How To Calculate Property Tax With Millage Rate

For example if the citys millage rate is 10 mills property taxes on a home with a taxable value of 50000 would be 500. Understand the Fundamentals of Millage.

How Do I Add A Mill Rate To A Report

How Do I Add A Mill Rate To A Report

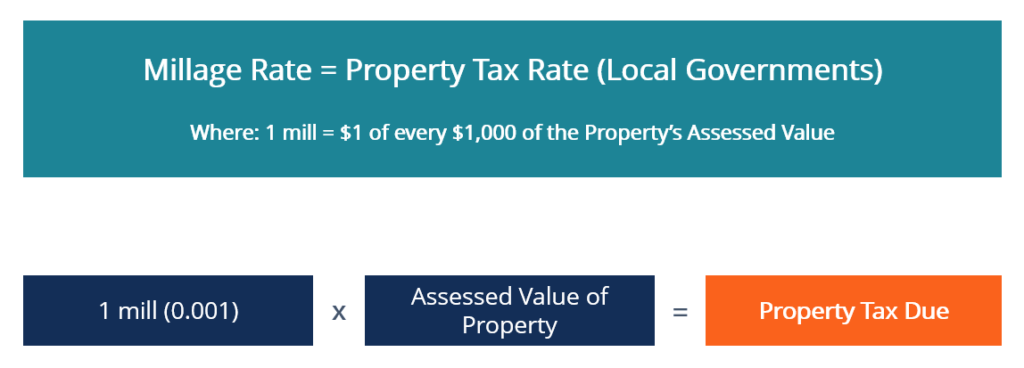

Millage or mills represent the amount of tax for every 1000 of a propertys assessed value.

How to calculate property tax with millage rate. If a real estate house has a value of 300000 and the rate is about twenty percent then the. 100000 300000. You need to remove the miles covered for personal purposes.

Overview of Oregon Taxes. In property tax a mill is one thousandth of a dollar. However specific tax rates can vary drastically depending on the county in which you settle down.

The rate represents the amount a homeowner has to pay for every 1000 of a propertys assessed value. The tax liability can also be calculated by multiplying the taxable value of the property by the mill rate and then dividing by 1000. Have you checked the AMT calculator for knowing if you need to file form 6521.

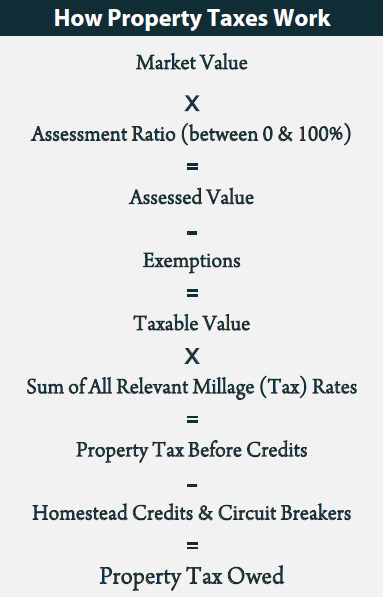

How to Calculate Millage Rates. The mathematical equation below illustrates how this is figured. How to Calculate Property Tax Using Mill Rate Calculating Tax From Mill Rate.

Millage rates are the tax rates used to calculate local property taxes. It is important to make a clear distinction between the property value of a home as. When calculating the homeowners property tax we consider the total imposed millage rate and the assessed value of the property.

How Do I Calculate Real Estate Taxes Using the Millage Rate. Additional millage information can be found on our eEqualization website. For example on a 300000 home a millage rate of 0003 will equal 900 in taxes owed 0003 x 300000 assessed value 900.

29 mills therefore is equal to 29 for every 1000 of assessed value or 29. Oregon has property tax rates that are nearly in line with national averages. TAX RATE MILLS ASSESSMENT PROPERTY TAX.

2005 Millage Rates - A Complete List. Taxes due County General 750001000 75 51639 38729. Various millage rate exports are available under the Review Reports section.

Calculation Method for mileage deduction In order to compute the deductible business moving medical or charitable expense you simply multiply the standard mileage rates by the number of miles travelled. One mill equals 100 of property taxes for every 1000 of assessed valuation. Thus a mill is one-thousandth of a dollar or 1 of tax for every 1000 of a propertys assessed value.

Property taxes are calculated by taking the mill rate and multiplying it by the assessed value of your property. A mill is one one-thousandth of a dollar and in property tax terms is equal to 100 of tax for each 1000 of assessment. 100000 30000.

Millage rates are expressed in tenths of a penny meaning one mill is 0001. Average currently stands at 107. Taxable Value1000 Millage rate Example.

Whatever millage rate is set by the local jurisdiction each year is then multiplied by the total taxable value of your property to calculate the property taxes due that year. Property owners can calculate their tax bill by multiplying their taxable value by the millage rate. 750001000 75 176379 132284 Note.

Your property tax bill might include additional. Property taxes are based on a propertys propertys total assessed value including the. The chart below shows millage rates for unincorporated Gwinnett County and for incorporated city areas billed by.

The millage rate is the amount per 1000 of assessed value thats levied in taxes. Percent means one part every hundred part. For the category select Excel Exports then select the desired report from the report drop-down list.

Use the Guest Login to access the site. For understanding more about how the judiciary bodies decide the millage rates you can consult with a property appraiser. To arrive at the assessed value an assessor first estimates the market value of.

The effective property tax rate in Oregon is 090 while the US. How the Millage Rate Is Determined. The millage rate then is dollars of tax levied for each 1000 of property value.

To calculate the millage or mill rate a property owner divides the number of mills by 1000. Tax authorities in some municipalities use the assessment of tax as 100 of the market value. Taxable Value1000 Total millage rate Example.

The assessed value of the property is the ratio of its present market value. Millage can be thought of as a proportional system of measure. Formula to calculate taxes per taxing authority.

The rates of several taxing authorities usually combine to make up your total tax bill. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout Michigan. 100000 60000.

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Http Www Tax Ohio Gov Portals 0 Tax Analysis Tax Data Series All Property Taxes Pr6 Pr6cy06 Pdf

Florida Property Taxes Explained

Florida Property Taxes Explained

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Millage Rate Sample Chart And Instructions

Millage Rate Sample Chart And Instructions

Http Www Fayettecountyga Gov News Archives 19aug 2019 Millage Rate Presentation Final 081519 Pdf

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Giarrusso What Comes Next For The Property Tax Assessments And Appeals Mid City Messenger

Tax Rates Gordon County Government

Tax Rates Gordon County Government

Millage Rate Sample Chart And Instructions

Millage Rate Sample Chart And Instructions

Figure Your Property Taxes Updated Millage Rates For 2019 Hilton Head 360

Figure Your Property Taxes Updated Millage Rates For 2019 Hilton Head 360

Should You Transfer Florida Homestead Property To A Revocable Trust Ask Two Florida Estate Lawyers And You May Get Revocable Trust Homestead Property Florida

Should You Transfer Florida Homestead Property To A Revocable Trust Ask Two Florida Estate Lawyers And You May Get Revocable Trust Homestead Property Florida

Millage Rate Overview Sources How To Calculate

Millage Rate Overview Sources How To Calculate

Millage Rate Overview Sources How To Calculate

Millage Rate Overview Sources How To Calculate

Millage Rate In Real Estate Modeling Top Shelf Models

Millage Rate In Real Estate Modeling Top Shelf Models

Mayor Recommends Lowering Millage Rate In Budget As Tax Assessor S Property Assessment Values Increase Tim Denson District 5 Commissioner

Average Statewide Millage Rates Download Table

Average Statewide Millage Rates Download Table

:max_bytes(150000):strip_icc()/taxes_due-6bb60b22f93948bbb123e098ecbf5d21.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home