What Is Zone No In Property Tax

They are intended to provide a basic understanding and awareness of Opportunity Zones. In case you choose the offline route to pay property tax you should do the following for modification of building appeal with respect to property tax and transfer of property tax.

Income Under The Head House Property With Questions And Answers Accounting Taxation This Or That Questions Income House Property

Income Under The Head House Property With Questions And Answers Accounting Taxation This Or That Questions Income House Property

Qualifications for agricultural tax exemptions vary from state to state too.

What is zone no in property tax. 16-07-2020 - Ensure Citizen Participation In Developed Ideal Parks 16 July 2019. The goal of Opportunity Zones is to encourage long-term investments specifically in low-income urban and rural areas throughout the country and bolster the economy. There is the additional benefit of being able to calculate the tax payable on outstanding bills as well.

The following questions and answers QAs were prepared in response to inquiries that have been proposed to the IRS. 16-07-2020 - Sewage Treatment Plant And Pump House To Be Expedited 16 July 2020. 14 Saraba NagarZone D.

Counties in California collect an average of 074 of a propertys assesed fair market value as property tax per year. Property tax is a recurring payment to be made by property owners to a municipal body of the state in which they own a property. The size of agricultural property tax exemptions varies from state to state because property taxes arent administered at the federal level.

Submit a filled application form and receipt of tax paid if the tax was paid at any of the TACTV counters in the Greater Chennai Corporation areas or headquarters. Cook Islands an offshore alternative to a Wyoming trust and one of the countries with no property taxes. California has one of the highest average property tax rates in the country with only nine states levying higher property taxes.

FS-2020-13 August 2020. Now you can cross-check the bill details with the online calculator and in case of any deviations the ward office can rectify the mistakes. The amount to be paid as tax varies based on which zone the property is located in.

While there arent any states with no property tax in 2021 there are 23 states plus the District of Columbia that with no personal property tax on vehicles. Upto date property tax paid receipt for the said property Demand Draft for Rs50- drawn in favour of The Revenue Officer Corporation of Chennai if the submission of documents exceeds three months from the date of registration in Sub-Register office in hisher favour. Pay Your Property Tax through Credit Cards or Debit cards or Net Banking or Suwidha center.

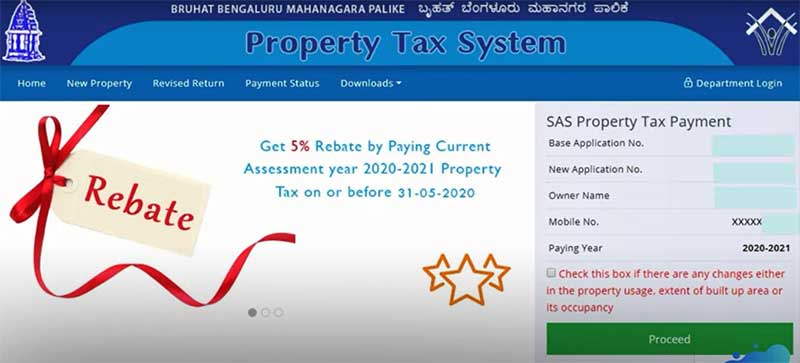

--select-- Residential Calculator Non-Residential properties without service area Non-Residential properties with service area Excess Vacant and Vacant Land not built upon. In Bangalore property tax is paid to the Bruhat Bengaluru Mahanagara Palike BBMP by April 30th of every year. This tax is used by.

Facts about opportunity zones. The property class code should not directly impact the amount of your assessment. In addition to no wealth taxes or capital gains taxes the Cook Islands in the South Pacific doesnt assess property taxes.

However if you disagree with the code assigned to your property you may wish to contact your assessor. Opportunity Zones are a new community development program that was established by Congress via the Tax Cuts and Jobs Act of 2017. They do not amend modify or add to the Income Tax Regulations or any other legal authority.

16-07-2020 - Inspection Of Banganga Drain 16 July 2020. The median property tax in California is 283900 per year for a home worth the median value of 38420000. Zonal Officer-Zone-XV Sozhinganallur-No120-Rajiv Gandhi Salai-Old Mahabalipuram RoadSholinganallur-Chennai-600119.

Phone no91-020-27646621 Mo9922501453454 e mail- azonepcmcindiagovin. The Tax Cuts and Jobs Act included changes for businesses and individuals. These QAs do not constitute legal authority and may not be relied upon as such.

Some municipalities may use their own coding scheme in addition to these codes to indicate aspects that go beyond the New York State codes. One of these is the creation of the Opportunity Zones tax incentive an economic development tool that allows people to invest in distressed areas. Some states base eligibility on the size of the property while others set a minimum dollar amount for agricultural sales of.

Bhel chowk Nigdi Pradhikaran. The property tax bill has information pertaining to carpet area type and age of the property. 16-07-2020 - Standing Order 2020_21 Property Tax.

BLOCKWISE LIST OF ALL ZONES. 13-07-2020 - Slum Lottery Hinotiya 01. Mahadevapura was the top zone in the citys eight zones with property tax collection at Rs 71625 crores while the east zones collections were worth Rs 50023 crores followed by the south zone with Rs 38816 crores the west zone at Rs 26908 crores Bommanahalli zone at Rs 26654 crores Yelahanka zone with 21869 crores Raja.

Contact collection teams of Municipal Corporation Ludhiana at contact numbers given on website Through registered Post at Room No. 13-07-2020 - Slum Lottery Hinotiya 95.

Read more »