Can I Get A Copy Of My Property Tax Bill

Search for Property Tax Information. Duplicate Tax Bills Copies of previous up to 5 years and current tax bills can be found on line by going to Account Lookup.

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

In addition you can use our website to look up taxes due request a duplicate bill and look up payment historyPlease CLICK HERE for more information on all payment optionsWe also created a TOP 5 DOs AND DONTS with helpful information on property tax payments including How To Avoid Penalties.

Can i get a copy of my property tax bill. On the City of Milwaukee Property Tax Search screen select the Print Page button to print out a PDF of the. You can request copies of property tax statements from your citytownshipvillagecounty assessors office or their web site. If you have further questions please contact our office at 951955-3900 or e-mail your questions to.

To make property tax information easily accessible Lake County has launched taxlakecountyilgov which combines data from the Treasurer County Clerk and Chief County Assessment Office into one searchable database. The Treasurer and Tax Collector mails Annual Unsecured Property Tax Bills between March 1 and June 30 of each year. Use an e-Check or credit card to make a payment.

Find out if your delinquent taxes have been sold. Search any Lake County property free of charge by entering an address property PIN number or property owner name to view tax bill. The minimum service fee is 149.

Property owners who misplace or who do not receive their bills can download a printable version via the site which also provides detailed account information including payment history and a breakout of specific charges for property school light crossing guard taxes. We do not have tax bills or amounts at this office. The only exception is that a property tax collector may wait to send a bill until the total taxes due for all taxing units the collector serves is 15 or more.

Property Address Address must be entered as it appears on the tax bill Click Search. How can I get a copy of my property tax bill. This search will also include properties that have delinquent property taxes.

Your Property Tax Overview. On a single page you can. Steps to viewprint property tax payment information.

See local governments debt and pensions. Enter the desired mailing address Assessor Parcel Number APN or unsecured property number to display a list of matching or related records. Click on the link for Personal PropertyMVLT and Real Estate.

On the Search Results screen select View Bill for any of the tax levy years shown. Click on the Online Services tab at the top of the website. HOW TO OBTAIN YOUR COPY.

You can always download and print a copy of your Property Tax Bill on this web site. Secured tax bills will be mailed by Oct. If you lost the original bill and are making a payment you can pay electronically or print out and send in the online copy with your tax payment.

Be sure to list your Roll Year and Bill Number and use the phrase Copy of Original Unsecured Bill in the subject line of the. On the Real Estate screen that appears next select Property Tax Report located on the right margin. You will need to contact the Denton County Tax Office.

Death Certificates Maps Ordinances Property Tax Bill Property Tax Rate Public Information Records Real Estate Records Sex Offender List. Enter your parcel number name or street name to view your invoice. If you do not receive your Unsecured Property Tax Bill by July 15 you may email us at unsecuredpaymentsttclacountygov.

1099 Tax Form for Vendors Adoption Records Arrest Records Auction Book for Delinquent Properties Audit Reports Birth Certificates Coroners Report County Publications Court Records. After you make an online payment it can take up to five business days for your tax bill to be updated with your new balance. For more information on how you may obtain a copy of an Unsecured Property Tax Bill from the Treasurer and Tax Collector please visit httpsttclacountygovrequest-duplicate-bill-unsecured.

The Treasurer and Tax Collectors website provides current year unsecured tax amounts. You do not need to request a duplicate bill. Download a copy of your tax bill.

Taxpayers may also call our office 925-957-5280 andor email Tax Information us to request a duplicate tax bill. If your tax bills are paid by a mortgage company or bank you are still responsible to make sure the bill is paid. When the results are returned click the Property Control Number to view andor pay.

The Department of Local Government Finance has compiled this information in an easy-to-use format to assist Hoosiers in obtaining information about property taxes. 940349-3500 or metro 972434-8835. Current Year Unsecured Taxes Online.

See if a refund is available. Click Get Started button above or. Sign up to receive tax bills by email.

I Want To Get A Copy Of. Tax Bill Search The information provided in these databases is public record and available through public information requests. A property owner may file a written request with the collector that a tax bill not be sent until the total amount of taxes due on the property is 15 or more.

Select the Tax Bill Payment option which is the 6 th option.

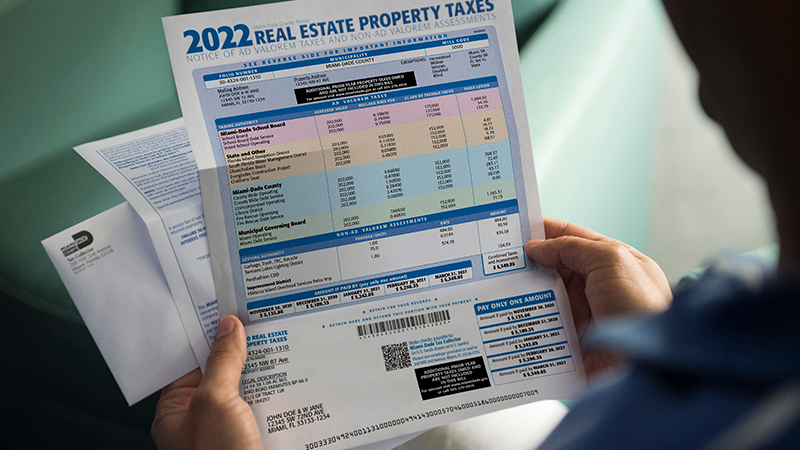

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Pay Your Property Tax Bill Online

Pay Your Property Tax Bill Online

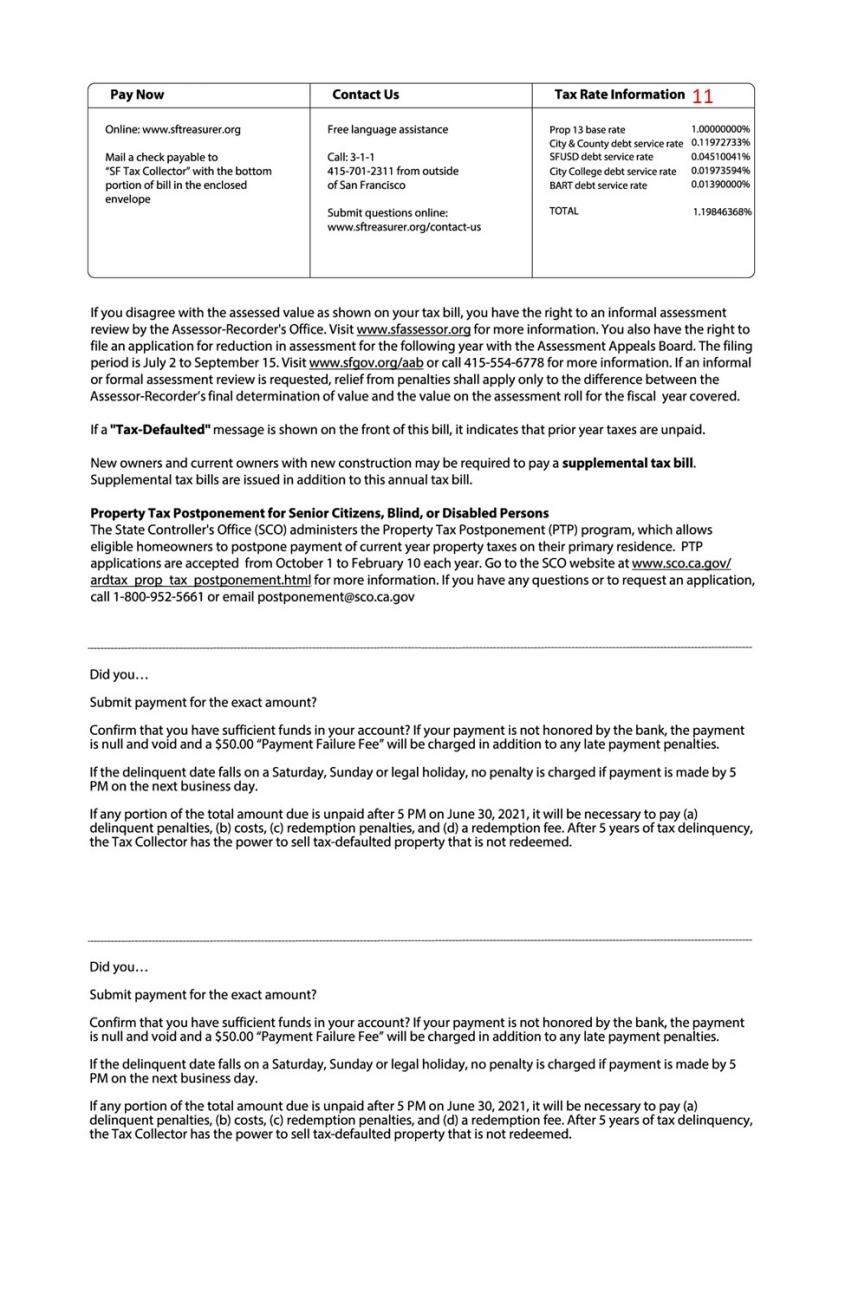

Understanding Property Tax In California Property Tax Tax Understanding

Understanding Property Tax In California Property Tax Tax Understanding

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Why Did My Property Tax Bill Increase So Dramatically Property Tax Estate Tax Tax

Why Did My Property Tax Bill Increase So Dramatically Property Tax Estate Tax Tax

Search Unsecured Property Taxes

Search Unsecured Property Taxes

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

Current Payment Status Lake County Il

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home