How To Find Assessment Number For Property Tax In Hyderabad

The main advantage of the online procedure in the property tax assessment calculation and payment is that it has given transparency and swiftness to work. X Monthly Rental Value in Rs.

How To Pay Property Tax In Mumbai

How To Pay Property Tax In Mumbai

Designed and Developed by Centre for Good Governance.

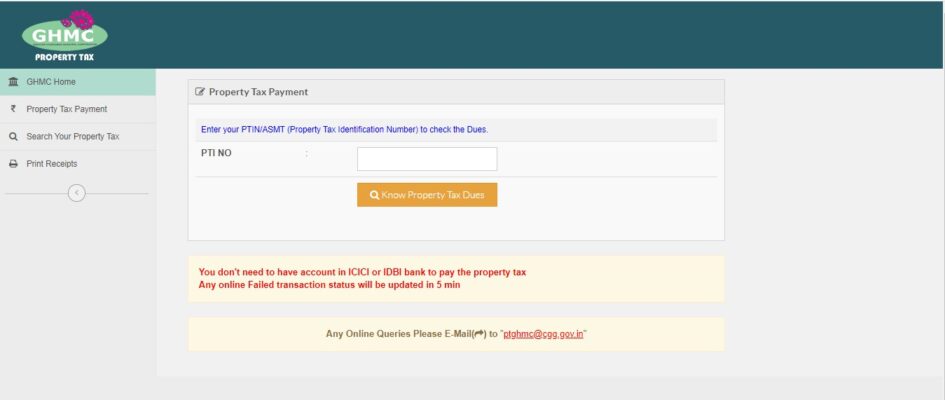

How to find assessment number for property tax in hyderabad. Here the Monthly Rental Value is determined by GMHC based on factors such as taxation zones. Click on the link and enter to the official website of GHMC property tax. Below is the formula to calculate property tax on your commercial property.

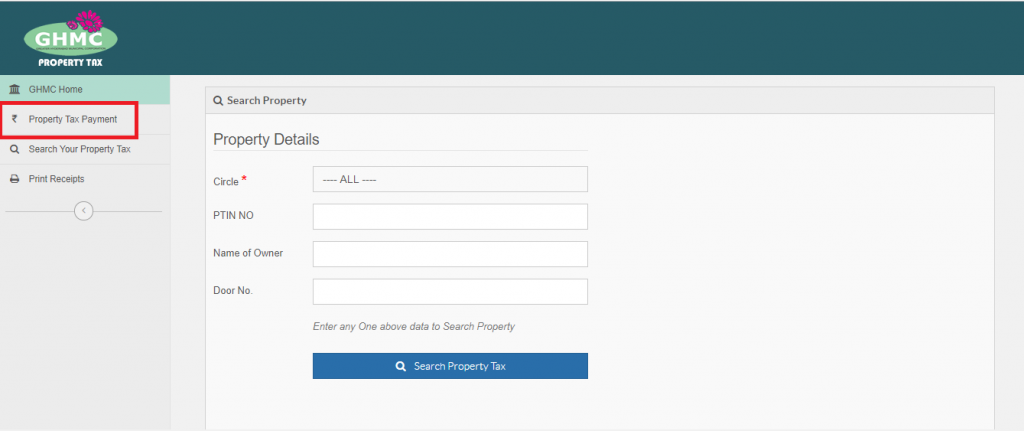

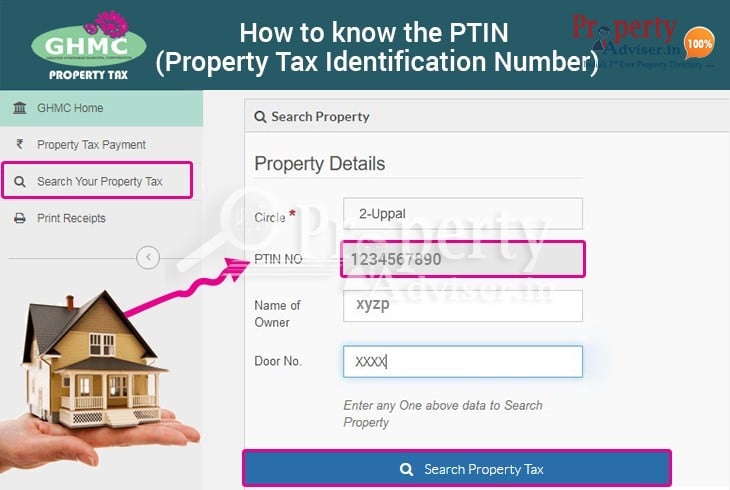

The search result displays the PTIN of the property. You can know your Property tax dues online. The Amdavad Municipal Corporation AMC calculates property tax payable on a property based on its capital valueThe formula for manual calculation of property tax is as follows.

To get the tax assessment done online the property owner better be armed with all the necessary information like the municipality or urban local body where the building or. Greater Hyderabad Municipal Corporation Property Tax. Property tax Area x Rate x f1 x f2 x f3 x f4 x fn.

If you dont know your door number you have to submit a self-assessment request house tax online payment or offline. Enter your door number. GHMC Helpline Numbers 1553041253 040-2322698223221978.

This number is located on your county tax bill or assessment notice for property tax paid on your principal residence during the tax year for which you are filing your return. GHMC website httpwwwghmcgovin Prompt payment of property tax might just make you rich. If your property tax is paid through your mortgage you can contact your lender for a copy of your bill.

Annual property tax 35 x. Greater Hyderabad Municipal Corporation Property Tax. For the online process you can visit the website for GHMC property tax online payment.

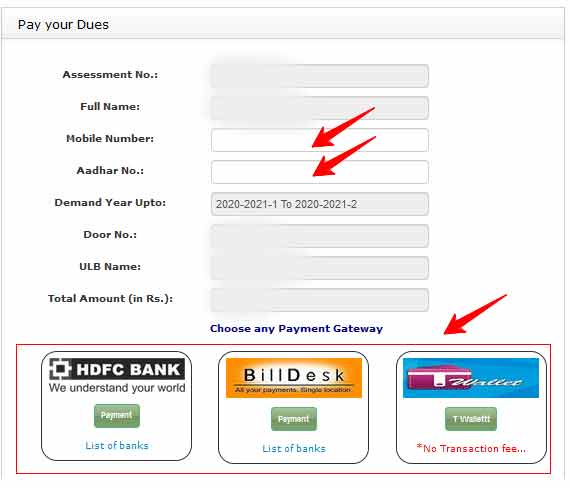

If you paid via NEFT or RTGS then you can generate a slip for it by searching in the. GHMC Property Tax Due Assessment Search. Include your property address account number the property owners email address and phone number.

No manual transactions in Tax assessment issue of special notice issue of annual demand notices and receipts 100 computerization of assessments notices collection GHMC offers the following modes Handheld machines of Bill Collectors are integrated with central server. Now you should select your property type Residential or commercial. Steps for Assessment of a New Property.

Locality Name. Commercial Taxes Department of Telangana enables citizens to avail various online services such as Dealer registration GST filing TIN verification Tax Payer Identification Number e-Payment of taxes etc. C Choose any of the online payment methods to.

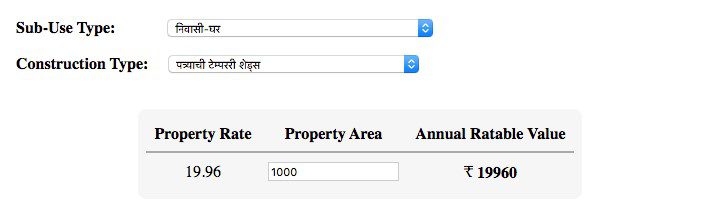

The GHMC fixes a monthly rental value to a commercial property for taxation purposes based on its exact location usage type and construction. In Case of New Assessment In Case of Additional Construction Change of Usage. Disclaimer Designed and Developed by Centre for Good Governance.

How to pay property tax online. Click Search Property Tax. If you have paid the Greater Hyderabad municipal corporation Property Tax you will get details of your payment.

The easiest and the most convenient way to calculate property tax in Hyderabad is to leverage the online tax calculator facilitated by the GHMC at httpwwwghmcgovintaxcalculationofpropertytaxasp You would require to input your circle number area number with the help of a drop-down list and your PTIN which is your unique fourteen digit old PTINs. B Enter your PTINASMT Property Tax Identification Number to check the dues. Copy right 2015.

Property tax on commercial property 35 x Plinth area in sq. Enter your property tax number or revenue number. Help Video for Self Assessment.

A Go to httpsptghmconlinepaymentcgggovinPtOnlinePaymentdo. By RJ 521 AM. The 2020 property taxes are due January 31 2021.

You can find this on your property tax bill. You may also get this number from your county assessors office. You can check for GHMC Property Tax dues against your property in the following box.

GHMC Property Tax Due Assessment Search. PropertyAdviser a realestate propertydirectory explains in brief. Do you know about PTIN and how it is used to make property tax payment in Hyderabad.

To calculate property tax for a commercial property in Hyderabad you can use the following formula.

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Dpms To Ease Property Tax Assessment In Hyderabad Real Estate Trends Property Tax Real Estate News

Dpms To Ease Property Tax Assessment In Hyderabad Real Estate Trends Property Tax Real Estate News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Online Payment Last Date Paisabazaar

Ghmc Property Tax Hyderabad Online Payment Last Date Paisabazaar

How To Pay Property Tax Online In Telangana Youtube

How To Pay Property Tax Online In Telangana Youtube

Five Things To Know About Residential Property Tax Payment

Five Things To Know About Residential Property Tax Payment

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Easy Way To Know The Ptin Property Tax Identification Number In Hyderabad Property Adviser Youtube

Easy Way To Know The Ptin Property Tax Identification Number In Hyderabad Property Adviser Youtube

Pay Telangana Property Tax Bill Due Payment Online

Pay Telangana Property Tax Bill Due Payment Online

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

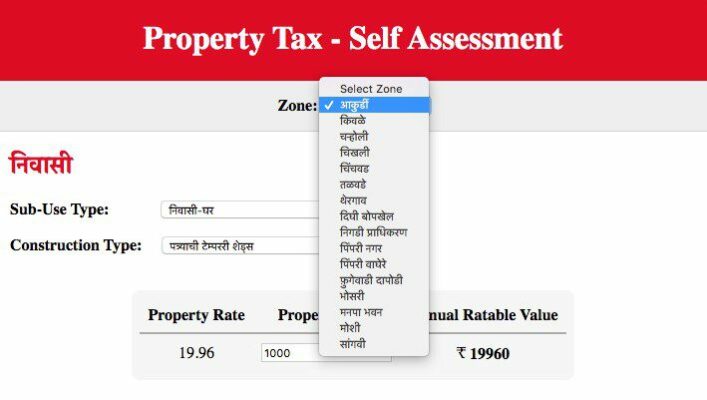

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Understanding Property Tax In California Property Tax Tax Understanding

Understanding Property Tax In California Property Tax Tax Understanding

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

House Property Tax Online Payment Hyderabad Property Walls

House Property Tax Online Payment Hyderabad Property Walls

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Labels: assessment, number

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home