victoria Toronto Luxury Homes Mansions

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Canada S Least Liked Cities Canadian Facts National Debt Relief Debt Relief

Canada S Least Liked Cities Canadian Facts National Debt Relief Debt Relief

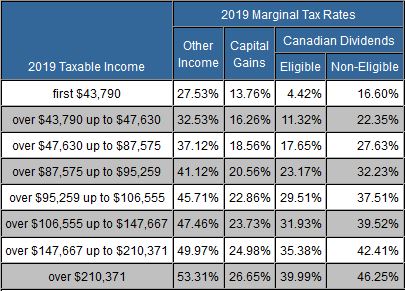

Quebec 2018 2019 Income Tax Rates

Quebec 2018 2019 Income Tax Rates

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home