Pay Personal Property Tax Online Missouri Jackson County

Taxes paid online after the website reopens in 2021 will accrue interest penalties and fees pursuant to Missouri. To save time and avoid crowds online payment is encouraged.

Assessment Notices Jackson County Mo

Pay online using e-check 150 fee or credit card fee of about 25 percent of the total amount due.

Pay personal property tax online missouri jackson county. Click the Real Estate button to pay Real Estate Taxes. An official app of Jackson County Missouri. I signed in as a guest will I be able to find my receipt later.

Interest penalties and fees will accrue if payment is late. We currently accept payment with E-Check Discover MasterCard American Express or Visa credit card. To be timely payment of 2020 property taxes must be received or postmarked no later than December 31 2020.

Well help you quickly pay property taxes schedule payments find receipts and more. Payments made on this site are posted based on the online payment transaction datetime. Visa MasterCard Discover AmEx and e-check are accepted.

To allow online renewal of your vehicle registration at the DOR website Jackson County provides the DOR with paid personal property tax information for the last two tax years electronically every business day. Wall Street Harrisonville Missouri 64701. Pay your property taxes or schedule future payments.

Pay-by-Phone IVR 1-866-257-2055. Find your personal property tax information. Make a Personal Income Tax Estimated Payment MO-1040ES.

Go to myJacksonCounty myJacksonCounty. An official app of Jackson County Missouri. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax.

Click Here for Online Payment The confirmation you receive is not a paid receipt. Search Personal Property Tax Info. Personal Property Business Business personal property refers to furniture fixtures machinery equipment and inventory located within businesses.

Receipts Receipts Todays Receipt How will I get the receipt for my payment. Welcome to the Platte County Tax Collector ePayment Service. COVID-19 INFO Jackson County Services related to COVID-19.

This site was created to give taxpayers the opportunity to pay taxes online. Pay Individual Income Taxes Online. On December 31 2020.

Find and link your properties through a simple search. The Missouri Department of Revenue accepts online payments including extension and estimated tax payments using a credit card or E-Check Electronic Bank Draft. Submitting a transaction from this site does not generate a payment for any city local or county property or other taxes.

Early payment is highly recommended when paying online in case of technical difficulties. E-Check is an easy and secure method allows you to pay your individual income taxes by bank draft. Want to avoid paying a 10 late penalty.

Cass County Missouri 102 E. No you may mail your payment payable to Jackson County Collector pay in person at one of the Countys Collection Department Offices or our satellite offices or you may also pay your property taxes on-line through the internet 24 hours a day. Find historical receipts and current receipts.

The City benefits by receiving 1 of the tax dollars collected for acting as an agent for Jackson County. Pay your taxes online. File Personal Income Tax Extension of Time to File MO-60.

Online payments are available for most counties. There is a convenience fee assessed with paying your taxes online. Property Tax Jackson County personal property business and real estate tax bills can be paid at Treasury located in the lobby of City Hall.

If you need an immediate receipt you must pay through the Collectors Office. Vehicle Licensing in Cass County. Click the Pay Personal button to pay Personal Taxes.

It will take several days to issue your paid receipt. Be sure to pay before then to avoid late penalties. The statewide property tax deadline is October 15.

Please note that the online payment website will close at 11 pm December 31. Find out how taxes are calculated how to pay them and what other fees are involved. License your vehicle in Cass County.

Continue to PayIt Login. By paying online physical receipts will only be furnished by our office upon request.

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

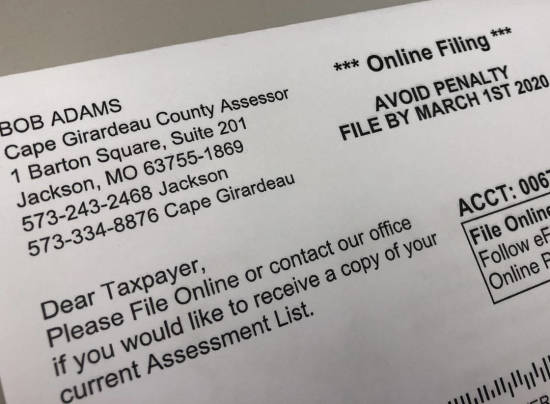

Local News Cape County Assessor Encouraging Online Filing For Personal Property Tax Assessments 1 10 20 Southeast Missourian Newspaper Cape Girardeau Mo

Local News Cape County Assessor Encouraging Online Filing For Personal Property Tax Assessments 1 10 20 Southeast Missourian Newspaper Cape Girardeau Mo

Online No Tax Due System Information

Online No Tax Due System Information

Revenue Collections Grandview Mo

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

How To Get A Copy Of Paid Personal Property Taxes Property Walls

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Https Www Jacksongov Org Documentcenter View 116 Real Property Tax Exemption 2021 Application Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home