Cra Ontario Senior Property Tax Credit

The maximum credit is 2500. The credit would allow seniors to stay in their homes for longer during the Covid-19 pandemic.

Solved Claimed Property Tax Doesn T Show Up In Box 61120

Solved Claimed Property Tax Doesn T Show Up In Box 61120

The Seniors Home Safety Tax Credit is worth 25 of up to 10000 in eligible expenses for a seniors principal residence in Ontario.

Cra ontario senior property tax credit. Maximum can be shared by the people who share a home including spouses and common-law partners. The grant is based on your adjusted family net income. If you file your taxes without using TurboTax you will need to apply for this tax credit by filling out Form ON-BEN Application for the Ontario Trillium Benefit and the Ontario Senior Homeowners Property Tax Grant.

Ontario senior homeowners property tax grant OSHPTG The Ontario senior homeowners property tax grant OSHPTG is intended to help offset property taxes for seniors who own their own home and who have low to moderate incomes. This is included as part of your personal income tax and benefit return. Adjusted family net income your family net income minus any universal child care benefit UCCB and registered disability savings plan RDSP income received plus any UCCB and RDSP amounts repaid.

If your income is 35466 or less you can claim the full 7033 which will result in a 105495 non-refundable tax credit. How to claim it The Seniors Home Safety Tax Credit is a refundable personal income tax credit. You cannot claim a property tax credit for more than one Ontario residence such as a house and a cottage for the same period.

The CRA administers this program for Ontario. The Ontario senior homeowners property tax credit OSHPTG helps low- to moderate-income seniors with offsetting the cost of their property taxes. The Ontario Energy and Property Tax Credit is one of the three credits that make up the Ontario Trillium Benefit.

The Seniors Home Safety Tax Credit would be a fully refundable tax credit for the 2021 tax year worth 25 of up to 10000 in eligible expenses to make homes safer and more accessible. However for all the monthly payments from July 2020 to June 2021 you must use your marital status on December 31 2019. Met either of the following income requirements.

The basic property tax credit for individuals age 65 or older is 625. To qualify for the maximum amount in 2021 your adjusted family net income for the 2020 tax year has to be 35000 or less singles or 45000 or less couples. Seniors and their families would be eligible for up to 2500 in a tax credit if they spend 10000 on home improvements to make their living space more comfortable including grab.

The basic property tax credit for individuals under age 65 is 250. The Ontario Energy and Property Tax Credit is a personal tax credit funded by the Province of Ontario and implemented to help individuals with low- to moderate-income with the sales tax on energy as well as their property taxes. The maximum grant is 500 each year.

Paid Ontario property tax for the year. 25 of up to maximum 10000 in eligible expenses for a seniors principal residence in Ontario resulting in maximum 2500 credit. 2020 Ontario energy and property tax credit OEPTC calculation sheets Your OEPTC entitlement is calculated on a monthly basis.

You qualify for this grant if you or your spousecommon-law partner as of December 31 of the previous year. The Ontario Senior Homeowners Property Tax Grant helps low-to-moderate income seniors with the cost of their property taxes. This program is funded entirely by the Province of Ontario.

If you qualify for the Ontario Seniors Homeowners Property Tax Grant you may be eligible for up to a 500 property tax refund. The age amount is a tax credit available to an individual who is 65 or older on December 31 and has a net income of less than 82353 2015.

Https Www Halton Ca Repository Property Tax Increase Deferral Program Application

Sam Seidman On Twitter Tax Help Filing Taxes Tax Preparation

Sam Seidman On Twitter Tax Help Filing Taxes Tax Preparation

Property Taxes And Water Sewer Bills

Ontario Senior Homeowners Property Tax Grant Qualifications Canadian Budget Binder

Ontario Senior Homeowners Property Tax Grant Qualifications Canadian Budget Binder

Ontario Senior Homeowners Property Tax Grant Oshptg

Solved How Can I Enter The Property Tax

Solved How Can I Enter The Property Tax

Ontario Senior Homeowners Property Tax Grant Qualifications Canadian Budget Binder

Ontario Senior Homeowners Property Tax Grant Qualifications Canadian Budget Binder

Unclaimed Financial Assets In Canada Financial Asset Financial Savings Bonds

Unclaimed Financial Assets In Canada Financial Asset Financial Savings Bonds

Solved Claimed Property Tax Doesn T Show Up In Box 61120

Solved Claimed Property Tax Doesn T Show Up In Box 61120

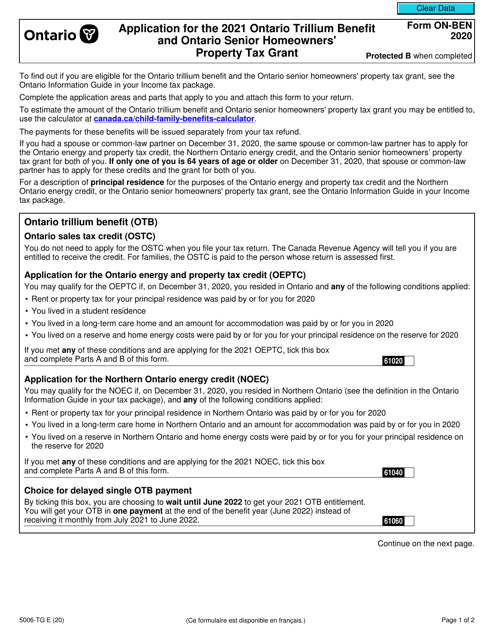

Form 5006 Tg On Ben Download Fillable Pdf Or Fill Online Application For The Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2020 Canada Templateroller

Form 5006 Tg On Ben Download Fillable Pdf Or Fill Online Application For The Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2020 Canada Templateroller

Provincial Land Tax Reform Overview Of The Provincial Land Tax Open Houses

Provincial Land Tax Reform Overview Of The Provincial Land Tax Open Houses

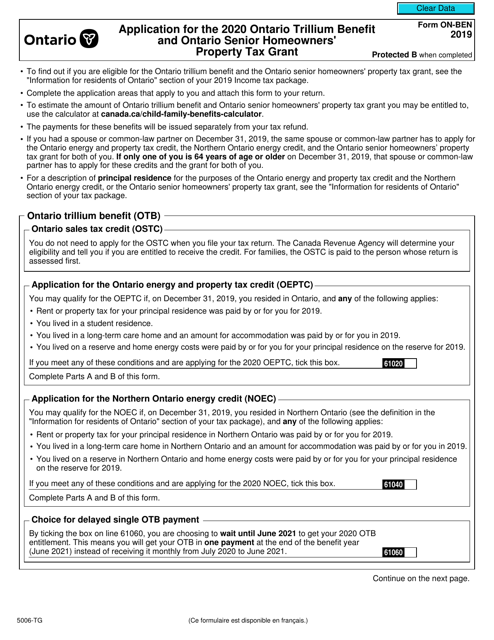

Form On Ben 5006 Tg Download Fillable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2019 Canada Templateroller

Form On Ben 5006 Tg Download Fillable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant 2019 Canada Templateroller

Property Taxes And Water Sewer Bills

Statistics Canada Property Taxes

Statistics Canada Property Taxes

How To Claim Ontario Trillium Benefit Turbotax Canada 2020 Youtube

How To Claim Ontario Trillium Benefit Turbotax Canada 2020 Youtube

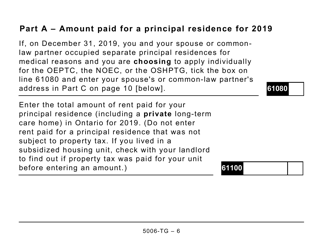

Form On Ben 5006 Tg Download Printable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Large Print 2019 Canada Templateroller

Form On Ben 5006 Tg Download Printable Pdf Or Fill Online Application For The 2020 Ontario Trillium Benefit And Ontario Senior Homeowners Property Tax Grant Large Print 2019 Canada Templateroller

Ontario Energy And Property Tax Credit 2021 Show Me The Green

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home