Can You Defer Property Taxes In Alberta

In 2013 Alberta started offering property tax deferral to individuals over age 65. It is used to pay for city services such as police the fire department and public transit as well as elementary and secondary education.

Alberta Government On Twitter During A Pandemic Ab Households Businesses Shouldn T Need To Worry About Paying Additional Property Taxes We Will Freeze Residential Education Property Tax Rates At 2019 Levels

Alberta Government On Twitter During A Pandemic Ab Households Businesses Shouldn T Need To Worry About Paying Additional Property Taxes We Will Freeze Residential Education Property Tax Rates At 2019 Levels

The program will pay the property taxes to your municipality on your behalf.

Can you defer property taxes in alberta. The CRA can charge capital gains tax on anything you sell that makes a profit including stocks bonds real estate investments and other assets most retirement accounts in Canada however allow you to defer paying taxes on gains until you actually withdraw the money you made. The interest rate is reviewed and adjusted every April and October. WHEREAS deferral of property taxes can assist certain homeowners in managing the costs of home ownership and in remaining in their own homes WHEREAS section 347 1 c of the Alberta Municipal Government Act prescribes that a municipal council may defer.

The Seniors Property Tax Deferral Program SPTDP allows eligible senior homeowners. It is based on the assessed value of a property. Some financial institutions will process payments at a teller only if their clients have been set up for online banking.

The greater your municipal tax rate is versus. You can pay taxes in full through your mortgage company. However some states have programs that allow seniors to defer their property tax payments in order to allow more financial flexibility for Americans on a fixed income which can also include veterans the disabled and those who have lost a spouse.

Property tax is calculated and billed annually using the pr opertys assessed value as found on your property assessment notice and the Council-approve d property tax rate. Sold your home and looking for a new mortgage. Before making a payment in person at your bank confirm that your bank accepts in-person paper payments using the remittance portion of your property tax notice.

Property Tax in Alberta. You may apply for a seniors property tax deferral loan to defer payment of residential. In person at your financial institution.

You repay the loan with interest when you sell your. The Seniors Property Tax Deferral program allows you to defer all or part of your property taxes through a low-interest home equity loan with the Alberta government. The province offers a low-interest home equity loan 258 to those who qualify.

Y ou dont meet ALL program qualifications Your current year property taxes have already been paid in full You have overdue property taxes. The Seniors Property Tax Deferral Program allows eligible senior homeowners to voluntarily defer all or part of their residential property taxes including the education tax portion. The conditions under which you can defer taxes on the sale of a rental property You must figure out your cost basis.

Read our Property Tax Frequently Asked Questions. To defer all or part of their annual residential property taxes through a low-interest home equity loan with the Government of Alberta. Do you have questions about your property taxes.

According to data from MoneyTalksNews the 12 states with property tax deferral programs are. The loans are repaid when the home is sold or sooner if the senior chooses. This is a voluntary program for which senior homeowners can apply.

You cannot defer your property taxes if. The Seniors Property Tax Deferral Program allows you to defer all or part of your residential property taxes through a low-interest home equity loan with the Government of Alberta. Through the Seniors Property Tax Deferral Program senior homeowners can defer all or part of their residential property taxes through a low-interest home equity loan with the Alberta government.

Municipal and education property taxes must defer the appropriate number of months to ensure the deferral benefit is equal to or greater than a six-month deferral of education property tax. If you qualify Seniors Property Tax Deferral Program will pay your residential property taxes directly to your. This will depend on the ratio between your municipal property tax rate and your local education property tax rate.

If you own a property you will have to pay property tax. Any calculations generated do not represent approval of your application and the Government of Alberta is not bound by any estimates generated. The interest rate is subject to change.

This is done through a low-interest home equity loan with the Government of Alberta. What you spent to buy the house what you spent on. Property tax is a tax on land and property.

The six-month deferral begins April 1. Applicants must meet all eligibility requirements as prescribed in the Seniors Property Tax Deferral Act and the Seniors Property Tax Deferral Regulation.

Canadian Property Tax Rate Benchmark Report 2020 Altus Group

Canadian Property Tax Rate Benchmark Report 2020 Altus Group

What Motor Vehicle Expenses Can You Claim On Income Tax In Canada Income Tax Motor Car Tax Prep

What Motor Vehicle Expenses Can You Claim On Income Tax In Canada Income Tax Motor Car Tax Prep

How Your Property Taxes Are Calculated

How Your Property Taxes Are Calculated

Coronavirus Canada Property Tax Deferrals By City Creditcardgenius

Coronavirus Canada Property Tax Deferrals By City Creditcardgenius

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Taxation Assessment The Town Of Edson

Taxation Assessment The Town Of Edson

Income Tax Deferral Strategies For Real Estate Investors Advisors To The Ultra Affluent Groco

Income Tax Deferral Strategies For Real Estate Investors Advisors To The Ultra Affluent Groco

Guide Property Tax Updates For The Covid 19 Pandemic Our Commercial Real Estate Services Altus Group

Guide Property Tax Updates For The Covid 19 Pandemic Our Commercial Real Estate Services Altus Group

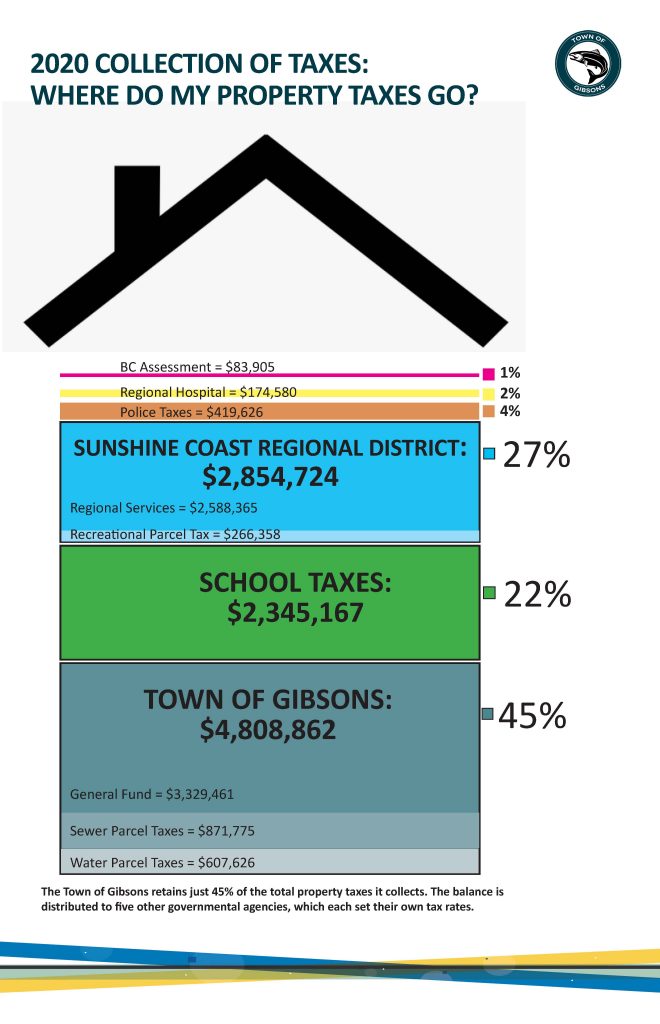

Property Taxes Town Of Gibsons

Property Taxes Town Of Gibsons

Here S How Mississauga S Property Taxes Compare To Other Ontario Cities Insauga Com

Canadian Property Tax Rate Benchmark Report 2020 Altus Group

Canadian Property Tax Rate Benchmark Report 2020 Altus Group

Taxing Property Instead Of Income In B C

Taxing Property Instead Of Income In B C

Statistics Canada Property Taxes

Statistics Canada Property Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home