How To Check Property Ownership Online Bbmp

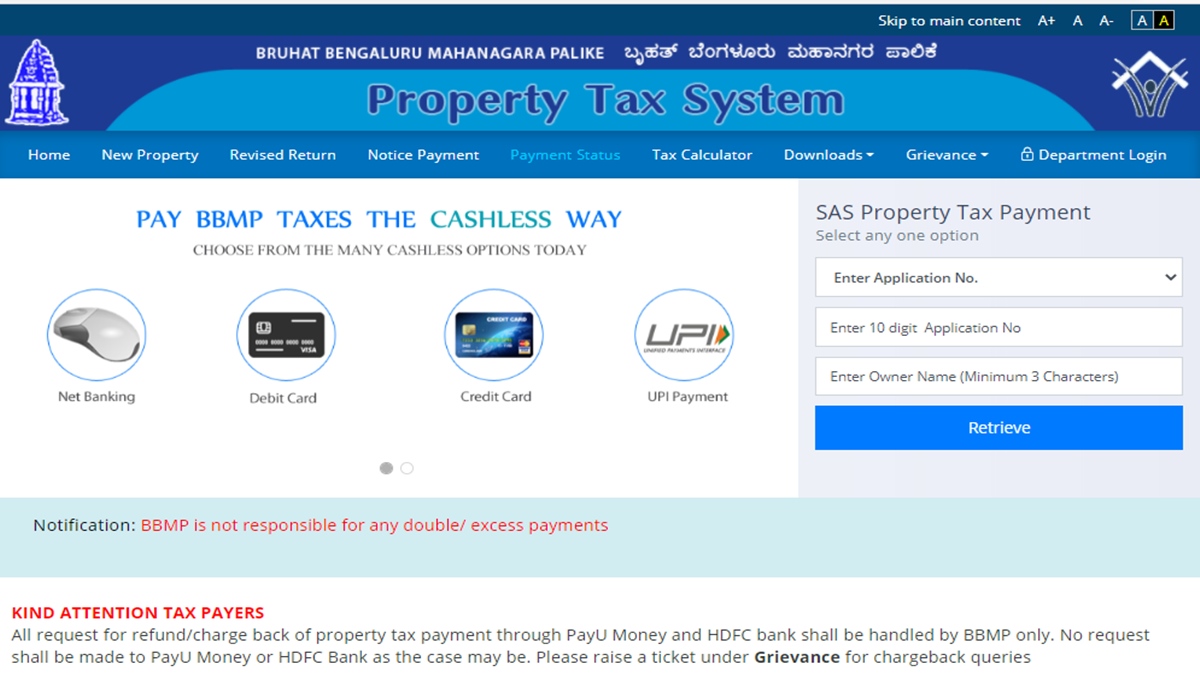

Go to the dedicated site for BBMP ie. Httpsbbmptaxkarnatakagvin Key in your Property Identification Number along with the SAS application number and then choose to fetch.

How To Pay The Bbmp Property Tax Online Quora

On the menu bar check for field to key in the SAS or the PID.

How to check property ownership online bbmp. Online Trade License New RegistrationFor Public Online Trade License RenewalFor Citizens. Go to bhoomi app or BBMP Web site enter door no or PID property index directory number you will get the owner details 23K views Sponsored by Gundry MD How to entirely empty your bowels every morning revealed. B Khata extract.

SAS Property Tax Payment. Click on citizen services Click here. 1 Go to the link bbmpgovin.

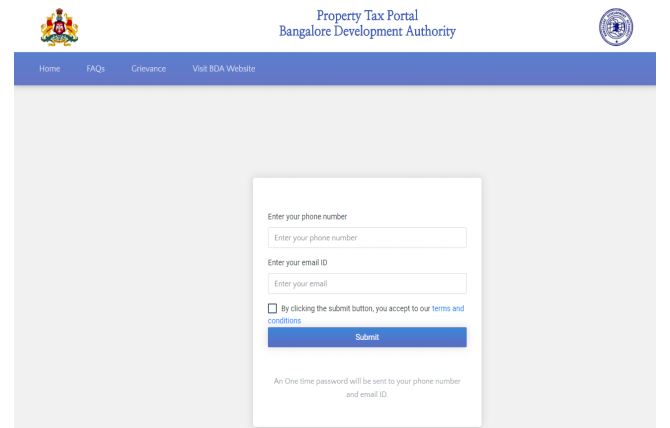

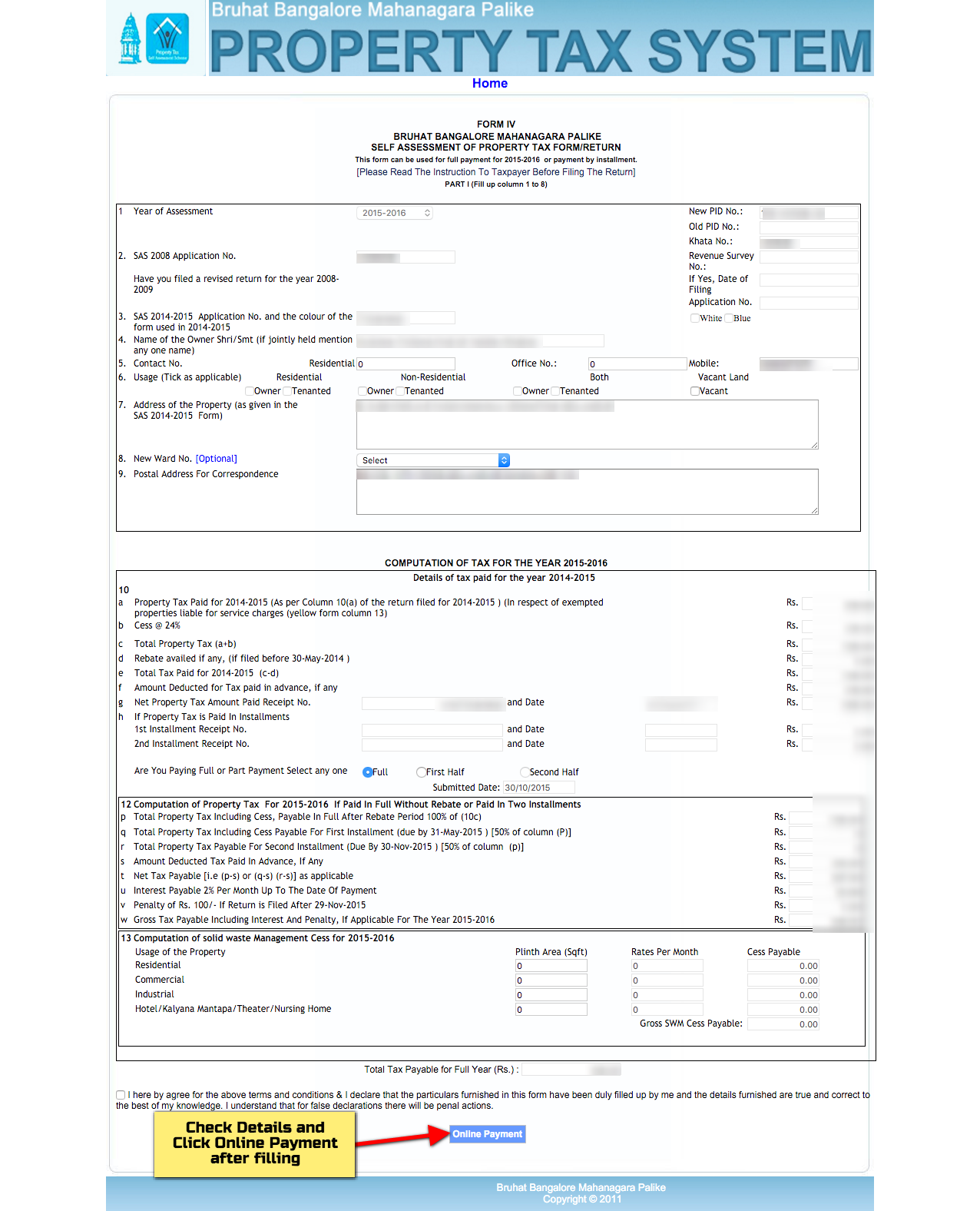

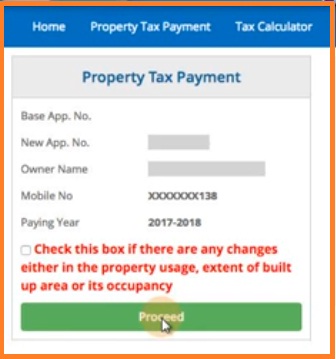

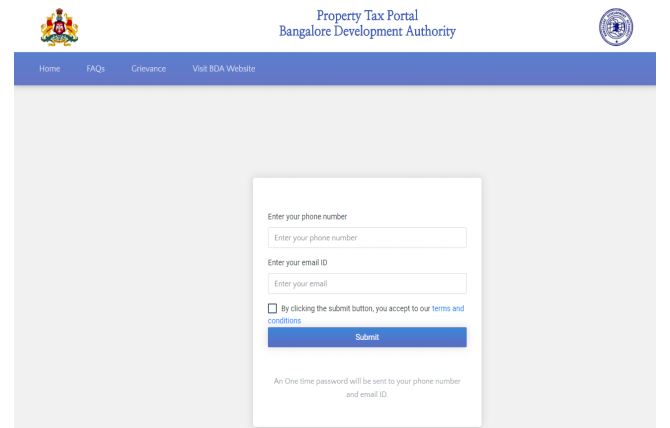

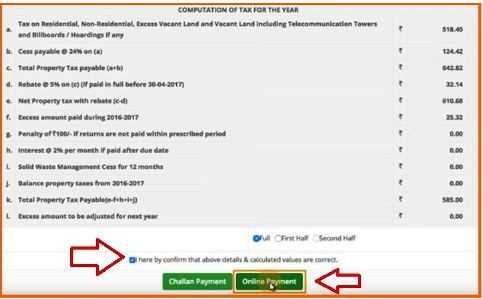

Register through your first number and mobile number. First enter the SAS application number or PID both available on the last receipt and click on Fetch which will display the property details If the description displayed is correct and there is no change in the property then click Continue and it will take you to Form IV. 3 Enter either your Application Number Challan.

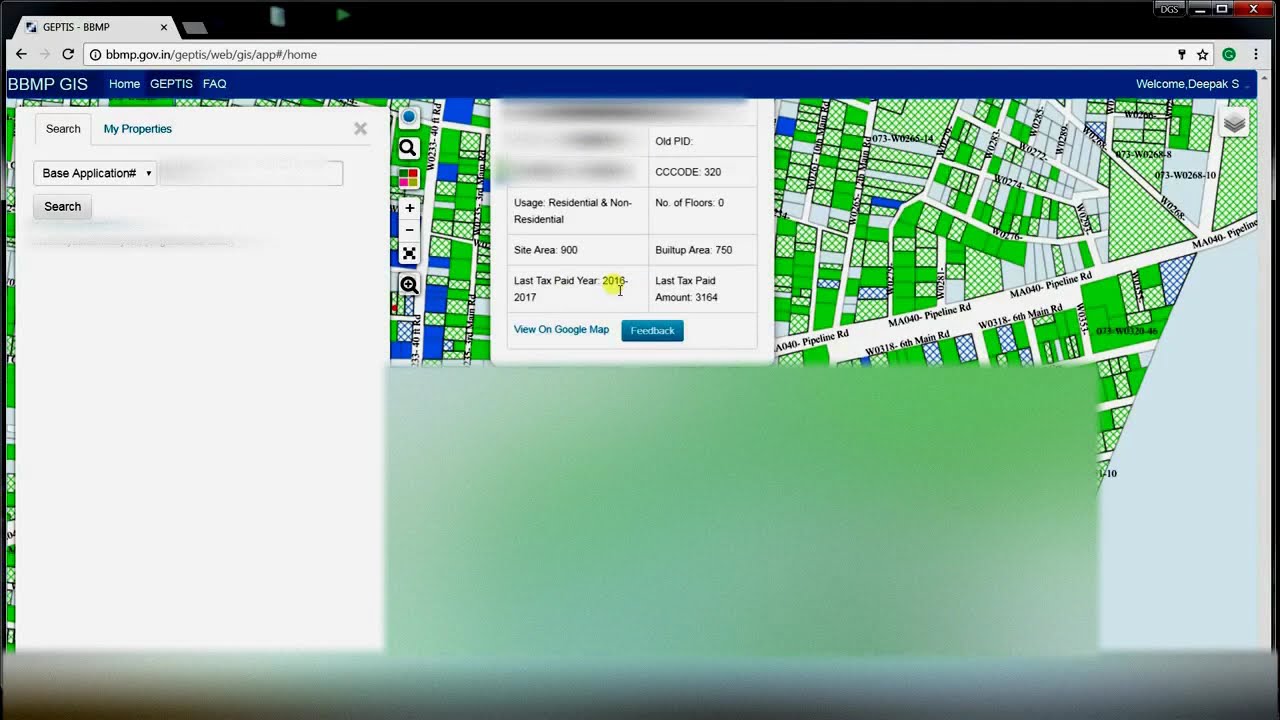

You will be redirected to a new page where you have to choose GIS Enabled Property Tax Information System. The official website for checking out the ownership of the land is provided here. 9 Easy steps to obtain your land records online.

Your property tax for the current fiscal year will be displayed on the screen. How to pay Property Tax. Details of property ownership in Bangalore.

BBMP Advertisement Bye Laws 2006. Citizen can pay Form IV White form should be filed by those property owners where there is no change either in the extent of built up area usage residential to non-residential or vice versa or its occupancy owner occupied to tenanted or vice-versa or change in. Citizen can pay property tax through Bangalore One Application.

Go to the official website page and click on the link. Click on view RTC MR. It is issued by the BBMP and states the name of the property owner and details of the property such as plot size built-up area etc.

After checking property such as status of tenancy area or property occupancy and owner details select proceed option then page will redirect to form IV of property tax if details of property and property owner details changed then tick right one and. After furnishing these details Click on SUBMIT button. Head onto the site to find yourself.

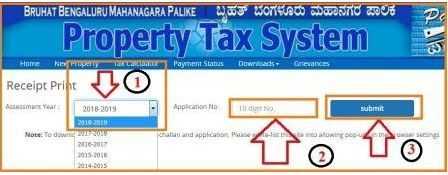

Process on Paying BBMP property tax online. Rather than running from pillar to post to get property documents one can easily login to the Bhoomi platform and download the relevant deeds within a matter of minutes. 1 Visit BBMP Property Tax Payment Portal 2 Choose the option Payment Status or click here for direct access to the page.

Below is a step by step process to help you download your property papers. This number is always attached at the last receipt received. 3 Go to the bottom of the page and click on To Know your New PID Click Here.

The property mapped on. Visit BBMP official website and select Citizen Services. HOW TO PAY BBMP PROPERTY TAX ONLINE PAYMENT bbmp bbmptax bbmppropertytax onlinepayment mobileVIDEO.

Online Payment for Agency Demand. 3 After the SAS Application Number is confirmed valid the name of the owner of. This will show you all the vital details linked to your ownership of the property.

Follow the below steps to check your BBMP property tax payment status. Pay your BBMP property Tax online using the following steps 1 Go to the official BBMP website for Property Tax. 5 Click on your name and then click Fetch.

Go to the BBMP Property Tax Calculator Fill in the required details - Usage Assessment Year Construction Type Zone Year of Construction and Built-up Area. Calculate and Pay your BBMP property tax online. No request shall be made to PayU Money or HDFC Bank as the case may be.

The copy of the particular page in the Khata register in which your account is maintained is called the Khata extract. Users can check the status of the property tax paid online to Bruhat Bengaluru Mahanagara Palike BBMP Karnataka. Raise Ticket Check Status.

4 Enter the application number you used for your 2008-2009 property tax payment or enter your old PID Number and click on Search. Pay Your Property Tax. All request for refundcharge back of property tax payment through PayU Money and HDFC bank shall be handled by BBMP only.

Online Khata Transfer. Services available with BangaloreOne Centres. Head to the official website.

2 Type your SAS Application Number and click on the tab Fetch.

Amit Jain Blog How To Pay Bbmp Property Tax 2017 2018

Amit Jain Blog How To Pay Bbmp Property Tax 2017 2018

Paying Property Tax Online In Bangalore

Paying Property Tax Online In Bangalore

Bbmp Property Tax 2020 21 Online Payment Calculator Forms Rebate Dates

Bbmp Property Tax 2020 21 Online Payment Calculator Forms Rebate Dates

We Paid The Bbmp Property Tax Online But We Can Not Download The Receipt We Keep On Getting Error Quora

How To Change The Name In The Bangalore Bbmp Property Tax Records Receipts Quora

Bbmp Property Tax Online Payment 2021 22 At Bbmptax Karnataka Gov In

Bbmp Property Tax Online Payment 2021 22 At Bbmptax Karnataka Gov In

How To Change The Name In The Bangalore Bbmp Property Tax Records Receipts Quora

We Paid The Bbmp Property Tax Online But We Can Not Download The Receipt We Keep On Getting Error Quora

Bbmp Property Tax 2020 21 Online Payment Calculator Forms Rebate Dates

Bbmp Property Tax 2020 21 Online Payment Calculator Forms Rebate Dates

Bbmp Property Tax 2019 20 Due Date Property Walls

Bbmp Property Tax 2019 20 Due Date Property Walls

How To Pay Bbmp Property Tax Online Payment Bbmp Bbmptax Bbmppropertytax Bangalore Tax Mobile Youtube

How To Pay Bbmp Property Tax Online Payment Bbmp Bbmptax Bbmppropertytax Bangalore Tax Mobile Youtube

A Mother Deed Is A Legal Document That Traces The Property Ownership When It Is Being Purchased Or Offered As Security Bangalo Legal Documents Property Legal

A Mother Deed Is A Legal Document That Traces The Property Ownership When It Is Being Purchased Or Offered As Security Bangalo Legal Documents Property Legal

Bbmp Property Tax Payment Online Download Receipts Status

Bbmp Property Tax Payment Online Download Receipts Status

Bbmp How To Find New Pid Number To Pay Property Tax Youtube

Bbmp How To Find New Pid Number To Pay Property Tax Youtube

Bbmp Bangalore Property Tax Online Payment Calculator Forms Rebate Dates

Bbmp Bangalore Property Tax Online Payment Calculator Forms Rebate Dates

Bbmp Property Tax 2020 21 Online Payment Calculator Forms Rebate Dates

Bbmp Property Tax 2020 21 Online Payment Calculator Forms Rebate Dates

Bbmp Property Tax Bangalore Pay It Online Check Out The Key Steps

Bbmp Property Tax Bangalore Pay It Online Check Out The Key Steps

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home