How Much Does It Cost To Have A Property Valued

These are usually fairly simple and cost 200 500 depending on the property size. You can expect to spend roughly 400 for an appraisal but the cost can be lower or higher based on where you live and the size of your home.

Get Legal And Pre Purchase Property Valuation With Valuations Nsw Property Valuation Divorce Help Family Law

Get Legal And Pre Purchase Property Valuation With Valuations Nsw Property Valuation Divorce Help Family Law

Although property valuations tend to range around 300-600 in high density areas such as capital cities they can.

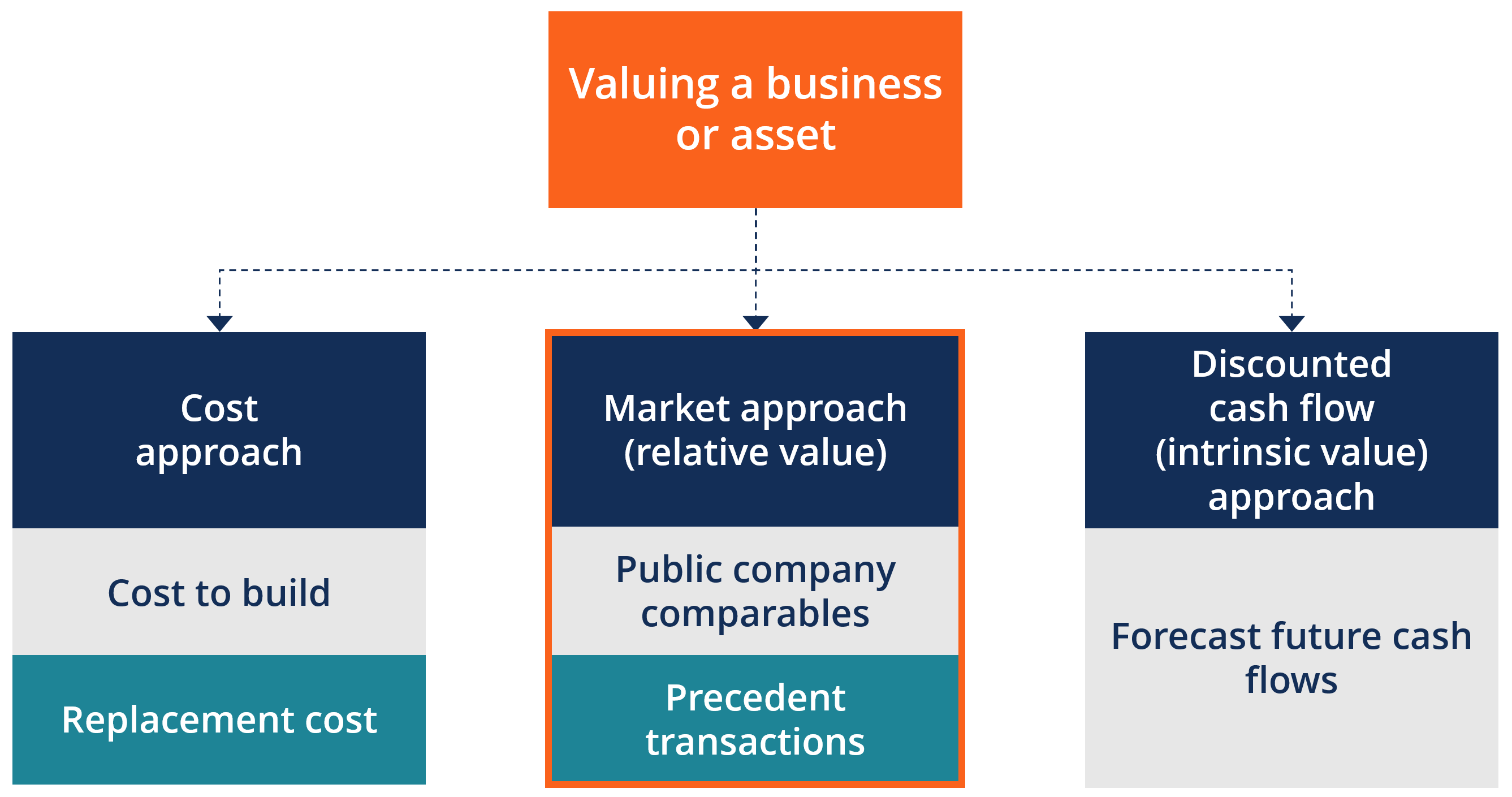

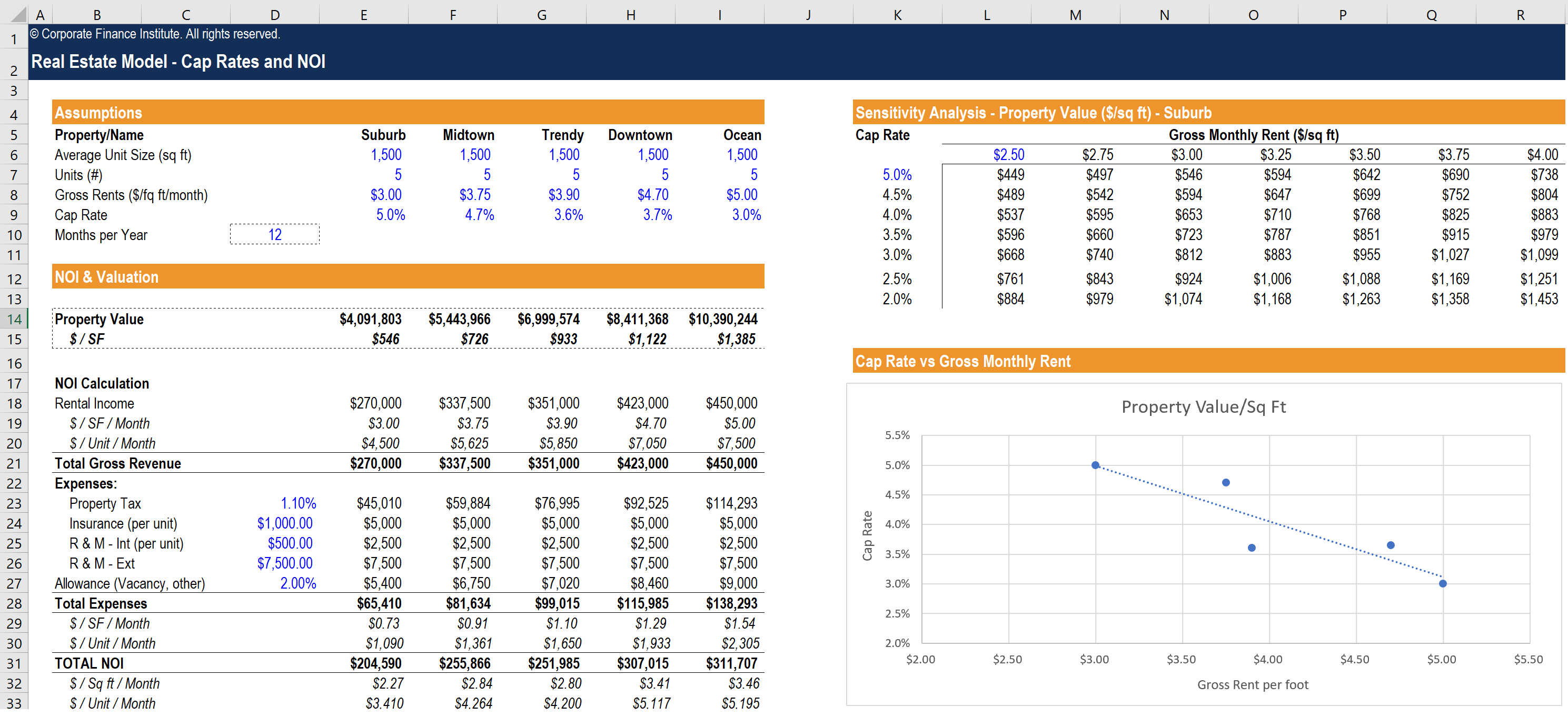

How much does it cost to have a property valued. Specific facts evaluated are operating expenses taxes. Cost Approach considers how much it would cost at current material and labor costs to replace your property and takes into account any applicable depreciation. Typically the cost will be from 3 to 7 of the estate plus various fees.

When buying or selling a property the real estate agent might use a particular appraiser and either add their price to closing costs or get the money upfront. Alternatives to using a pre-appraisal. Valuers rely heavily on comparable sales data to base their.

Income Approach considers the income derived from income producing properties such as rental apartments and warehouses. The cost of a registered property valuation is usually in the range 500-800. The exact cost of a property valuation depends on the size and value of the property and each valuer will also charge slightly different rates for their services.

How much they charge for property valuation. If you choose to seek out the services of a professional probate valuer or solicitor which is highly advisable in all but the most clear-cut of cases most firms will charge up to 5 of the total value of the estate in fees. Also in a single family home the owner pays for the roof painting and other costs that typically are covered by HOA fees in a common interest development so take that into account.

Ive seen estate costs from as little as 5000 to as much as 50000 Reischer says. What is the Reason for the Difference in Price. Still while the market does have an impact a commercial propertys assessed value is based on higher-level market influencers and therefore is less likely to fluctuate year-over-year compared to a market value.

The cost varies depending on the lender and is also based on the value and size of the property. Total area of the property. According to data from the National Association of Home Builders the median price of constructing a single-family home is 289415 or 103 per square foot.

Land value is the value of a piece of property that takes into account any improvements that have been made to it and increases as demand for. Assessed property values will also factor much less into property transactions. Your partner also owns a 2000 bike and you guys love brand name stuff.

The assessment ratio is the ratio of the home value as determined by an official appraisal usually completed by a county assessor and the value as determined by the market. So a property valued at 180000 would have 1800 per year or 150 per month in these costs. Just keep in mind that the cost to.

The sales price of a house might be 150000 but the value could be significantly higher or lower. That said the majority of valuations will cost somewhere between 300 and 600 and most valuers will provide the customer with a standard three-page report of their findings within two or three days of their visit. The amount youd want in personal property coverage would look something like this.

Many things can impact this such as the condition age size and type of property. Lets say youre a college student you probably think you dont have so much stuff. It basically based on following criterias Location Estimated value of the property vacant land unit multi tenanted etc Purpose of the valuation Type of property to be valuated.

Getting Quotes Estimates for a Survey. Property valuations vary in price so it is important to do your research before choosing someone to do your property valuation for you. While cost and price can affect value they do not determine value.

The sole aim of the mortgage valuation is to satisfy the lender that your desired property is worth the price youre paying. So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000. This question depends very much on whether you choose to carry out the valuation yourself or bring in professional help.

These are the basic criterias on which the cost of property valuation depends. Costs for a house valuation can vary and often depend on many things including size of the property as well as location. Often the most expensive property to value will be an unusual one - it may not be big or grand just unique.

1500 1500 5000 2000 15000 2 40000. Typically the fee is between 150 to 1500.

How Much You Need To Pay For A Property Appraisal Property Valuation Appraisal Home Appraisal

How Much You Need To Pay For A Property Appraisal Property Valuation Appraisal Home Appraisal

3 Main Property Valuation Methods For Real Estate Investors Mashvisor

3 Main Property Valuation Methods For Real Estate Investors Mashvisor

Cost Approach Real Estate Overview How To Calculate Limitations

Cost Approach Real Estate Overview How To Calculate Limitations

Methods To Calculate Land And Property Value Housing News

Methods To Calculate Land And Property Value Housing News

What Is Property Valuation And How To Calculate It Realestate Com Au

What Is Property Valuation And How To Calculate It Realestate Com Au

Market Approach Methods Uses Advantages And Disadvantages

Market Approach Methods Uses Advantages And Disadvantages

Valuation Process Is The Way To Find Out The Value Of Your Property And West Coast Valuers Make This Process Very E Property Valuation How To Find Out Property

Valuation Process Is The Way To Find Out The Value Of Your Property And West Coast Valuers Make This Process Very E Property Valuation How To Find Out Property

Methods To Calculate Land And Property Value Housing News

Methods To Calculate Land And Property Value Housing News

10 Awesome Websites Who Let You Check Your Home S Value For Free

10 Awesome Websites Who Let You Check Your Home S Value For Free

How To Value Your Own Property Yopa Homeowners Hub

How To Value Your Own Property Yopa Homeowners Hub

What Is Property Valuation And How To Calculate It Realestate Com Au

What Is Property Valuation And How To Calculate It Realestate Com Au

Property Valuation Melbourne Property Valuation Property Do You Work

Property Valuation Melbourne Property Valuation Property Do You Work

How To Find Fair Market Value Of Property As Per Income Tax Laws

How To Find Fair Market Value Of Property As Per Income Tax Laws

10 Awesome Websites Who Let You Check Your Home S Value For Free

10 Awesome Websites Who Let You Check Your Home S Value For Free

Property Valuations Sydney Property Valuation Home Values Do You Work

Property Valuations Sydney Property Valuation Home Values Do You Work

10 Awesome Websites Who Let You Check Your Home S Value For Free

10 Awesome Websites Who Let You Check Your Home S Value For Free

Benefits Of Investing In Real Estate Property Property Valuation Real Estate Investing Property

Benefits Of Investing In Real Estate Property Property Valuation Real Estate Investing Property

How To Value Your Own Property Yopa Homeowners Hub

How To Value Your Own Property Yopa Homeowners Hub

Foundations Of Real Estate Financial Modeling What You Need To Know

Foundations Of Real Estate Financial Modeling What You Need To Know

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home