How To Select Zone In Bbmp Property Tax

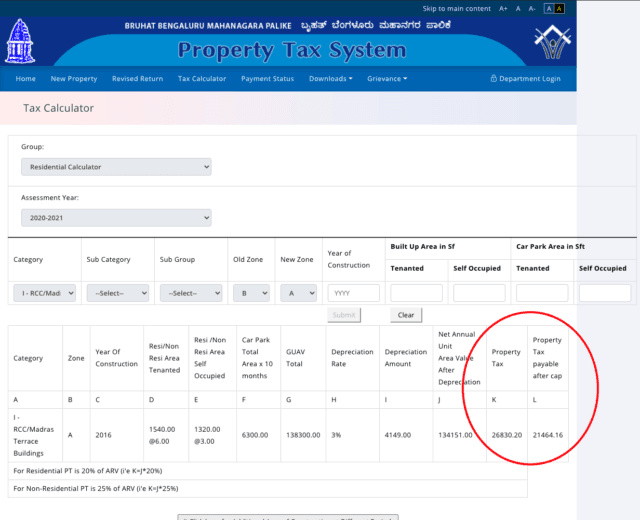

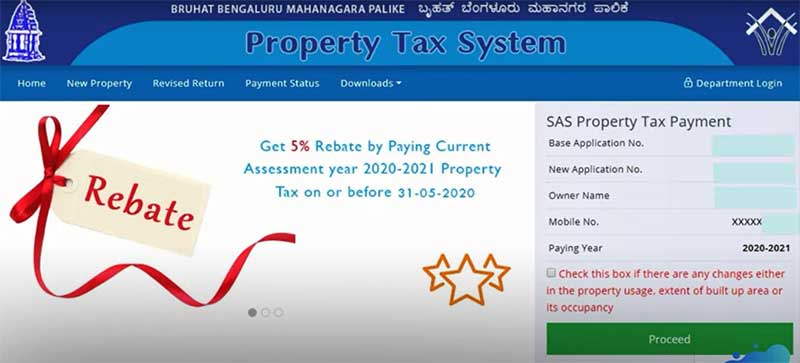

26 If you are paying the entire amount as calculated above in one. 1 Log in to BBMP Property Tax Portal Palike Sampanmoola.

Residential or non-residential property.

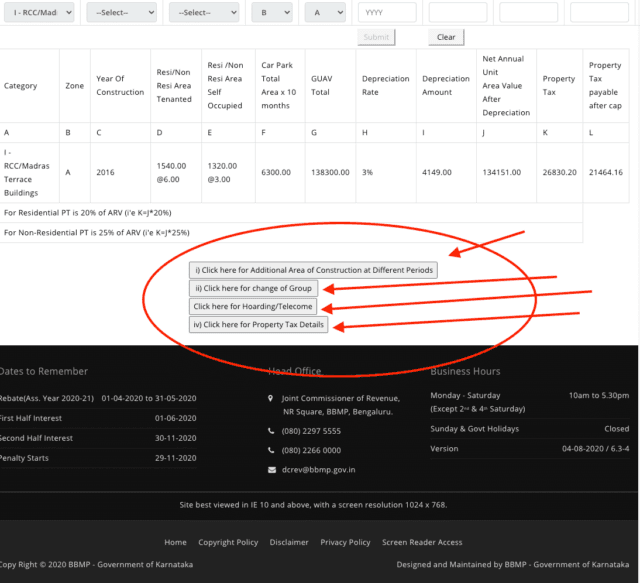

How to select zone in bbmp property tax. Click on ward and two options will come up. The property tax rate will differ according to the zone in which the property is located. First take the built up place plus the value per unit area and also the depreciation that can apply.

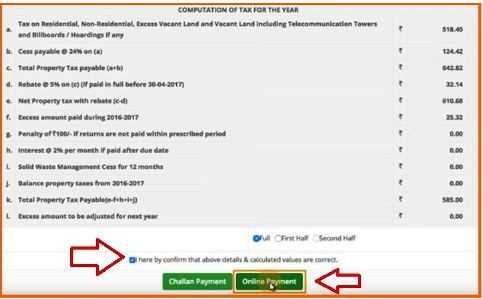

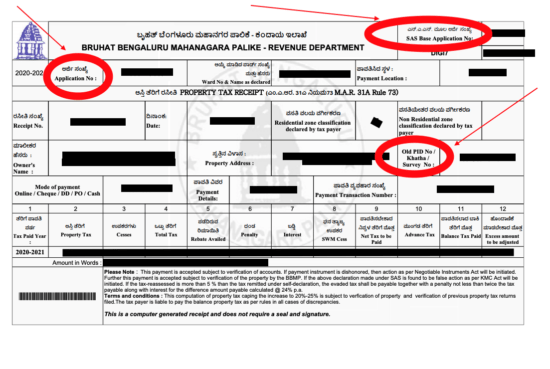

4 Click Submit and all your BBMP property tax details will be displayed. 25 In column 19 total tax payable after inclusion of cess is calculated and shown. The jurisdiction of the BBMP is divided into six value zones based on the guidance value published by the Department of Stamps and Registration.

And the last year tax was 336- after 5 rebate and this year its become 707- after 5 rebate. H Percentage of depreciation rate which depends upon the age of the property Hence property tax is equal to 20 of total area of property. The formula used to calculate property tax is as follows.

Then I visited the relevant BBMP office and got the challan and paid in Canara Bank. Click on the property tax 2016-17 option on the homepage which will throw up zonal classification subdivision and wards. --select-- Residential Calculator Non-Residential properties without service area Non-Residential properties with service area Excess Vacant and Vacant Land not built upon.

Bangalore 198 BBMP wards PDF 8 zones. Once you have all the factors needed that contribute to the property tax all you need to do is select the category of your property the zone it is under the year of construction the built-up area. They say 30 increase in Property Tax but in my case it is increased by 110.

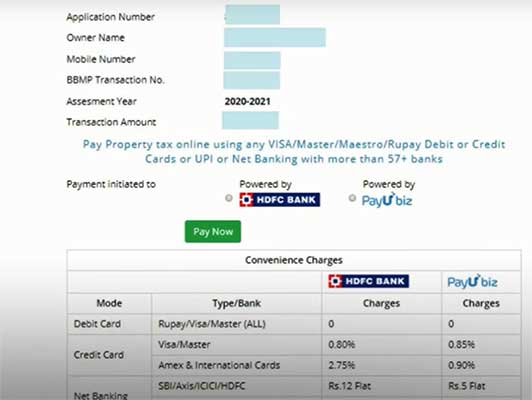

Step by Step Procedure on how to pay BBMP property tax online 2021-22. New 243 ward list yet to release. 24 In column 18 total cess payable 24 of property tax payable is calculated and shown.

To make the calculation of property tax simple for all property owners BBMP has introduced a property tax calculator on their website. My site is moved from F and E. KIND ATTENTION TAX PAYERS All request for refundcharge back of property tax payment through PayU Money and HDFC bank shall be handled by BBMP only.

3 Select the category of your property enter the zone year of construction and other details. Using this tool you can get an accurate estimation of the tax payable on your property. 66 rows Zonal Classification of roads - Zone Sub-division Ward wise Corrigendum regarding Final.

23 In column 17 total property tax to be paid is shown. Where GGross value of the area per sqft. Also using the search tool you can select an address or parcel and create a PDF report of relevant information related to that point such as zoning area.

Z Vehicle parking area x Per sq ft rate of vehicle parking area x 10 months. Where G Gross unit area value arrived by XYZ and I GH100 X Tenanted area of property x Per sq ft rate of property x 10 months. To find the zone where your property is located log on to ಮಖಪಟ - BBMP or httpwwwbb httpmptaxkarnatakagovin.

Residential or non-residential property. Put in your details in the property tax calculator The official BBMP website offers a well-designed and accurate BBMP property tax calculator to make the entire process of tax payment easy and hassle-free. To calculate your property tax 2016-17 go to this page httpbbmptaxkarnatakagovinFormsCalculatoraspx.

A deeper analysis of the notification shows the hike could vary from 40 to 100 depending on the tax zone. This can be through the BBMP website httpbbmpgovin or directly at httpbbmptaxkarnatakagovin. 65 rows The formula used for computation of BBMP property tax is G-I20 Cess.

The BBMP has already achieved 75 per cent of its target set this year and Mahadevapura Zone tops the list of tax-payers With Rs 2606 cr in the bag Palike likely to collect more tax this year. To find the zone where your property is located log on to wwwbbmpgovin or wwwbb mptaxkarnatakagovin 3. Updated list of BBMP zones for property tax contact numbers.

Click on ward and two options will come up. 1 Visit the BBMP Property Tax System portal and click on Tax Calculator. Now multiply the unit area value and the built up area after this multiply it by 10 representing 10 months.

The recent BBMP announcement hiking property tax by 20 to 25 appears to be hogwash. Property Tax G-I x 20100. Property Tax K G I x 20.

No request shall be made to PayU Money or HDFC Bank as the case may be. 2 Choose the appropriate dropdown option under Group and Assessment Year. List of BBMP wards 2021.

Y Self-occupied area of property x Per sq ft rate of property x 10 months. Use the Identify tool to select a point on the map and display the data contained within each of your selected layers. Click on the property tax 2016-17 option on the homepage which will throw up zonal classification subdivision and wards.

Where G X Y Z.

Bbmp Property Tax Payment Online Download Receipts Status

Bbmp Property Tax Payment Online Download Receipts Status

Bbmp Property Tax 2020 21 Online Payment Calculator Forms Rebate Dates

Bbmp Property Tax 2020 21 Online Payment Calculator Forms Rebate Dates

Bbmp Property Tax Receipt Print Page 1 Line 17qq Com

Bbmp Property Tax Receipt Print Page 1 Line 17qq Com

A Guide To Understanding Bbmp Property Tax In Bangalore Getmeroof Blog

A Guide To Understanding Bbmp Property Tax In Bangalore Getmeroof Blog

Amit Jain Blog Pay Bbmp Property Tax 2018 2019

Amit Jain Blog Pay Bbmp Property Tax 2018 2019

A Guide To Understanding Bbmp Property Tax In Bangalore Getmeroof Blog

A Guide To Understanding Bbmp Property Tax In Bangalore Getmeroof Blog

A Guide To Understanding Bbmp Property Tax In Bangalore Getmeroof Blog

A Guide To Understanding Bbmp Property Tax In Bangalore Getmeroof Blog

How To Pay Property Tax In Bangalore

How To Pay Property Tax In Bangalore

How To Pay Property Tax For The Year 2016 17

How To Pay Property Tax For The Year 2016 17

A Guide To Understanding Bbmp Property Tax In Bangalore Getmeroof Blog

A Guide To Understanding Bbmp Property Tax In Bangalore Getmeroof Blog

How To Pay Property Tax In Bangalore

How To Pay Property Tax In Bangalore

A Guide To Understanding Bbmp Property Tax In Bangalore Getmeroof Blog

A Guide To Understanding Bbmp Property Tax In Bangalore Getmeroof Blog

Bbmp Property Tax 2020 21 Online Payment Calculator Forms Rebate Dates

Bbmp Property Tax 2020 21 Online Payment Calculator Forms Rebate Dates

Bbmp Property Tax Payment Online Download Receipts Status

Bbmp Property Tax Payment Online Download Receipts Status

Bbmp Property Tax Payment Online Download Receipts Status

Bbmp Property Tax Payment Online Download Receipts Status

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home