How To Get A Copy Of Your Self Assessment Tax Return

When filling out your tax return youll need the documents mailed to you by your employer such as your P60 End of Year Certificate P11D Expenses or benefits or P45 Details of employee leaving work payslips. For example if you claimed for maintenance on a Buy to Let property in a previous tax year you cannot claim for the same expense as part of your Capital Gains tax return when you come to sell the property.

Save Money With This Free To Download Allowable Tax Expenses Swipefile Business Tax Saving Money Small Business Finance

Save Money With This Free To Download Allowable Tax Expenses Swipefile Business Tax Saving Money Small Business Finance

Notify me when a return is filed with my SSN Protect yourself from fraud.

How to get a copy of your self assessment tax return. Find out who has to complete a tax return for the 2020-21 tax year and how self-assessment works. Completing your corporation income tax T2 return Preparation and filing methods for your T2 return and what to. The Internal Revenue Service IRS can provide you with copies of your tax returns from the most recent seven tax years.

If you usually file a Self Assessment tax return every year then HMRC might also send it to you by post. Its not as complicated as it might seem. As you probably know youve got to get your tax return in by Jan 31 2018 at the very latest or youll be liable for a 100 fine.

Sign up for notifications. If you need your prior year Adjusted Gross Income AGI to e-file choose the tax return transcript type when making your request. You can get various Form 1040-series transcript types online or by mail.

You can get a blank Self Assessment tax return or guidance notes by either. Youre a landlord earning rental income. You should first work out why you need to do a tax return.

You are responsible for the information provided so take your time filling in your information on your return. Make your check or money order payable to United States Treasury. You earn over 100000.

You can request copies by preparing Form 4506 and attaching payment of 50 for each one. HMRC encourage people to file online by sending out a notice to file a tax return form SA216 rather than a paper copy of the return. Only the signature from the requesting spouse is required on the Form 4506 Request for Copy of Tax Return.

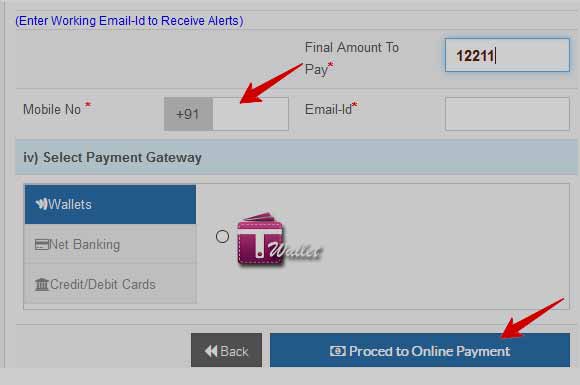

If you filed online using HMRC tax return you can log in to your account and under tax return options you should be able to choose the year and view the return I am not a lawyer and neither am i still in practice as a qualified accountant. Protest a Proposed Assessment File a protest online. In this step-by-step guide youll find everything you need to know to fill in your tax return online one of the most important self assessment forms when you become self-employed to help you beat the HMRC deadline.

When to file your corporation income tax return T2 return filing deadlines and how to avoid penalties. Receive your 1099-G Electronically Setup GTC to make your 1099-G available online. If youre not sure how to do a Self Assessment tax return dont panic.

Gather the documents youll need for the self-assessment form. Choose the Taxes tab at the top of the screen and select Self Assessment from the drop-down menu. Do not send any receipts accounts or other paperwork to HMRC in support of your Self Assessment return unless HMRC asks for them.

But its a necessary thing to do. Select the tax year that you need it for for example the 2020 version is for the 20192020 tax year. Even then you should only send copies and keep the originals safe.

Filing your Self Assessment return is never going to be something that makes you whoop for joy. From Your tax account choose Self Assessment account if you do not see this skip this step. Download the SA100 form.

Select the appropriate Self Assessment tax return from the list of tax years on the left-hand. Getting a corporation income tax T2 return Different ways to get a return. Print it fill it in and submit it.

This is because you might be claiming expenses as part of your Self Assessment tax return for property in previous years. You should complete Form 4506 and mail it to the address listed in the instructions along with a 43 fee for each tax return requested. Youll also need the P2 PAYE Coding Notice.

No outstanding tax liability or missing returns. Choose More Self Assessment details. Choose At a glance from the left-hand menu.

Self-assessment tax returns must be submitted each year by self-employed people but also those with many other types of income. Once the IRS receives your request it can take up to 60 days for the agency to process it. The tax deadline has now been extended from 31 January to 28 February as part of the government support measures put in place to support the self-employed as a result.

When an agent submits your tax return they use 3rd party software this means that your return cannot be viewed in your own online account. Downloading them from the GOVUK website calling this number to ask for them to be posted to you You can order up to 10. To find out how much you owe or to verify.

Currently you can file your self-assessment tax return by post or online. Navigating to the completed Self Assessment tax return. You have side-gigs alongside your full-time job.

Read more »