How To Look Up A Tax Levy

Contact the IRS immediately to resolve your tax liability and request a levy release. Credit reporting agencies may find the Notice of Federal Tax Lien and include it in your credit report.

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

By opting-out of this tracking you may still see Intuit advertisements but they may not be tailored to your interests.

How to look up a tax levy. The Internal Revenue Code IRC authorizes levies to collect delinquent tax. Current My Tax Account User. To resolve a levy you will need to call us at 518-457-5893 during regular business hours and speak with a representative.

How do I start. For a complete list visit the New York Civil Practice Law and Rules CPLR Article 52. To learn more about liens see Understanding a Federal Tax Lien.

A levy is a legal seizure of your property to satisfy a tax debt. A tax levy can include penalties such as garnishing wages or seizing assets and bank accounts. SITLP matches federal tax delinquent accounts against a database of state tax refunds for states participating in.

Levy action isnt taken until all reasonable efforts have been made to contact you and allow for voluntary resolution of your debt. Currently this only applies to individual state tax refunds but may include business state tax refunds in the future. To request the release of a levy due to a coronavirus hardship please contact your revenue officer point of contact or fax 855-796-4524 following these instructions.

Register as a new user in My Tax Account and create your profile. Request access to the e-Levy account using the e-Levy User Access Form. Where does Internal Revenue Service IRS authority to levy originate.

Some of the most common strategies include. The Department may serve a levy against your financial institution banks credit unions brokerage firms etc which requires your financial institution to send any funds being held to the Department up to the total past due tax penalty and interest amount. A tax levy is the seizure of property to pay taxes owed.

Levy Search Search levy orders from oldest to newest or use our filters to find a specific levy. The State Income Tax Levy Program SITLP is an automated levy program administered by the IRS that uses state tax refunds as the levy source. When a levy is issued against a taxpayer typically due to failure to collect on unpaid debt the IRS is legally allowed to seize assets including individual wages bank accounts social security benefits retirement income and personal property like cars boats and real estate.

The IRS can require your bank to prevent withdrawals from your account for 21 days and then withdraw funds from your. A levy is a legal seizure of a taxpayers property to satisfy a tax debt. For example in California federal tax liens are filed with the County Clerk Recorder.

If we levy your salary or wages contact the person listed on the Notice of Levy for assistance or call the phone number on the notice. You may appeal before or after the IRS places a levy on your wages bank account or other property. The IRS can also release a levy if it determines that the levy is causing an immediate economic hardship.

Renewal of the EMS regular property tax levy at a rate of 02651000 for the first year of the six-year levy an increase in rate of. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to satisfy the tax debt. An IRS levy is not a public record and should not affect your credit report.

The Internal Revenue Code authorizes the Internal Revenue Service IRS to collect federal tax liabilities by levying on property and rights to property of taxpayers who refuse to pay their liabilities. We leverage outside service providers who assist us with our marketing and advertising activities. What is a tax levy.

Tax levies can collect funds in several different ways including taking funds from your bank account or garnishing your wages. The e-Levy User Guide provides step-by-step instructions. Be sure to enter your taxpayer.

A tax levy is a procedure that the IRS and local governments use to collect money that you owe. You need a taxpayers name and the year of the lien. If the IRS denies your request to release the levy you may appeal this decision.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. The Notice of Levy is sent to you at your last known address. It can garnish wages take money in your bank or other financial account seize and sell your vehicle s real estate and other personal property.

The Sacramento County office offers an online index of documents recorded in that county so that you can verify the existence of a lien. A number of levies and other property tax measures were approved by voters in 2019 for collection in 2020. Levies are different from liens.

Under the State Income Tax Levy Program we may levy take your state tax refund. 2020 levy real estate taxes Installment 1A - June 3 2021 Installment 1B - August 3 2021 Penalty for late payment on the 1st installment will accrue on August 4 2021.

Understanding How To Stop An Irs Tax Levy Irs Taxes Irs Irs Problems

Understanding How To Stop An Irs Tax Levy Irs Taxes Irs Irs Problems

Stop Irs Tax Lien Or Levy And Beat Home Foreclosure Legally Irs Taxes Foreclosures Irs

Stop Irs Tax Lien Or Levy And Beat Home Foreclosure Legally Irs Taxes Foreclosures Irs

Capital Gains Tax Spreadsheet Australia Excel Spreadsheets Templates Capital Gains Tax Spreadsheet Template

Capital Gains Tax Spreadsheet Australia Excel Spreadsheets Templates Capital Gains Tax Spreadsheet Template

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

National Internet Tax Solutions Solutions National Internet

National Internet Tax Solutions Solutions National Internet

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

The Irs Issues Millions Of Tax Levy Notices Every Year A Levy Is A Legal Seizure Of Your Property To Satisfy A Tax Debt Levies Tax Debt Irs Taxes Tax Help

The Irs Issues Millions Of Tax Levy Notices Every Year A Levy Is A Legal Seizure Of Your Property To Satisfy A Tax Debt Levies Tax Debt Irs Taxes Tax Help

Tax Lien Help Greensboro Ga 30642 M M Financial Blog Debt Relief Programs Irs Taxes Tax Debt Relief

Tax Lien Help Greensboro Ga 30642 M M Financial Blog Debt Relief Programs Irs Taxes Tax Debt Relief

Irs Tax Relief Irs Tax Attorneys Offer In Compromise Settlements Irs Tax Relief What Is A Tax Levy Irs Taxes Debt Relief Programs Tax Attorney

Irs Tax Relief Irs Tax Attorneys Offer In Compromise Settlements Irs Tax Relief What Is A Tax Levy Irs Taxes Debt Relief Programs Tax Attorney

As You Can See Releasing A Tax Lien Has A Multitude Of Nuances And Variables To Consider The Actions And Strategies Are Dependent Tax Debt Debt Debt Reduction

As You Can See Releasing A Tax Lien Has A Multitude Of Nuances And Variables To Consider The Actions And Strategies Are Dependent Tax Debt Debt Debt Reduction

Irstaxdebtresolution Tax Problems Merit Professional Help When Individuals Cannot Pay Tax Liabilities Of 10 000 Or More T Irs Taxes Tax Debt Tax Relief Help

Irstaxdebtresolution Tax Problems Merit Professional Help When Individuals Cannot Pay Tax Liabilities Of 10 000 Or More T Irs Taxes Tax Debt Tax Relief Help

Tax Relief Help Tax Relief Help Irs Taxes Debt Relief Programs

Tax Relief Help Tax Relief Help Irs Taxes Debt Relief Programs

Small Business Owners Did You Know Wave Small Business Software Bookkeeping Business Small Business Tax Small Business Organization

Small Business Owners Did You Know Wave Small Business Software Bookkeeping Business Small Business Tax Small Business Organization

Taxes And Import Charges Sales Tax State Tax Tax Advisor

Taxes And Import Charges Sales Tax State Tax Tax Advisor

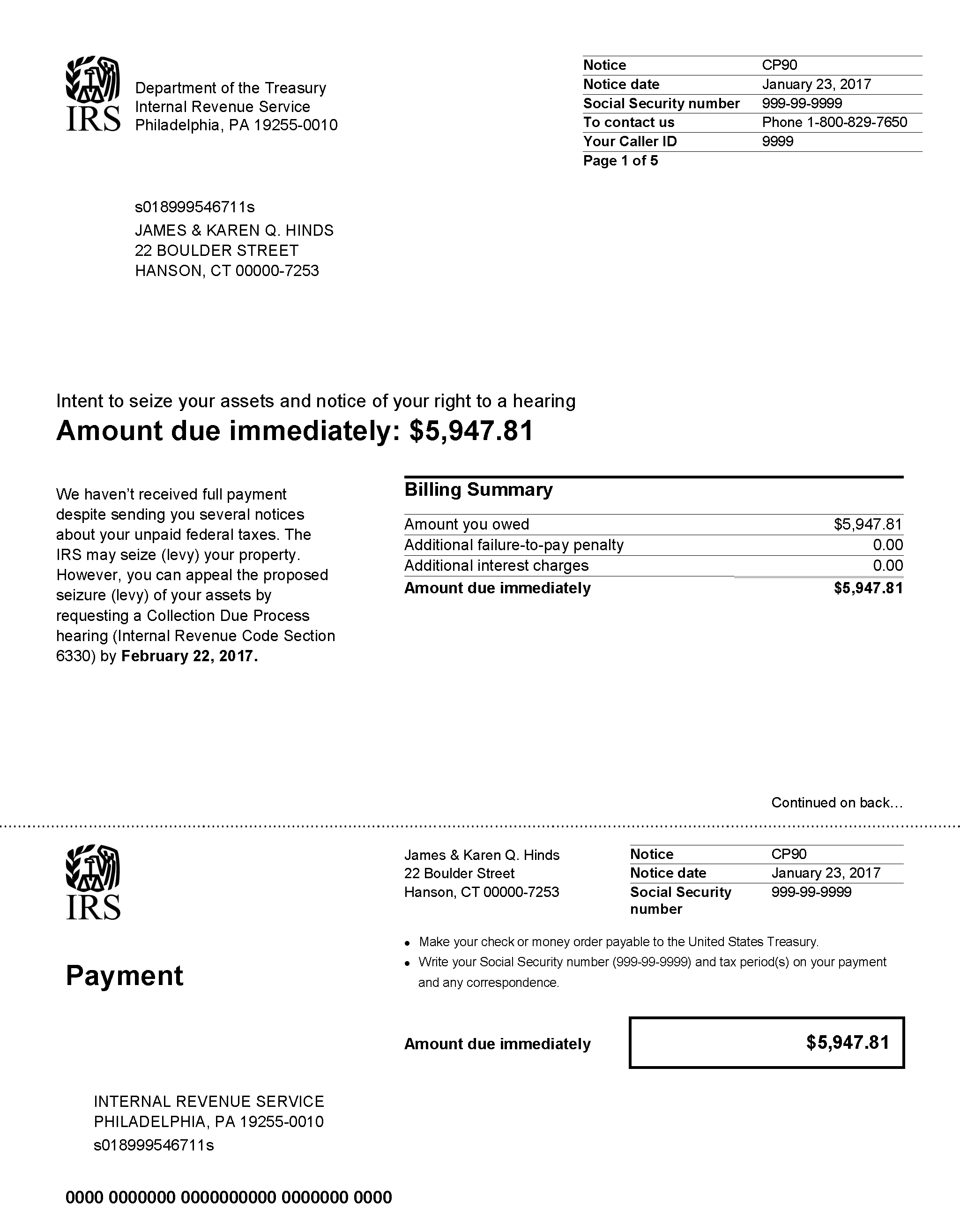

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

Houston Tx Taxation Just Reading The Word Makes You Yawn Doesn T It But Wait Till You Read About Tax Levy Tax Consulting Words Relief

Houston Tx Taxation Just Reading The Word Makes You Yawn Doesn T It But Wait Till You Read About Tax Levy Tax Consulting Words Relief

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Overdue Taxes

The Irs Notice 1058 Is The Irs Telling You Their About To Levy Your Bank Account S If You Ve Gotten This Letter I Letter Templates Lettering How To Find Out

The Irs Notice 1058 Is The Irs Telling You Their About To Levy Your Bank Account S If You Ve Gotten This Letter I Letter Templates Lettering How To Find Out

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home