Property Tax Appeal In South Carolina

Shawn earned his BA. Furthermore once the decision has been made to appeal the procedures involved are often technical and complex and the legal requirements for filing an appeal are usually strictly enforced against the taxpayer.

What To Do If You Receive A Notice From The Scdor

What To Do If You Receive A Notice From The Scdor

Degree from the University of South Carolina School of Law and his LLM.

Property tax appeal in south carolina. The appeal must be submitted in writing to the assessor. You may appeal a property tax assessment or the denial of a property tax exemption made by the Department of Revenue Department by filing a protest within 90 days of the date of the property tax assessment or the date of the notice setting forth the denial of the property tax exemption. How do you appeal property taxes South Carolina.

Code 12602550 your assessment may be reduced to not less than 80 of the protested property tax assessment until the appeal is resolved. A boat or a motor vehicle may be established as a primary 4 or secondary 6 residence which would lower the assessment ratio from 105. An appeal submitted before the first penalty date January 15th applies for the property tax year for which that penalty would apply.

Under the provision of state law the property owner may reasonably challenge his appraisal assessment using the following procedure. Beginning June 20th 2016 the Assessors office will be requiring additional necessary information for those who apply to obtain a legal residence classification. If after receiving your assessment notice you disagree with the new value assigned to your property you have the right to appeal.

CALL TODAY 864-288-3049. Within ninety 90 days after dated notice of reassessment the property owner or his agent must file a written objection with the assessor. The office is open from 830 to 500 Monday through Friday even through lunch with the exception of County Holidays.

If you need assistance contact the tax area related to the appeal. For more information please see Revenue Procedure 20-1. An appeal must be filed in writing within 90 days of the mailing of the assessment notice.

They usually have a form and instruction sheet. South Carolina South Carolina. Whenever a propertys value is increased by 100000 the assessor must give written notice to the taxpayer by July.

South Carolina Department of Revenue 12-60-2520 as amended. South Carolinas method of taxation provides several alternatives for relief. In years when there is no notice of property tax assessment.

Formations mergers acquisitions and real estate transactions and property tax appeals involving real estate. A second-home owner may wish to establish residency in South Carolina to take advantage of the lower tax liability for primary residents can lower your taxes by more than 23 of your bill. Tax Appeal Procedures for State Assessed Property Tax Refund Claims.

The request for this reduced assessment must be in writing and must be received in the Assessors Office prior to December 31 of the tax year in which the appeal is requested. An appeal submitted before the first penalty date January 15th applies for the property tax year for which that. The decision of the Board may be contested by either the real property owner or the Assessor to the Administrative Law Judge Division of the SC.

Tax Appeal Procedures for State Tax Refund Claims Other Than Property Tax Bingo and Alcoholic Beverage Matters Form CID-26. If you decide to appeal or to seek a different classification dont wait until the last minute and be sure to allow yourself plenty of time before your deadline. The property taxpayer may appeal the fair market value the special use value the assessment ratio and the property tax assessment of a parcel of property at any time.

South Carolina commercial property tax appeal services from Meilinger Consulting PC. Contact us now to find out how we can reduce your real estate taxes. Every South Carolina resident should carefully examine their property tax bills to ensure they are being taxed appropriately.

Within thirty 30 days of the receipt of the decision of the board the property taxpayer may appeal such decision by requesting a contested case hearing before the. Details may vary so you need to contact City Hall Assessors Office and ask how to appeal. You must file your appeal with the Dorchester County Assessors Office.

South Carolina Code 12-60-2510 and 12-60-2520 establish the steps necessary to appeal an assessment made by a county assessor. In accordance with SC. The decision of the this judge may be further appealed by either party to the SC.

An appeal submitted on or after the first penalty date of January 15th applies for the succeeding property tax year. The general process is the same everywhere. Degree from Furman University his JD.

If you were not sent a property tax assessment notice you must file. Watch the appeal deadlines. In Taxation from the University of Alabama School of Law.

11 Reasons North Carolina Is Better Than South Carolina North Carolina Carolina Asheboro

11 Reasons North Carolina Is Better Than South Carolina North Carolina Carolina Asheboro

Myrtle Beach South Carolina Cheapest Places Where You Ll Want To Retire Saving For Retirement Early Retirement Retirement

Myrtle Beach South Carolina Cheapest Places Where You Ll Want To Retire Saving For Retirement Early Retirement Retirement

How To Sell A House By Owner In South Carolina 2021 Update

How To Sell A House By Owner In South Carolina 2021 Update

Https Www Lincolninst Edu Sites Default Files Pubfiles Deep Dive On Scs Property Tax System Volume 2 Pdf

Sweet Little Bungalow Craftsman House Craftsman Exterior Historic Homes

Sweet Little Bungalow Craftsman House Craftsman Exterior Historic Homes

Eoa Property Management Sleek Professional Coastal Logo For An Up And Coming Property Management Company My Monogram Logo Logo Design Property Management

Eoa Property Management Sleek Professional Coastal Logo For An Up And Coming Property Management Company My Monogram Logo Logo Design Property Management

82 83 Brams Point Road Hilton Head Island South Carolina 29926 Single Family Homes For Hilton Head Island Waterfront Property Hilton Head Island South Carolina

82 83 Brams Point Road Hilton Head Island South Carolina 29926 Single Family Homes For Hilton Head Island Waterfront Property Hilton Head Island South Carolina

118 Fort Fremont Rd Saint Helena Island Sc 29920 Zillow Saint Helena Island St Helena Fremont

118 Fort Fremont Rd Saint Helena Island Sc 29920 Zillow Saint Helena Island St Helena Fremont

Moving To South Carolina The Truth About Living Here

Moving To South Carolina The Truth About Living Here

Https Www Charlestoncounty Org Departments Assessor Files Definitions And Common Terms Pdf

Fort Mill Sc Tax Adjustment Attorney Rock Hill Property Tax

Fort Mill Sc Tax Adjustment Attorney Rock Hill Property Tax

South Carolina Georgian With Acreage Save This Old House Updating House Colonial House Old Houses

South Carolina Georgian With Acreage Save This Old House Updating House Colonial House Old Houses

Outdoor Design And Ideas Outdoor Area Designs Marshall Erb Design In 2021 Sullivans Island Island Living Sullivans Island Sc

Outdoor Design And Ideas Outdoor Area Designs Marshall Erb Design In 2021 Sullivans Island Island Living Sullivans Island Sc

67 Barony Ct Edisto Island Sc 29438 75 Photos Mls 21005385 Movoto Edisto Island Edisto Beach Kiawah Island

67 Barony Ct Edisto Island Sc 29438 75 Photos Mls 21005385 Movoto Edisto Island Edisto Beach Kiawah Island

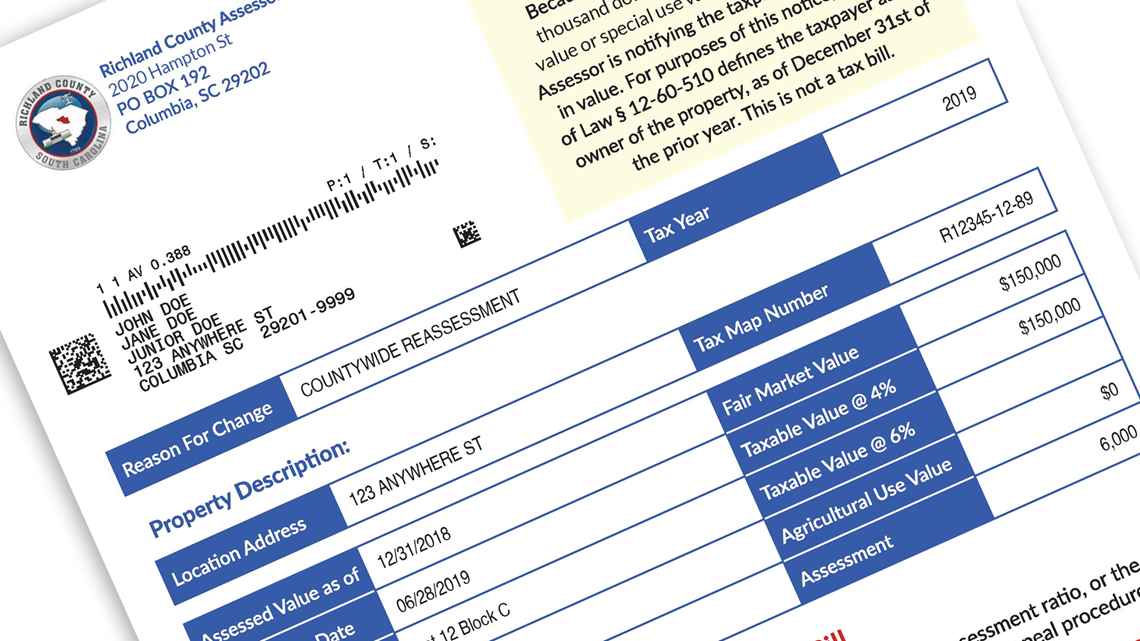

2019 Richland County Property Tax Reassessment Notices In The Mail Wltx Com

2019 Richland County Property Tax Reassessment Notices In The Mail Wltx Com

Table 2 Federal And State Individual Income Tax Bill For Taking The Cash Option On The 2018 Hgtv Smart Home In Bluffton South Ca Income Tax Diy Network Income

Table 2 Federal And State Individual Income Tax Bill For Taking The Cash Option On The 2018 Hgtv Smart Home In Bluffton South Ca Income Tax Diy Network Income

11 Caspian Lane Bluffton South Carolina 29909 Single Family Homes For Sale Bluffton Home And Family Bluffton South Carolina

11 Caspian Lane Bluffton South Carolina 29909 Single Family Homes For Sale Bluffton Home And Family Bluffton South Carolina

If You Find The Tax Amount For Your Residential Asset Is A Bit Too High Then You Always Have The Right To G Property Investor Rental Property Investment Firms

If You Find The Tax Amount For Your Residential Asset Is A Bit Too High Then You Always Have The Right To G Property Investor Rental Property Investment Firms

Https Www Colletoncounty Org Data Sites 1 Media Assessor Instructionsforspassessment Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home