Queens County Property Tax Bill

If you pay your taxes online or by phone a convenience fee is charged in addition to the property tax amount paid. Payments may be made to the county tax collector or treasurer instead of the assessor.

Https Www Osc State Ny Us Files Local Government Documents Pdf 2020 07 Property Tax Exemptions Pdf

Property Business Excise Tax Professionals Forms Select Tax Bills and Payments Data and Lot Information Dividing Merging Lots Assessments Tax Rates Guides.

Queens county property tax bill. Find a Property Borough Block and Lot BBL or Address. HST is not applicable on property taxes. Property Tax Bills Bills are generally mailed and posted on our website about a month before your taxes are due.

Property tax bill for 712020 to 6302021. Tax Rates Property taxes in the Region of Queens are calculated by applying the applicable tax rate to every 100 in assessed property value. Create Cover Pages and Tax Forms to Record Documents.

The real property tax rate for fiscal year 2021 covering the period of July 1 2020 to June 30 2021 is 08471 per 100 of assessed value. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. Credit and debit cards.

Property tax bills and. 025 discount on the last three quarters if you wait until October to pay the entire amount due for the year. Paying Your Property Tax The Queens County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan.

Bills are generally mailed and posted on our website about a month before your taxes are due. You will receive a transaction number when you finish see disclaimer. The median property tax in Queens County New York is 2914 per year for a home worth the median value of 479300.

Queens County collects on average 061 of a propertys assessed fair market value as property tax. On your tax bill you will see 1 Maximum Levy listed with the other individually identified charges for voter-approved debt. View your property tax bills annual notices of property value NOPV and other important statements.

Tax bill calendars differ in some downstate counties as well as some cities. Tax Payment Online System User Guide PDF Real Property Tax Payment System Fees. Use our property tax estimator to calculate the tax owed.

05 Central County Chester Grasonville Queenstown 06 Central - East County Queen Anne Ruthsburg 07 Northwest County Chestertown Crumpton Millington Property Account Code. The Automated City Register Information System ACRIS allows you to search property records and view document images for Manhattan Queens Bronx and Brooklyn from 1966 to the present. 244 Fair Street PO Box 1800 Kingston NY 12401 Phone.

05 on the full amount of your yearly property tax if you pay the full years worth of tax shown on your bill by the July due date or grace period due date. The assessed value is determined by an independent organization the Property Valuation Services Corporation a company that performs the valuation services for all properties in Nova Scotia. View or Pay Your Tax Bill - Youll need either the Parcel ID 8 digits Bill Number 8 digits or the Property Address.

Property Tax Estimator XLSX To find out about any potential homestead tax credits please call the State Department of Assessments and Taxation at 410-819-4160. In most communities the second bill arrives in early January and is for county and town taxes as well as other special district charges. Estimated property tax bill for 712021 to 6302022.

These records can include Queens County property tax assessments and assessment challenges appraisals and income taxes. If your propertys Assessed Value is. We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance.

Simply begin by searching for a property by address or borough-block-lot BBL number. If a bank or mortgage company pays your property taxes they will receive your property tax bill. Rather than receiving tax bills those who have their property taxes held in escrow receive receipts.

Email or call 410-758-0414 ext. Apply for tax exemptions and see which exemptions you already receive. 1804999999 Serial Number of Property within District.

Compute Property Transfer Taxes. The mission of Ulster County Real Property Tax Service Agency is to provide local and state government officials as well as the public with comprehensive accurate and reliable real property information assessment data property tax data. Tracey Williams Director.

If you have any questions contact us. Convenience fees are paid to the service provider not San Joaquin County. When searching for Unsecured taxes use the ASSESSMENT NUMBER.

Queens County has one of the highest median property taxes in the United States and is ranked 171st of the 3143 counties in order of median property taxes. The median property tax in Queens County New York is 291400 All of the Queens County information on this page has been verified and checked for accuracy. Not collected by the County and will appear as a second charge on your statement.

If any of the links or phone numbers provided no longer work please let us know and we will update this page. Queens County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Queens County New York.

The Red Cross Secret Disaster Propublica Red Cross Secret Disasters

The Red Cross Secret Disaster Propublica Red Cross Secret Disasters

Cpa For Freelancers And The Self Employed In Nyc Small Business Cpa Manhattan Cpa Self Employed Nyc Cpa Income Tax Return Accounting Services Income Tax

Cpa For Freelancers And The Self Employed In Nyc Small Business Cpa Manhattan Cpa Self Employed Nyc Cpa Income Tax Return Accounting Services Income Tax

Queens Property Tax Records Queens Property Taxes Ny

Queens Property Tax Records Queens Property Taxes Ny

Pwrdbyyt Black Png 670 179 Secondary School High School Fun Health Science

Pwrdbyyt Black Png 670 179 Secondary School High School Fun Health Science

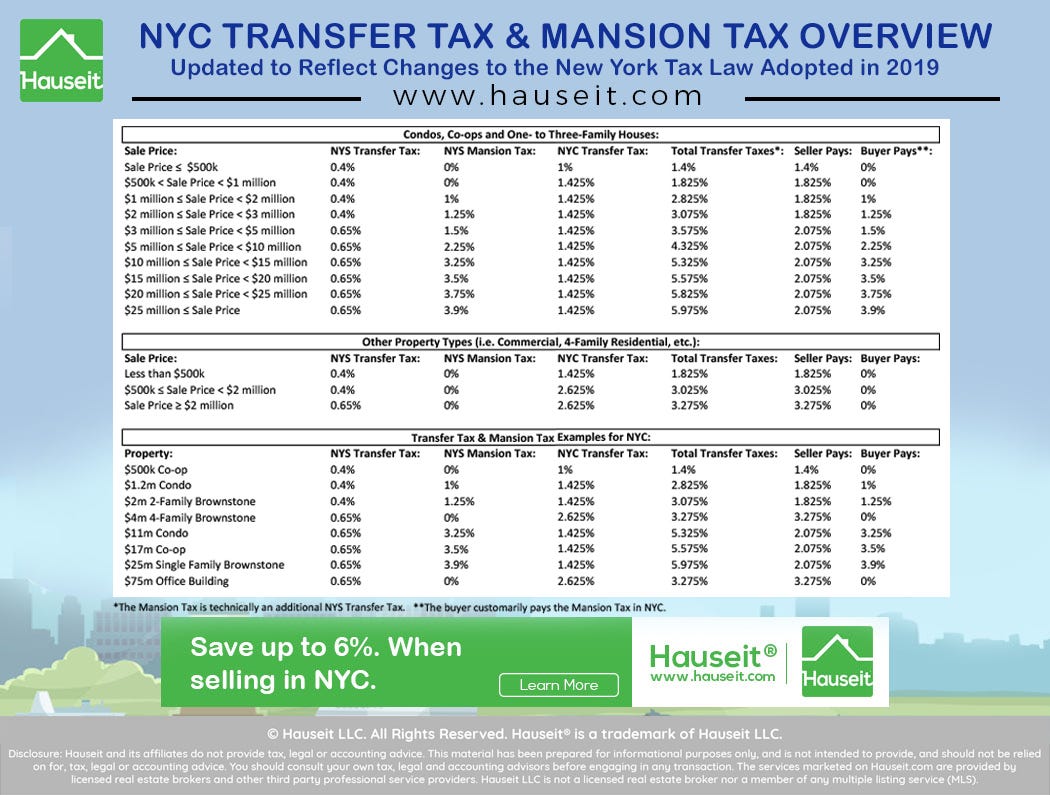

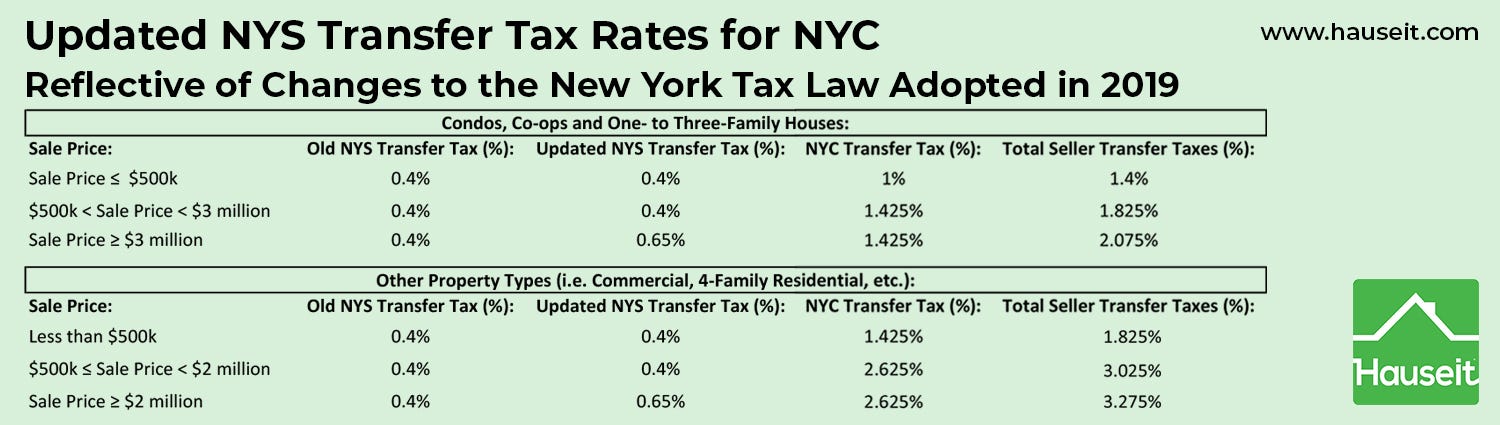

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

Property Valuation Service West Kenya Real Estate Property Letting Property Management And Sales Property Valuation Property Rental Property Management

Property Valuation Service West Kenya Real Estate Property Letting Property Management And Sales Property Valuation Property Rental Property Management

Rhoa S Kenya Moore Atlanta Home Up For Auction Due To Unpaid Tax Bill Kenya Moore Housewives Of Atlanta Real Housewives

Rhoa S Kenya Moore Atlanta Home Up For Auction Due To Unpaid Tax Bill Kenya Moore Housewives Of Atlanta Real Housewives

Connetquot River State Park Preserve Suffolk County Ny New York State Parks State Parks Suffolk County

Connetquot River State Park Preserve Suffolk County Ny New York State Parks State Parks Suffolk County

Nyc Real Estate Buyers Agent Duties Hauseit Real Estate Buyers Agent Real Estate Buyers Nyc Real Estate

Nyc Real Estate Buyers Agent Duties Hauseit Real Estate Buyers Agent Real Estate Buyers Nyc Real Estate

Not Having A Buyers Agent Nyc Hauseit Nyc Buyers Agent Buyers

Not Having A Buyers Agent Nyc Hauseit Nyc Buyers Agent Buyers

What Is An Open House By Appointment Only In Nyc Hauseit Open House Appointments House

What Is An Open House By Appointment Only In Nyc Hauseit Open House Appointments House

Construction Accident Lawyer Queens Law Firm Personal Injury Attorney Injury Attorney

Construction Accident Lawyer Queens Law Firm Personal Injury Attorney Injury Attorney

Motor Vehicle Accident Attorney Bronx Motor Car Accident Attorney Car Accident

Motor Vehicle Accident Attorney Bronx Motor Car Accident Attorney Car Accident

Queens Property Tax Records Queens Property Taxes Ny

Queens Property Tax Records Queens Property Taxes Ny

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home