Jackson County Property Tax Bill

No Reminder billing will be submitted for the Fall installment. Tax account look up is for informational purposes only and does not constitute a municipal tax search.

Personal property refers to tax.

Jackson county property tax bill. Interest penalties and fees will accrue if payment is late. If your propertys Assessed Value is. To save time and avoid crowds online payment is encouraged.

Property Tax Bills Bills are generally mailed and posted on our website about a month before your taxes are due. Payments must be received or federally postmarked by the deadline to avoid penalties. Pay your property taxes or schedule future payments.

View an Example Taxcard View all search methods. Real property includes tax on land and improvements. Anyone who has paid Jackson County personal or real estate property taxes may get a duplicate tax receipt.

We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance. However this material may be slightly dated which would have an impact on its accuracy. Jackson Township is not responsible for erroneous interpretation of the records or for changes made after the look up.

Account information is subject to updates corrections and reversals. Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. Jackson County OR A new bill has passed the Oregon House of Representatives that will change current tax laws in Oregon to provide relief for fire-affected propertiesThe new bill would.

All of these fees are third-party merchant fees and are not kept by Jackson County. Select one of the 2 online payment options. State law requires that personal property taxes be paid before license plates on vehicles can be issued or renewed.

Keep track of properties and upcoming bills online. In addition the Collectors Office is responsible for the collection of taxes levied by the Town of Dillsboro Village of Forest HillsTown of Highlands and the Town of Webster. The Tax Commissioners Office in Jefferson is the only location in Jackson County for handling motor vehicle transactions and the billing and collecting of mobile home timber and property taxes for the County.

About the Taxes Taxes are a lien against the real estate and remains with the property not the. Personal Property Business Business personal property refers to furniture fixtures machinery equipment and inventory located within businesses. The Oregon law specifies the due dates for property taxes and no extensions have been offered at this time.

Tax bills are mailed once a year with both installments remittance slips included Spring and Fall. You may obtain a duplicate of your original property tax receipt for free online. Partial payments on taxes are accepted through the due date but not after.

Taxes are assessed on personal property owned on January 1 but taxes are not billed until November of the same year. Bills are generally mailed and posted on our website about a month before your taxes are due. We are closed New Years Day Memorial Day Independence Day.

If a bank or mortgage company pays your property taxes they will receive your property tax bill. The Collectors Office mails tax bills during November. Click Link Account and Pay Property Tax.

The Jackson County Tax Collectors Office is responsible for the timely collection and disposition of real and personal property taxes within Jackson County. Map Group Parcel Special Interest. How much is a duplicate receipt.

Taxes are due for the entire amount assessed and billed regardless if property is no longer owned or has been moved from Jackson County. Skip the trip to the court house and pay your property taxes on. Find out how taxes are calculated how to pay them and what other fees are involved.

Our office hours are Monday through Friday 800 am. Download an official app of Jackson County Missouri myJacksonCounty. On December 31 2020.

Taxes Jackson County - GA makes every effort to produce and publish the most accurate information possible. Property tax information last updated. A 275 fee of the total tax bill will be added.

If a tax bill is not received by December 10 contact the Collectors Office at 816-881-3232. However sometimes bills are delayed in being mailed and then the delinquent date would be the day after the due date stated on your bill. The last Trimester Payment is due by May 17th Because the 15th falls on the weekend.

Any errors or omissions should be reported for investigation. You may begin by choosing a search method below. Jackson Countys assessment director Gail McCann Beatty said such a change would create a huge inequity in the property tax system by favoring the longtime owners of a property whose value has.

JACKSON COUNTY TAXATION OFFICE IS CLOSED TO THE PUBLIC. Tax Account Lookup Disclaimer. 2020 Tax Season To be timely payment of 2020 property taxes must be received or postmarked no later than December 31 2020.

Taxes paid online after the. Property taxes for Real and Personal Property are generally mailed in October and have a normal due date of December 20. You may also obtain a duplicate of your original property tax.

The 2020 Jackson County property tax due dates are May 10 2021 and November 10 2021.

Property Data Online Jackson County Oregon

Property Data Online Jackson County Oregon

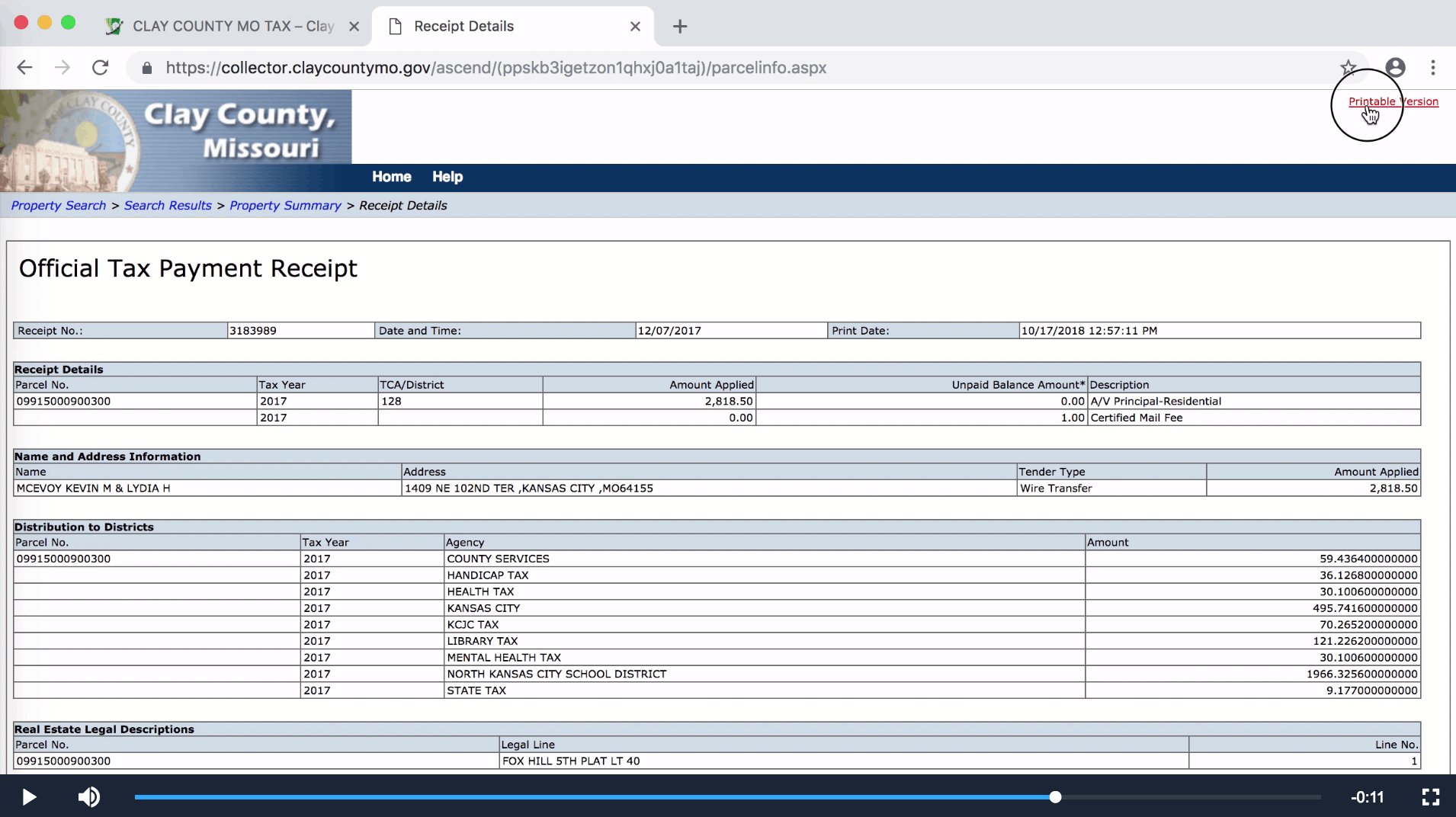

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

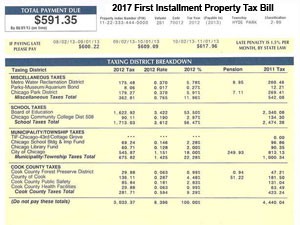

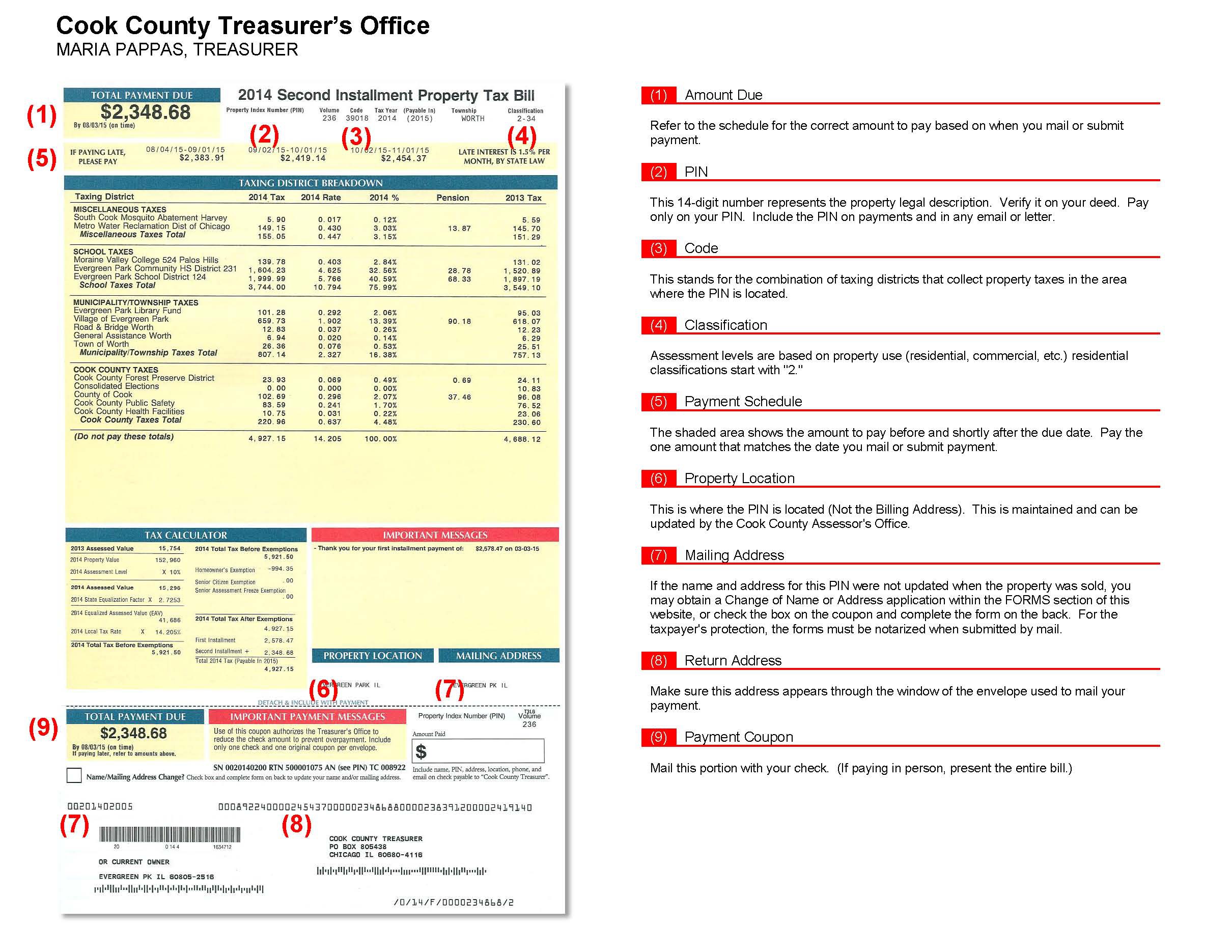

Cook County Property Tax Bill How To Read Kensington Chicago

Cook County Property Tax Bill How To Read Kensington Chicago

Assessment Notices Jackson County Mo

Cook County Property Taxes 2017 2nd Installmant Looms Kensington

Cook County Property Taxes 2017 2nd Installmant Looms Kensington

Cook County Property Tax Bill How To Read Kensington Chicago

Cook County Property Tax Bill How To Read Kensington Chicago

Jackson County Mo Property Tax Calculator Smartasset

Jackson County Mo Property Tax Calculator Smartasset

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

Tax Bills Are Being Delivered Jackson County Mo

Fourth Lawsuit Asks Judge To Stop Collection Of Rising Property Taxes In Jackson County Investigations Kctv5 Com

Fourth Lawsuit Asks Judge To Stop Collection Of Rising Property Taxes In Jackson County Investigations Kctv5 Com

Paying Your Taxes Online Jackson County Mo

Paying Your Taxes Online Jackson County Mo

Jackson County Tax Assessor S Office

Jackson County Tax Assessor S Office

Where Do Cook County Property Taxes Go Kensington

Where Do Cook County Property Taxes Go Kensington

Mary Carol Murdock Jackson County Tax Collector

Mary Carol Murdock Jackson County Tax Collector

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home