How To Claim Tax Relief For Working From Home Self Assessment

If you do self-assessment you wont be able to use HMRCs online portal. You would need to claim this online or with a P87 claim form.

How To Claim Tax Relief If You Re Working From Home Due To Covid 19

How To Claim Tax Relief If You Re Working From Home Due To Covid 19

As mentioned above HMRC has confirmed that employees are able to continue claiming the working from home tax relief for the entire 202122 tax year however a new claim must be submitted.

How to claim tax relief for working from home self assessment. Assuming you needed to work from home due to Covid-19 them you are essentially confirming that the 312 claimed is correct for that year. Through your employer as a non-taxable benefit. For workers who dont fill in a self-assessment tax return each year the online claim page will take you to Government Gateway where you will be asked for the date you started working from home.

If you have multiple jobs you might need to claim your tax relief by post. Due to that there is essentially a flat rate of 6 a week available to you. As self-employed workers are taxed on their profits expenses incurred from working from home can be deducted therefore reducing the amount of tax youll pay.

The employee performs substantive duties at home. Employees who are continuing to work from home as a result of the Coronavirus pandemic and whose expenses have not been reimbursed by their employers should make new claims to continue receiving working from home tax relief. HMRC is encouraging customers claiming tax relief.

If your employer wont pay expenses for your extra costs due to necessary working from home but you have them then you can ask for the amount to be deducted from your taxable income it says. Your work Self Employment Full Form Details Expenses breakdown 1 tick the top of the page to report your expenses in details and input the entry in the box labelled Rent rates power and insurance costs. HMRC will accept that a home is a workplace where.

If you usually complete a self-assessment returns. This includes if you have to. Claiming for the 202122 tax year.

Yet apportioning extra costs such as heating and electricity is tough. In order to claim tax relief for homeworking costs the usual rules are that an employee must show that their home is a workplace. Make a charity donation now to reduce your tax bill for last year With self-assessment you normally only report things on your tax return that relate to the previous tax year.

Your work Self Employment Short Form Details Allowable expenses Complete the box labelled Rent power insurance and other property costs Full Form. 29 June 2020 at 502PM. Claim tax relief for your job expenses.

Through HMRC and the usual self-assessment. This is because claims made in the 2020-21 tax year which ended on 5 April 2021 will not be carried over automatically to the current 2021-22 tax year. You are expected to fill out this form print it and send it to HMRC.

You cannot claim tax relief if you choose to work from home If you go through the calculator it simply tells you to claim the expenses on your self assessment return. If you also worked from home during 2020-21 you can still claim for that too meaning you can gain up to 250 in total for both tax years. If you dont include it on your Self Assessment return then you will effectively need to repay the tax relief you received via your tax.

I assume box 20 in SA102 is the place but there will be others who can confirm this or correct it. Working from home You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week. If you are already filing a self-assessment tax return you can claim for this under the section on the form called Using Your Home As An Office otherwise you will need to fill in a P87 form.

If you are a group of flatmates working from home then you can all claim it. But with gift aid. Your tax code is just a provisional attempt to collect the correct tax.

Employees who have not received the working from home expenses payment direct from their employer can apply to receive the tax relief from HMRC. You can only claim via a self-assessment tax return which as a self-employed worker youll have to submit each year anyway. Employees can claim the relief if they are required to work from home and have additional expenses even if.

Instead apply for the tax relief. If youre working from home even if its not full-time you can now make a tax relief claim of up to 125 for the new 2021-22 tax year. To claim the tax relief you must have and declare that you have had specific extra costs due to working from home.

This can be done via your usual expense claim which means cash will usually be paid straight to your bank account and without tax being deducted. You do not need to file a return to claim working from home expenses.

Uniform Tax Rebate Form P87 Download Tax Rebates Tax Refund Tax

Uniform Tax Rebate Form P87 Download Tax Rebates Tax Refund Tax

Apply For A Repayment Of Tax Using R40 Tax Form Tax Forms Savings And Investment Tax Free

Apply For A Repayment Of Tax Using R40 Tax Form Tax Forms Savings And Investment Tax Free

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations In 2021 Business Tax Deductions Tax Deductions Business Tax

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations In 2021 Business Tax Deductions Tax Deductions Business Tax

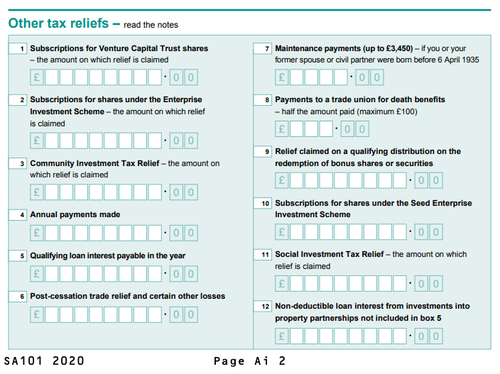

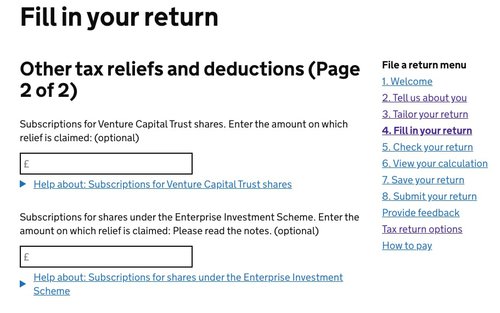

How To Claim Eis Income Tax Relief A Step By Step Guide

How To Claim Eis Income Tax Relief A Step By Step Guide

Can I Claim Them As A Dependent For All The Visual Learners Out There This Board Is For You We Ve Condensed Complica Filing Taxes Tax Questions Tax Guide

Can I Claim Them As A Dependent For All The Visual Learners Out There This Board Is For You We Ve Condensed Complica Filing Taxes Tax Questions Tax Guide

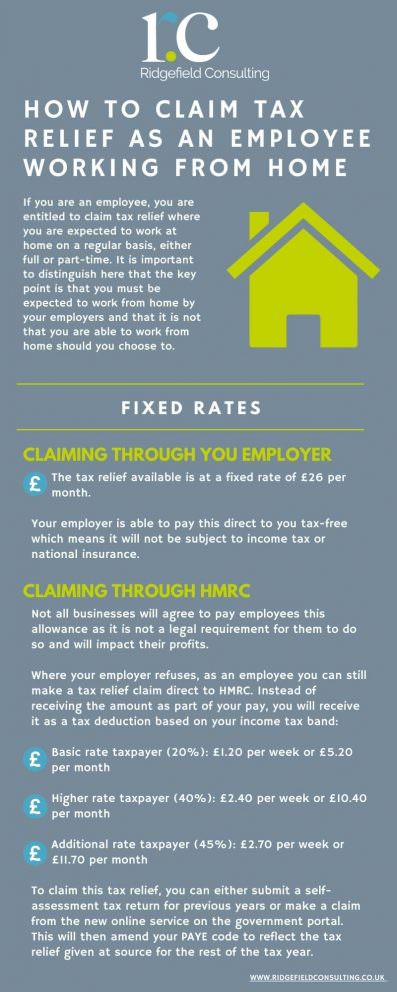

Different Ways To Claim Tax Relief When Working From Home

Different Ways To Claim Tax Relief When Working From Home

Income Tax Form Hmrc Why You Should Not Go To Income Tax Form Hmrc Tax Forms Income Tax Tax

Income Tax Form Hmrc Why You Should Not Go To Income Tax Form Hmrc Tax Forms Income Tax Tax

Selfemployedproduct Job Info Tax Forms Self Assessment

Selfemployedproduct Job Info Tax Forms Self Assessment

Tax Guide For Uk Bloggers Social Media Influencers Goselfemployed Co Finance Blog Tax Guide Business Checklist

Tax Guide For Uk Bloggers Social Media Influencers Goselfemployed Co Finance Blog Tax Guide Business Checklist

7 Self Employment Tax Forms For Home Business Owners Tax Forms Business Budget Template Business Tax

7 Self Employment Tax Forms For Home Business Owners Tax Forms Business Budget Template Business Tax

Filing Your Tax Return Don T Forget These Credits Deductions Business Tax Small Business Tax Business Tax Deductions

Filing Your Tax Return Don T Forget These Credits Deductions Business Tax Small Business Tax Business Tax Deductions

Tax Refund Letter Template Sample For Money From Bank

Tax Refund Letter Template Sample For Money From Bank

How To Claim Eis Income Tax Relief A Step By Step Guide

How To Claim Eis Income Tax Relief A Step By Step Guide

How Do I Tailor My Self Assessment Tax Return Youtube

How Do I Tailor My Self Assessment Tax Return Youtube

What Are Disallowable Expenses Goselfemployed Co Business Tax Deductions Small Business Tax Deductions Tax Deductions

What Are Disallowable Expenses Goselfemployed Co Business Tax Deductions Small Business Tax Deductions Tax Deductions

Claim 6 A Week Tax Back Working From Home Theformfiller Youtube

Claim 6 A Week Tax Back Working From Home Theformfiller Youtube

Millions Of People Missing Out On Refund From Hmrc Skint Dad Money Saving Expert Money Saving Tips Tax Refund

Millions Of People Missing Out On Refund From Hmrc Skint Dad Money Saving Expert Money Saving Tips Tax Refund

Business Expenses What You Can And Can T Claim The Independent Girls Collective Business Tax Deductions Business Expense Small Business Organization

Business Expenses What You Can And Can T Claim The Independent Girls Collective Business Tax Deductions Business Expense Small Business Organization

A Free Guide To Uk Tax For Bloggers And Small Businesses This Post Includes Information On Uk Tax Band Financial Coach Tax Organization Small Business Finance

A Free Guide To Uk Tax For Bloggers And Small Businesses This Post Includes Information On Uk Tax Band Financial Coach Tax Organization Small Business Finance

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home