How To Correct Address In Bbmp Property Tax

1 Duly filled and signed application form 2 Most recent property tax paid receipt 3 Attested copy of the registered sale deed with your name in it. New 243 ward list yet to release.

Sub Registrar Offices In Bangalore Are Clustered Into Zones If You Own A Property Under Any Of The Following Locations You Can Visit The Office Property Naha

Sub Registrar Offices In Bangalore Are Clustered Into Zones If You Own A Property Under Any Of The Following Locations You Can Visit The Office Property Naha

How to pay Property Tax.

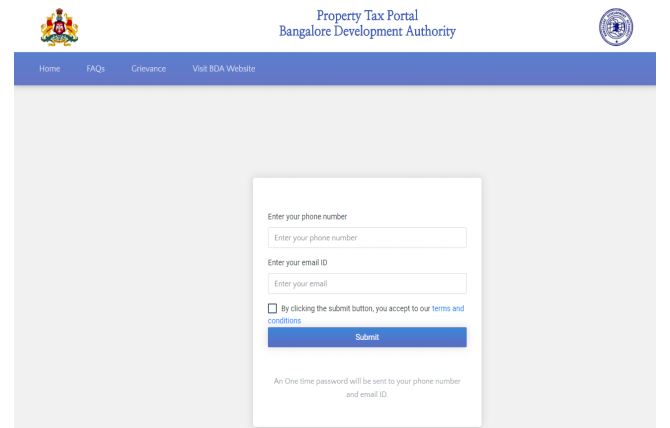

How to correct address in bbmp property tax. FAQ on Trade License. Online Payment for Agency Demand. Enter 10 digit application number or.

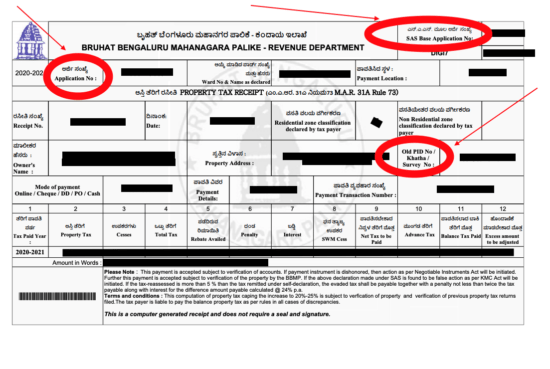

Refer to the below image in circle for your reference. Pay Your Property Tax. Property owners in Bangalore have to pay this tax to the Bruhat Bangalore Mahanagara Palike BBMP.

Updated list of BBMP zones for property tax contact numbers. If the amount is deducted and not updated at BBMP mail to dcrevbbmpgovin. Site best viewed in IE 10 and above with a screen resolution 1024 x 768.

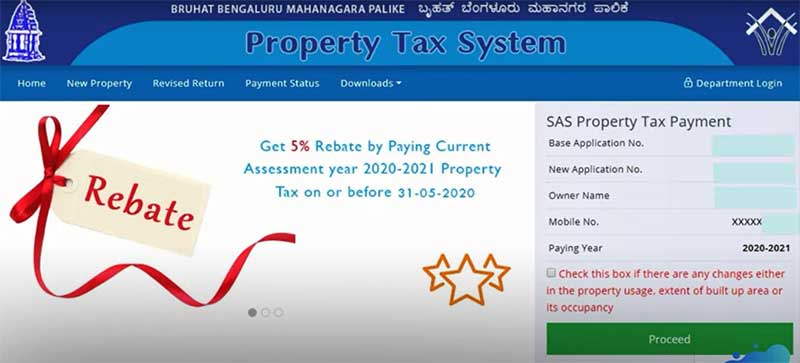

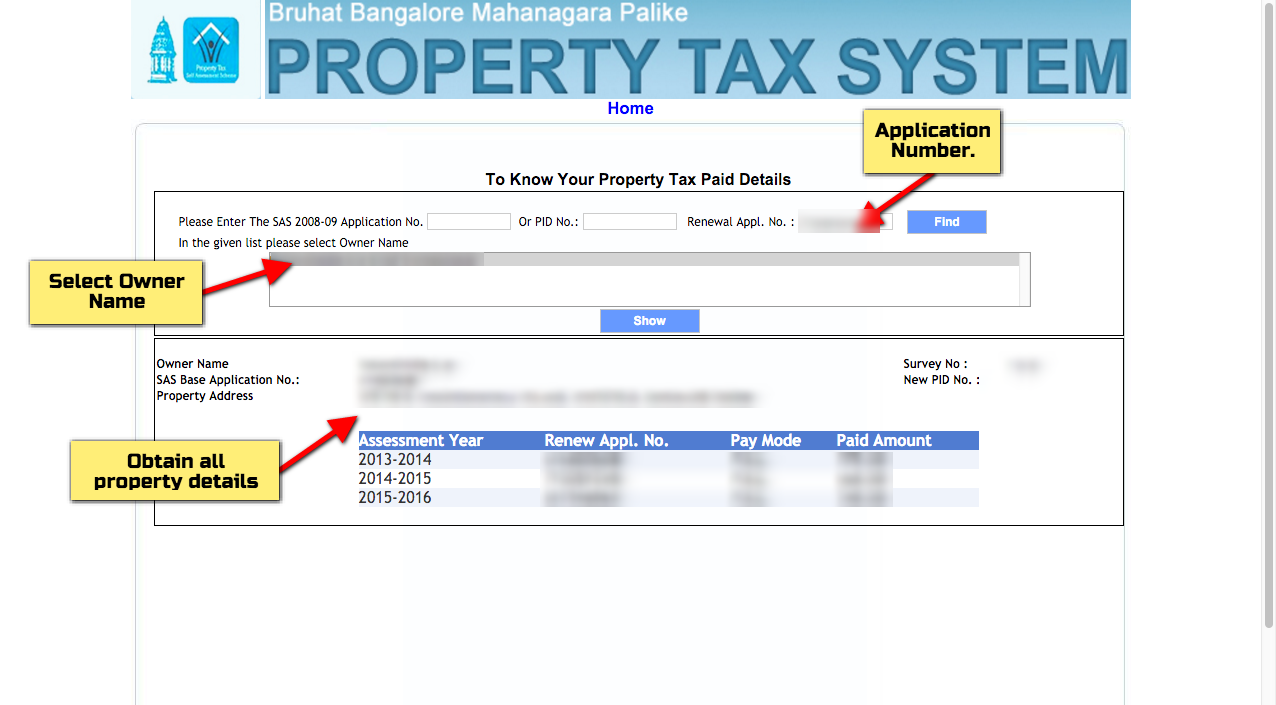

Open the BBMP website BBMP Property Tax System enter the application number. List of BBMP wards 2021. Bangalore 198 BBMP wards PDF 8 zones.

Property Tax Corrections a. A deeper analysis of the notification shows the hike could vary from 40 to 100 depending on the tax. HOW TO PAY BBMP PROPERTY TAX ONLINE PAYMENT bbmp bbmptax bbmppropertytax onlinepayment mobileVIDEO.

Open the BBMP property tax website BBMP Property Tax System. Problems in BBMP property tax 2016-17 payment system. You can get your name changed in the BBMP Property Tax records by submitting the requisite application to the BBMP Commissioner along with the following documents.

This tax is collected to maintain the basic civic facilities and services in the city such as roads parks sewer systems light posts etc. X is tenanted area of property x per sq ft rate of property x 10. Pay your BBMP property Tax online using the following steps 1 Go to the official BBMP website for Property Tax.

HttpsbbmptaxkarnatakagovinThis video is regarding how to pay BBMP property tax online for 2020-21If you have any queries just drop in a com. The recent BBMP announcement hiking property tax by 20 to 25 appears to be hogwash. New Property Creation a.

Refer to the circle in the below image where you should enter the application number. Sandeep has been paying tax to the same property for many years and was shocked to further learn that the BBMP documents suddenly showed up some other person as owner for that property. Form for the block period in respect of taxpayers who have filed returns in the previous year in form i property with pid number or form ii property without pid but have a khatha number or form iii property that have no pid or khatha but a revenue survey number.

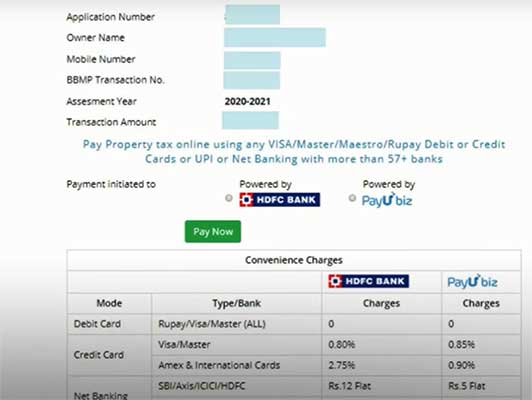

Iii Please check your bank statement before trying again. 3 After the SAS Application Number is confirmed valid the name of the owner of the property. This procedure is applicable for resale property as well.

No request shall be made to PayU Money or HDFC Bank as the case may be. This is the 10 digit number. The builders did not give the correct address of each property at the start.

Ii If amount already deducted by bank not updated in bbmp system please wait for next 4 hours. Form 6 Exemption Properties to Other forms and Vice. 2 Type your SAS Application Number and click on the tab Fetch.

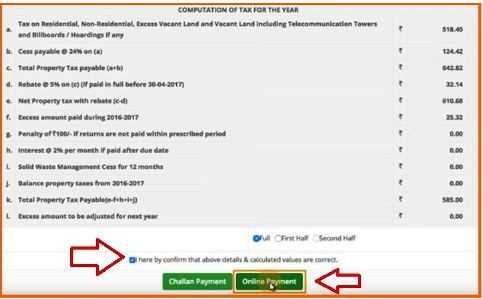

Before requesting any change in name or address records for property tax of any property make sure you have the complete documentation including copy of the following documents 1 Receipt of tax last paid 2 Attested copy of the sale transaction deed or sale deed in your name 3 No Objection Certificate from the associated housing society. The formula used for computation of BBMP property tax is G-I20 Cess 24 of property tax. Enter your application number which is located in your tax paid receipt.

Contact and Address Details of MOH Office. BBMP Advertisement Bye Laws 2006. Bangalore property tax is a local tax collected by the municipal authorities from the property owners.

May 2 2016 S Srinivasan. Online Khata Transfer. Form see rule 8cc ii bruhat bengaluru mahanagara palike self assessment of property tax form return.

While getting Khatha certificate and extract documents. KIND ATTENTION TAX PAYERS All request for refundcharge back of property tax payment through PayU Money and HDFC bank shall be handled by BBMP only. There were lots of errors in the property addresses though the correct information was given in the Forms in subsequent years.

Form 123 and 6 2008 2016 Block Period 8. In this G is Gross Unit area value arrived by XYZ and I is GH100.

Read more »Labels: bbmp