Property Tax Rate Eugene Oregon

Property tax is set by and paid to the county where your property is located. Personal taxation in Eugene.

Property Taxes Add Up Levies Taxes Bonds Can Cause Your Increase To Be More Kval

Property Taxes Add Up Levies Taxes Bonds Can Cause Your Increase To Be More Kval

You can also e-mail us at assessorlanecountyorgov and visit the various links below for property tax related information.

Property tax rate eugene oregon. 087 of home value. The majority of city funds 783 come from user fees and property taxes which are primarily paid by city residents. Annual income 25000 40000 80000 125000 200000.

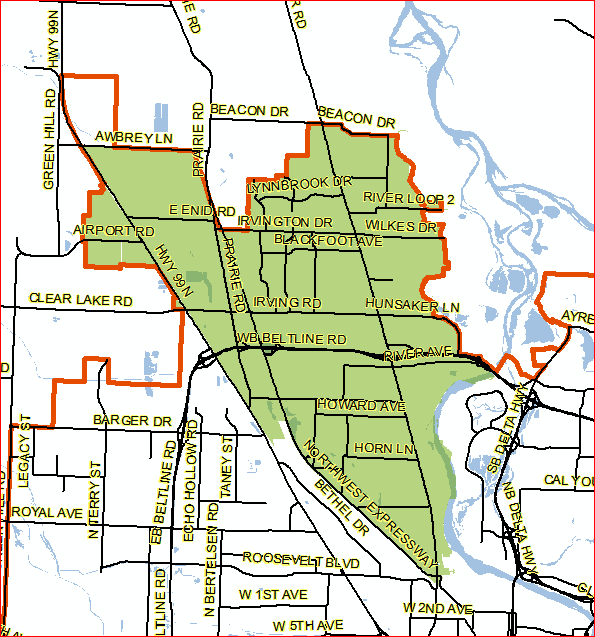

Oregon has property tax rates that are nearly in line with national averages. How property taxes work in Oregon. The green area on the map at right shows the general area for which annexation property tax estimates are available.

Taxes become payable in October. One-third of your full property tax amount. The median property tax in Lane County Oregon is 1986 per year for a home worth the median value of 230000.

Lets take a look at a few important dates. Counties in Oregon collect an average of 087 of a propertys assesed fair market value as property tax per year. Lane County collects on average 086 of a propertys assessed fair market value as property tax.

2 of 23rds of your property tax. If paying in installments the final installment is due May 15. Lane County has one of the highest median property taxes in the United States and is ranked 454th of the 3143 counties in order of median property taxes.

There are some taxes that come from other sources to help provide the services used by residents visitors and others who spend time in Eugene. Property tax reports and statistics. In Lane County the average tax rate is 1542 per 1000 of assessed value but the average homeowner is taxed 1114 per 1000 of real market value.

Property taxes have a timeline that is different than most other taxes or bills that we pay. 1271 per 1000 of real market value for residential homes and land. Heres Teleports overview of personal corporate and other taxation topics in Eugene Oregon.

Other taxes on individuals Real property tax. One-third of your full property tax amount. The median property tax on.

SEE Detailed property tax report for 2829 SE Belmont St Multnomah County OR. There was no voter-approved temporary tax rate although of course this can change over time. Oregon is ranked number fifteen out of the fifty states in order of the average amount of property taxes collected.

However an additional tax of 113 per 1000 of assessed value was opposed for other purposes bringing the total rate to 814 per 1000 assessed value. Housing in Eugene Oregon is 235 more expensive than Cheyenne Wyoming. How does the program work.

Effective average tax rate. In light of the Oregon Health Authoritys newest guidelines our payment and public information counters will be closed for the time being. For general questions regarding annexation please contact City of Eugene Planning Division staff at 541-682-5377 or eugeneplanningcieugeneorus.

However specific tax rates can vary drastically depending on the county in which you settle down. Tax generally is imposed by the local governments at various rates. Tax amount varies by county.

The median property tax on a 25740000 house is 223938 in Oregon. One-third of your full property tax amount. Quick links 2019 Industrial property return 2019 Personal property return 2019 Real property.

If you qualify for the program the Oregon. Effective personal income tax rate. The effective property tax rate in Oregon is 090 while the US.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor. Our Premium Cost of Living Calculator includes House Prices for Homeowners and Renters Home Appreciation Rental Prices Local Property Taxes and other must-know detailsClick here to customize. Average currently stands at 107.

For questions related to property taxes please contact Lane County Assessment. You can reach us Monday through Thursday from 10am to 3pm at 541-682-4321. The permanent property tax rate was at 701 per 1000 of assessed value.

8-13-20 3 Property Tax Deferral for Disabled and Senior Citizens Property Tax Deferral for Disabled and Senior Citizens As a disabled or senior citizen you can borrow from the State of Oregon to pay your property taxes to the county. Taxes are due November 15 and may be paid in thirds. Links to county websites take me to ORMAP.

No discount will be applied. The median property tax in Oregon is 224100 per year for a home worth the median value of 25740000. 3 of your full property tax amount.

City Of Eugene Planning And Development Annexation Property Tax Estimator

City Of Eugene Planning And Development Annexation Property Tax Estimator

Eugene Oregon Or Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Payroll Service Eugene Oregon Payroll Company Office Payroll Specialties Payroll Eugene Oregon Eugene

Payroll Service Eugene Oregon Payroll Company Office Payroll Specialties Payroll Eugene Oregon Eugene

Eugene Oregon Or Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Harlow Eugene Or Neighborhood Guide Trulia

Harlow Eugene Or Neighborhood Guide Trulia

Https Www Eugene Or Gov Documentcenter View 35447

Eugene Property Tax How Does It Compare To Other Major Cities Movoto Foundation

Eugene Property Tax How Does It Compare To Other Major Cities Movoto Foundation

Eugene Oregon Or Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Eugene Oregon Or Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Eugene Oregon Or Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Eugene Oregon Or Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Search Ferry Street Bridge Listings Eugene Oregon House Styles Street

Search Ferry Street Bridge Listings Eugene Oregon House Styles Street

Eugene Oregon Or Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Eugene Oregon Or Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Eugene Oregon Or Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Eugene Oregon Or Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home