What Happens If You Don't Pay Property Taxes On Your Car

Generally in the first first weeks or months of having unpaid property taxes you will incur additional penalties and interest. What happens if you dont pay on time.

What Not To Do When You Re Closing On A Home Things To Sell Loan Money Sell Car

What Not To Do When You Re Closing On A Home Things To Sell Loan Money Sell Car

Should they fail to pay their taxes by the due date a.

What happens if you don't pay property taxes on your car. Property taxes may be a strain on your budget but if you dont pay them you could face serious consequences. Waiting for a taxing body to contact you about its money is never the way to go. If you continually ignore your taxes you may have more than fees to deal with.

If its a check for less than 1250 the penalty is the amount of the payment or 25. What if you dont pay your property taxes. If you dont pay up youll be in default under the terms of the mortgage and the servicer can foreclose on the home in the same manner as if you had fallen behind in monthly payments.

If it doesnt clear youll be saddled with a penalty of 2 of the payment if its a check for 1250 or more. Interest and Penalties Will Accrue If you dont pay your property taxes when theyre due your local taxing authority will start charging interest on your tax account. Sometimes homeowners run into financial trouble and cant come up with their property taxes as a result.

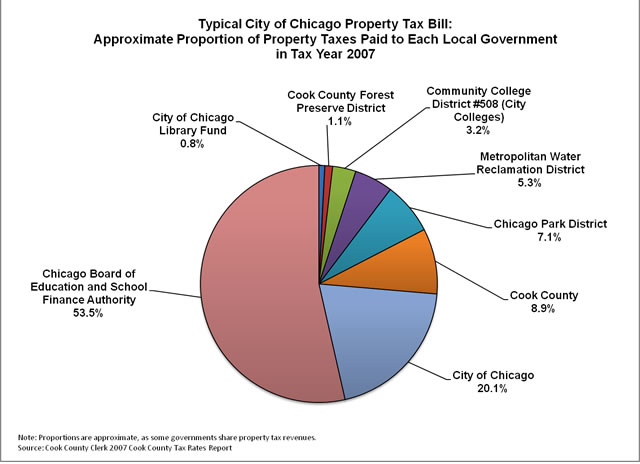

If you file your taxes but dont pay them the IRS will charge you a failure-to-pay penalty which is 05 percent of your unpaid taxes for each month you dont pay up to 25 percent. You may also incur monetary penalties. Any residents who fail to pay their personal property tax by the deadline will immediately be charged a 10 percent fee on top of their tax.

If you refuse to pay your property taxes a few different things can happen. Your countys property tax department is your main contact and source of information. They are likely not going to forgive the taxes and you may be subject to penalties and interest but jail time is a little extreme for something like this.

If the PPT is very seriously past-due they can suspend your drivers license. Then the taxing authority can take ownership of your home based on that lien. When a person doesnt pay their property taxes their property goes to the state.

If that happens to you you could. There are strict timelines involved. Typically the amount of property taxes that a homeowner must pay is based on the assessed value of the property.

In addition to garnishing your wages and seizing your assets the CRA can seize your personal property and sell it in order to repay your tax debt. Penalty charges for late payments can be up to 25 percent of the amount of tax you owe. If you cant afford to pay what you owe in taxes a CRA collections officer will be assigned to your case in order to ensure that you pay.

A lien effectively makes the property act as collateral for the debt. Your Servicer Might Set Up an Escrow Account. Eventually the taxing authority can put a lien on the house.

If you fail to pay your property taxes by the due date the taxing authority will start charging you with interest and penalties. Most states charge you a late payment penalty and all of them charge interest on the debt. But the process of losing their home forfeiture is run by the county where the property is located.

The state can levy your wages for unpaid taxes. The terms of the loan contract usually require the borrower to stay current on the property taxes. This interest typically accrues monthly.

Good news No. Itll go down next year Since vehicle taxes are based on the resale value of your car they tend to go down each year as your. That will turn a routine traffic stop into a first-class nightmare.

In San Francisco those who do not pay their property taxes on time are subject to a 10 percent penalty on the unpaid portion. There are several ways you can handle the situation and you get the best chance for a deal if you initiate it. I know here in Washington they dont even really deal with that until you register the vehicle.

The government uses the money that property taxes generate to pay for schools public services libraries roads parks and the like. Plus interest accrues on your unpaid taxes. They usually force you to pay when you have to get something else done there.

Additionally in most states the taxing authority automatically. If you do not settle your account promptly after you receive an assessment notice legal action will begin that may include filing a property lien or attaching your bank accounts and salary or referring your account to an outside collection agency. When homeowners dont pay their property taxes the overdue amount becomes a lien on the property.

Read more »