Columbus Ohio Property Tax Rate

As a tool for our audit teams and a service to the tax community the Division of Income Tax annually compiles information from Ohio municipalities on their income tax. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000.

Tips For Managing Property Taxes And Finding Tax Rates Exterior House Colors Siding Cost Colonial House

Tips For Managing Property Taxes And Finding Tax Rates Exterior House Colors Siding Cost Colonial House

7485 Tottenham Pl New Albany OH 43054.

Columbus ohio property tax rate. The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. 3 bds 3 ba 2545 sqft - For sale by owner. Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property.

As property taxes increase with soaring property values a. Based on those figures property taxes are expected to increase from 13 percent in Dublin to 415 percent in Grandview Heights. This interactive table ranks Ohios counties by median property tax in dollars percentage of home value and percentage of median income.

Columbus - 100000 x 148 148000. Median property tax is 183600. Required by Ohio Revised Code section 319301 frequently described as House Bill 920 were 138 billion for tax year 2008 an increase of 53 percent over 2007.

Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year. The list is sorted by median property tax in dollars by default. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

Delinquent tax refers to a tax that is unpaid after the payment due date. It has been an ad valorem tax meaning based on value since 1825. The County assumes no responsibility for errors in the information and does not guarantee that the data is free from errors or inaccuracies.

Residents of Columbus pay a flat city income tax of 250 on earned income in addition to the Ohio income tax and the Federal income tax. However tax rates vary significantly between Ohio counties and cities. Columbus City Taxes - Columbus OH Real Estate.

Homes for You Price High to Low Price Low to High Newest Bedrooms Bathrooms Square Feet Lot Size. This amount does not include deductions for the 10 percent partial exemption on certain residential and agricultural property the 25 percent. Hilliard - 100000 x 208 208000.

The real property tax is Ohios oldest tax. Grandview Heights homeowners will pay on average 130 more in. Filter by year All 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004.

Nonresidents who work in Columbus also pay a local income tax of 250 the same as the local income tax paid by residents. Users of this data are notified that the primary information source should be consulted for verification of the information contained on this site. 267 days on Zillow.

Multiply the market value of the property by the percentage listed for your taxing district. Rates range from 0-3 in Ohio. Municipalities may offer partial or full credit to residents who pay municipal income taxes to a different municipality where they are employed.

The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work conducted by each County. The information on this web site is prepared from the real property inventory maintained by the Franklin County Auditors Office. The departments Tax Equalization Division helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work of local county auditors.

The rate is determined locally with a maximum rate of 1 without voter approval. To use the forms provided by the City of Columbus Income Tax Division we recommend you download the forms and open them using the newest version of Acrobat Reader. Taxes for a 100000 home in.

The highest rates are in Cuyahoga County where the average effective rate is 244. In Ohio the average property tax paid by residents is 1553 percent or around 1553 per 100000 in valued property. The average effective property tax rate in Ohio is 148 which ranks as the 13th-highest in the US.

Ohio senator to propose bill capping annual property tax hikes at 5 for eligible homeowners. Columbuss property taxes are incredibly high compared to the state average so those looking to save money may want to live just outside Franklin County which determines the pricing of the property taxes in the area. Whitehall - 100000 x 172 172000.

A simple percentage used to estimate total property taxes for a property.

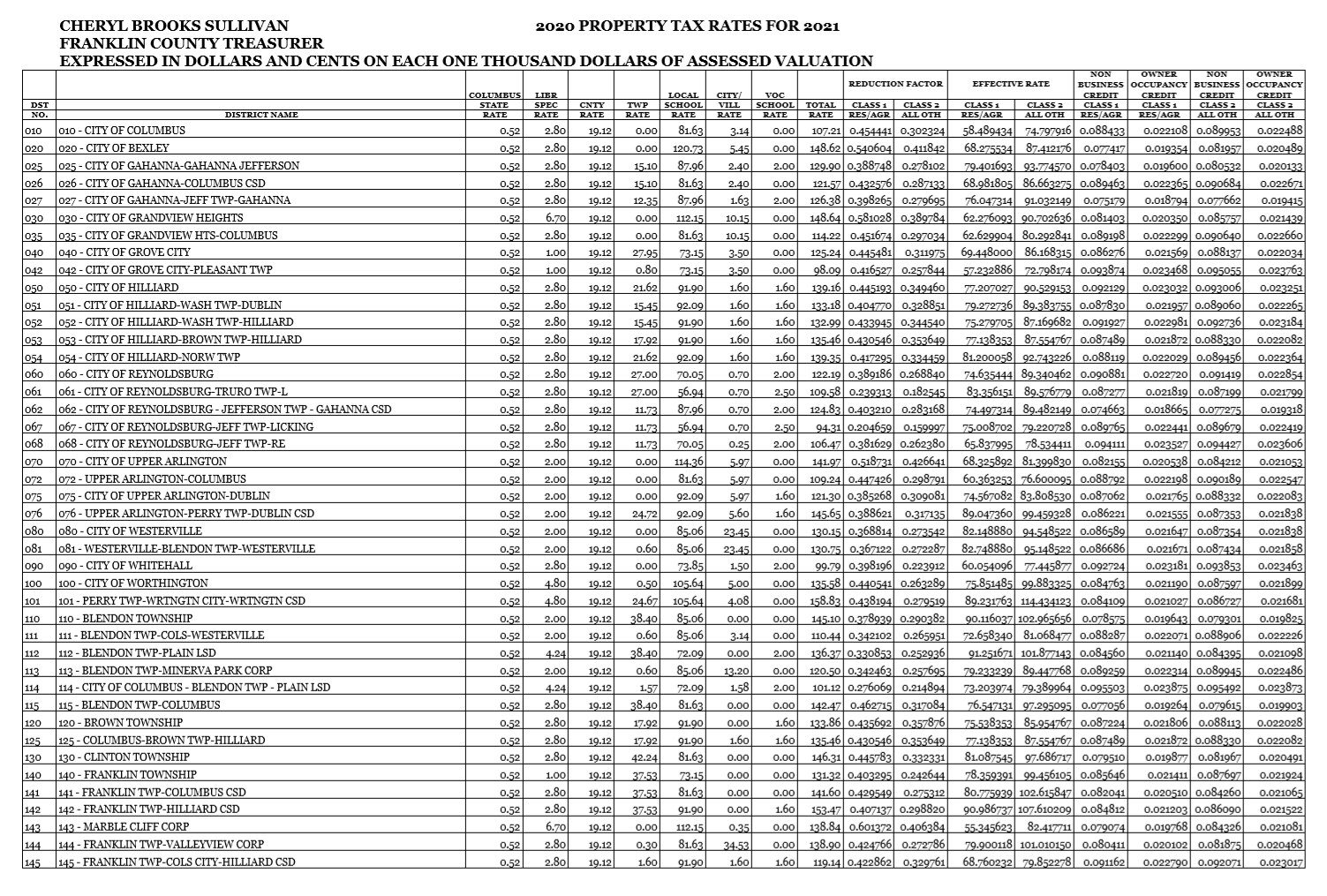

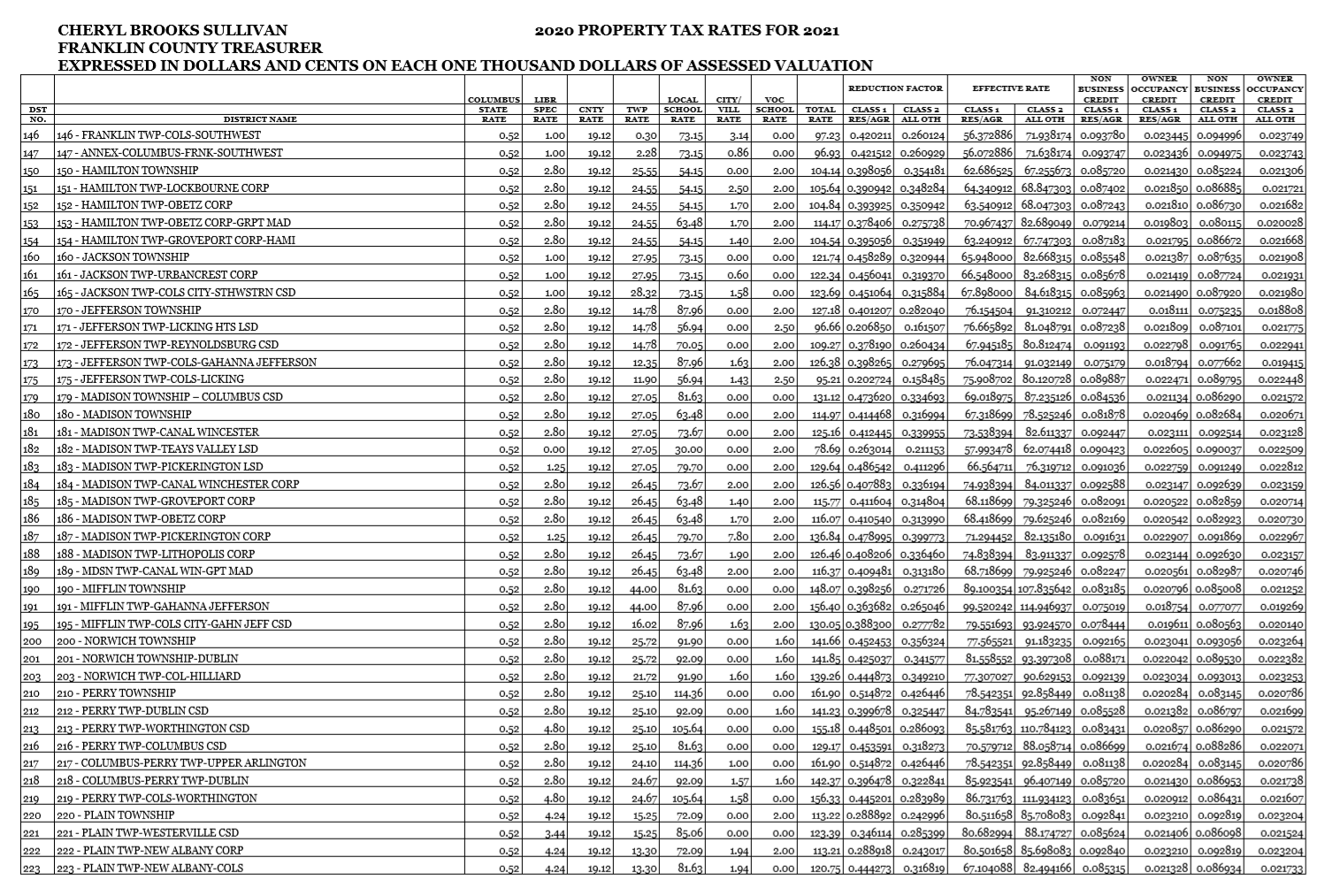

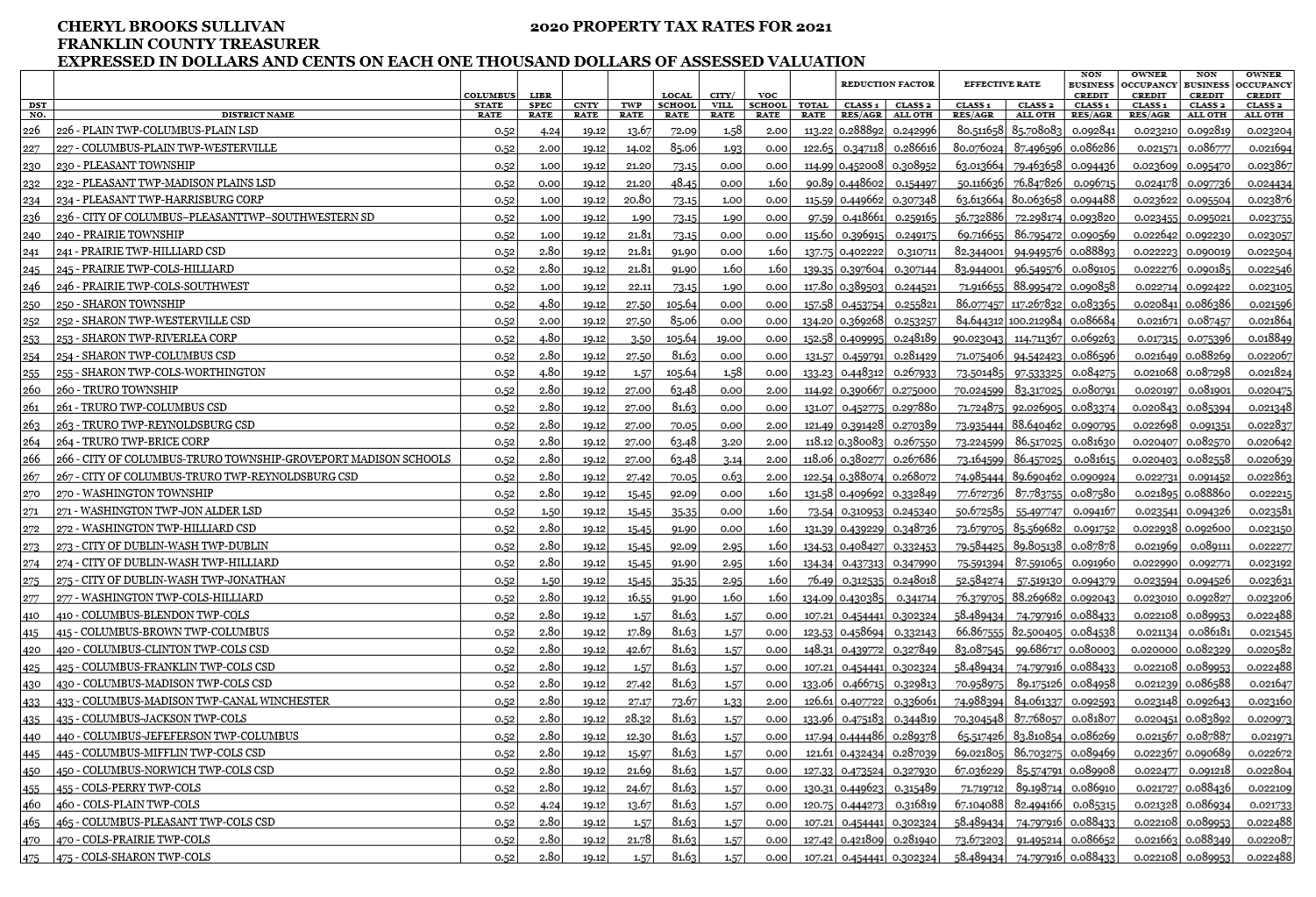

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Ohio Homestead Exemption For Disabled Veterans Disabled Veterans Va Mortgage Loans Mortgage Loan Officer

Ohio Homestead Exemption For Disabled Veterans Disabled Veterans Va Mortgage Loans Mortgage Loan Officer

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Delaware County Rents Most Affordable In Nation Delaware County Rent National

Delaware County Rents Most Affordable In Nation Delaware County Rent National

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Property Tax Rates High In Ohio And Cincinnati Area

Property Tax Rates High In Ohio And Cincinnati Area

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

States With The Lowest Corporate Income Tax Rates Infographic Infographic History Geography Usa Map

States With The Lowest Corporate Income Tax Rates Infographic Infographic History Geography Usa Map

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home