How To File For Homestead Exemption In Louisiana

After your closing your closing agent will file your act of sale in the Conveyance Office of the Parish Clerk of Court. Louisiana residents do not have to file a homestead declaration in order to claim the homestead exemption in bankruptcy.

Bankruptcy Exemptions See If You Qualify In Louisiana The Cook Law Firm Aplc

Bankruptcy Exemptions See If You Qualify In Louisiana The Cook Law Firm Aplc

The basics of homestead protections in Louisiana.

How to file for homestead exemption in louisiana. In Louisiana the homestead declaration is automatic. Columbia Street 985 809-8180. The deadline to timely filer your exemption may vary by state county or parish.

This exemption applies to all homeowners. Fill out the St. If you change primary residence you must notify the assessor.

Homestead Exemption Rights After Death. The homestead exemption applies to owner-occupied primary residences and reduces assessed value by 7500. 1 The bona fide homestead consisting of a tract of land or two or more tracts of land even if the land is classified and assessed at use value pursuant to Article VII Section 18C of this constitution with a residence on one tract and a field with or without timber on it pasture or garden on the other tract or tracts not exceeding.

Homeowners in Louisiana are eligible for the homestead exemption which can significantly reduce property taxes owed. Regardless of how many houses are owned no one is entitled to more than one homestead exemption which is a maximum of 7500 of assessed value. To be eligible for homestead exemption the property must be your primary residence and you must be a resident of Caddo Parish.

Each year thereafter you will receive a renewal card in the mail. Slidell Office 61134 North Military Rd. What is the Homestead Exemption.

The value of your home is exempt up to 75000 from state and parish property taxes. After qualifying for homestead exemption the property. Application for homestead in East Baton Rouge Parish can be made by applying in person either at the Main office the Coursey Branch office or the Zachary Branch office.

To apply homestead exemption must be in place and an A25 form from the Louisiana Department of Veterans Affairs will need to be provided. Tammany Parish Justice Center 701 N. To receive homestead exemption on your primary residence you must file a homestead application with the Caddo Parish Tax Assessor.

Louisianas constitution dictates that only 160 acres and 7500 in property value can be designated as a homestead. How do I file for Homestead Exemption. To qualify for Homestead Exemption the property in Tangipahoa Parish must be your primary residence and must be in your name.

To apply for Homestead Exemption you will need your drivers license or voters registration that reflects your current address. Showing a combined Adjusted Gross Income of 100000 or less. You should bring with you a recorded copy of your act of sale for the property and a photo identification showing the address of the property on which the homestead exemption is being filed.

In order to qualify for homestead exemption one must own and occupy the house as hisher primary residence. To file for Homestead Exemption contact the Tax Assessors Office at 318 226-6701. Louisiana Homestead Exemption - Filing Every Year Must I file for the Homestead Exemption every year.

The homestead exemption is a tremendous benefit for homeowners. A valid Louisiana Drivers License address must correspond to propertys address on application. A short time later you will receive a recorded copy of your title along with the recordation numbers the Conveyance Office.

Disabled military veterans rated with 100 percent unemployability are eligible for a homestead exemption of 150000. You must appear in person at either location of the Jefferson Parish Assessors office to sign for the homestead exemption. Tammany Homestead Exemption Form and bring it to one of the following offices.

It can reduce your taxes by up to 7500. In Louisiana the homestead exemption continues after an owners death for the benefit of the surviving spouse and any minor children. Contact your local assessors office for specific filing details.

Thus the net assessed taxable value for the home in the above example would be just 2500. You can take advantage of this exemption only once with a single property. How do I get my Homestead Exemption.

You are entitled to Louisiana property tax homestead exemption if the property in question is your primary residence. As long as you still own and occupy that same property as your residence simply return the card to this office and your homestead exemption will automatically be renewed for. Tangipahoa Parish has a permanent homestead exemption.

Property Tax Exemption Type. To be eligible to apply for a homestead exemption you must own and occupy your home as your permanent residence by January 1st of that filing year. Louisiana State Law allows an individual one homestead exemption up to 75000.

You will also need a copy of your recorded cash saledeed. To apply for a Senior Freeze you will need proof of age and your 2019 federal tax returns. How to file for Homestead Exemption To claim a Homestead Exemption a person must appear in person at the Assessors Office and present the following.

How to file for a Homestead Exemption To claim a Homestead Exemption a person must appear at the Assessors Office and present the following. Also for property owned by a veteran with a service connected disability rating of 100 by the United States Department of Veterans Affairs an additional 75000 of market value will be homestead exempt. Homestead exemptions are based upon conditions existing as of January 1st every year.

First District Assessor Office Hours 830 am. Initially you must file for the homestead exemption in person.

Orleans Parish Homestead Exemption Information And Where To File

Orleans Parish Homestead Exemption Information And Where To File

Homestead Exemptions West Feliciana Parish Assessor S Office

Homestead Exemptions West Feliciana Parish Assessor S Office

Jefferson Parish Assessor S Office Homestead Exemption

Voters Say Yes To Increasing Homestead Exemption Special Assessment Level

Voters Say Yes To Increasing Homestead Exemption Special Assessment Level

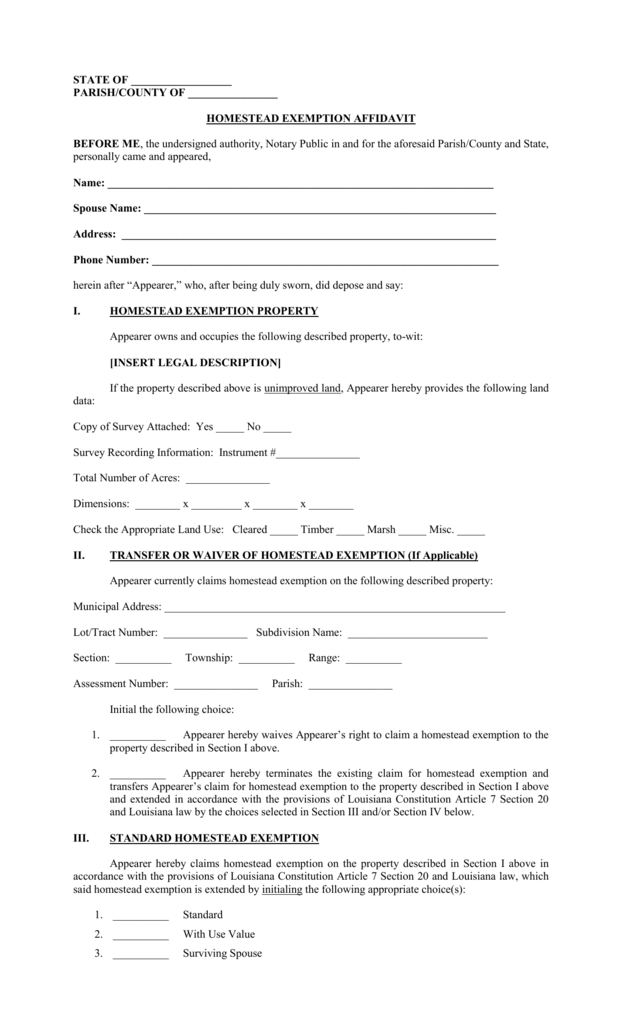

State Of Parish County Of Homestead Exemption

State Of Parish County Of Homestead Exemption

Free Form Otc 921 Application For Homestead Exemption Free Legal Forms Laws Com

Free Form Otc 921 Application For Homestead Exemption Free Legal Forms Laws Com

Http Qpublic Net La Orleans Docs Home Exemp Flyer Pdf

Caddo Parish Assessor Fill Online Printable Fillable Blank Pdffiller

Caddo Parish Assessor Fill Online Printable Fillable Blank Pdffiller

Homestead Exemption Louisiana Fill Online Printable Fillable Blank Pdffiller

Homestead Exemption Louisiana Fill Online Printable Fillable Blank Pdffiller

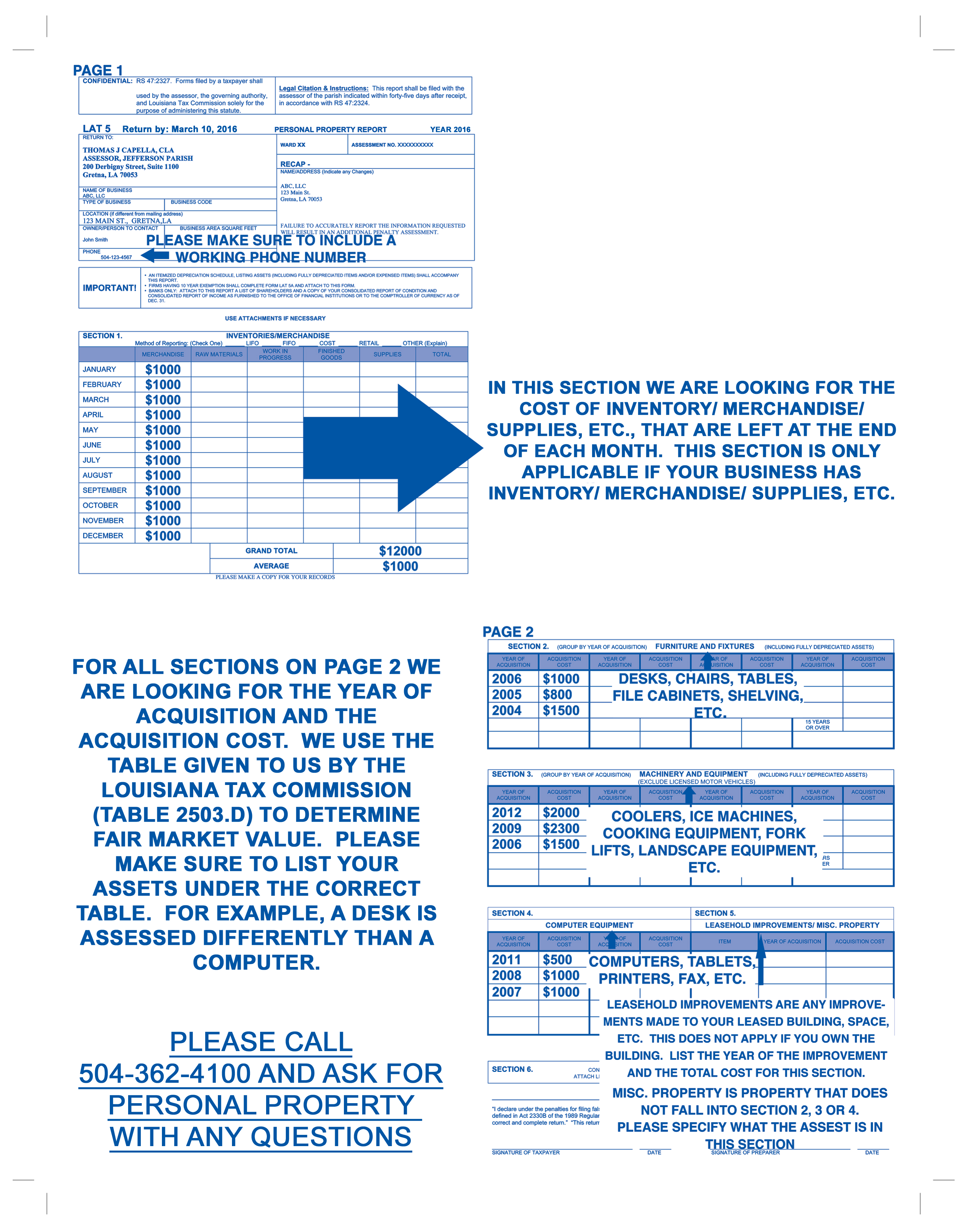

Jefferson Parish Assessor S Office Resources

Jefferson Parish Assessor S Office Resources

Homestead Exemption Louisiana Fill Online Printable Fillable Blank Pdffiller

Homestead Exemption Louisiana Fill Online Printable Fillable Blank Pdffiller

How To Apply For Your Homestead Exemption Witry Collective New Orleans Real Estate

How To Apply For Your Homestead Exemption Witry Collective New Orleans Real Estate

St Martin Parish Geoportal Fill Online Printable Fillable Blank Pdffiller

St Martin Parish Geoportal Fill Online Printable Fillable Blank Pdffiller

Everything About Louisiana Property Tax Exemption Top Tips

Everything About Louisiana Property Tax Exemption Top Tips

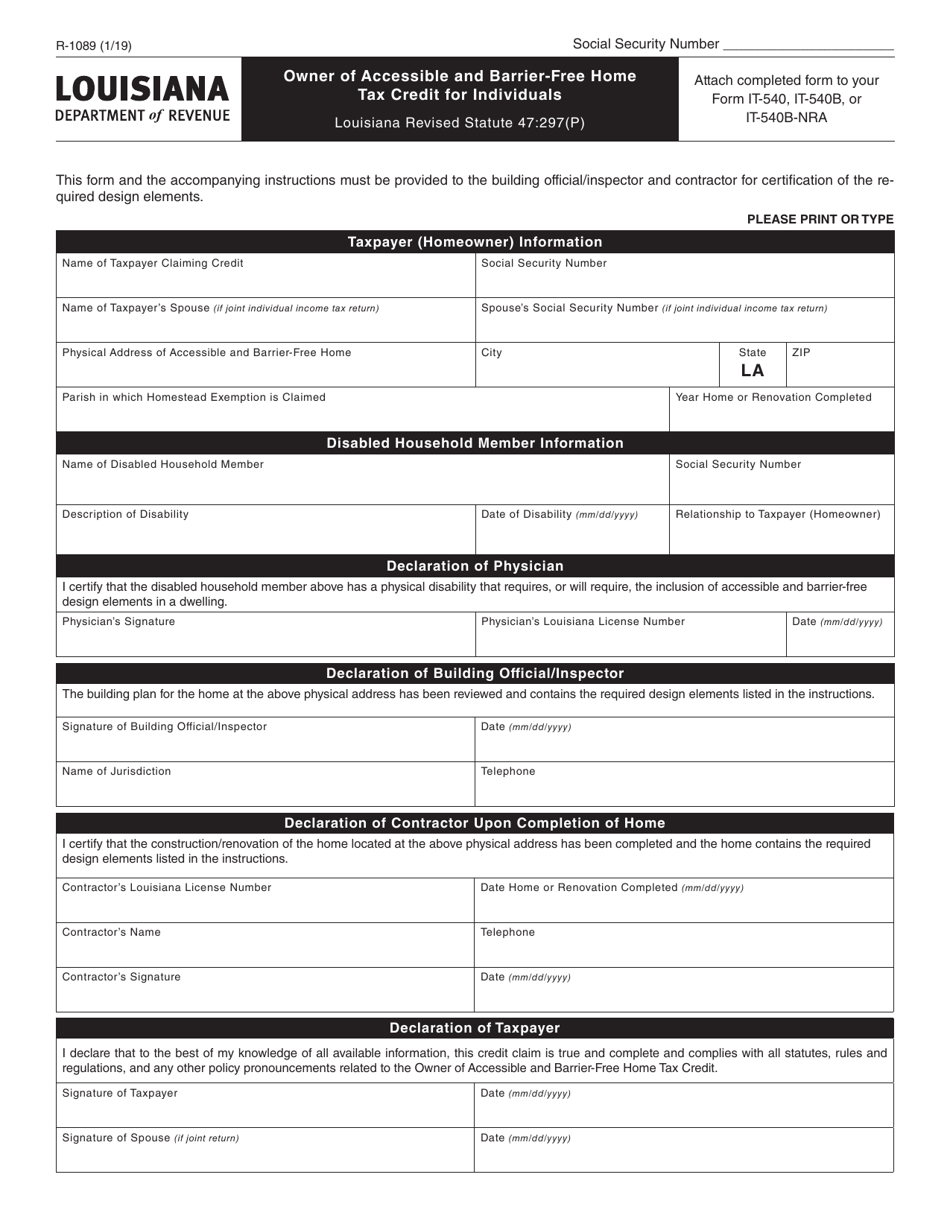

Form R 1089 Download Fillable Pdf Or Fill Online Owner Of Accessible And Barrier Free Home Tax Credit For Individuals Louisiana Templateroller

Form R 1089 Download Fillable Pdf Or Fill Online Owner Of Accessible And Barrier Free Home Tax Credit For Individuals Louisiana Templateroller

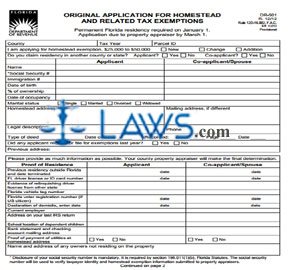

Free Form Dr 501 Originial Application For Homestead And Related Tax Exemptions Free Legal Forms Laws Com

Free Form Dr 501 Originial Application For Homestead And Related Tax Exemptions Free Legal Forms Laws Com

Homestead Exemption In New Orleans La How To File

Homestead Exemption In New Orleans La How To File

Louisiana Amendment 6 Homestead Exemption Special Assessment Income Limit Arklatexhomepage

Louisiana Amendment 6 Homestead Exemption Special Assessment Income Limit Arklatexhomepage

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home