Apply For Homestead Exemption In Florida Online

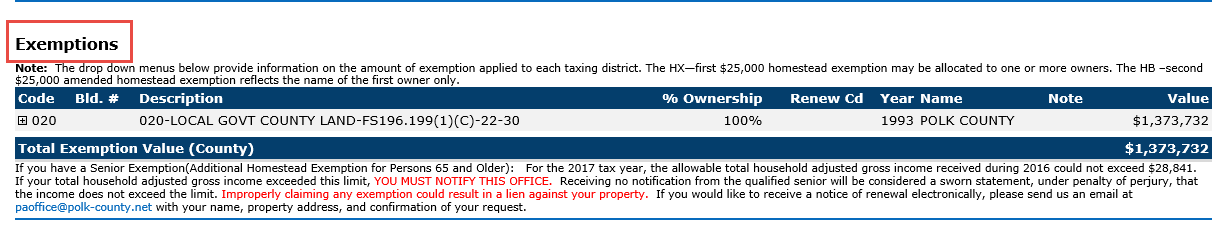

The first 25000 of this exemption applies to all taxing authorities. Floridas constitution provides for a 25000 exemption which is deducted from a propertys assessed value if the owner qualifies.

Don T Forgot To Apply For Your Homestead Exemption In Florida

Don T Forgot To Apply For Your Homestead Exemption In Florida

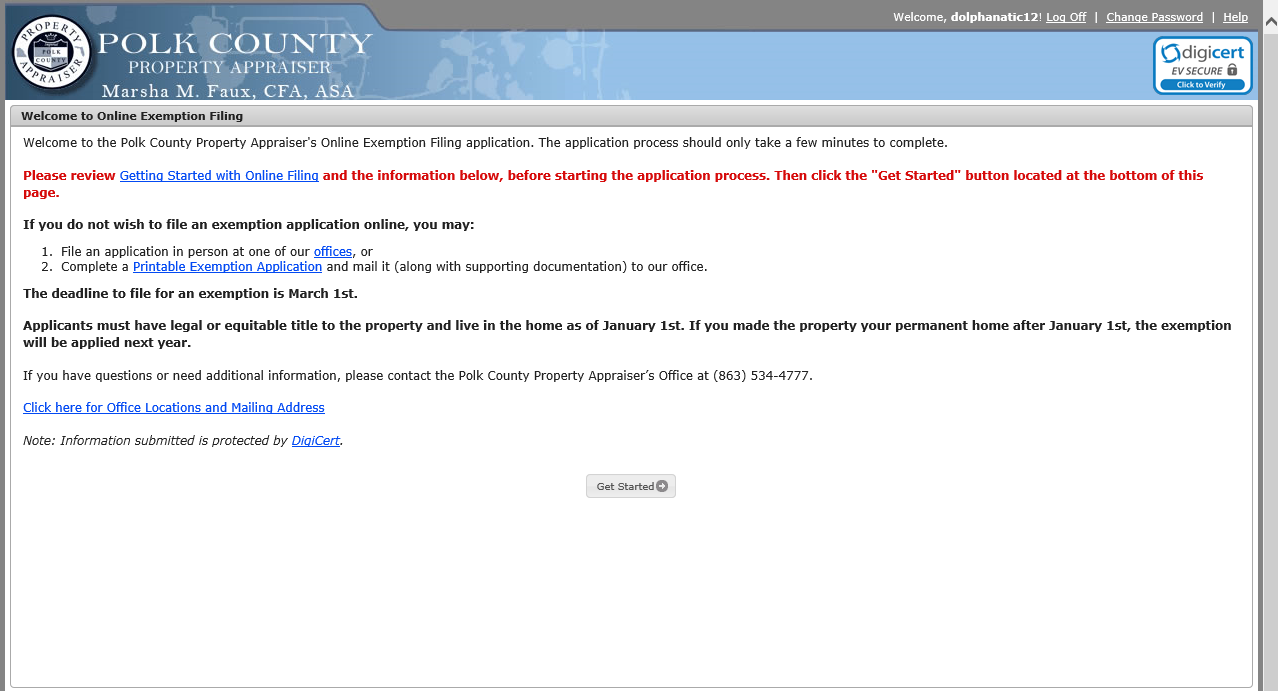

Welcome Welcome to the Duval County Property Appraisers on-line homestead exemption application system.

Apply for homestead exemption in florida online. However we encourage you to use our online service for filing homestead. Filing for the Homestead Exemption can be done online. It reduces the value of a home for assessment of property taxes by 50000 so a home that was actually worth 500000 would be taxed as though it.

Permanent Florida residency required on January 1. Property owners with Homestead Exemption and an accumulated SOH Cap can apply to transfer or Port the SOH Cap value up to 500000 to a new homestead property. Will be used to verify taxpayer identity and homestead exemption.

In Florida the homestead exemption accomplishes two things. There are two ways to apply depending on certain criteria. If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity.

Print the application form. Application due to property appraiser by March 1. Under Florida law e-mail addresses are public records.

Complete the application online click here. If you meet ALL of the criteria below. If filing online please read.

The Department of Revenueswebsite has more information about property tax benefits for homestead properties. The second 25000 excludes school board taxes and applies to properties with assessed values greater than 50000. File Homestead Exemption online File for Homestead online File Homestead Exemption By Mail.

Online Homestead Application Service You will need to gather the following information in order to complete this application. This secure server uses 128-bit encryption to maintain your privacy. First-time Homestead Exemption applicants and persons applying for the Homestead Assessment Difference Portability.

Olive Ave West Palm Beach FL 33401 Visit one of our five service centers to file in person. Your application you may file a petition with the countys value adjustment board. If you elect to purchase a residence in Florida as opposed to renting the positive result of changing your residence to Florida is that you may claim the Florida homestead exemption.

Completing your application at home and returning it by mail can save you travel time and money. Carefully review the requirements described below and select the application process that applies to you. Homeowners may claim up to a 50000 exemption on their primary residence.

Homestead Exemption Application can now be made Online. Once we have processed your purchase information and your name appears in our records as the owner you may file online for your 2022 tax-year homestead exemption. Our office is open to the public.

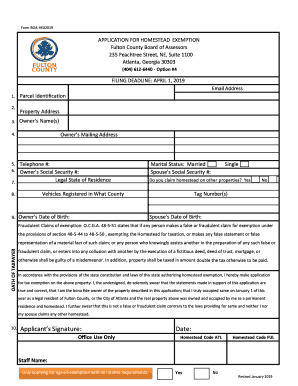

PROPERTY TAX EXEMPTION FOR HOMESTEAD PROPERTY. Welcome to the Lee County Property Appraisers Office on-line filing for Homestead Exemption. To apply for the homestead exemption in Florida you must fill out the Form DR501 application.

Proof of ownership copy of your deed or v oter registration card Social security numbers for all owners give a copy of your social security card military identification card or Medicare card. It is required by section 1960111b Florida Statutes. Please follow these steps.

The social security number. For more information see Petitions to the Value Adjustment Board. In the State of Florida if you own property reside on that property and are a permanent resident of Florida all as of January 1st of the tax year you may qualify for homestead exemption.

Lucie and Martin County homestead exemption is one way to reduce the amount of real estate taxes you will have to pay on your residential property. Instead contact this office by phone or in writing. Disclosure of your social security number is mandatory.

Print it out and mail to the Palm Beach County Property Appraisers Office Exemption Services 1st Floor 301 N. You must also provide the following information. AND RELATED TAX EXEMPTIONS.

INFORMATIONDOCUMENTATION IS REQUIRED IN ORDER TO FILE FOR ANY EXEMPTION - PERMANENT FLORIDA RESIDENCY OWNERSHIP AND OCCUPANCY OF THE PROPERTY AS YOUR PRIMARY HOMESTEAD PROPERTY IS REQUIRED AS OF JANUARY 1. This application is known as the Transfer of Homestead Assessment Difference and the annual deadline to file for this benefit and any other property tax exemption is March 1st. Click here to begin the online Homestead application process and you will automatically be prompted to print and complete a Portability application if your application information indicates you held an eligible Homestead Exemption on a previous Florida property.

Review and obtain the required documentation. Here is what you need to continue. Homestead Exemption Application can also be made by mail.

We are providing this system in an attempt to make filing for homestead exemption and other personal exemptions a little more convenient for you the property owner.

Read more »