Property Tax Cap In New Jersey

For more information on the property tax deduction or credit see the New Jersey Resident Income Tax Return instructions. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

Property Taxes In Nevada Guinn Center For Policy Priorities

Property Taxes In Nevada Guinn Center For Policy Priorities

Payments-in-Lieu-of-Tax payments were made to the municipality.

Property tax cap in new jersey. To receive a receipt for taxutility payments please forward the entire bill with a self-addressed stamped envelope. Property shall be assessed under general law and by uniform rules. Democratic legislators came back with a 29 proposal keeping many of.

If enacted the bill would have further encumbered already over-burdened middle and working-class taxpayers. That was recently changed to 15000 Then theres the charity idea. The basic authority for the assessment of real property is derived from Article VIII Section 1 paragraph 1 of the New Jersey Constitution.

New York States property tax cap. Questions regarding tax base growth factors may be directed by email to Kristen Forte or Jason Ayotte. Second is New Jerseys longstanding 10000 cap on deducting real estate taxes on your primary residence.

8 per annum on the first 150000 of a delinquency and 18 per annum on any delinquency in excessive of 150000. Tax amount varies by county. New Jersey Puts 2 Cap on Local Property Taxes.

Overall the tax levy cap has kept a lid on increases across New Jersey over the last three years. Century property taxes were levied on real estate and certain personal property at arbitrary rates within certain limits referred to as certainties The Public Laws of 1851 brought to New Jersey the goals of uniform assessments based on actual value and a general property tax meaning that all property classes were to be treated the. You rented a residence that was exempt from local property taxes or on which PILOT.

TRENTON - Governor Phil Murphy today absolute vetoed S4289 legislation that would have allowed for certain school districts to raise property taxes above the 2 cap without voter approval. Some 40 school districts across New Jersey could bypass states property tax cap under bill awaiting governors signature. Office of the State Comptroller.

189 of home value. These payments are not considered property taxes. New Jersey lawmakers on Monday imposed a 2 percent limit on annual property tax increases by local governments trying to gain control of.

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Before middle-class property taxpayers have to again take it on the chin we. There is a 2000 returned payment fee.

The deduction cap hit New Jersey and other high-tax states the hardest the same states that send billions of dollars more to Washington than they receive in services. Christies approach made much more sense. Statewide the property tax levy has grown from.

The Legislature needs to work with the governor immediately to remove the states 10000 cap on. Implementing legislation is found in New Jersey Statutes Annotated Title NJ. According to data direct from the IRS allowing property tax deductions up to 10000 which I fought for and won will cover nearly every taxpayer in the Third Congressional District.

New Jerseyans deserve a long-term solution. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. Real Property Tax Cap and Tax Cap Compliance.

Earlier this week New Jersey Governor Chris Christie R signed into law a more stringent property tax cap a compromise that supporters hope will slow the growth in local spending and property taxes. Allowing them to waive the 2 on cap on property tax increases. Christie had proposed a 25 cap with only debt payments exempted.

Help districts control spending by passing pension and benefit reforms placing caps on superintendents salaries and imposing a 2.

Why Are Nj Property Taxes So Incredibly High When It Is The Most Densely Populated State In The Country Shouldn T Nj Residents Pay Less Property Tax Since There Are More People Per

Nj School Funding Basics The Tax Levy Civic Parent

Nj School Funding Basics The Tax Levy Civic Parent

Interactive Map Where Nj S High Property Taxes Are Highest And Lowest Nj Spotlight News

Interactive Map Where Nj S High Property Taxes Are Highest And Lowest Nj Spotlight News

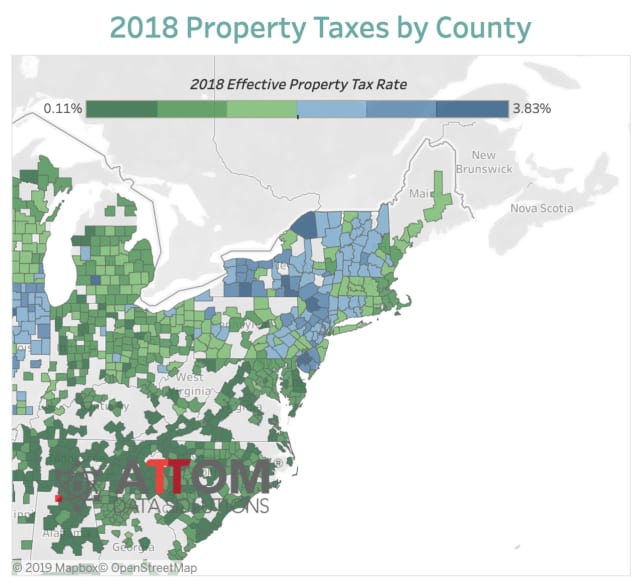

Property Tax Map Reforming Government

Property Tax Map Reforming Government

Shared Services In New York S Counties The Recession The State Imposed Property Tax Cap And The Governo Records Management Shared Services Government News

Shared Services In New York S Counties The Recession The State Imposed Property Tax Cap And The Governo Records Management Shared Services Government News

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Tax

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Tax

With Obamacare Repealed 1 In 4 Adults Could Be Uninsurable Due To A Pre Existing Condition Marketwatch Property Tax Education Funding School

With Obamacare Repealed 1 In 4 Adults Could Be Uninsurable Due To A Pre Existing Condition Marketwatch Property Tax Education Funding School

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

Types Of Property Tax Exemptions Millionacres

Types Of Property Tax Exemptions Millionacres

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Why Are Texas Property Taxes So High Home Tax Solutions

Why Are Texas Property Taxes So High Home Tax Solutions

The Fight Over Funding To Combat Homelessness Is Heating Up In Sacramento California S Big City Mayors Comprised Of Mayors Tax Refund Vacation Home Vacation

The Fight Over Funding To Combat Homelessness Is Heating Up In Sacramento California S Big City Mayors Comprised Of Mayors Tax Refund Vacation Home Vacation

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Property Taxes In Nevada Guinn Center For Policy Priorities

Property Taxes In Nevada Guinn Center For Policy Priorities

New Tax Laws Have Home Buyers Checking New Places Corporate Law Property Tax Tax Rules

New Tax Laws Have Home Buyers Checking New Places Corporate Law Property Tax Tax Rules

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

2019 Cap Rates Of The Nation S Top 50 Multifamily Markets Joe Fairless Real Estate Agent Marketing Marketing Logo Design Art

2019 Cap Rates Of The Nation S Top 50 Multifamily Markets Joe Fairless Real Estate Agent Marketing Marketing Logo Design Art

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home