Delinquent Property Tax List Oregon

Each year thousands of Cook County property owners pay their real estate property taxes late or neglect to pay them at all. 1401 n hayden is dr.

Assessment And Taxation Clackamas County

Assessment And Taxation Clackamas County

November 15 February 15 and May 15.

Delinquent property tax list oregon. Thunderbird hotel llc attn. The delinquent tax list is essentially list of properties in your area that are likely to be seized in tax foreclosure ie. Assessor Delinquent Taxes Tax Foreclosures Yamhill County Assessor and Taxation Office 535 NE 5th St Room 135 McMinnville OR 97128 Phone 503434-7521 Fax 503434-7352.

On May 16 2020 they are delinquent. For example taxes billed in October 2018 are delinquent if not paid by May 15 2019. 15 get a three percent discount.

The property is subject to a tax foreclosure three years after the first date of delinquency. Delinquent Taxpayers over 5000 Top 100 List About Us. You selected the state of Oregon.

This is the first year the state has posted its list. Real property taxes are considered delinquent on May 16 of each year per ORS 312010. LINN COUNTY DELINQUENT PROPERTY TAX LIST Published in the Mount Vernon-Lisbon Sun Marion Times and Linn News-Letter May 29-31 2018 DELINQUENT REAL ESTATE TAXES I Sharon K.

The lien warrant will affect your credit rating. With bank deposit account rates at an all-time low tax liens are a great opportunity to get much higher interest rates on your money. If your property is in the foreclosure process you will receive notifications via mail further explaining the.

First the delinquent tax list that occurs the day after you are late on your property taxes. For sale and cheap. Typically in Oregon property owners who pay their entire tax bill by Nov.

Real property tax is delinquent if not paid in full by May 15th. Search Yamhill County property tax and assessment records by account number address and pin number. 2016 tax year Taxes become delinquent on May 16 2017.

We want Oregons taxpayers to. But in an attempt to collect millions in unpaid taxes the State of Oregon has posted online the names of the 50 individuals with the biggest delinquent tax bills. On May 16 2021 these taxes would be one year delinquent.

For example if the 2019-20 real property taxes were not paid in full. If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount. In May of 2020 any Real Property owing 2016 or earlier taxes became subject to the 2020 foreclosure process.

The county prepares a list called a foreclosure list of all properties subject to foreclosure. A two-year redemption period follows during which certain interested parties may bring the account current by paying the delinquent taxes fees penalties and interest due. Real property tax is.

Taxes on real property not paid on or before May 15 of the tax year in which they are billed are delinquent. The responsible taxpayer can be served with a lien warrant 30 days after delinquency. So once you have the delinquent list you have insider knowledge.

Temp agency Courtesy Staffing of Boardman with 509000 in unpaid tax bills tops the list of delinquent businesses. 2102 rows delinquent tax. The homeowner hasnt been delinquent long enough for the county to put them on the tax lien property list.

Foreclosure proceedings on real property begin three years from the date of delinquency. Those who made only a third of their payment the. 312010 312050.

Any unpaid balance due may then be subject to sale to a third party. All personal property tax is delinquent when any installment is not paid on time. Real Estate Tax Redemption.

All personal property tax is delinquent when any installment is not paid on time. In Polk County warrants are routinely served after the February 15th payment date. On May 16 2022 these taxes would be two years delinquent.

For late payments interest accrues at a rate of 1 and 13 percent per month 16 percent per year. Also in the event of a foreclosure your tax lien results in you successfully acquiring the property. FIRST THREE YEARS OF DELINQUENCY Property taxes may be paid in full by November 15 or in three installments.

And the second is the tax lien property list which happens down the road. If after three years from the tax due date taxes still are unpaid the county will initiate tax foreclosure proceedings. Are tax liens a good investment.

The responsible taxpayer must be served with a warrant when the tax becomes delinquent. Once a delinquent property makes the Tax Delinquent List it becomes a golden opportunity for real estate investors and wholesalers. Gonzalez Treasurer of Linn County Iowa hereby give notice that on Monday the 18th of June 2018 at the Nine OClock in the forenoon at Jean Oxley Public Service Center I will.

If the property is real property taxes are delinquent if not paid fully by May 15. It then applies for a judgment with the court and publishes the foreclosure list in a newspaper. If the account remains delinquent at the end of the two-year redemption period the property is deeded to the county in which the foreclosure has taken place.

Https Www Co Benton Or Us Sites Default Files Fileattachments Assessment Page 274 2021 Senior Deferral App Fillable Pdf

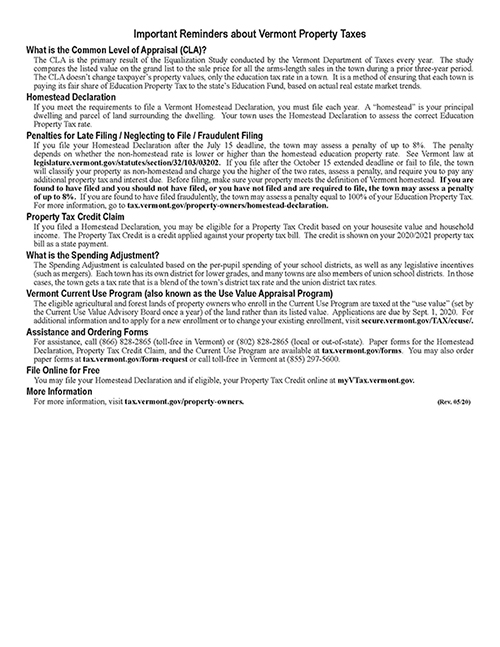

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

2020 Lucas County Auditor Delinquent Land Tax Notices The Blade

2020 Lucas County Auditor Delinquent Land Tax Notices The Blade

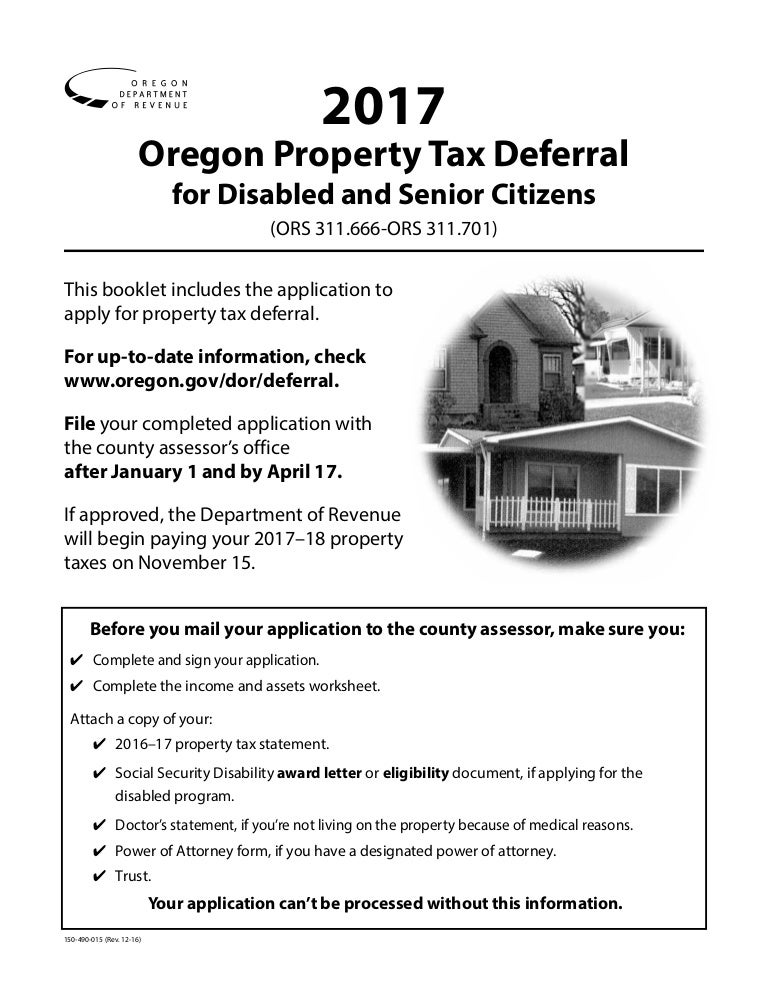

Property Tax Deferral Disabled Senior Citizens

Property Tax Deferral Disabled Senior Citizens

Deeds And Dont S Cottages Gardens Public Records Real Estate Information Housing Market

Deeds And Dont S Cottages Gardens Public Records Real Estate Information Housing Market

What Is Tennessee Property Tax H R Block

What Is Tennessee Property Tax H R Block

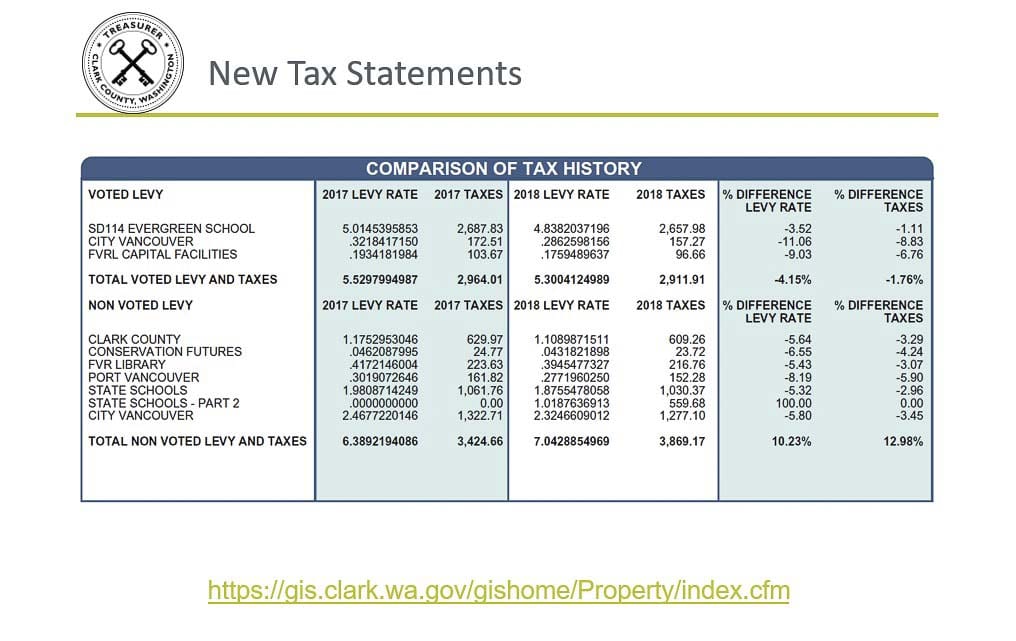

What S Happening With Property Taxes In 2019 Clarkcountytoday Com

What S Happening With Property Taxes In 2019 Clarkcountytoday Com

Decorative Crosses Home Decor Australia Dwelling Decoration Http Home Decorating Ideas For You Com D Home Decor Australia Crosses Decor Interior Decorating

Decorative Crosses Home Decor Australia Dwelling Decoration Http Home Decorating Ideas For You Com D Home Decor Australia Crosses Decor Interior Decorating

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

Property Tax Prorations Case Escrow

Property Tax Prorations Case Escrow

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

Everything You Need To Know About Getting Your County S Delinquent Tax List Tax Filing Taxes Sales Tax

Everything You Need To Know About Getting Your County S Delinquent Tax List Tax Filing Taxes Sales Tax

Everything You Need To Know About Getting Your County S Delinquent Tax List Tax Filing Taxes Sales Tax

Everything You Need To Know About Getting Your County S Delinquent Tax List Tax Filing Taxes Sales Tax

Utility Billing Notice Ez Landlord Forms Being A Landlord Credit Card Statement Rental Agreement Templates

Utility Billing Notice Ez Landlord Forms Being A Landlord Credit Card Statement Rental Agreement Templates

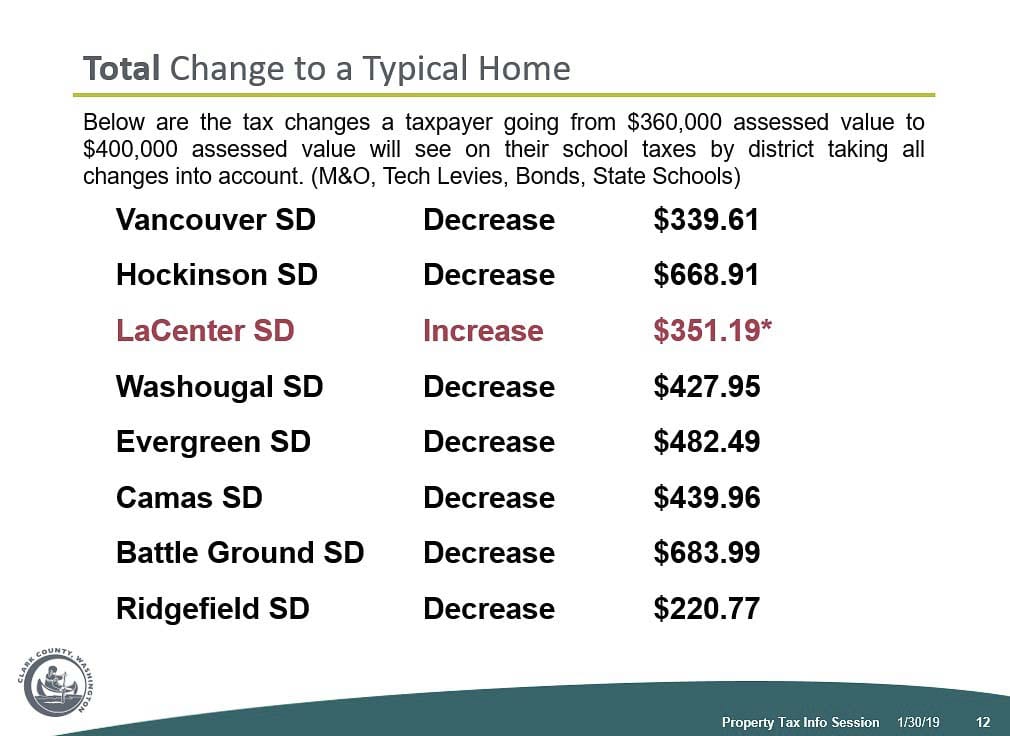

What S Happening With Property Taxes In 2019 Clarkcountytoday Com

What S Happening With Property Taxes In 2019 Clarkcountytoday Com

Charlotte Foreclosure Notice Sell House Fast Sell House Fast Foreclosures Selling House

Charlotte Foreclosure Notice Sell House Fast Sell House Fast Foreclosures Selling House

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Https Www Oregon Gov Dor Forms Formspubs Utility Large Communication 302 131 Pdf

Labels: delinquent, list, oregon, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home