How Do I Apply For Homestead Exemption In Montgomery County Texas

Print and fill out the application for mailing to the Montgomery County Auditor. Homestead exemptions remove part of your homes value from taxation so they lower your taxes.

Map Search Properties In The Woodlands Lake Conroe Spring Tx The Woodlands Tx The Woodlands Texas Houston Map

Map Search Properties In The Woodlands Lake Conroe Spring Tx The Woodlands Tx The Woodlands Texas Houston Map

Taxpayers with an Over 65 OR Disabled Person Exemption ONLY.

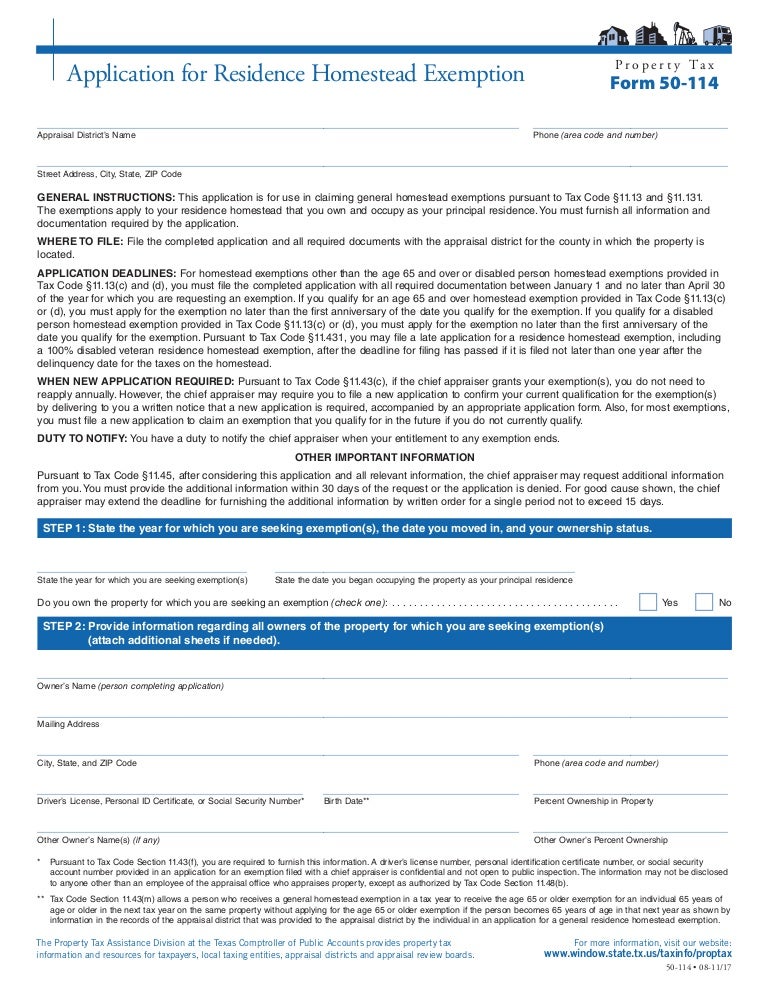

How do i apply for homestead exemption in montgomery county texas. Download Form You can download the homestead exemption form with the following link. TO APPLY FOR THE HOMESTEAD EXEMPTION. You must furnish all information and documentation required by the application.

You must reapply if the chief appraiser requires you to do so or if you want the exemption to apply to property not listed on this application. For more information please contact your County Appraisal District. How do You Apply for a Homestead Exemption in Texas.

The typical delinquency date is February 1. For example your home is appraised at 100000 and you qualify for a 25000 exemption this is the amount mandated for school districts you will pay school taxes on the home as if it was worth only 75000. If the county grants an optional exemption for homeowners age 65 or older or disabled the owners will receive only the local-option exemption.

Application must be made to receive this exemption. Click the image below to see a detailed PDF explaining the information on the tax statement. Below are some helpful resources about how to apply for homestead exemption for those who live in the Greater Houston Area.

Click here to fill out your form online and submit it electronically. A copy of your valid Texas drivers license or identification card with an address matching your homestead address. HOMESTEAD EXEMPTION APPLICATION File with the county auditor on or before the December 31.

General Residential Homestead Exemption. View 2013 Homestead Exemption Act memorandum. Taxpayers with an Over 65 or Disabled Person Exemption may pay current taxes on their homestead residence in four4 installments without penalty andor interest.

Visit your local county office to apply for a homestead exemption. If a county collects a special tax for farm-to-market roads or flood control a residence homestead owner is allowed a 3000 exemption for this tax. You may apply for homestead exemptions on your principal residence.

It must not be filed with. The exemptions apply to your residence homestead that you own and occupy as your principal residence. Homestead Exemption Application for Senior Citizens Disabled Persons and Surviving Spouses Real property and manufactured or mobile homes.

Every school district is. A Texas homeowner may file a late county appraisal district homestead exemption application if they file no later than one year after the date taxes become delinquent. You must notify the chief appraiser in writing before May 1 of the year after your right to thisexemption ends.

The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. State of Texas Property Tax Code. To complete your Residence Homestead Exemption Application you will need The Residence Homestead Exemption Application Form 50-114 for your county appraisal district.

File the completed application and all required documents with the appraisal district for the county in which the property is. File with the county auditor on or before December 31. Filing in Brazoria County.

The applicant must own and occupy the residence on January 1 of the year for which they are making application. Senior citizens age 65 and older and surviving spouse applications may be filled out and either submitted online or printed and mailed. The Application for Residence Homestead Exemption is required to apply for a homestead exemption.

You can WebFile or use the downloadable PDF reports from the website. Disabled applicants andor those not filing Ohio income tax will be required to. To apply you must complete your countys application for homestead exemption as well as provide a copy of your drivers license or state-issued personal identification certificate.

STEP 1 THIS APPLICATION APPLIES TO THIS PROPERTY Legal description and street address. Application for Residence Homestead Exemption Form 50-114 50-114 10-1323 _____ _____ Appraisal Districts Name Phone area code and number _____ Street Address City State ZIP Code This document must be filed with the appraisal district office in the county in which your property is located. Weve provided links to local Texas appraisal districts below.

Form 50 114 Fill Online Printable Fillable Blank Pdffiller

Form 50 114 Fill Online Printable Fillable Blank Pdffiller

What Is Homestead Exemption Find Houston Homes

What Is Homestead Exemption Find Houston Homes

The Beauty Of Nature In Carlton Woods The Woodlands Texas The Woodlands Texas Woodlands Woodland

The Beauty Of Nature In Carlton Woods The Woodlands Texas The Woodlands Texas Woodlands Woodland

Residence Homestead Exemption Information Youtube

Residence Homestead Exemption Information Youtube

Residence Homestead Exemption Information Williamson Cad

Residence Homestead Exemption Information Williamson Cad

How To File Homestead Exemption Application In Texas Tcp Real Estate

How To File Homestead Exemption Application In Texas Tcp Real Estate

Montgomery County Homestead Exemption Texas Page 1 Line 17qq Com

Montgomery County Homestead Exemption Texas Page 1 Line 17qq Com

Homestead Exemption What You Need To Know The Loken Group

Homestead Exemption What You Need To Know The Loken Group

How To File For Homestead Exemption In Texas Houston Harris County Montgomery County For Free Youtube

How To File For Homestead Exemption In Texas Houston Harris County Montgomery County For Free Youtube

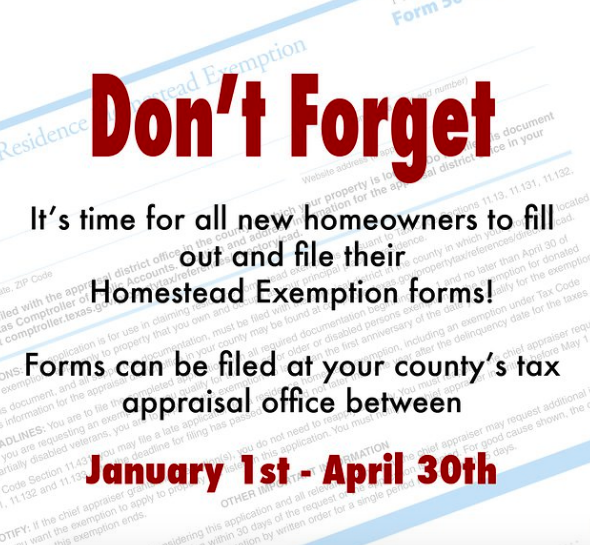

File Before April 30th Video Homesteading Home Buying Homeowner

File Before April 30th Video Homesteading Home Buying Homeowner

How To Fill Out Homestead Exemption Form Texas Homestead Exemption Harris County Youtube

How To Fill Out Homestead Exemption Form Texas Homestead Exemption Harris County Youtube

Santa Can T Do What Real Estate Advertising Home Buying Real Estate Infographic

Santa Can T Do What Real Estate Advertising Home Buying Real Estate Infographic

Montgomery Co Tx Homestead Exemption Form

Montgomery Co Tx Homestead Exemption Form

How To Fill Out Your Texas Homestead Exemption Form Youtube

How To Fill Out Your Texas Homestead Exemption Form Youtube

Homestead Exemption Texas Form Page 1 Line 17qq Com

Homestead Exemption Texas Form Page 1 Line 17qq Com

2021 Update Houston Homestead Home Exemptions Step By Step Guide

2021 Update Houston Homestead Home Exemptions Step By Step Guide

Homestead Exemption Application Montgomery County Tx

Homestead Exemption Application Montgomery County Tx

Pin By Amy Craft On Realtor Need To Know Real Estate Business Homeowner How To Remove

Pin By Amy Craft On Realtor Need To Know Real Estate Business Homeowner How To Remove

Your 2019 Guide To Filing Your Homestead Exemption Bhgre Homecity

Your 2019 Guide To Filing Your Homestead Exemption Bhgre Homecity

Labels: texas

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home