Property Held In Trust Que Es

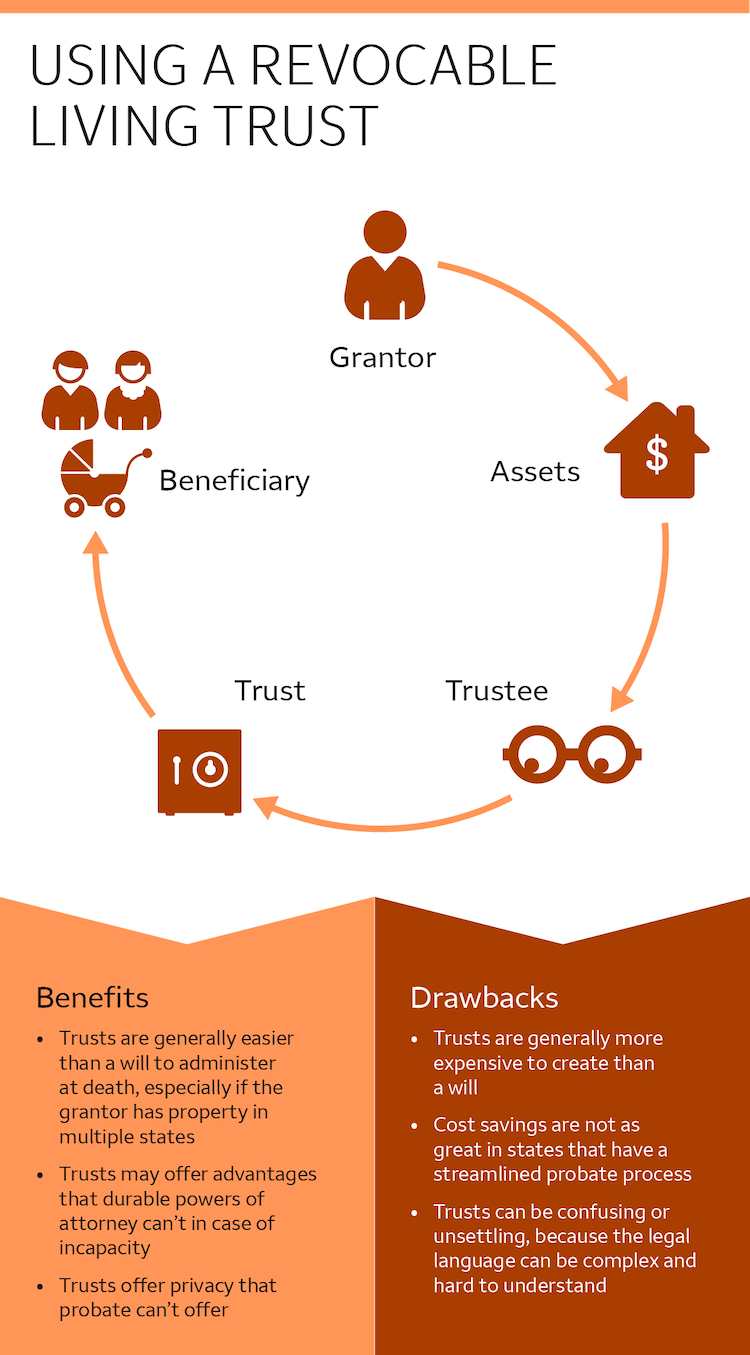

The uses of trusts are many and varied for both personal and commercial reasons and trusts may provide benefits in estate planning asset protection and taxes. This means you can addremove assets or properties anytime you want change beneficiaries and even dissolve the whole thing should your situation change.

What Is A Deed Of Trust Definition Overview Video Lesson Transcript Study Com

What Is A Deed Of Trust Definition Overview Video Lesson Transcript Study Com

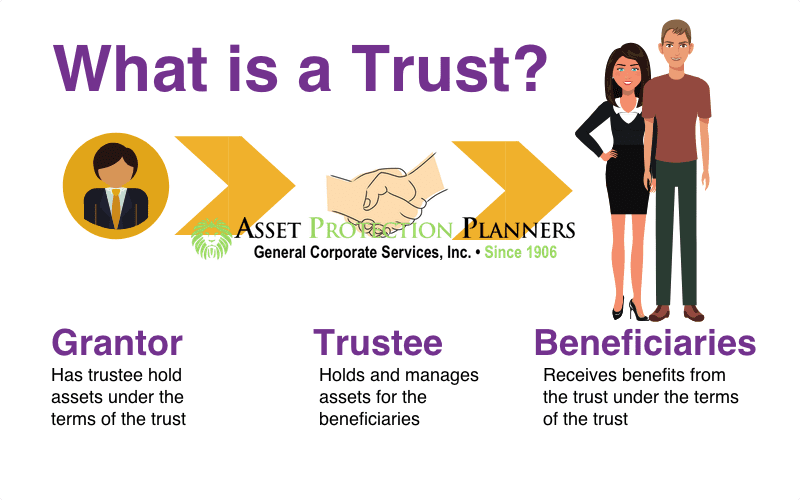

What Is a Trust.

Property held in trust que es. Property aka Res or Corpus. Trust Property means any and all property real or personal tangible or intangible which is owned or held by or for the account of the Trust or the Trustees including without limitation any and all property allocated or belonging to any series or class of Shares pursuant to Section 69 or Section 610 hereof. The creator of the trust generally remains the beneficiary over the course of his or her lifetime and retains the right to direct and control the trustee.

The trustee is the grantor until that person dies. Property held in a Title Holding Trust or Land Trust can be easily gifted to children grandchildren or other parties by completing and executing an assignment of all or a portion of the beneficial interest in the Title Holding Trust. You might get pushback from a lender when you try to refinance a property held by a trust.

Below are the processes that one should undertake when selling a property held in a revocable trust. The Title Holding Trust or Land Trust would name the existing living trust or other asset protection entity as the beneficiary of the Title Holding Trust or Land Trust. When setting up the trust the landowner who is both the.

The grantor dictates all of this in the entitys documentation when heshe first sets it up. If you dont understand the terms associated with a particular type of trust it will be much more difficult to understand what you need to do to sell a property held in. Property protection trusts mean that half of the value of the property is held separately so it does not come within the life tenants estate.

Held in trust means that although some items will be delivered to and will therefore be in the possession of the Service Provider for the purposes of Auction Services items will remain the property of the Debtor until any fees due for the sale of the item are cleared in the Clients bank account. Property Held in Trust Gasoline Station ISSUE Whether an interest in real estate is subject to Pennsylvania inheritance tax in the estate of the Decedent where the property was conveyed by Decedent to Decedents Wife in trust as per a property settlement agreement executed three years before the Decedents date of. Insuring a property held in trust I live in a property held in a Deed of Trust set up by my parents as the original trustees.

This is the essential step that allows you to avoid Probate Court because there is nothing for the courts to control when you die or become incapacitated. But if you the trustee are granted the power to encumber the property take out a mortgage within the trust you should be able to negotiate the. Subject Matter of a Trust.

Trust funds can hold a variety of assets such as money real property stocks and bonds a business or a combination. Every trust must have some property as its subject matter or res. A revocable or living trust allows you to maintain full legal control and ownership of the trust including the properties and assets until the time of your death.

Selling A Property Held In A Revocable Trust. A neutral third party called a trustee is tasked with managing the assets. Property of any sort may be held in a trust.

Land trusts are a form of revocable trust only used for real property and the main benefit is privacy. The Trustees obligation must be to apply defined or ascertainable property to the benefit of another. Ease of Making a Gift.

A trust fund from which I am the beneficiary the life tenant. Then a new trustee takes over management. The simple answer is any assets not held within the trust must go through probate but this doesnt have to be a huge ordeal.

A trust is an arrangement usually used to minimize estate taxes. Common objectives for trusts are to reduce the estate tax liability to protect property in your estate and to avoid probate. The concept is simple but this is what keeps you and your family out of the courts.

It allows a third party the trustee to hold assets such as property on behalf of beneficiaries. The trust is held to one third to my children one third to my sister or. A trust agreement is a document that spells out the rules that you want followed for property held in trust for your beneficiaries.

Legally your Trust now owns all of your assets but you manage all of the assets as the Trustee. As you can see until death the owner really doesnt change but how the property is kept does. A land trust is a private agreement that designates a trustee to hold a title to a property for the benefit of the beneficiary.

In a title-holding land trust the landowner signs a document called a Deed in Trust which transfers legal ownership of the property. The homeowner grants the property to the trustee in trust. Sample 1 Based on 1 documents.

The benefit of a life interest trust is that the survivor can continue to live in the house until they die but at least half the value of the estate is preserved for the children to inherit. It cannot be merely to confer benefits from any source chosen by the trustee. Living trusts may be created during a persons life through the drafting of a trust instrument or after death in a will.

If you have a trust then you should also have pour-over Will that transfers any assets currently outside of the trust to the trust upon your death. Homes are often held in trusts to keep the property from entering probate which can be a long and drawn-out legal process to settle a deceased persons estate.

Buying Property With A Land Trust Youtube

Buying Property With A Land Trust Youtube

Sample Printable Standard Real Estate Lease Agreement Buying Form Real Estate Lease Real Estate Forms Rental Agreement Templates

Sample Printable Standard Real Estate Lease Agreement Buying Form Real Estate Lease Real Estate Forms Rental Agreement Templates

Bible Lock Screens App On Instagram We Are Fully Equipped For Life And Godliness Our Heavenly Father Has Held Nothing Back His Nature Quotes Words Bible

Bible Lock Screens App On Instagram We Are Fully Equipped For Life And Godliness Our Heavenly Father Has Held Nothing Back His Nature Quotes Words Bible

Crystal Properties Spiritual Crystals Crystal Healing Stones Charoite

Crystal Properties Spiritual Crystals Crystal Healing Stones Charoite

Simple Trust Vs Complex Trust Legalzoom Com

Simple Trust Vs Complex Trust Legalzoom Com

Land Trusts For Asset Protection And Home Privacy

Land Trusts For Asset Protection And Home Privacy

Land Trusts For Asset Protection And Home Privacy

Land Trusts For Asset Protection And Home Privacy

What Are My Options For Wealth Transfer

What Are My Options For Wealth Transfer

Definition Of A Grantor Settlor Or Trustor Of A Trust Ameriestate

Definition Of A Grantor Settlor Or Trustor Of A Trust Ameriestate

What Are My Options For Wealth Transfer

What Are My Options For Wealth Transfer

Free Land Trust Agreement Form Printable Real Estate Forms Real Estate Forms Real Estate Templates Land Trust

Free Land Trust Agreement Form Printable Real Estate Forms Real Estate Forms Real Estate Templates Land Trust

Word Of The Year Trust Creatively Living Blog Broken Trust Trust Quotes Trust Yourself

Word Of The Year Trust Creatively Living Blog Broken Trust Trust Quotes Trust Yourself

Pros And Cons Of Putting Property In A Trust Halt Org

Pros And Cons Of Putting Property In A Trust Halt Org

Como Funciona Un Confianza En Texas Tax Protest Property Tax Protest

Como Funciona Un Confianza En Texas Tax Protest Property Tax Protest

Trust And Foundation Compared Side By Side Which Is Best

Trust And Foundation Compared Side By Side Which Is Best

Trust Lawyer Near Me Trust Attorney In Los Angeles Ca Trust Lawyer Revocable Trust Trust

Trust Lawyer Near Me Trust Attorney In Los Angeles Ca Trust Lawyer Revocable Trust Trust

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home