How To Check Your Property Tax Bill

How to check your outstanding property tax. When searching for an unsecured bill for businesses boats airplanes etc please search by the 4-digit year and 6-digit bill number.

Supplemental Property Tax Information Property Tax Mortgage Companies Property

Supplemental Property Tax Information Property Tax Mortgage Companies Property

Appealing decisions on your assessed value and subsequent tax bill.

How to check your property tax bill. For questions about property tax bills and collections call the Property Tax Assistance Divisions Information Services Team at 512-305-9999 or 1-800-252-9121 press 2. Bills are generally mailed and posted on our website about a month before your taxes are due. See local governments debt and pensions.

Read The Pappas Study. Your actual tax rates. The property tax account is being reviewed prior to billing.

Sign up to receive tax bills by email. Search to see a 5-year history of the original tax amounts billed for a PIN. When your town or city publishes the tentative assessment roll you should check the assessment full value and exemptions for your property.

Find out if your delinquent taxes have been sold. The Department of Local Government Finance has compiled this information in an easy-to-use format to assist Hoosiers in obtaining information about property taxes. Peek at IRS Form 1098 Every homeowner with an active mortgage should.

The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online. Tax Collections Open Property Tax Bill Search in new window If you have questions on your tax bill please call 311 or dial 704-336-7600 if outside Mecklenburg County limits. You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statements.

Enclose your payment stub s from your Property Tax Bill. To pay by phone call 240-777-8898. NRIC FIN number or your property tax reference number.

To learn more visit Overview of the assessment roll. To locate the amount of your Secured Property Taxes click the following link How much are my property taxes. Billed Amounts Tax History.

Ask Jamie your virtual assistant. Write the Assessors Identification Number on the lower left-hand corner of your check or money order. Use the Check Property Tax Balance e-Service without having to log in to mytaxirasgovsg.

You also can check and update key information about your property such as. Access the 20-Year Property Tax History. Mail the payment in a sealed envelope properly addressed and with the required postage.

And enter your Assessors Identification Number. Then click on the payment type. The 2020 property taxes are due January 31 2021.

Download a copy of your tax bill. This website provides current year and delinquent secured tax information. Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page.

Search using your property address and your tax reference number ie. Current year is available between October 1 and June 30 only. Do not attach staples clips tape or correspondence.

Bills are generally mailed and posted on our website about a month before your taxes are due. If a bank or mortgage company pays your property taxes they will receive your property tax bill. When searching for a current secured defaulted supplemental or escape bill please search either by the parcel number or the current mailing address.

For questions regarding the Streamside Subdivision assessment Matthews jurisdiction only please call. Begin by entering your account number or bill number or street address for the bill you want to pay in the box below. Steps to Check Outstanding Tax.

Click Proceed with search. We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance. Using that information and a basic knowledge of the value of your home you can determine if you are fairly assessed.

Tax Bill Search The information provided in these databases is public record and available through public information requests. Paying by electronic check will not incur any service fees and you can conveniently schedule these payments to be paid on the date you select. If your propertys Assessed Value is.

Checking property taxes is easy as looking at your tax bill form 1098 or visiting the county assessors office or website. Visit Treasurer and Tax Collector website.

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

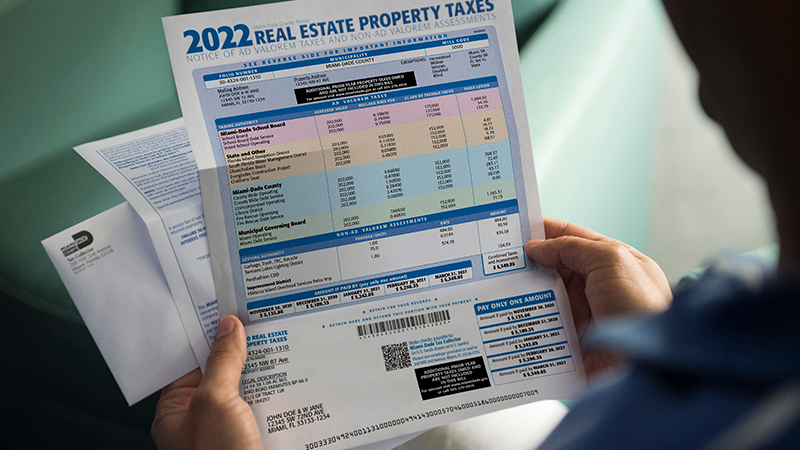

Did You Receive Your Property Tax Bill New Video Link In Bio Don T Leave Money On The Table Here S What You Need To Know Property Tax Video Link Bills

Did You Receive Your Property Tax Bill New Video Link In Bio Don T Leave Money On The Table Here S What You Need To Know Property Tax Video Link Bills

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Your Property Tax Assessment What Does It Mean Property Tax Real Estate Values Tax

Your Property Tax Assessment What Does It Mean Property Tax Real Estate Values Tax

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

How To Appeal Your House S Assesment To Lower Your Property Tax Bill Property Tax Property Tax

How To Appeal Your House S Assesment To Lower Your Property Tax Bill Property Tax Property Tax

Pay Your Property Tax Bill Online

Pay Your Property Tax Bill Online

Think Your Property Tax Bill Is Too High If So Here S How To File A Formal Complaint With The County Auditor To Dispute Your Property Tax Dispute Assessment

Think Your Property Tax Bill Is Too High If So Here S How To File A Formal Complaint With The County Auditor To Dispute Your Property Tax Dispute Assessment

Dupage County Il Treasurer Sample Tax Bill

Dupage County Il Treasurer Sample Tax Bill

Info About The Property Tax Bill For San Diego County Property Tax San Diego County Informative

Info About The Property Tax Bill For San Diego County Property Tax San Diego County Informative

Tax Information Nether Providence Township

What Is Real Estate Tax Bill In 2021 Estate Tax Real Estate Checklist Listing Presentation Real Estate

What Is Real Estate Tax Bill In 2021 Estate Tax Real Estate Checklist Listing Presentation Real Estate

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home