Jackson County Business Personal Property Tax

There are public meetings you can attend and voice. Taxes are assessed on personal property owned on January 1 but taxes are not billed until November of the same year.

Printable Sample Power Of Attorney Form Power Of Attorney Form Power Of Attorney Legal Forms

Printable Sample Power Of Attorney Form Power Of Attorney Form Power Of Attorney Legal Forms

2nd Half Taxes due postmarked by May 10th 2020.

Jackson county business personal property tax. Doing Business with Jackson County. When can I appeal my business personal property value. 400 New York Avenue Courthouse - Room 206 Holton Kansas 66436.

A penalty of 10 of the assessed value will be assessed on all property owners that do not return a rendition by April 1 as mandated by State law. Taxable Business Personal Property includes but is not limited to. A postcard reminder will be mailed in March 2021 as a final notification to each account holder to declare their business items.

Be involved with the budget process. Property Tax Search Bills and Receipts Property Tax Property Information. Household personal property if used for personal use is not taxed.

Taxes not paid in full on or before December 31 will accrue interest penalties and fees. Development Codes Manuals. 2 if paid in January.

Bills are generally mailed and posted on our website about a month before your taxes are due. Personal Property Business Business personal property refers to furniture fixtures machinery equipment and inventory located within businesses. Jackson County Properties for Sale.

Personal Property Personal property includes furniture fixtures equipment and machinery used in the operation of a. The purpose of this page is to familiarize business owners with the Personal Property tax. The appraisal of personal property is based on replacement cost new less depreciation.

County Treasurer Linda Gerhardt. The first deadline for your Business Personal Property Declaration to be completed and returned to the Jackson County Assessment Department. Taxes become delinquent April 1 of each year at which time a 15 penalty per month 18 per year is added to the bill.

Register of Deeds Search. Paying taxes online takes just a few minutes. Within 45 days after the Personal Property Tax becomes delinquent a list of delinquent tangible personal property taxpayers will be advertised once in a local newspaper.

Please contact PayIt Customer Support at. BusinessPersonalReal Property Tax Forms. If you obtain a 2 year license plate with the State you are still responsible to pay personal property tax each year by December 31 or interest and penalty will be applied to your account.

You can pre-pay what you owe for the next payment period. All business owners are required to file a rendition by April 1 each year. The Jackson County Code contains the law of the county relating to county finances planning and zoning petty offenses construction of buildings and park operations among many other subjects.

Online Property Tax Payments Now Available - 1st Half Taxes due postmarked by December 20th 2019. The cost of the advertisement will be added to. Property Tax payments can also be made in person at any of our Business Centers.

B If you have moved into Jackson County and have not established an account with the Assessment Department please contact the Business Personal property section at 816-881-4672 to enquire about an account on the Jackson County tax roll. Your September 2011 school taxes and January 2012 towncounty taxes are based on the value of your home. Timber TaxHeavy Duty Equipment Timber tax and Heavy Duty equipment may be paid directly to this office.

This is the place to be if you need information regarding a wide variety of county issues. If a bank or mortgage company pays your property taxes they will receive your property tax bill. Property Business Excise Tax Professionals Forms.

Its fast and secure. Personal property refers to tax on furniture fixtures tools inventory and equipment used in the operation of a business. 3 if paid in December.

1 if paid in February. If you are concerned with the amount of property taxes being collected in your community you may wish to be involved with the local budgeting processes. You will receive a Property Tax Bill if you pay the taxes yourself and have a balance.

Is there any additional information available about business personal property. We will attempt to explain the function of the Township and City Treasurers and Assessors Offices in the administration of the tax. Your appeal must be made to Jackson County Tax Assessor.

Find out how taxes are calculated how to pay them and what other fees are involved. 105-3171 you may appeal your business personal property value within 30 days of the bill date. Personal property is assessed at 15 of appraised value.

ORS 308290 January 2016 - New Legislature becomes effective - NO BUSINESS PERSONAL. Inventory supplies movable furniture fixtures equipment leasehold improvements rental furnishings and other personal property used by business and industry. Multiply the assessed value 1000000 by the appropriate millage rate 32 mills to determine taxes owed 1000000 X 032 32000.

Personal Property Tax - A Yearly Tax Personal property tax is paid to Jackson County by December 31 of every year on every vehicle you owned on January 1. 2021 Business Personal Property Declarations were mailed on January 4 2021. This is before any exemptions have been applied.

Taxes are due for the entire amount assessed and billed regardless if property is no longer owned or has been moved from Jackson County. You will get a discount if you pay your property taxes for the entire tax year in advance. For example an owner occupied residence valued at 10000000 would have an assessed value of 10 1000000.

Florida Property Tax H R Block

Florida Property Tax H R Block

Jackson Howard Whatley Cpas A Professional Tax And Accounting Firm In Vestavia Hills Alabama Splash Page Tax Attorney Accounting Firms Tax

Jackson Howard Whatley Cpas A Professional Tax And Accounting Firm In Vestavia Hills Alabama Splash Page Tax Attorney Accounting Firms Tax

Download Print Tax Receipt Clay County Missouri Tax

Download Print Tax Receipt Clay County Missouri Tax

Https Www Jacksongov Org Documentcenter View 118 Business Personal Property Tax Exemption 2021 Application Pdf

Tax Bills Are Being Delivered Jackson County Mo

Proof Your Mortgage Is Paid In Full By Your Signature Mortgage Companies Mortgage Origination Fee

Proof Your Mortgage Is Paid In Full By Your Signature Mortgage Companies Mortgage Origination Fee

Here S How Tennessee S Property Taxes Stack Up Nationwide Nashville Business Journal

Business Property Tax The Ultimate Guide

Business Property Tax The Ultimate Guide

Paying Your Taxes Online Jackson County Mo

Paying Your Taxes Online Jackson County Mo

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Real Property Vs Business Personal Property Poconnor Com

Real Property Vs Business Personal Property Poconnor Com

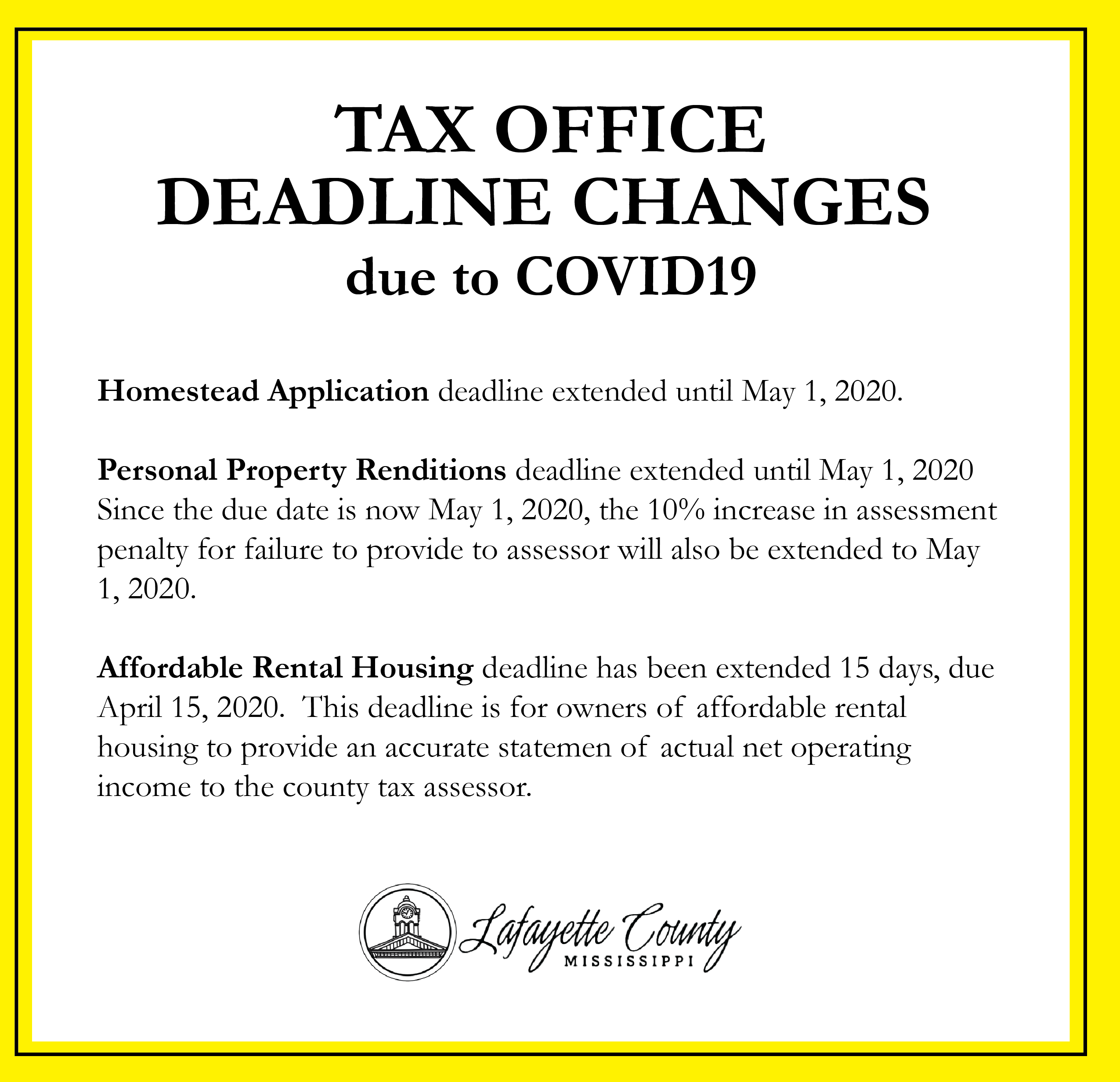

Tax Assessor Collector Lafayette County

Tax Assessor Collector Lafayette County

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home